Why Q1 Earnings Are Worse Than They Look

Three companies are playing an outsize role in trimming a first-quarter decline in earnings.

First-quarter earnings may look like they’re coming in better than analysts had expected, but scratch the surface, and the results are actually weaker than they would seem.

The reason is that a handful of companies—Amazon.com AMZN, Uber Technologies UBER, and Teladoc TDOC—are posting earnings increases that have had an outsize impact on the overall level of earnings across the market by shaving several percentage points off a first-quarter fall in earnings.

Q1 Earnings on Track for Second Straight Quarterly Drop

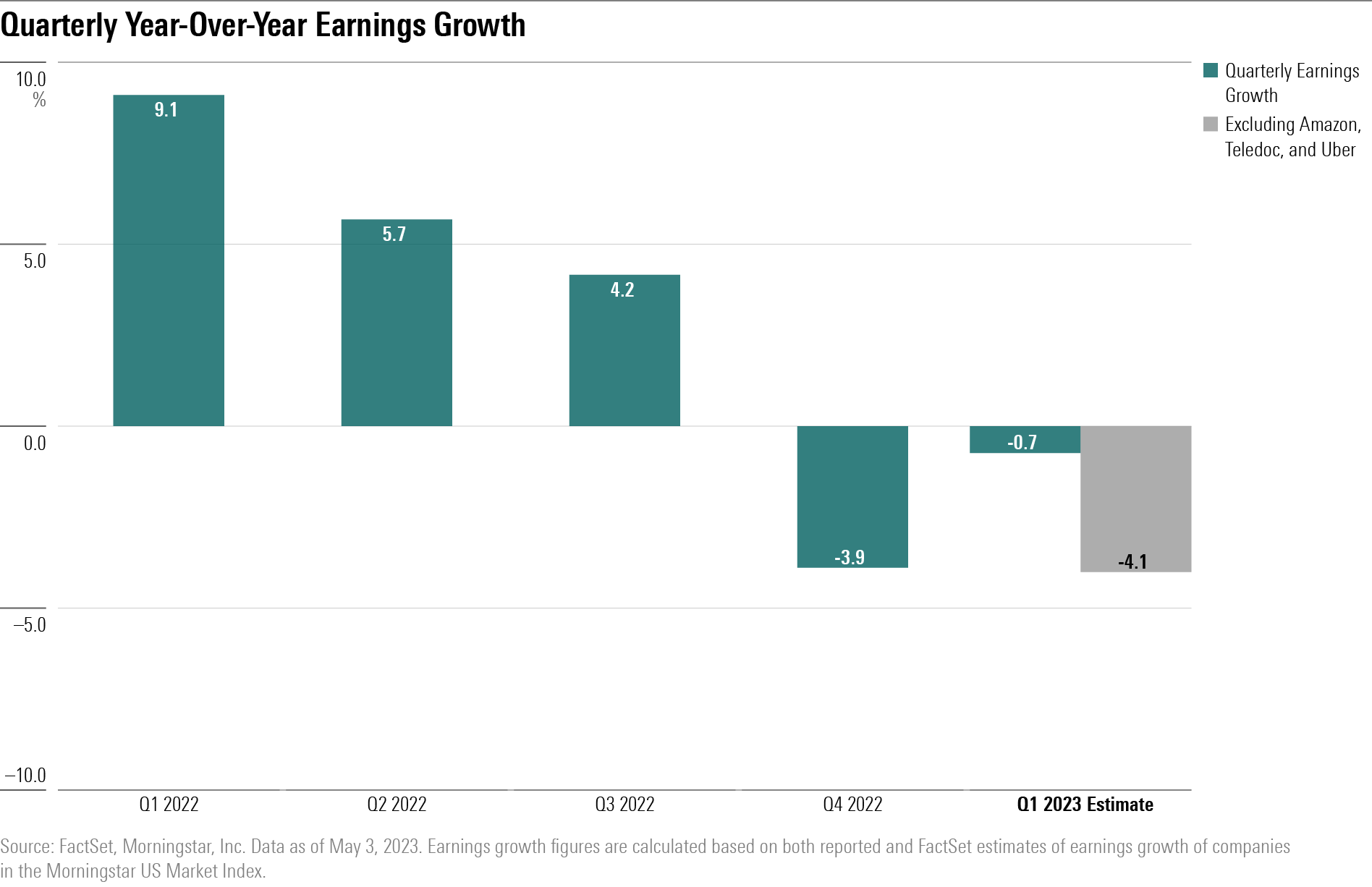

U.S. companies are on track to see earnings decline for the second quarter in a row, albeit at a seemingly slower pace than during the fourth quarter of 2022.

