Markets Brief: Why Fourth-Quarter Earnings Turned South

Poor results from retailers, media, and entertainment companies are dragging down earnings growth.

Check out our weekly markets recap at the bottom of this article.

What had been looking like a small positive for earnings growth for the fourth quarter has turned negative as poor results from companies in the retail, news, and entertainment industries drag on overall profits.

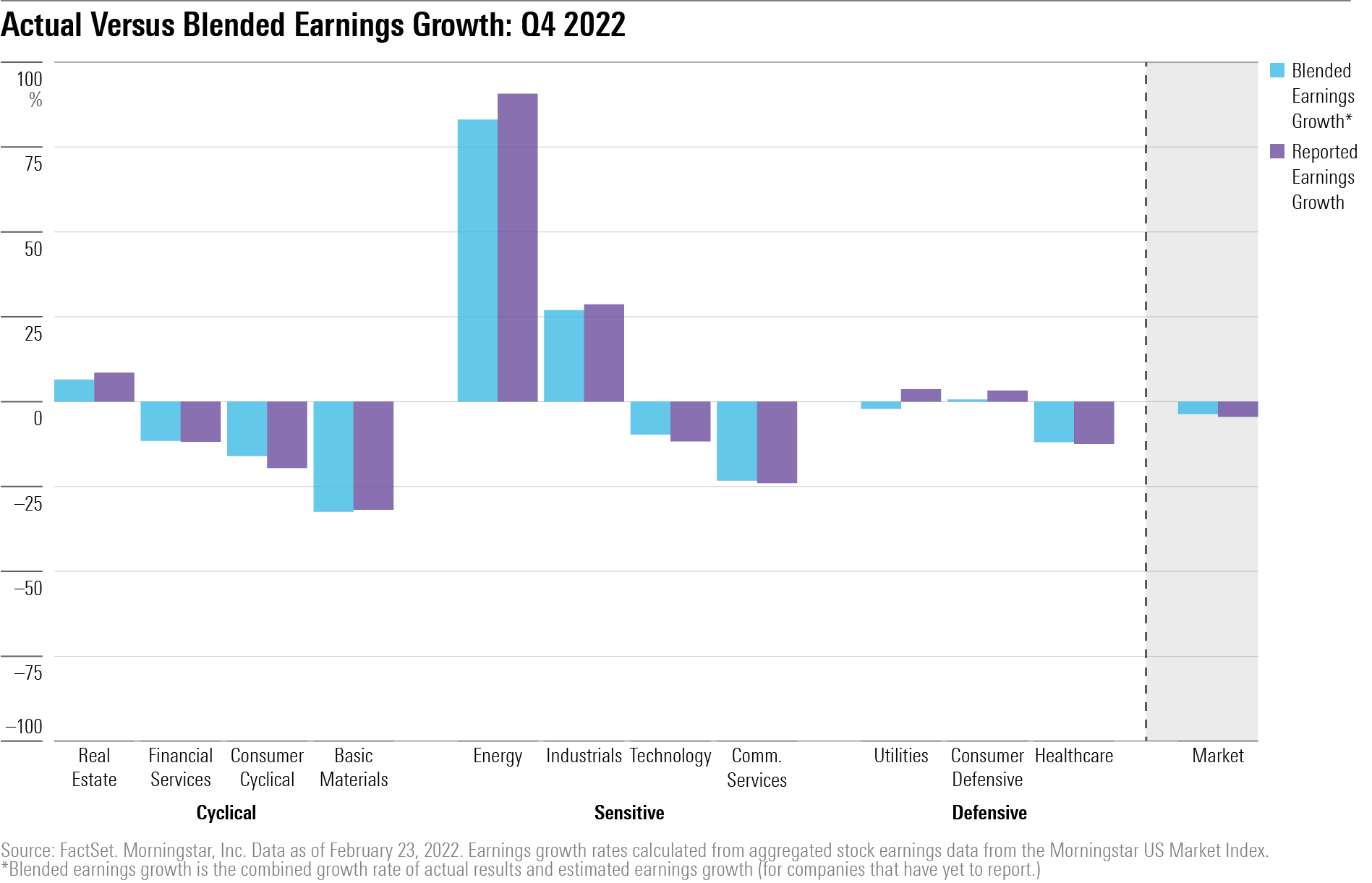

Out of 11 stock sectors, six have reported double-digit declines in earnings, while energy, industrials, real estate, utilities, and consumer defensive companies are showing positive earnings growth. Those increases range from just over 3% for consumer defensive stocks to north of 90% for energy companies.

Overall, as of Feb. 23, companies in the Morningstar US Market Index have reported a decline in earnings of 4.5%, compared with 0.7% growth reported at the beginning of the month.

