Markets Brief: Stocks Are in Limbo. What Should Investors Do Now?

Uncertainty about the economy, Fed policy, and earnings has stocks moving in tighter ranges.

Check out our weekly markets recap at the bottom of this article.

The first-quarter rally in stocks seems to have run out of steam, leaving the market treading water well up from bear-market lows but seemingly without catalysts for a continued rally.

In a dynamic that is frustrating to both stock market bears and bulls, investors may be in for a choppy, sideways market as the answers to key questions about the outlook for the U.S. economy, interest rates, and corporate earnings remain elusive.

Are we heading into a recession? Will inflation come down enough that the Federal Reserve will be able to lower interest rates? How bad will corporate earnings be?

Unfortunately, it’s entirely possible that it could take months or even quarters before the picture comes into focus.

“We’re in a wait-and-see period,” says Marta Norton, chief investment officer at Morningstar Investment Management.

A Muddy Stock Market Outlook

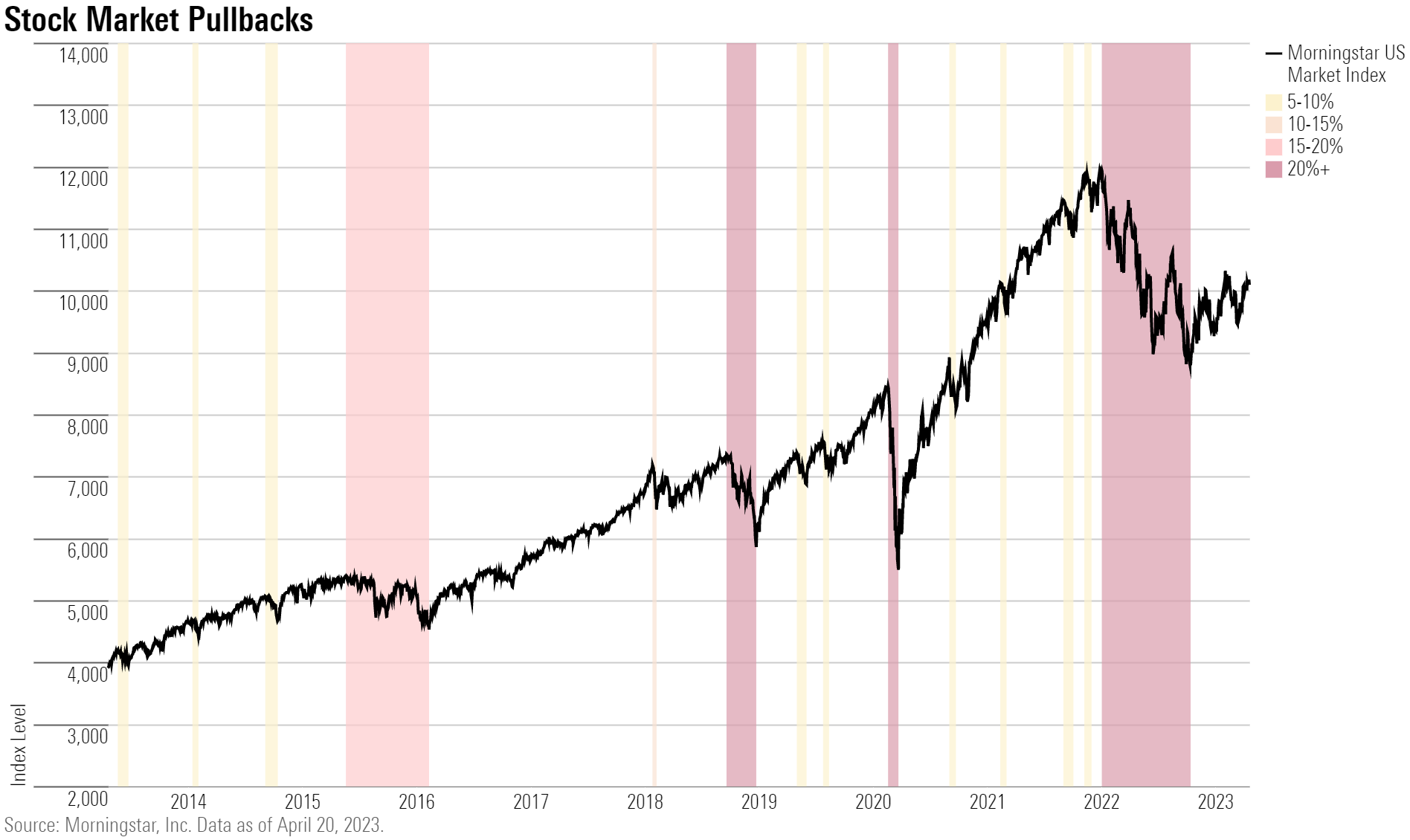

A directionless market would be unfamiliar territory for investors. In recent years, the stock market has tended to post strong moves, generally higher. Stocks have posted double-digit gains in seven out of the last 10 calendar years. And of course, last year’s bear market produced double-digit losses.

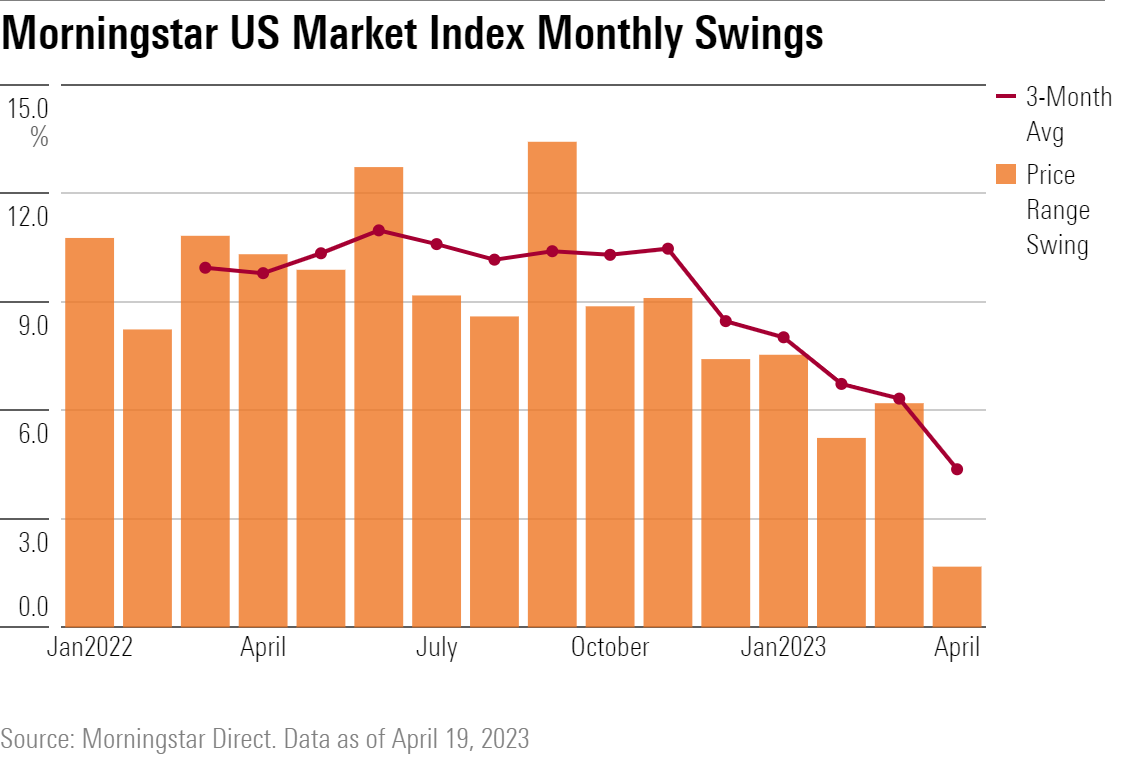

While the Morningstar US Market Index is up 15.4% from its bear-market low on Oct. 14, the market is only 1.4% higher than it was at the end of November. In recent months, the stock market has been moving in tighter and tighter bands. So far in April, the Morningstar US Market Index has only moved up 0.9%, making it on track to be one of flattest monthly returns since May 2022.

“It feels like we’re in a trading range,” says Saira Malik, chief investment officer at Nuveen. A big reason, she says, is “investors are concerned that the baton is going to pass from rate hikes to a recession, and what does that mean?” At Nuveen, Malik says, the expectation is that the U.S. economy will slip into a recession but most likely a mild decline.

