Investors Are Flocking to These Active Value ETFs

Even as value funds see record outflows, Capital Group, DFA, and others are drawing money.

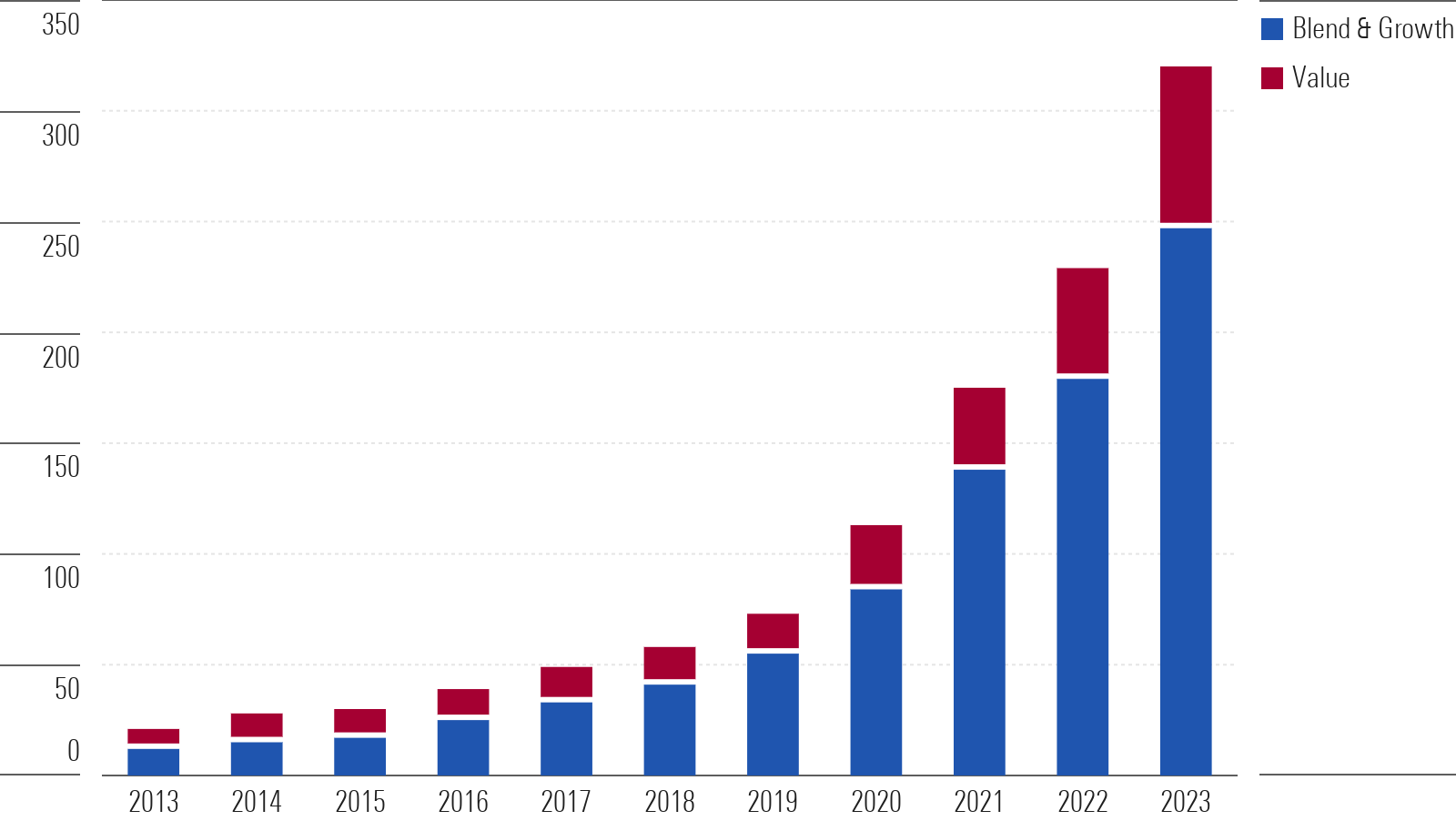

Value funds are on track to record their worst year of outflows ever. But there’s one corner of the category where investors are putting new money to work: actively managed exchange-traded funds.

Thanks to heavy interest in new funds from American Funds parent company Capital Group, along with funds from Dimensional Fund Advisors and Avantis, active value ETFs have collected $8.5 billion so far in 2023, with many doubling in size. That’s in contrast to outflows from passively managed value stock ETFs and open-end active value funds, which have shed more than $75 billion combined.