Steve Sosnick, chief strategist at Interactive Brokers, says that it’s not surprising that fourth-quarter earnings have gone into the red. “We know it’s not a great economy. We know that there are pressures that are affecting businesses of all stripes,” he says.

However, when it comes to the market’s reaction to results, “Investors were charitable and continually looking for the silver lining in company earning,” Sosnick says. Encouraged by recent gains in the market, especially as popular companies like Tesla TSLA and Amazon.com AMZN bounced back from their lows in 2022, Sosnick says investors were willing to take on more risk despite earnings disappointments.

“Investors felt it was safe to put on risk again in their favorite names, particularly tech stocks … they might not be treating negative news as bad as they normally would.”

Despite tech companies reporting a 11.7% decline in earnings over the last year, the Morningstar US Technology Index is up 10.7% year to date versus the Morningstar US Market Index, which is up 4.1%.

However, the overall market has pared back gains from its rally at the start of the year in recent weeks, mainly in response to rising bond yields and expectations that the Federal Reserve will take interest rates higher and hold them there longer. In early February, stocks had been up roughly 10% since the start of the year.

Consumer Cyclicals Earnings Growth Evaporated

A key change in the landscape was a reversal of positive earnings growth reported early on in the consumer cyclical sector. While most sectors have been tracking their overall projected earnings growth expectations as results came in over the last several weeks, consumer cyclicals saw a major reversal in reported earnings growth in the last month.

In early February, strong results from early reporting companies in the automotive industry lifted earnings growth for the sector to 26.3%. However, as more companies reported results in recent weeks, the sector’s earnings growth nose-dived. As of Feb. 23, consumer cyclical companies saw their earnings broadly decline by 19.54%.

On an industry level, earnings growth has remained strong for companies in automobile and consumer services, which include travel services companies and restaurants.

It’s companies in the retail industry that have dragged on the overall trend for consumer cyclical sector earnings.

Firms such as Hanesbrands HBI, VF VFC, and Gap GPS released negative guidance for sales in upcoming quarters as they continue to struggle from low consumer demand and high inventories, which led to major discounts and lower profits during the holiday quarter.

Sosnick attributes the difference between the earnings performance of consumer cyclical industries to the disconnect in consumer spending habits in goods versus services.

The pandemic “disrupted the balance between goods and services,” he says. Consumers shifted their spending to primarily goods, such as home improvement products for do-it-yourself projects, while cutting back on services such as travel.

Now, consumers have started shifting back to services, which has contributed to falling revenue for consumer goods companies. Home Depot HD recently reported results that showed a slowdown in sales growth, after several strong quarters previously, as an indicator of consumers changing their spending habits.

Sosnick notes that services are also benefiting from an increasingly cautious consumer. Consumers are “going to be more cautious on how they spend, and sometimes services are where you spend it because they add productivity to your life.”

Other major industries contributing to the overall negative earnings growth for the fourth quarter are media and entertainment firms, which include companies such as Netflix NFLX, Walt Disney DIS, and even Meta Platforms META and Alphabet GOOGL.

“The bottom line is consumers are watching where their money is going and advertisers are watching where consumer money is going,” he says.

Events Scheduled for the Coming Week Include:

- Saturday, Feb. 25: Berkshire Hathaway BRK.B reports earnings.

- Tuesday: Target TGT reports earnings.

- Thursday: Macy’s M reports earnings.

For the Trading Week Ended Feb. 24:

- The Morningstar US Market Index fell 2.7%.

- The best-performing sector was energy, up 0.3%.

- The worst-performing sectors were communication services, down 4.5%, and consumer cyclical, down 4.3%.

- Yields on 10-year U.S. Treasuries rose to 3.94% from 3.83%.

- West Texas Intermediate crude prices fell 0.1% to $76.32 per barrel.

- Of the 849 U.S.-listed companies covered by Morningstar, 121, or 14%, were up, and 728, or 86%, declined.

