Why Are Covered-Call Fund Yields So High?

These are the factors influencing big payouts on JEPI and other popular covered-call ETFs and funds.

High yields are one of the main attractions for investors pouring billions of dollars into exchange-traded funds that use options to generate extra income.

Among the most popular of these funds are covered-call strategies. These funds generally offer much higher yields than what’s available elsewhere in the stock and bond markets, with some of the highest payouts solidly in double-digit territory.

For example, the $5.7 billion JPMorgan Equity Premium Income Fund JEPAX posted a 12-month yield of 10.01% as of the end of October. That’s more than six times the yield on the $380 billion SPDR S&P 500 ETF Trust SPY and more than three times the yield on the $46.2 billion Vanguard High Dividend Yield ETF VYM. But a year ago, JEPAX had a yield of 11.9%, and in February of 2021, it hit a record high of 12.2%.

What’s behind the swings in yields on the increasingly popular covered-call funds? Their payouts are determined by a complex mix of expectations for stock market volatility, the inner workings of the options market, changes in interest rates, the nuances of each particular fund’s strategy, and stock dividends. “These are complicated products,” says Morningstar analyst Lan Anh Tran.

Take their recent history. Even as interest rates have been rising, yields on covered-call funds have been falling, largely thanks to declining volatility in the stock market.

Hamilton Reiner, portfolio manager and head of U.S. Equity Derivatives at JP Morgan Asset Management, says investors can think of the factors that influence covered-call yields as individual levers that pull the yields higher or lower at any given time. He says, “The two most critical [factors] are volatility and interest rates.”

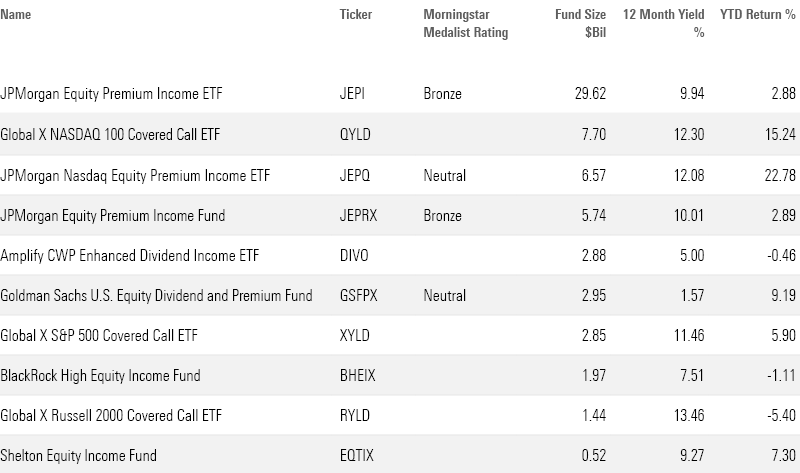

12-Month Yield %

What Is a Covered-Call Fund?

A covered-call fund owns a basket of stocks and sells a “call” option on them. If these stocks rise above a specified “strike” price, the seller of the call pays the buyer of the option the difference between the stock price and the strike price. However, if the stock declines or simply stays below the specified price, the fund keeps the income paid by the option buyer. That income stream is a major reason that covered-call writing reduces the volatility of a fund’s total returns.

This means covered-call funds tend to do well in falling or sideways stock markets, while they lag when stocks are rising. In addition to providing income, Reiner says covered-call writing reduces a fund’s volatility.

For example, over the past year, as the stock market recovered from its bear market lows and the S&P 500 index advanced 13.8%, the JPMorgan Equity Premium Income ETF JEPI gained 9.9%. Conversely, last year, when the S&P 500 fell 18.1%, JEPI declined only 3.5%.

JEPI is the ETF version of the JPMorgan Equity Premium Income Fund. Since JEPI’s launch in May 2020, it has grown to $29.6 billion in assets, making it the largest active ETF and largest covered-call strategy. This year alone, investors have poured more than $12.6 billion into it.

Why Stock Market Volatility Matters

Tran says that implied volatility is the most-watched stock market factor around the premiums these funds collect on the calls they sell. Implied volatility is the market’s assessment of how much an index or individual investment is expected to move in price during a specific time period. When stock prices are expected to swing more widely, calls become more costly because it becomes more difficult to predict whether a stock or index will reach a certain strike price. Tran notes that because implied volatility can have wide swings, it can have a large impact on a fund’s payout.

The most widely watched measure of volatility is the CBOE S&P 500 Volatility Index, or VIX, which reflects the market’s expectation of volatility over the next 30 days. In March 2020, the VIX spiked following the COVID-19 stock market crash, and it stayed elevated above its historical level for much of the year. At that point, the JEPI’s yield hit double digits.

Currently, the VIX is near 20, down from 31 a year ago. “The VIX has dipped a little bit, but right now it’s toward the higher end of the year,” says Reiner. So while volatility is down, by historical standards it remains high, which benefits the funds selling options. “When volatility goes up, options tend to get more expensive,” he explains.

Implied volatility will vary based on the underlying investments. For example, volatility in the Nasdaq is measured by the CBOE Nasdaq 100 Volatility Index. This year, Nasdaq stocks have been more volatile than stocks in the S&P 500 ETF. This means funds that write calls on the Nasdaq are able to collect higher premiums. For example, as of Oct. 31, the $7.7 billion Global X Nasdaq 100 Covered Call ETF’s QYLD 12-month yield was 12.3%, higher than the $2.9 billion Global X S&P 500 Covered Call ETF’s XYLD 11.5%.