As of May 3, earnings for U.S. companies in the Morningstar US Market Index are projected to decline by 0.7% based on aggregated reported earnings growth and FactSet estimates of earnings growth. As of May 3, 53% of the companies in the US Market Index have posted their quarterly results.

That 0.7% decline represents a far better picture for earnings than the 5.5% decline that was projected at the beginning of earnings season. In addition, it would mark a slower pace of earnings declines than was seen in the fourth quarter of 2022, when earnings fell 3.9%.

Although that seems like good news, the reality is that the better-than-expected earnings results have been skewed in a positive direction by Amazon, Uber, and Teladoc.

These three firms have reported some of the largest gains in net income in the last year among the companies in the Morningstar US Market Index. Each company saw its net income rise by $5.5 billion or more in the last year, leading to a collective addition of nearly $20 billion in the Morningstar US Market Index’s earnings.

That was enough to significantly affect the overall trend in expected first-quarter earnings. Excluding these three companies from index earnings growth calculations, U.S. companies are projected to see earnings decline by about 4.1% instead of the current 0.7%, based on FactSet earnings data.

The Impact of ‘Easy Comparisons’

At the same time, the year-over-year earnings increases reported by Amazon’s, Uber’s, and Teladoc’s earnings are largely due to being inflated by what is known on Wall Street as “easy comparisons” against results from the first quarter of 2022.

Take Amazon, which posted a net income of $3.17 billion for the first quarter of 2023. In the first quarter of 2022, Amazon posted a net loss of $3.84 billion when it wrote down $7.6 billion in paper losses on its stake in Rivian Automotive RIVN, an electric vehicle company. When this year’s results are measured against the year-ago losses, that leads to an almost $7 billion increase in earnings year over year.

Paper losses on investments for Uber and Teladoc during the first quarter of 2022 also set up easier comparisons in first-quarter 2023. Uber wrote down losses in its equity portfolio from investments in international ride-share businesses Grab and Didi, as well as in its self-driving vehicle firm Aurora. Those losses led to a reported net loss of $5.93 billion last year, versus a $157 million loss in first-quarter 2023.

Teladoc wrote down $6.6 billion a year ago as a goodwill impairment charge for its Livongo acquisition, a diabetes health coaching platform, setting up the conditions for the firm’s net losses to jump to $69.23 million in first-quarter 2023 from a loss of $6.67 billion a year ago.