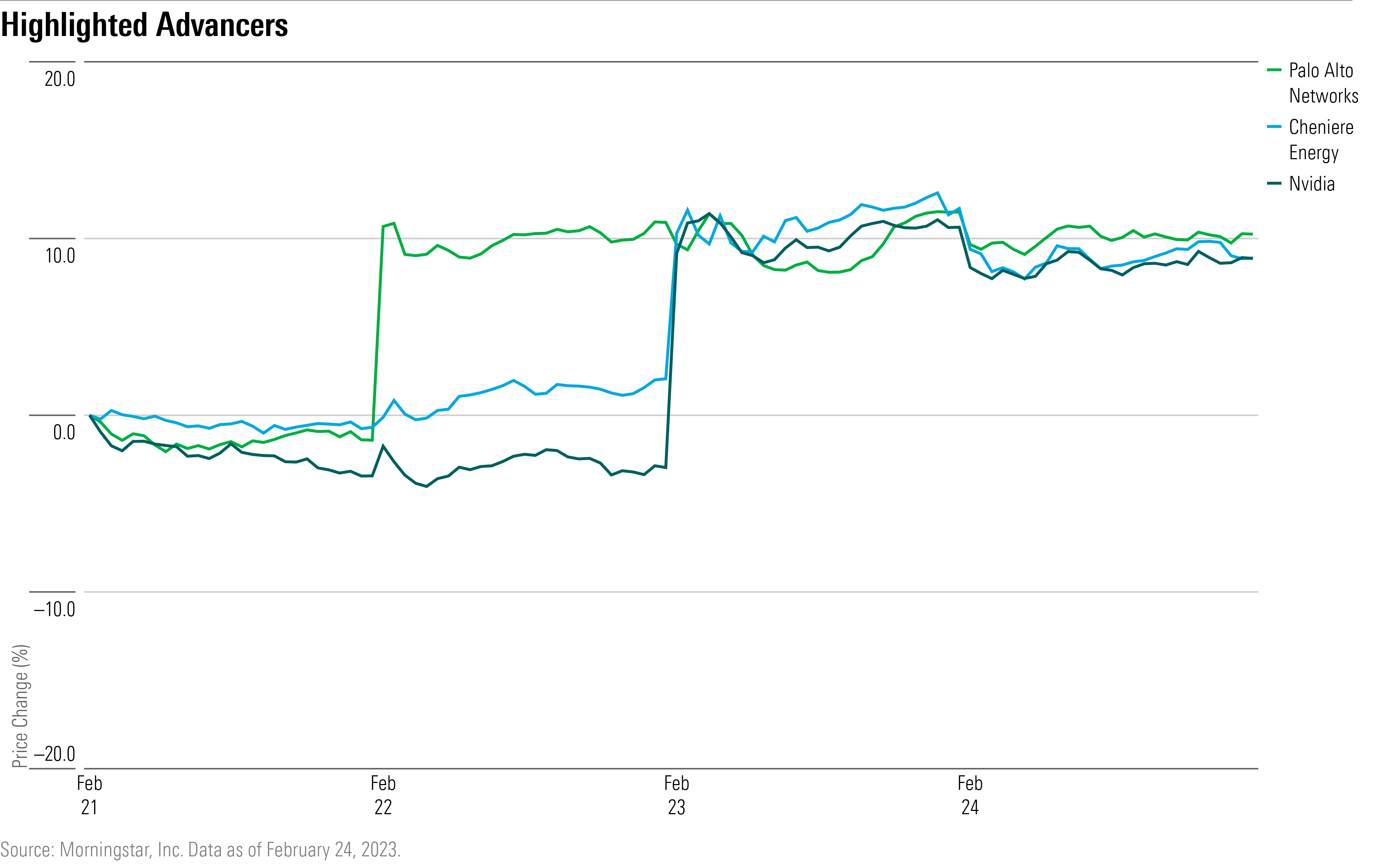

What Stocks Are Up?

Nvidia NVDA shares jumped as it reported higher-than-expecting earnings and investors weighed how the company could benefit from new artificial intelligence technologies. Morningstar strategist Abhinav Davuluri maintained his $200 fair value estimate for the firm despite the beat.

“Our estimates already incorporate meaningful growth driven by the proliferation of AI. Shares are up 45% year to date and 85% since mid-October lows, as we believe the market has already rewarded Nvidia for its exposure to the likes of ChatGPT,” he says.

Shares of Palo Alto Networks PANW surged after the company reported strong fourth-quarter results. Morningstar is maintaining a $200 fair value estimate for wide-moat Palo Alto Networks, writes analyst Malik Ahmed Khan. “We still see marginal upside for investors searching for high-quality, cybersecurity exposure,” he writes.

After reporting very strong fourth-quarter results, Cheniere Energy LNG shares rallied. “The-fourth quarter captured the last few months of extremely wide spreads before the market weakened during 2023,″ writes sector strategist Stephen Ellis.

