5 Stocks With the Largest Fair Value Estimate Cuts After Q1 Earnings

The RealReal and Lumen Technologies are among those with the deepest reductions to their valuation estimates.

While valuation estimates for the 849 U.S.-listed stocks covered by Morningstar analysts changed little overall following first-quarter earnings, some companies had their estimates slashed.

Among the stocks on Morningstar’s list, the average change in fair value estimates was a 0.06% increase, compared with a 10-year average of a 1.60% increase per earnings season.

Of those 849 stocks, about 4% saw their fair value estimates cut by a meaningful amount of 10% or more.

Among the companies with the largest reductions, common threads were concerning levels of debt and declining forecasts for revenue and margins. That was especially true for luxury clothing resale firm The RealReal REAL, which saw its fair value estimate reduced by 59%—the worst cut of the quarter.

(See the companies with the largest fair value estimate increases here.)

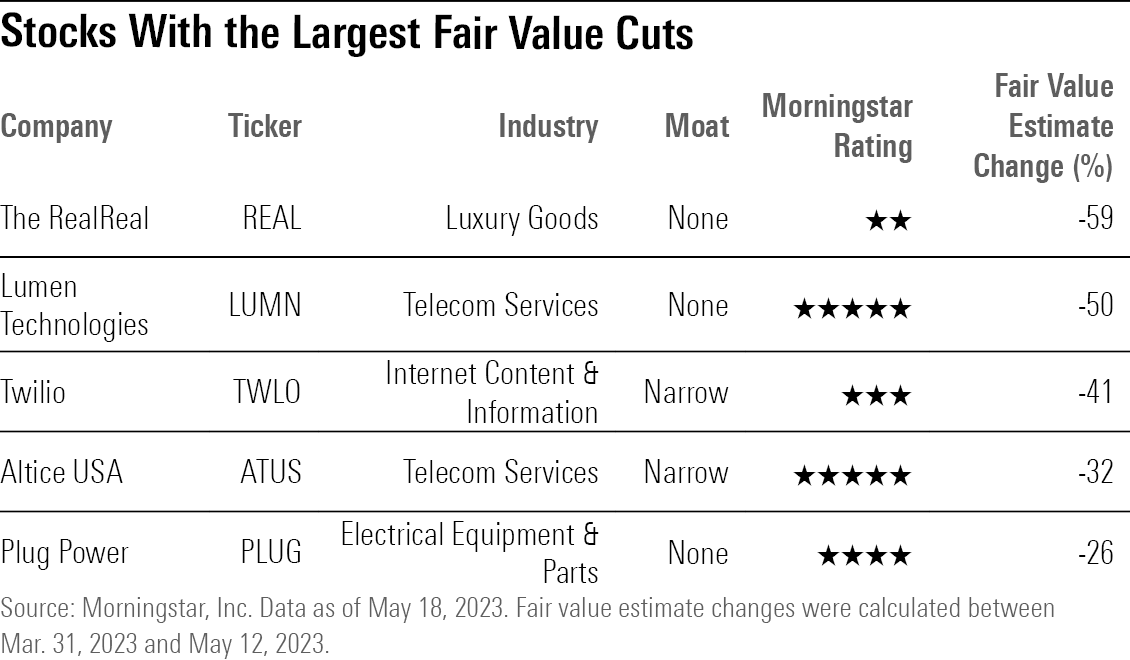

Stocks With the Largest Fair Value Estimate Cuts

- The RealReal—$1.07 from $2.58

- Lumen Technologies LUMN—$5 from $10

- Twilio TWLO—$56 from $95

- Altice USA ATUS—$13 from $19

- Plug Power PLUG—$14 from $19

Here’s what Morningstar’s analysts had to say about these cuts.

The RealReal

Morningstar equity analyst Sean Dunlop cut the fair value estimate on luxury fashion resale platform The RealReal by more than half, to $1.07 per share from $2.58 at the end of March. The rationale was centered on slower-than-expected growth in the platform’s gross merchandise volume, or GMV, and lower long-term operating margins. He now forecasts GMV to decline 4% in 2023 versus growth of 1.3% previously.

