Markets Brief: The Fed Pause May Finally Be Here, but Volatility Could Linger

Rates could stay high through year-end as expectations for a second-quarter rate cut seem optimistic.

Check out our weekly markets recap—including a look at stocks making some of the week’s biggest moves—at the bottom of this article.

The past week brought what many in the markets believe is the last in the Federal Reserve’s unprecedented series of interest-rate hikes.

That doesn’t mean the Fed will be reversing gear and lowering rates any time soon, however.

Unless the U.S. economy were to suddenly weaken significantly, or the regional banking crisis spirals out of control, stock and bond market strategists say investors should get used to short-term interest rates being where they are now at least through the end of the year.

That’s especially the case with inflation still running well above the Fed’s targets. More evidence of sticky inflation could arrive this coming week with the release of the April Consumer Price Index report. Forecasts center on the CPI report showing inflation running at a historically hot 5% annual rate, according to FactSet.

At the same time, investors shouldn’t get too comfortable. Markets could still be volatile around news events such as new regional bank failures or the debt ceiling drama in Washington.

A Likely Pause in Fed Rate Hikes

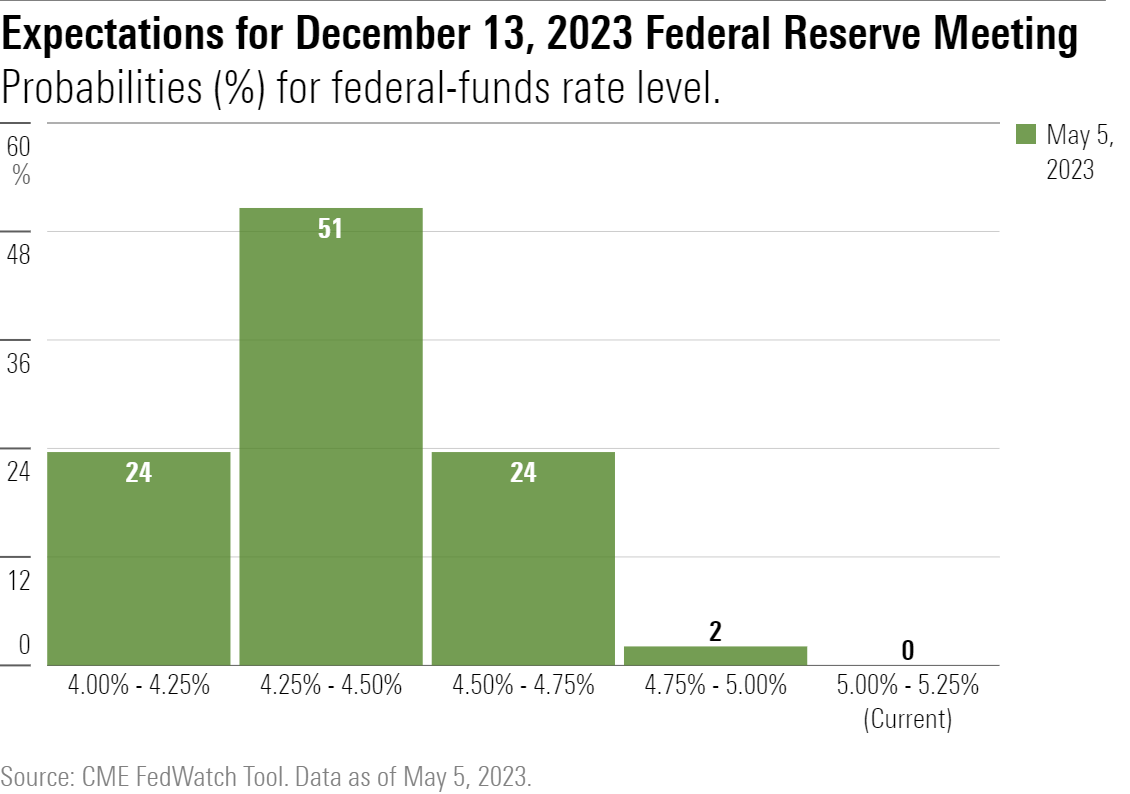

For now, at least, there’s agreement in the markets that the Fed is done tightening monetary policy in its effort to stamp out inflation. On Wednesday the Fed raised the federal-funds rate by 0.25 percentage points as expected, taking the fed-funds target rate to 5%-5.25%. Fed Chair Jerome Powell wouldn’t commit to rates being held steady from here, but did say “I think policy is tight.”