Amazon, Uber, and Teledoc Earnings Skew Sector Earnings Growth

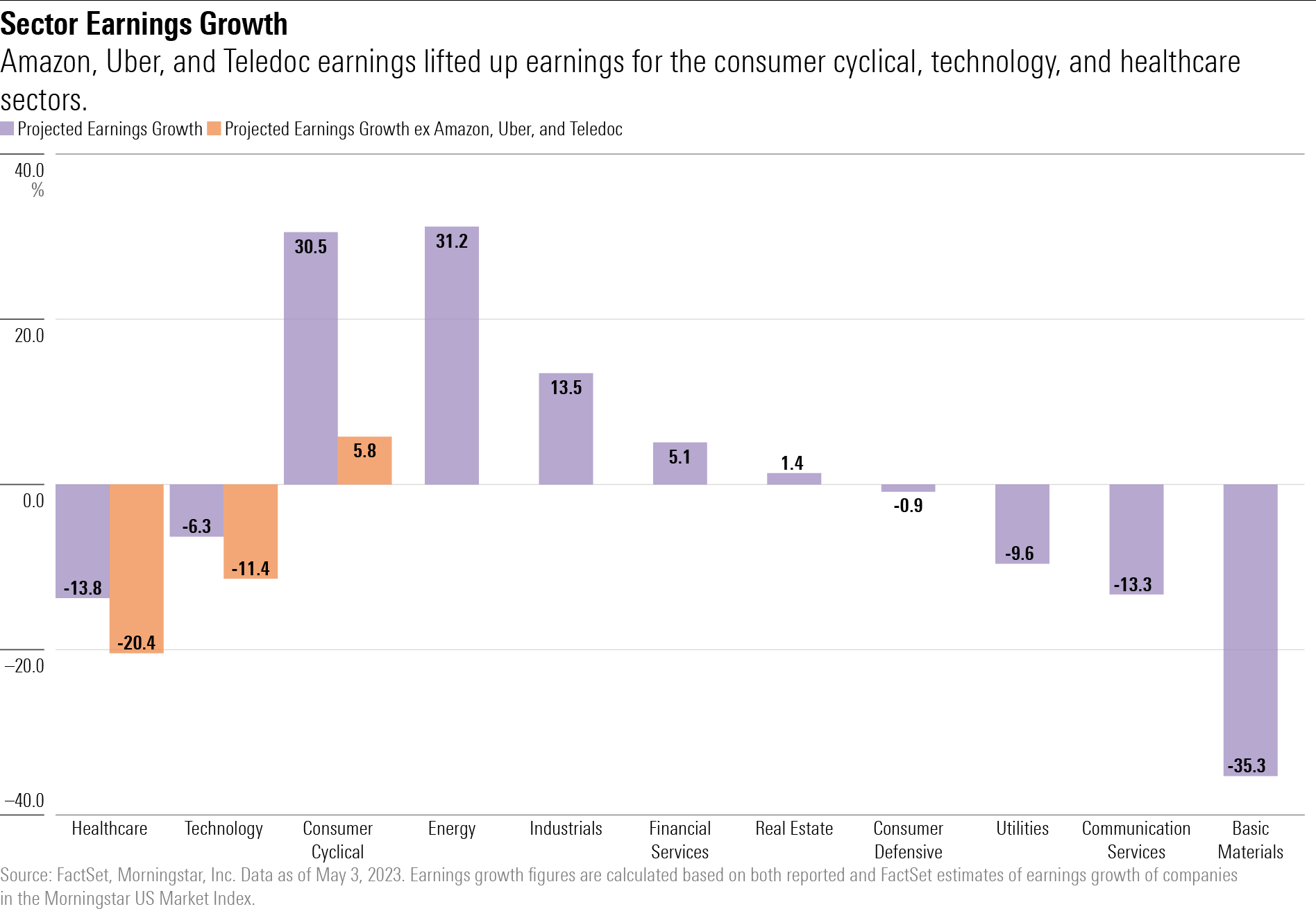

The impact of these easy comparisons also has ramifications for sector-level earnings growth metrics, skewing the picture from being overwhelmingly positive to better than expected.

It is most apparent in consumer cyclicals, where earnings are projected to grow 30.5%. However, a considerable portion of that growth is a result of Amazon. When excluding Amazon from the calculation, earnings for the consumer cyclical sector drop to 5.8%.

Likewise, Teledoc and Uber are having an outsize impact on the earnings trajectory for the healthcare and technology sectors.

Healthcare’s projected earnings worsen to a 20.4% decline from a 13.8% decline when excluding Teledoc. Meanwhile, technology stocks’ earnings decline to an 11.4% projected fall versus a 6.3% drop when taking Uber out of the picture.

Investors should also be cautious as aggregated market earnings growth metrics tend to be extremely volatile as the results roll in from each company. Earnings trends have had a tendency to look stronger at the start of the reporting season before being pulled down as the latter half of companies come out with results.

For example, at this stage during the fourth-quarter earnings season, earnings growth for companies that reported was 0.7% (during the first week of February). At the end of February, that number had dropped to a 4.5% decline in earnings, before ending the season with a 3.9% decline.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/MQJKJ522P5CVPNC75GULVF7UCE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZYJVMA34ANHZZDT5KOPPUVFLPE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/S7NJ3ZTJORFVLCRFS2S4LRN3QE.png)