Lower GMV and signs of slower sales suggest revenue growth momentum is slowing. After modeling for slower top-line growth, Dunlop forecasts operating margins to hit 5.9% in 2032, versus 8.0% previously.

Spelling more trouble for investors is a looming $172.5 million debt obligation coming up in 2025, which Dunlop says makes a dilutive equity issuance more likely, given the recent difficult capital market environment. The RealReal stock trades with a Morningstar Rating of 2 stars.

Lumen Technologies

Lumen Technologies, one of the largest telecommunications carriers in the United States, had its fair value estimate cut by Morningstar equity analyst Matthew Dolgin to $5 from $10. The firm’s recent guidance amid its poor financial profile has set off alarm bells. The firm set guidance for free cash flow to be between zero dollars and $200 million in 2023, following years of regularly generating $2 billion to $3 billion prior to 2022.

Dolgin does not think this is the new normal for Lumen, since the firm’s spending has increased aggressively as it attempts to pivot to growth. Still, he is skeptical of the “return to growth” story, writing: “We don’t think the company will continue throwing cash at a failing solution. If management shows no progress in its vision to grow, we’d expect much less cash being funneled to ‘growth spending’ and perhaps a sale of assets that we still think have significant value.”

Lumen also has time before its situation becomes completely dire, according to Dolgin. The firm won’t have to start worrying about rolling its debt until 2027. “If, by that time, the firm has returned to growth, there should be no doubts about Lumen as a going concern and little trouble issuing new debt,” he says. Lumen stock has a Morningstar Rating of 5 stars.

Twilio

Reduced growth estimates for customer-engagement software firm Twilio contributed to a significant cut to its stock’s fair value estimate, which is now at $56 per share from $95. While the firm posted solid revenue results and strong profitability, “guidance for the second quarter, while only slightly below our model on profitability, was materially below on revenue,” says Morningstar senior equity analyst Dan Romanoff. The firm now calls for revenue to be between $900 million and $990 million versus the market’s prior estimate of $1.05 billion.

“We think the stock remains a work in progress, with the timing of growth acceleration a moving target,” Romanoff says. Twilio stock has a Morningstar Rating of 3 stars.

Altice USA

Altice USA, a cable provider, had its fair value estimate slashed to $13 from $19 after adjusting for weaker broadband pricing and margin expectations, according to Michael Hodel, Morningstar director of communications-services equity research.

“We still believe Altice USA owns an attractive set of assets, but its equity value is tiny relative to its debt load, making this a highly volatile investment,” Hodel writes. The stock has a Morningstar Rating of 5 stars.

Plug Power

Green hydrogen energy firm Plug Power’s fair value estimate was cut to $14 from $19 as a result of its progress toward improved revenue and margins happening more slowly than anticipated. “Plug’s ambitions are sizable, and execution against these plans—including bringing online the first green hydrogen plants in the U.S.—carries challenges. As such, we adjusted our forecast to represent a more gradual ramp in green hydrogen production,” says Morningstar analyst Brett Castelli, Morningstar energy and utilities equity analyst.

Castelli also incorporated slower growth rates for revenue from end-market applications of green hydrogen, as customers await additional policy clarity on its use. Those changes led to a cut in 2025 revenue forecasts to $2.7 billion from $3.1 billion, as well as a cut in his operating income forecast to $121 million from $133 million. Plug Power stock trades with a Morningstar rating of 4 stars.

Data notes: Fair value estimates were sourced from Morningstar Direct for the end dates of each quarter. Fair value estimate percentage changes were then calculated between their values at the end of each quarter and any new fair value estimates as of six weeks after the quarter ended, which we define as earnings seasons for the purposes of this article. For example: For the first quarter of 2023, fair value estimate percentage changes were calculated between March 31 and May 12. For the fourth quarter only, we expand our earnings season to eight weeks to adjust for the holidays. In some cases, fair value estimate adjustments may have also been made outside these date ranges and would not be captured in this review.

Stocks without a fair value estimate at the beginning and/or end of the six-week period were excluded from data aggregation to account for any changes in our equity coverage list.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TP6GAISC4JE65KVOI3YEE34HGU.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/4JOND5R2SBFPZE63XWPYQDG56A.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/CGEMAKSOGVCKBCSH32YM7X5FWI.png)