5 Top-Performing Corporate Bond Funds With High Yields

These funds have outperformed in 2023 and come with high yields for investors.

In a year when many bond funds have lost money, corporate bond funds have eked out gains, with the best returns coming from some of the most aggressive strategies.

Driving the returns on the top-performing corporate bond funds has been the same factor sending many other bond funds into negative territory: the surprising strength of the U.S. economy.

Unlike funds focused on bonds that are more sensitive to changes in interest rates, for corporate bond funds, the resilience of the economy has been a plus. The kinds of investment-grade and lower-quality corporate bonds that would most likely suffer in an economic downturn have posted solid returns. And the higher yields those bonds offer in return for their credit risks have cushioned them against rising interest rates in 2023.

For example, Columbia Corporate Income CRIYX holds more high-yield bonds—in other words, lower-quality bonds—than the average corporate bond fund. The $1.7 billion fund is up 2.2% through Nov. 9 while the average corporate bond fund is up 1.7%, putting it in the 7th percentile in the category.

Among other top-performing corporate bond funds this year with high yields:

- Lord Abbett Income LAUVX

- iShares Investment Grade Bond Factor ETF IGEB

- iShares 5-10 Year Investment Grade Corporate Bond ETF IGIB

- Shares Broad USD Investment Grade Corporate Bond ETF USIG

Corporate Bond Funds Are Outperforming In 2023

This trend of funds with heavier weightings in lower-quality bonds outperforming comes as corporate bond funds more broadly have performed solidly during an otherwise tough year for the bond market.

As of Nov. 9, the largest corporate bond fund, the $37.1 billion Vanguard Intermediate-Term Corporate Bond ETF VCIT, was up 1.64% for 2023, while the $23.1 billion iShares Us Treasury Bond ETF GOVT was down 0.2%. In the same period, the average corporate bond fund is up 0.7% and the average intermediate-term government bond fund is down 1.2%.

Corporate bonds have outperformed in part because many investors expected a recession in 2023. In a recession, a greater number of companies are at risk of becoming unable to make payments on their debt. But the U.S. economy not only avoided a downturn in 2023; it gained strength as the year went on. This translated into good news for bond issuers. “There have been fewer [credit rating] downgrades and defaults than expected [among corporate bonds],” says Dave Sekera, Morningstar’s chief U.S. market strategist.

Corporate bonds are inherently riskier than U.S. Treasury bonds, which are backed by the government, but because of that risk, they come with higher yields. For example, the yield on the Vanguard Intermediate-Term Corporate Bond ETF was 6.24% as of Oct. 31—1.25 percentage points higher than the 4.99% yield on the iShares US Treasury Bond ETF.

Meanwhile, interest rate risk and not credit risk has been the main detractor for many bonds this year. Funds that have greater sensitivity to interest rates (especially those that focus on intermediate and longer-term government debt) have taken a hit from the rise in bond yields.

The yield on the U.S. 10-year Treasury note rose above 5% for the first time in 16 years in October, from 3.87% at the start of the year. Intermediate core bond funds, which invest in a mix of corporate and government debt, are down 1.24% on average for the year through Nov. 9. At the same time, the average corporate bond fund is up 0.7%.

Year-To-Date Performance

“Investors have been well-compensated for taking on more risk this year,” says Sekera. Part of the outperformance seen by corporate bonds this year is due to their high starting yields, he explains.

As of Jan. 1, the SEC yield (a measure of yield that represents the income investors would hypothetically receive over the next 12 months based on the income the fund paid over the last 30 days) on the Vanguard Intermediate-Term Corporate Bond ETF was 5.30%, while the yield on the iShares US Treasury Bond ETF was 4.00%.

Corporate bonds offer higher yields because they invest in investment-grade bonds issued by corporations in U.S. dollars, which tend to have more credit risk than government or agency-backed bonds. For example, debt issued by banks and consumer defensive companies like Pfizer PFE and Abbvie ABBV make up the largest sector exposure in the biggest corporate bond funds.

Even as some investors start to fear a recession is looming again, corporate bonds still hold appeal. The spread (the difference between the yield investors receive for investing in a risk-free treasury bond versus a corporate bond) has narrowed slightly since the beginning of the year, but corporate bonds are still an attractive investment, according to Sekera. Their higher yields should help offset losses if credit conditions tighten in the United States.