Among the new ETFs from well-known firms that have powered the influx of money into active ETFs:

- Capital Group Dividend Value ETF CGDV has collected $2.3 billion in the year to date

- Avantis US Small Cap Value ETF AVUV has gathered $1.8 billion

- Dimensional US Large Cap Value DFLV took in $734.9 million

And with the launch of 22 active value ETFs this year, investors have even more options.

Growth of Active ETFs

Value Fund Returns Lag

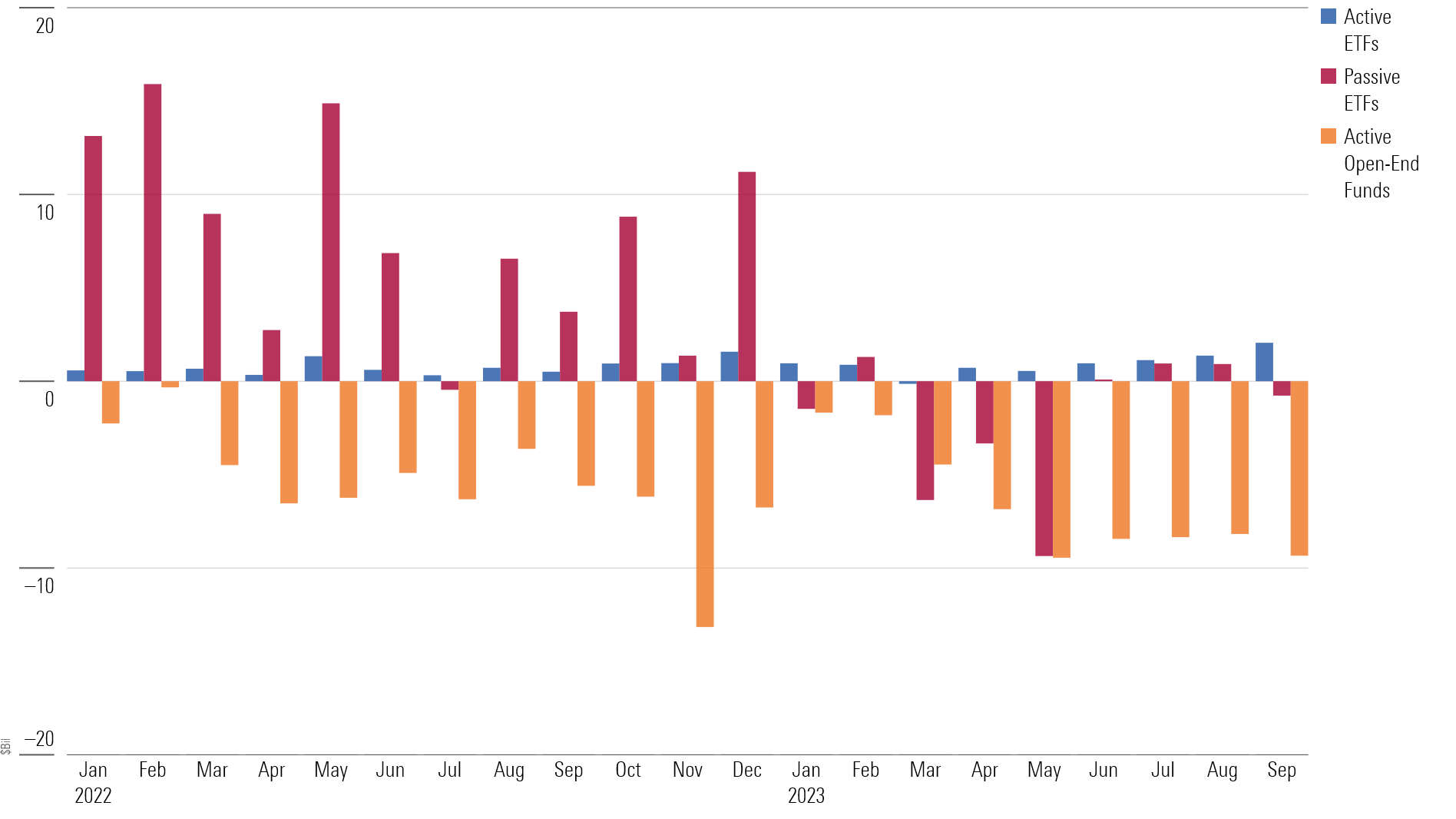

Overall, value funds are struggling again after seeing relatively better returns amid the 2022 bear market. The biggest losses were concentrated among what had been high-flying technology-driven names, which growth funds tend to hold. As those funds suffered big losses, investors poured money into passive value ETFs, but on net, they still redeemed from value open-end funds.

