How the Largest Bond Funds Did In Q3 2023

The Fed’s ‘higher for longer’ message has most funds posting both short- and long-term losses.

A negative third quarter has put investors in many of the largest bond funds on track for a nearly unheard-of third consecutive year of losses.

In the background, even though the Federal Reserve held interest rates steady at its September meeting, its “higher for longer” messaging sent waves through the bond market. In response, yields on intermediate and long-term bonds rose sharply, and bond funds focused on those maturities suffered.

However, with the central bank holding its federal-funds rate target unchanged at its August and September meetings after a quarter-point hike in July, funds heavy on short-term bonds fared relatively well. Some managed to eke out gains for the quarter. “Bonds’ third-quarter success was mostly a function of their interest rate sensitivity,” says Morningstar analyst Ryan Jackson.

Still, for many bond funds, including those in the intermediate-core category (a building block for many portfolios), 2023 is now on track for a third year of losses. According to Morningstar Direct, core bond funds haven’t lost three years in a row since the mid-1970s.

For example, the widely held $350 billion Vanguard Total Bond Market Index fund VTBSX fell 3.1% in the third quarter. The tough quarter eliminated any gains for the year, and the fund is now down 0.9% in 2023. It has lost 5.2% on an annualized basis over the past three years.

Even among the handful of the largest bond funds posting gains, returns are minimal. The $128.2 billion multisector fund Pimco Income PIMIX is up over the last three years, but only by an average of 0.67% per year over that time frame.

Here’s a look at how the largest mutual funds and exchange-traded funds fared in the third quarter. Performance data for this article was based on the lowest-cost share class for each fund. Some funds may be listed with share classes not accessible to individual investors outside of retirement plans. The individual investor versions of those funds may carry higher fees, which reduces returns to shareholders.

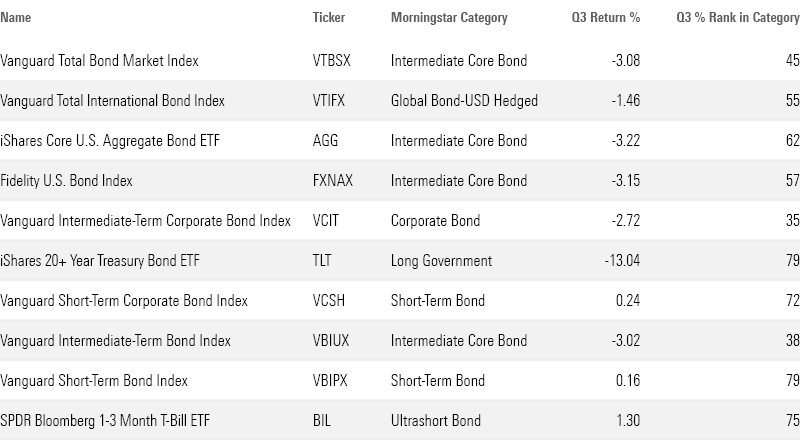

Q3 Performance: Largest U.S. Bond Index Funds

Among the largest passive funds, only short-term and ultrashort-term bond funds made gains.

Short-term bond funds invest in bonds with shorter durations, a measure of interest rate sensitivity. Such funds are less sensitive to changes in interest rates. The $33 billion Vanguard Short-Term Bond Index VBIPX gained 0.2% during the third quarter, while the $31 billion SPDR Bloomberg 1-3 Month T-Bill ETF BIL advanced 1.3%.

However, long-term funds posted steep losses. The $37.8 billion iShares 20+ Year Treasury Bond ETF TLT lost 13%—its worst quarter since the first quarter of 2021, when it declined 14%.

Corporate bond funds held up slightly better. For example, while the $36.4 billion Vanguard Intermediate Bond Index VBIUX fell 3%, the $37.7 billion Vanguard Intermediate-Term Corporate Bond Index VCIT fell 2.7%

Largest Passive Bond Funds Q3 2023 Performance

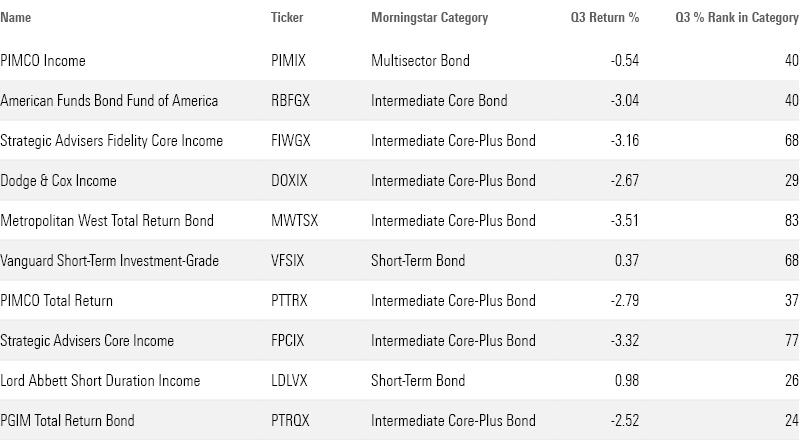

Q3 Performance: Largest Active U.S. Bond Funds

Among active funds, short-term funds such as the $44.1 billion Lord Abbett Short Duration Income LDLVX and $55.2 Vanguard Short-Term Investment-Grade VFSIX fared the best.