Yield Comparison

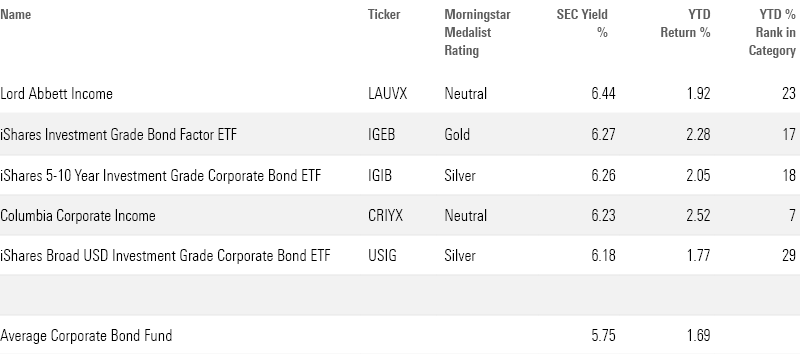

Top-Performing Funds With High Yields

For this article, we screened for the corporate bond funds with the highest yields as of the end of October. that also rank in the top third of the category in terms of year-to-date returns. This screen includes funds in the Morningstar corporate bond category with more than $100 million in assets, and it features both active and passive funds.

Within this category, funds with more aggressive approaches have done well this year. This includes funds that allocate larger percentages of their assets to lower-rated debt, like high-yield bonds, as well as funds that took large concentrations in certain industries.

Among the top performers, the $3.5 billion Lord Abbett Income offered the highest yield at 6.44%, well above the category average of 5.8%. The fund is more aggressive than its peers, as it invests in more lower-rated bonds than the typical corporate bond fund, according to Morningstar’s analysis. This means it does well when credit rallies, but hurts the fund during credit market selloff. This year the fund is up 1.9%, while the average corporate bond fund is up 1.7%.

Among passive funds, the $321.4 million iShares Investment Grade Bond Factor ETF carried a 6.27% yield. The ETF tracks an index composed of investment-grade corporate bonds, according to its prospectus. Banks and consumer defensive companies are its largest sector allocation. Morningstar’s data shows the fund doesn’t hold any high-yield bonds, but it allocates a greater-than-average amount to the lower rung of investment-grade debt: BBB-rated bonds. As of September, 77% of the portfolio was invested in BBB-rated debt, compared to the category average of 45.4%.

The $11.1 billion iShares Investment Grade Bond Factor ETF is another passive option that offers a high yield, with a 6.26% payout. “The fund’s bonds are weighted by their market value, which tilts it toward the largest investment-grade corporate bond issuers,” writes analyst Lan Anh Tran. “These tend to be financial-services firms, which account for the fund’s largest sector exposure.”

The fund excludes short-term bonds, but its overall duration profile (a measure of interest rate risk) is similar to those of other funds in the category. “In recent years, companies have been taking advantage of the low-interest-rate environment and issuing more bonds on the longer end of the curve. This has increased the average duration of category peers’ portfolios,” explains Tran. The iShares Investment Grade Bond Factor ETF is up 2.05% this year.

Columbia Corporate Income is one of the top-performing funds in the category this year, with a 6.23% yield. The managers take a more aggressive approach compared with those of most corporate bond funds. The team allocates a larger-than-average amount to high-yield bonds (debt that’s rated BB or lower), and its portfolio is highly concentrated in certain industries.

“The strategy has a persistent large bias toward the utilities and life insurance industries. With a combined allocation at times higher than 30%, the returns in these two industries can have a significant impact on performance,” says Morningstar’s analysis. Columbia’s aggressive approach has paid off this year; it’s up 2.52% through Nov. 9, putting it in the 7th percentile of the category.

Top-Performing Corporate Bond Funds With High Yields

Long-Term Performance

Over longer time periods, this year’s top-performing corporate bond funds have held up well compared to the rest of the category. All five rank in the top half for the past three- and five-year periods.

For example, Lord Abbett Income is down 3.3% on an annualized basis over the past three years, while the average corporate bond fund is down 4.2% per year.

While corporate bond funds have been in the red over the past three-year period, returns are positive over the past five years. The iShares Investment Grade Bond Factor ETF is up 2.3% on average over the past five years, while the average corporate bond fund is up only 1.6%.

Longer-Term Performance

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/MQJKJ522P5CVPNC75GULVF7UCE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZYJVMA34ANHZZDT5KOPPUVFLPE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/S7NJ3ZTJORFVLCRFS2S4LRN3QE.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)