“Although they stopped short of saying that it would be an official pause, we do think the bar is pretty high for them to continue to hike rates,” says Collin Martin, fixed-income strategist at Charles Schwab. That’s especially the case with inflation still running too high for the Fed’s liking, Martin says.

“The market seems to think that when the Fed tighten, they hit a peak and then we need to go back to zero (interest rates) because that’s what we’ve done the last two times,” Martin says. “But that’s not necessarily the case.”

What comes next, however, is less clear.

In the bond market, for example, there is evidence that investors think the Fed will soon be lowering interest rates.

According to the CME FedWatch Tool, which tracks bets placed in the futures market on the direction of interest rates, the odds of the Fed cutting rates at its July meeting are roughly 36% and more than 75% for September. In fact, the chances of the Fed cutting rates by year-end are currently almost 100%, according to the CME data. In addition, the market is priced for not one but three rate cuts by year-end.

To many observers, these expectations seem out of line with both the Fed’s messaging—its forecasts don’t include rate cuts this year—and the current state of the U.S. economy.

In order for the Fed to cut rates in July as the bond market suggests, “it would have to be economic whiplash,” says Kristina Hooper, chief global market strategist at Invesco.

Strong Jobs Report Helps Case for Avoiding Recession

Candice Tse, global head of strategic advisory solutions at Goldman Sachs Asset Management, is among those in the camp of seeing the Fed pausing its rate cuts but also not lowering rates this year, especially if the economy avoids recession.

Tse points to the April jobs report, which showed the U.S. economy adding 253,000 jobs in April, well above economists’ forecasts. “The jobs market is still strong,” she says.

The base case at Goldman, she says, is a “narrow path to a soft landing,” with a 35% chance of a recession this year. Healthy dynamics in the jobs market, a lack of private-sector structural imbalances of the kind seen during the 2008 global financial crisis, and inflation likely on a downward trajectory are supportive of the economy being able to avoid recession, she says.

So when it comes to the Fed, Tse says the jobs data and news out of the latest meeting reinforce their expectations that the markets have seen the last Fed rate hike for the current cycle. “But we don’t see any cuts,” she says.

For the Fed to cut rates three times by the end of the year as the bond market suggests would take substantially different scenarios for the economy and markets than the ones that are playing out now, says Invesco’s Hooper.

To end up with three interest rate cuts by the end of the year, “it would have to be a very, very significant economic downturn,” Hooper says.

The other argument in favor of easing policy would be a very significant deflationary trend. “Certainly, the overall trend for inflation has been downward, but I’m unconvinced that we’re in a very significant disinflationary environment,” she says.

Hooper points to the Fed’s own statements and forecasts, which suggest officials have been inclined to hold rates at higher levels as they assess the impact of higher interest rates on the economy. “The Fed has made it very, very clear they want to keep the terminal rate intact for some time,” she says.

At Morningstar, U.S. economist Preston Caldwell sees the Fed holding off on rate cuts until the end of this year, but then lowering rates aggressively in 2024 and 2025.

Stocks Could Remain Volatile

For investors, this backdrop presents a mixed bag. On the one hand, it appears that the uncertainty over interest rates that has been a headwind for stocks over the past year is over for now. At the same time, catalysts seem scarce for a solid uptrend in stocks, strategists say.

Goldman’s Tse notes that their expectations are for flat earnings growth for U.S. stocks this year, which raises the importance of getting individual stock calls right rather than riding a broad market trend higher.

At Goldman, expectations are that the overall stock market will end the year roughly where it is now. However, “there’s going to be a lot of volatility along the way,” Tse says. In this environment, dividend-paying stocks or looking at equity markets outside the U.S. could bolster returns, she says.