Among other categories, Pimco Income (a multisector fund) lost 0.5%, just ahead of the 0.6% decline posted by the average fund in the class.

“The fund’s exposure to the ultra-short-term rates as cash and cash-like exposures generated a lot of income as the Fed has raised short-term rates so high,” says Morningstar director of manager research Eric Jacobson. The fund exposure to nonagency mortgages also helped, he says.

Among intermediate core-plus funds, the $65.8 billion Dodge & Cox Income DOXIX lost 2.7%, an improvement over the 3% drop seen in the average fund in its category. “The fund has a shorter duration and a greater corporate-credit-focused stance relative to core-plus rivals, so it has done well as shorter-duration credit has outperformed,” says senior analyst Sam Kulahan. Dodge & Cox Income is up 0.4% this year, while the average intermediate core-plus bond fund is down 0.5%.

The $73.7 billion American Funds Bond Fund of America RBFGX outperformed many of its peers in the third quarter, but it has struggled throughout 2023. It is down 2.3%, while the average intermediate core bond fund is down 0.8%. The managers have been slightly cautious on credit, says Kulahan. This may have hurt the fund, as riskier parts of the bond market have been outperforming.

Largest Active Bond Funds Q3 2023 Performance

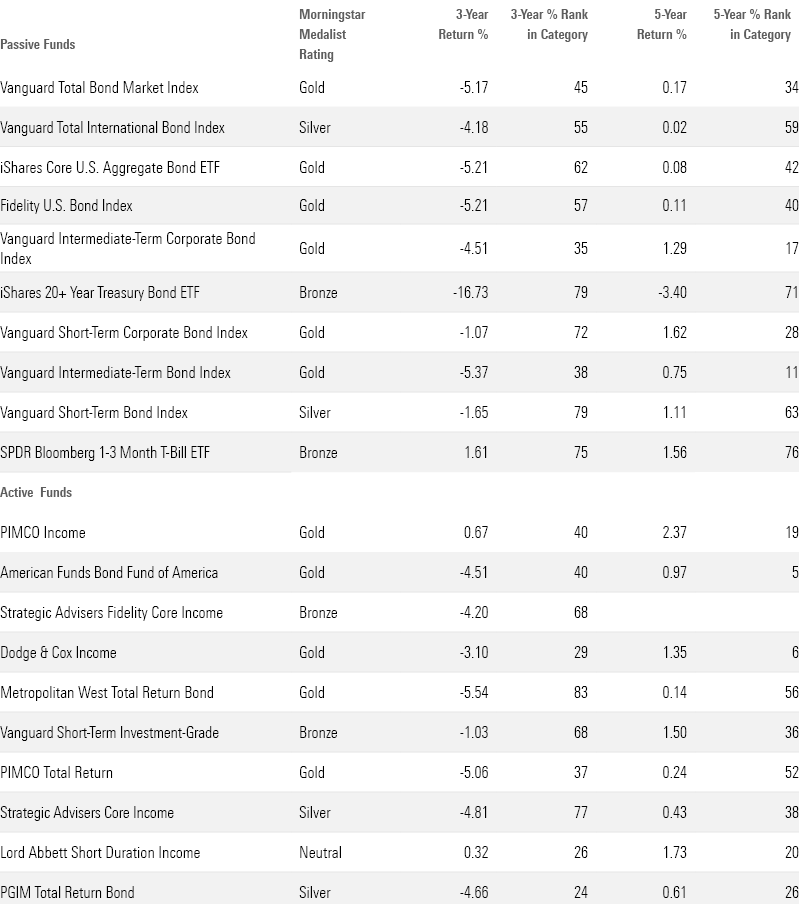

Long-Term Performance Trends

Most bond funds show negative results over the past three years. Among the largest passive funds, only SPDR Bloomberg 1-3 Month T-Bill ETF is up over the past three years, gaining 1.6% on an annualized basis. Among active funds, Pimco Income is up the most with an annualized gain of 0.7%.

Returns are only slightly better when looking at five-year track records. Vanguard Short-term Corporate Bond Index is up the most among passive funds with an average annual gain of 1.6%, while Pimco Income again comes out ahead among the largest active funds with a gain of 2.4% on an annualized basis.

Largest Bond Funds Long-Term Performance

What Rising Bond Yields Mean for Investors

The author or authors own shares in one or more securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TP6GAISC4JE65KVOI3YEE34HGU.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/4JOND5R2SBFPZE63XWPYQDG56A.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/CGEMAKSOGVCKBCSH32YM7X5FWI.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)