2023’s Best-Performing U.S. Stock Funds

Fueled by the ‘Magnificent Seven’ stocks, growth funds take the lead.

When it comes to the top-performing funds for 2023, investors can just about take the ranks of 2022′s best and worst performers and flip the lists.

In 2023, growth-stock funds reclaimed their top-performing ways, having been bloodied during the 2022 bear market. Some of the best-performing growth stock funds are finishing 2023 with gains of more than 50% thanks in large part due to big holdings from among the “Magnificent Seven” names that posted huge gains earlier this year.

Among 2023′s best-performing funds: Baron Fifth Avenue Growth BFTIX, up 57.9%, and Fidelity Blue Chip Growth ETF FBCG, up 57.2%. Gains in both funds were fueled by the massive rally in Nvidia NVDA, which surged 230% this year.

Meanwhile, value funds—especially small value—flipped to worst from best.

Over longer periods, the story is mixed. For the past three years, value funds led growth. Zooming out over five years, growth funds hold an advantage.

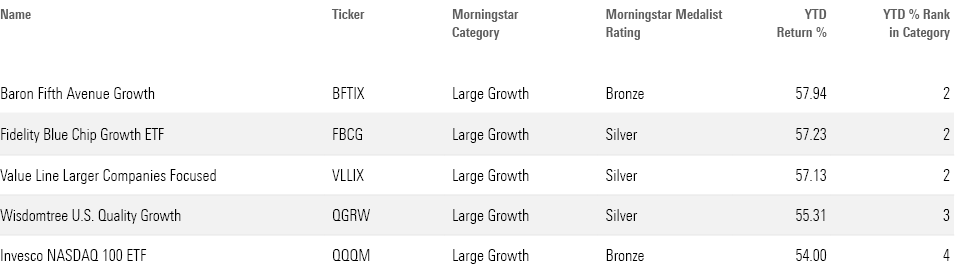

2023 Performance

Tech-Stocks Fuel Growth Fund Rebound

Heading into 2023, the outlook for stocks was dim, with investors focused on the Federal Reserve’s ongoing interest-rate hikes, high inflation, and the possibility of recession. But as the year went on, investor sentiment turned increasingly positive as inflation came down, the economy remained healthy, and it appeared that the Fed could end its rate hikes. At the same time, tech-focused growth stocks were given a boost in the spring after Nvidia reported blowout earnings fueled by a growing boom in artificial intelligence.

This year, the average large-growth fund is up 35% through Dec. 18, while the average large-blend fund is up 21.3%.

2023′s Best-Performing Stock Funds

For this article, we screened for mutual funds and exchange-traded funds that carry Morningstar Medalist Ratings of Bronze, Silver, or Gold. We ranked performance using the lowest-cost share class of each fund.

While growth funds overall thrived in 2023, Baron Fifth Avenue Growth is closing out the year well ahead of the pack. It’s beaten the average large-growth fund’s 35% gain by almost 23 percentage points, with a 58% gain through Dec. 18.

More than half of the portfolio is dedicated to technology stocks, which, on average, are up 68% this year. Specifically, the fund’s large concentration in Nvidia, which composes 9% of the fund, and Amazon.com AMZN, an 8% weight, have powered the fund. Amazon is up 83.4% through Dec. 18.

2023 Best-Performing Stock Funds

The $984.6 million Fidelity Blue Chip Growth ETF has also seen its gain powered by Nvidia and Amazon, according to Morningstar Direct. Morningstar strategist Robby Greengold describes the fund as a “relatively volatile, aggressive-growth portfolio that thrives when growth stocks outperform but lags when value stocks are in favor.” He says, “A key driver of the strategy’s stellar results in 2023 was its hefty stake in semiconductors. It recently exceeded 15% of assets—a stake that exceeded all other large-growth open-end mutual funds and ETFs.”

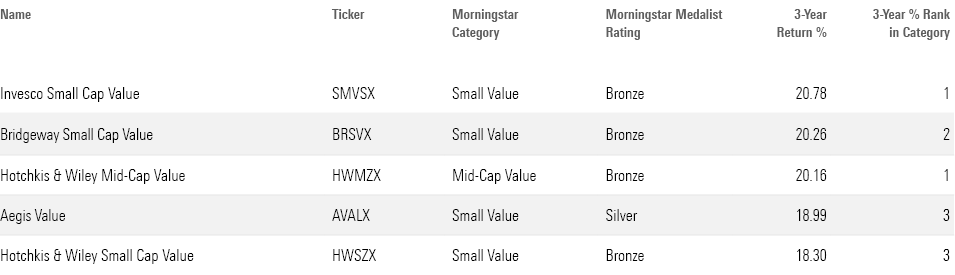

Three-Year Best-Performing Stock Funds

Value funds’ relatively strong performance during 2022′s bear market has helped them maintain an advantage over growth funds over the past three years. For example, the $3.5 billion Invesco Small Cap Value SMVSX was one of the few U.S. equity funds to squeak out a positive return last year. The fund’s strong performance has carried into 2023. Invesco Small Cap Value is up 20.8% on an annualized basis over the past three years, the most among U.S. equity funds.

“Almost everything has gone right for this strategy, especially during the last three years,” says Morningstar analyst Andrew Redden. Lead manager “Jonathan Edwards is willing to pile into and out of sectors based on macroeconomic trends—which have largely worked in his favor.” These calls include an overweighting to energy in 2020 and underweightings in healthcare and regional banks, according to Redden.

Three-Year Best-Performing Stock Funds

Hotchkis & Wiley Small Cap Value HWSZX, with $785.8 million under management, also ends up on the best-performers list over the past three years and was one 2022′s top performers. It’s up an average of 18.3% over the past three years.

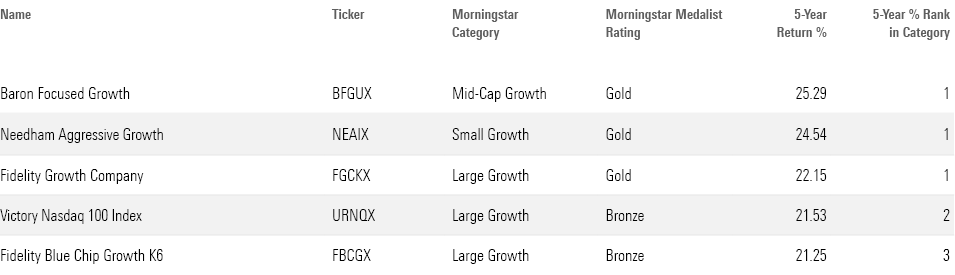

Five-Year Best-Performing Stock Funds

Despite the beating that growth funds took in 2022, their strong performance this year and in 2021 help many of their names lead the pack over the last five years.

At the top of the list is the $1.2 billion Baron Focused Growth BFGUX. Baron Focused Growth holds a large allocation to Tesla TSLA—currently north of 13%—that has propelled the fund to a 25.3% on an annualized gain over the past years. Meanwhile, the average mid-cap growth fund is up 12.5% per year in the same period.

The $51 billion Fidelity Growth Company FGCKX also makes the list of top performers. The fund is 22.2% per year, while the average large-growth fund is up 15.9% per year. “The strategy has become increasingly defined by its top holding, Nvidia,” writes strategist Robby Greengold.

Five-Year Best-Performing Stock Funds

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/4JOND5R2SBFPZE63XWPYQDG56A.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/CGEMAKSOGVCKBCSH32YM7X5FWI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/BAG2H5VQKBERZKT5SM7JTWM6CY.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)