Which Funds and ETFs Took a Hit From Alphabet Stock’s Slide?

Growth-focused funds and communications sector ETFs are the largest holders.

Thanks to the hefty weighting of Alphabet GOOGL stock in many mutual funds and exchange-traded funds, the company’s postearnings plunge has dented numerous portfolios. But for some stocks, the damage was more visible.

Alphabet shares fell 9.5% on Wednesday, the stock’s largest daily decline since March 2020. The steep drop came after Alphabet posted stronger-than-expected overall quarterly results for revenue and earnings per share, but investors were disappointed by the performance of the company’s Google Cloud unit.

The technology giant is one of the most widely held stocks. With many funds, the impact of the stock’s fall decline was noticeable but not necessarily in a significant way. For example, Alphabet makes up 3.93% of the $385.7 billion SPDR S&P 500 ETF SPY, making it the ETF’s third-largest holding behind Microsoft MSFT, which makes up 7.2% of the fund, and Apple AAPL, which is a 7.1% weight in the index.

On Wednesday, SPY fell 1.4%, and according to Morningstar Direct, 0.34 percentage point of that decline owed to Google’s drop.

In the more technology-focused $195.8 billion Invesco QQQ ETF QQQ, Alphabet constitutes 6.1% of the fund. QQQ fell 2.5% on Wednesday, with 0.53 percentage points of that loss caused by Alphabet’s decline.

Prior to Wednesday’s decline, Alphabet had been one of the prime drivers of the rally in U.S. stocks out of the 2022 bear market. Before Wednesday’s fall, it was up 57.3% on the year. Now, it is up 42.3%.

Year-to-Date Performance

Biggest Active Stock Fund Owners of Alphabet

In general, thanks to Alphabet’s profile, funds that invest in growth stocks, along with technology and communications sector ETFs, are the largest holders of Alphabet stock, according to Morningstar Direct.

Among actively managed funds with more than $100 million in assets, Provident Trust Strategy PROVX has the largest stake in the company. As of Sept. 30, more than a fifth of the funds’ assets were invested in Alphabet. The $172 million fund fell 2.6% on Wednesday.

In a recent commentary, the managers wrote that Alphabet was one of its top-performing holdings in the third quarter. Still, compared with other large-growth funds, Provident struggled this year. The fund is up only 2.1%, putting it in the 96th percentile in the large-growth Morningstar Category.

Lazard US Equity Concentrated LEVIX also holds a large stake, with 10.8% of the $288 portfolio invested in Alphabet. The manager, Christopher Blake, “invests with conviction, which amplifies single-stock risks,” writes associate analyst David Carey.

The fund is up only 0.8% this year, putting it in the 90th percentile of large-blend funds.

Fidelity OTC FOCPX holds around 10% of its portfolio in Alphabet. The $23.4 billion fund tilts toward more growth-oriented stocks. “Household-name tech firms such as Apple AAPL and Alphabet GOOG are large holdings given their ubiquity and irreplaceability,” writes senior analyst Todd Trubey.

The fund is up 23.8% this year, putting it in the 21st percentile of large-growth funds.

Active Funds With the Largest Alphabet Exposure

Biggest Stock Index Fund Owners of Alphabet

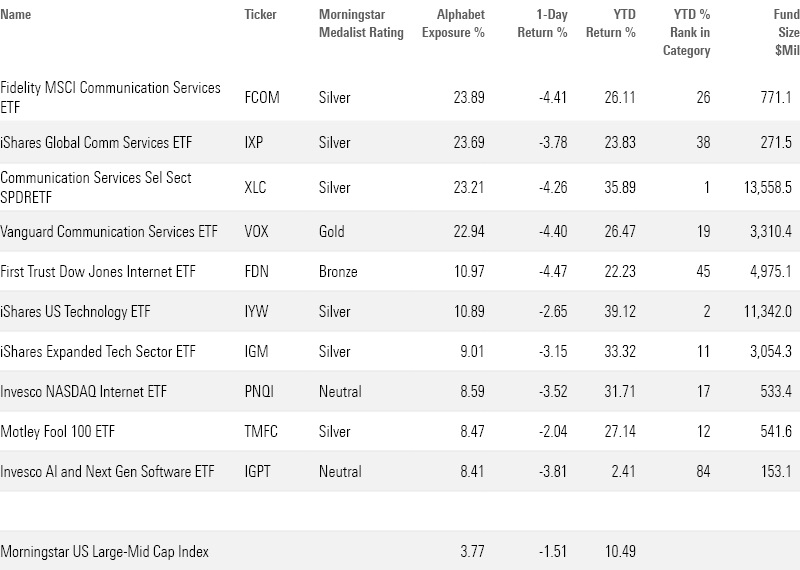

Among index funds, technology and communications sector ETFs hold the largest stakes in Alphabet stock.

Fidelity MSCI Communication Services ETF FCOM carries the largest exposure, with 23.9% of the $771 million portfolio invested in Alphabet. The ETF fell 4.4% on Wednesday.

The largest communications sector ETF, the $13.6 billion Communication Services Select Sector SPDR ETF XLC, similarly holds around 23% of the fund in Alphabet stock and fell 4.5% on Wednesday.

Sector ETFs focused on technology stocks also have heavy exposure. As of Oct. 25, 10.9% of the $11.3 billion iShares US Technology ETF IYW was allocated to Alphabet, and in the $533 million Invesco NASDAQ Internet ETF PNQI, Alphabet was an 8.6% weight.

Passive Funds With The Largest Exposure to Alphabet

The author or authors own shares in one or more securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/F2S5UYTO5JG4FOO3S7LPAAIGO4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TP6GAISC4JE65KVOI3YEE34HGU.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/4JOND5R2SBFPZE63XWPYQDG56A.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)