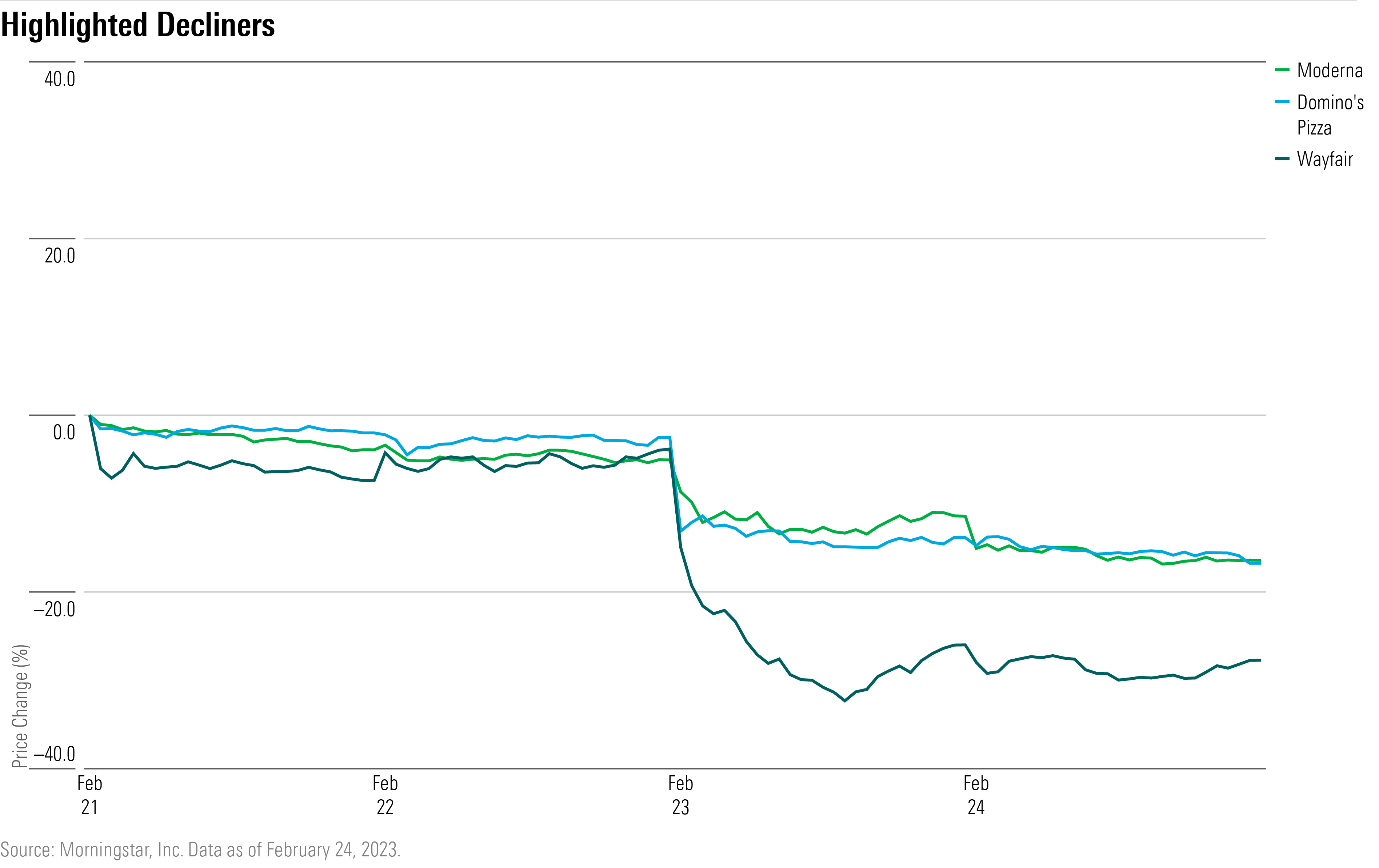

What Stocks Are Down?

Wayfair W shares fell after reporting disappointing fourth-quarter results. Sales, active customers, and repeat customer orders all fell, writes senior equity analyst Jaime Katz. “This raised concerns that demand has yet to bottom,” she writes.

Shares of Moderna MRNA declined after the company reported lower earnings for the fourth quarter of 2022. Less demand for its coronavirus vaccine hurt sales. “The market’s negative reaction to earnings appears to reflect a focus on higher cost of goods and operating expenses and continued uncertainty around the flu vaccine program but not the improving potential of the firm’s pipeline (particularly in RSV and oncology),” writes sector strategist Karen Andersen.

Domino’s Pizza DPZ stock sunk after posting lower earnings than most expected. “The year figures to be challenging for restaurateurs, with our expectations for limited pricing power as consumers navigate inflationary headwinds,” writes equity analyst Sean Dunlop.

The author or authors own shares in one or more securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/MQJKJ522P5CVPNC75GULVF7UCE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZYJVMA34ANHZZDT5KOPPUVFLPE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/S7NJ3ZTJORFVLCRFS2S4LRN3QE.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)