CBOE Volatility Index

How Interest Rates Affect Covered-Call Funds

Interest rates are another key factor influencing covered call yields, according to Tran. But she notes that rates typically don’t move “as quickly or frequently” as volatility. “The impact of interest rates is most evident year over year, more than the monthly or daily changes in implied volatility that could impact the fund’s yield.”

Rising interest rates drive up call premiums while falling rates tend to lower them. “Higher rates make calls more expensive,” says Reiner. That’s good for those selling the options.

The higher prices are tied to the margin needed to sell an option. When interest rates go up, so too does the opportunity cost of the cash used for collateral in the options trade—in other words, the potential missed returns from investing that money in safe bonds or in stocks. In essence, the seller looks to be compensated for that missed opportunity.

For example, there was little opportunity cost for keeping cash in an account two years ago, when interest rates were near zero, but now, with the federal-funds rate at about 5%, the price of the call increases.

With the Federal Reserve raising interest rates several times since 2022, JEPI has been able to collect higher premiums. The pace of interest rate increases has been rapid by historical standards. As of Oct. 31, the yield on the 10-year Treasury bond is at 4.8%, up from 3.8% a year ago.

Yields Differ by Strategy

The specifics of a fund’s option strategy also affect its yield. A seller can set the strike price either at the current price of the stock/index or further “out of the money,” meaning higher than that current level. Selling calls “out of the money” is less risky for the seller because there is less chance the stock or index will reach that price. However, this translates to a lower premium for the fund.

The duration—the amount of time before the option will expire—also impacts the premium the fund can charge. “One-to-three-month options are more dynamic and reflect market movements, but 12-month or longer options can generate higher premiums,” says Tran.

The managers of these funds take different approaches to placing covered calls. JEPI sells 30-day out-of-the-money calls. In more volatile environments, they may place calls further out of the money, according to Reiner. In contrast, Global X, the second-largest provider of covered-call funds by assets, places at-the-money calls on its largest funds.

Other funds that use covered-call strategies in the Derivative Income Morningstar Category are affected by the same factors as JEPI, but they vary in key ways.

Tran points to five main ways covered-call funds differ: their underlying investments, the types of options they use, the details of the calls used, the management team, and fees. Most simply, funds vary in the markets they invest in. Some of the most popular funds invest in stocks included in the popular S&P 500 Index, the technology-focused Nasdaq-100, or the small-cap Russell 2000 Index. A fund’s stock selection naturally affects its returns. For example, the Global X NASDAQ 100 Covered Call ETF is up 15.2% this year, while the Global X Russell 2000 Covered Call ETF RYLD is down 5.4%.

Other funds combine investing in dividend stocks with covered-call writing to increase the income they provide to investors. For example, the $3 billion Goldman Sachs US Equity Dividend and Premium fund GSFPX targets a 6% annual payout after fees. “The fund sells index call options on the S&P 500 to generate a 4% annual income premium, and secondly owns a highly diversified portfolio favoring dividend-paying stocks with a yield after fees generally above 2% per year,” writes senior analyst Chris Tate.

The most popular derivative income funds sell calls on the S&P 500 or the Nasdaq-100 indexes, but some write covered calls on individual stocks. The $2.9 billion Amplify CWP Enhanced Dividend Income ETF DIVO writes covered-call options on individual stocks “on a tactical basis,” according to its prospectus. Writing calls on single stocks is riskier, says Tran, because single stocks have higher standard deviations, meaning their prices are more likely to move and potentially hit their strike prices, which is bad for the seller. But with the increased risk comes an increase in premiums the fund can collect and deliver to investors.

Stock Dividends

A small part of a covered-call fund’s yield generally comes from the dividends collected on the stocks that the fund owns. Around 80% of JEPI’s assets are invested in stocks in the S&P 500 Index. As of Oct. 31, the 12-month yield on the S&P 500 Index was 1.6%. Over the past year, yields have risen slightly after dipping in 2021.

“Equity dividends make up a minimal portion of the fund’s payout, as the manager doesn’t specifically target dividend-payers,” writes Tran.

Combining the Factors

The fusion of these factors determines the yield on a fund. At any time, one factor could push the fund’s yield higher while another drags on it.

Reiner notes that five years ago, JEPI’s yield hovered around 8%. He says that’s similar to the fund’s yield today, but the market environment is markedly different. Volatility is lower, while interest rates are higher compared with their 2018 levels.

Instead of focusing on any certain factor, Reiner said investors need to decide if they want to own the underlying asset (in this case, the stocks in the S&P 500 Index) when the market goes down. “Call-writing is about getting income and some of the upside of your investment,” he says.

Tran says income on covered-call funds could fall in the long run, should interest rates or volatility decline. However, she says JEPI should still rank among the highest-yielding covered-call strategies.

Largest Covered-Call Funds

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TP6GAISC4JE65KVOI3YEE34HGU.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/4JOND5R2SBFPZE63XWPYQDG56A.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/CGEMAKSOGVCKBCSH32YM7X5FWI.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)