Invesco’s Hooper also says the most likely outcome in coming months is volatility in the stock market. “I would argue for a defensive stance,” she says. That means generally underweight stocks compared with a standard allocation, and a tilt toward large company stocks, with a focus on companies with strong secular growth trends, such as technology. “When growth becomes scarce, secular growth becomes attractive,” she says.

In the bond market, Schwab’s Martin says they’re recommending investors move to lock in the high yields available today by moving into longer-maturity debt. “High-quality bond yields are at the highest level since the end of the financial crisis,” he notes. So even as the Fed pauses now, the likely next significant move for interest rates will be lower, even if that doesn’t come until 2024.

Events Scheduled for the Coming Week Include:

- Monday: PayPal PYPL and Palantir PLTR report earnings.

- Wednesday: Consumer Price Index April report. Occidental Petroleum OXY, Roblox RBLX, and Walt Disney DIS report earnings.

For the Trading Week Ended May 5:

- The Morningstar US Market Index fell 0.8%.

- The best-performing sector was technology, up 0.4%.

- The worst-performing sectors were energy, down 5.4%, and financial services, down 3.0%.

- Yields on 10-year U.S. Treasuries inched down to 3.44% from 3.45%.

- West Texas Intermediate crude prices fell 7.1% to $71.34 per barrel.

- Of the 846 U.S.-listed companies covered by Morningstar, 339, or 40%, were up, and 507, or 60%, declined.