The trend reversed in 2023, with investors redeeming from both active value open-end and passive ETFs. As of Oct. 12, the Morningstar US Value Index has advanced 2.1% while the Morningstar US Growth Index is up 20.6%.

May was the worst-ever month for passive value fund flows, as close to $9 billion left across large-, mid-, and small-cap strategies. Only active ETFs proved resilient, collecting $600 million. During the year through September, passive value ETFs have shed $18 billion, and active value open-end funds have lost $58.6 billion.

New Value ETF Launches

More firms are taking note of the rise of active ETFs. This year, 22 active value ETFs have launched, up from the 13 that launched in 2022. T. Rowe Price opened the $13.8 million T. Rowe Price Value ETF TVAL in June, and the $6.1 million Blackrock Large Cap Value ETF BLCV launched in May.

Active value ETFs are proving to be more popular and prevalent than active growth ETFs. Only 10 active growth ETFs launched this year, following the eight that launched in 2022. And compared to the $8.5 billion haul seen by active value ETFs in the year to date, active growth ETFs have collected much less, only $1.3 billion.

Value Funds' Monthly Fund Flows

What Is an Active ETF?

Active ETFs combine the benefits of active management with the more tax-efficient vehicle of the exchange-traded fund.

While passive ETFs track defined indexes like the S&P 500, active ETFs are controlled by a manager who makes decisions about how to invest. For equity funds, this includes decisions about what sectors to invest in and what specific stocks the fund will purchase.

Unlike with some open-end funds, there is no minimum investment. With many popular brands launching active ETFs, investors now have access to managers they once couldn’t. Many firms now offer active ETFs that are run by the same managers as their long-standing mutual funds.

The biggest benefit of active ETFs, though, is that they have lower expense ratios than open-end funds, and many of the most popular ones have the lowest prices.