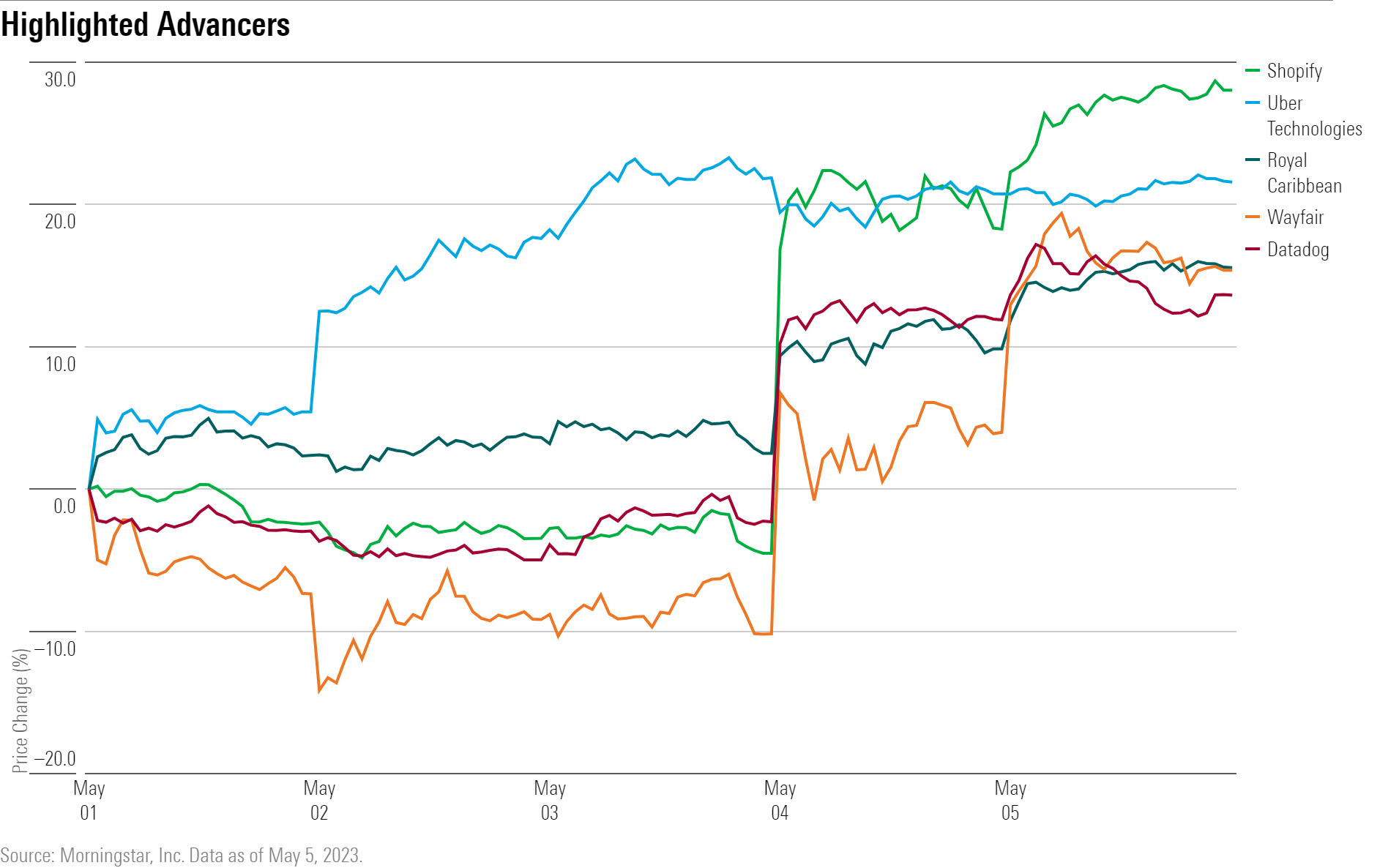

What Stocks Are Up?

Shopify SHOP stock rallied after the company released strong first-quarter results that exceeded expectations. But the highlight was the firm’s announcement that it was selling its logistics business, which includes its Shopify Fulfillment Network, to Flexport, says Morningstar senior equity analyst Dan Romanoff.

“We had thought Shopify Fulfillment Network would help drive meaningful growth but pressure margins, especially as it scaled,” he says. After updating his model for Shopify after it sells its logistics business, Romanoff increased his fair value estimate of Shopify stock to $57 from $45.

Shares of Uber UBER also jumped following quarterly results. The firm posted revenue of $8.82 billion, 29% higher from a year ago. Demand for the firm’s services has been increasing as “consumer and driver acquisition costs decline; together, this is driving top-line growth and margin expansion,” writes Ali Mogharabi.

Datadog DDOG also posted better-than-expected first-quarter results, with revenue growing 33% year over year and margins coming in at 18%, ahead of Morningstar analyst Malik Ahmed Khan’s estimates of 16%. The company also revised its operating income guidance higher to $350 million from $310 million.

Modest first-quarter earnings beats at Wayfair W also led its stocks higher. Wayfair posted a loss of $1.13 per share versus FactSet consensus estimates of a $1.71 loss per share. Driving the outperformance was solid progress in the firm’s efforts to reduce costs by $1.4 billion, leading to better gross margins than expected, says Morningstar senior equity analyst Jaime M. Katz.

Likewise, cruise line operator Royal Caribbean RCL stock rallied after it reported a smaller-than-expected loss per share of $0.23 versus FactSet estimates of a $0.60 loss per share due to “better close-in bookings, higher prices, strong onboard spending, and solid expense management,” says Katz.

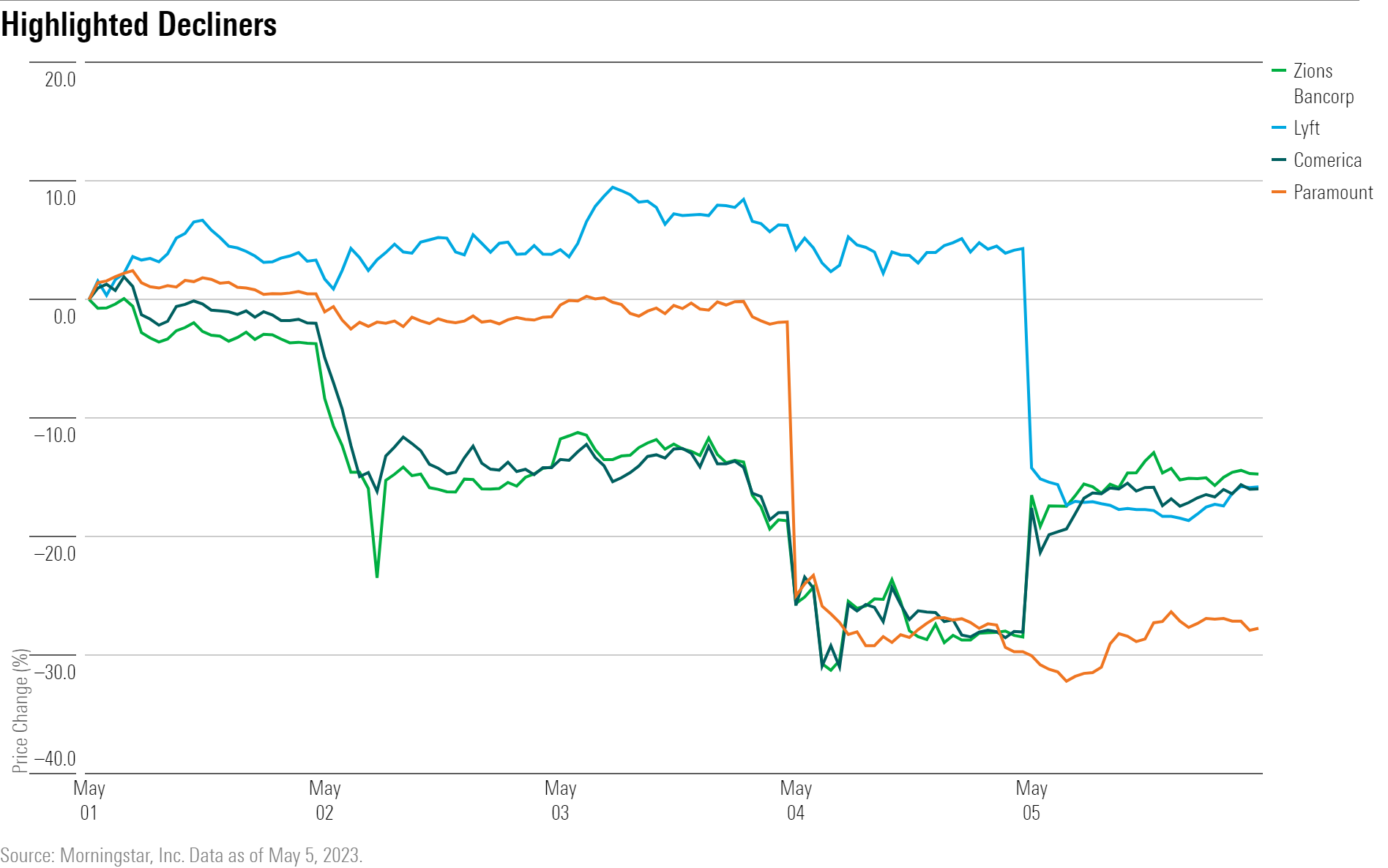

What Stocks Are Down?

First Republic Bank FRC was seized by regulators and sold to JPMorgan Chase JPM. The deal is good news for J.P. Morgan, but effectively zeros out First Republic equityholders, says Eric Compton, Morningstar strategist. The aftershocks contributed to declines in other regional bank shares such as Comerica CMA and Zions Bancorp ZION.

Paramount PARA stock slid as the firm posted earnings of only $0.09 per share versus FactSet estimates of $0.17. The company also announced a dividend cut to $0.05 from $0.20 per share, which should provide the firm with about $500 million in annual savings. “This money will not be allocated to increased content spending but rather to gain financial flexibility and is a direct consequence of Paramount lagging peers in shifting its focus to profitability from DTC customer growth at all costs,” says Neil Macker, Morningstar senior equity analyst. He cut his fair value estimate for Paramount stock to $35 from $40 following the results.

Shares of Lyft LYFT fell after the firm lowered its revenue guidance to $1 billion for the second quarter as the firm shifts to a defensive position to protect market share from Uber and increase demand with more-competitive pricing.

Morningstar senior equity analyst Ali Mogharabi lowered his fair value estimate for Lyft to $32 from $34 per share in response. “We are now projecting lower revenue growth as we don’t think the impact of Lyft’s lower prices will be completely offset by higher ride volume,” he says.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ed529c14-e87a-417f-a91c-4cee045d88b4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/MQJKJ522P5CVPNC75GULVF7UCE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZYJVMA34ANHZZDT5KOPPUVFLPE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/S7NJ3ZTJORFVLCRFS2S4LRN3QE.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ed529c14-e87a-417f-a91c-4cee045d88b4.jpg)