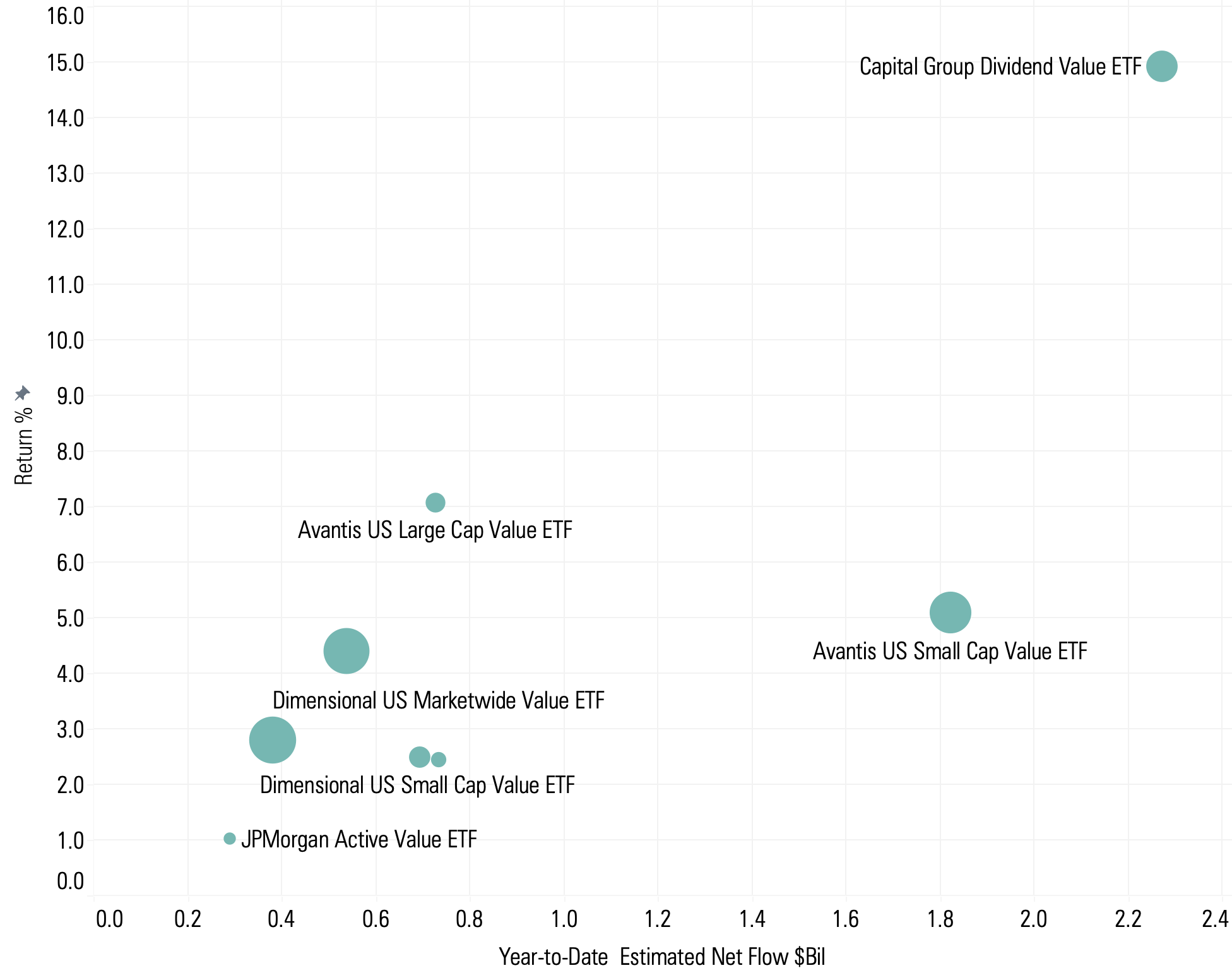

Active Value ETF Inflows

New funds by established firms have powered the surge of money into active ETFs.

The $3.8 billion Capital Group Dividend Value ETF CGDV, launched in February 2022, has collected $2.3 billion this year through September, making it one of the top-grossing value funds. It has more than doubled in size this year just from inflows. In the same period, open-end funds from American Funds, a division of Capital Group, shed $42.8 billion.

The ETF aims for a dividend yield before fees that is 30% greater than the S&P 500, according to its prospectus. “Its 0.33% net expense ratio places it among the large-value category’s cheapest actively managed funds, and its structure is more tax-advantaged than a mutual fund, making it a solid option,” writes Morningstar senior analyst Stephen Welch.

CGDV is one of the top-performing value funds in 2023. The fund has gained 14.9%, while the average large-value fund is up only 1.8%. Welch points to the fund’s larger technology and industrial allocations for its strong performance this year, along with winning stock picks that include Broadcom AVGO, General Electric GE, and Carrier Global CARR. “Its tech weighting ranks in the top quintile of large value funds,” he says.

Active ETFs Year-To-Date Return & Flows

CGDV was one of the first active ETFs launched by Capital Group. After launching five ETFS in February 2022, it launched four more in October. In September, the firm announced five new active ETFs. “Some of the ETFS share the same characteristics as the firm’s long-standing mutual funds,” writes Welch.

The $6.8 billion Avantis US Small Cap Value ETF AVUV, launched in September 2019, gathered $1.8 billion through September. “This fund sifts through the small-cap universe for stocks with the best combination of value and profitability characteristics, an attractive duo,” writes Morningstar analyst Ryan Jackson. Its expense ratio of 0.25% places it in the cheapest quintile of small-value funds. AVUV is up 5.1% compared to the average small-value fund’s 3.2% gain this year to date.

Avantis, a part of American Century, launched Avantis US Large Cap Value ETF AVLV in 2021. This year, the $1.6 billion fund has collected $728.5 million, and the $443.5 million Avantis Small Cap US Equity ETF AVSC has gathered $364.2 million.

Dimensional is the most successful firm in this space. It manages almost $20 billion across its four value active ETFs. Its first foray was in 2021 with the conversion of the $8.2 billion Dimensional US Targeted Value ETF DFAT from a mutual fund to an ETF. Later, the firm established the $8.6 billion Dimensional US Marketwide Value ETF DFUV in May 2022.

Along with launching new funds and converting some of its mutual funds into ETFs, the firm recently filed a request with the SEC to offer an ETF share class with its existing mutual funds, similarly to the structure Vanguard employs. “The firm’s new ETFs have proved popular among its clients. In 2022, they brought in enough new money to nearly offset the outflows from its mutual funds,” writes Morningstar senior analyst Daniel Sotiroff.

The Dimensional US Large Cap Value ETF DFLV has taken in $734.9 million so far in 2023. Launched in December 2022, it has grown to $941 million. “DFA’s portfolio managers build this portfolio from a diverse collection of stocks trading at low price/book multiples,” says Sotiroff. Dimensional launched Dimensional US Small Cap Value ETF DFSV in 2022 as well. So far in 2023, the $1.9 billion ETF has collected $692.7 million.

Most Popular Value Active ETFs

Falling Mutual Fund and ETF Fees a ‘Big Win for Investors’

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/MQJKJ522P5CVPNC75GULVF7UCE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZYJVMA34ANHZZDT5KOPPUVFLPE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/S7NJ3ZTJORFVLCRFS2S4LRN3QE.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)