“Of course, the timing and depth of a recession are in question, so I think that’s why the market is drifting around or in a holding pattern,” Malik says.

Jason Trennert, chief investment strategist at Strategas Research Partners, counts himself in the frustrated bear camp on stocks, in large part because he believes that investors haven’t really factored in the risks of a recession that he believes is on its way. But he also acknowledges that the picture is far from clear on that front.

In particular, he points to the continued strength in the job market. For investors to start believing a recession is happening, “you’re going to have to have evidence of employment actually weakening in a meaningful way, and so far, that has been the dog that hasn’t barked.” In part, he says, that labor market strength could reflect the lingering boost to the economy provided by the significant fiscal and monetary stimulus pumped into the economy in the wake of the pandemic.

“But then we have the banking (crisis impact), which hasn’t kicked in, and we don’t know the impact of that yet,” he says. At the same time, “what’s really going to happen on inflation and whether the Fed is going to start to ease? So, it seems like we’re kind of boxed in” when it comes to the stock market.

One aspect of the dynamic, Trennert says, is that ever since the 2008 financial crisis, many investors haven’t lived through a traditional business cycle that plays out very gradually in response to changes in monetary policy. “This is more of a traditional business cycle that plays out slowly,” he says. “The Fed only started tightening a year ago and from zero” interest rates, he notes.

The Earnings Question Mark

Another significant uncertainty is corporate earnings, which are expected to post a second consecutive quarter of declines. Earnings on the stocks in the Morningstar US Market Index are seen dropping by 5.2%, which would follow a 3.8% decline in the fourth quarter.

Nuveen’s Malik notes that in recent quarters revenue has continued to grow even as earnings strength tailed off.

“But if you take a look under the hood on revenues, most of that has been driven by pricing power,” Malik says. “And that gets us to our concern with earnings. It’d be hard for companies to hold on to pricing power with inflation rolling over, and margins are already compressing,”

Still, Morningstar’s Norton notes that company fundamentals are “pretty strong” and that consumers are “in a reasonable place,” which could help position the economy to withstand ongoing pressures. While Morningstar Investment Management considers a variety of economic outcomes and does not tend to make forecasts, Norton says that a “soft or mild recession seems more likely to us than a hard landing.”

As for what investors should be doing with their portfolios during this lull period following a major stock market climb, Norton looks to short-dated, high-quality, fixed-income instruments as an especially attractive opportunity. “When you have more compelling yield numbers coming out of fixed income, you’re getting a safer return expectation than you’re getting when you’re investing in equity, especially after equities have rallied pretty hard,” she says.

Within the stock market, Nuveen’s Malik favors companies with a history of growing dividends. “We like these companies. They’re resilient, they have strong balance sheets, they provide income, and if you look at their upside versus downside [potential], they tend to participate in most of the upside in a rally and protect you on the downside.”

At Strategas, Trennert says they’re focusing on companies that generate strong cash flows, an advantage during times of higher long-term interest rates. “You want to focus on what we call shorter duration equities, which is just a fancy way of saying companies that are generating enough cash flow that they can return the cash flow back to shareholders in some way, either through dividends, or through share repurchases.”

Events Scheduled for the Coming Week

- Monday: First Republic Bank FRC, Coca-Cola KO report earnings.

- Tuesday: Alphabet GOOGL, Microsoft MSFT, General Motors GM, and Visa V report earnings.

- Wednesday: Meta Platforms META and ServiceNow NOW report earnings.

- Thursday: Cullen/Frost Bankers CFR, Snap SNAP, AbbVie ABBV, Eli Lilly LLY, Mastercard MA, and Sirius XM SIRI report earnings.

For the Trading Week Ended April 21

- The Morningstar US Market Index declined 0.01%.

- The best-performing sectors were consumer defensive, up 1.7%, and real estate, up 1.6%.

- The worst-performing sectors were energy, down 2.9%, and communication services, down 2.7%.

- Yields on 10-year U.S. Treasuries rose to 3.57% from 3.52%.

- West Texas Intermediate crude prices fell 5.6% to $77.9 per barrel.

- Of the 847 U.S.-listed companies covered by Morningstar, 441, or about 52%, were up, and 406, or about 48%, declined.

What Stocks Are Up?

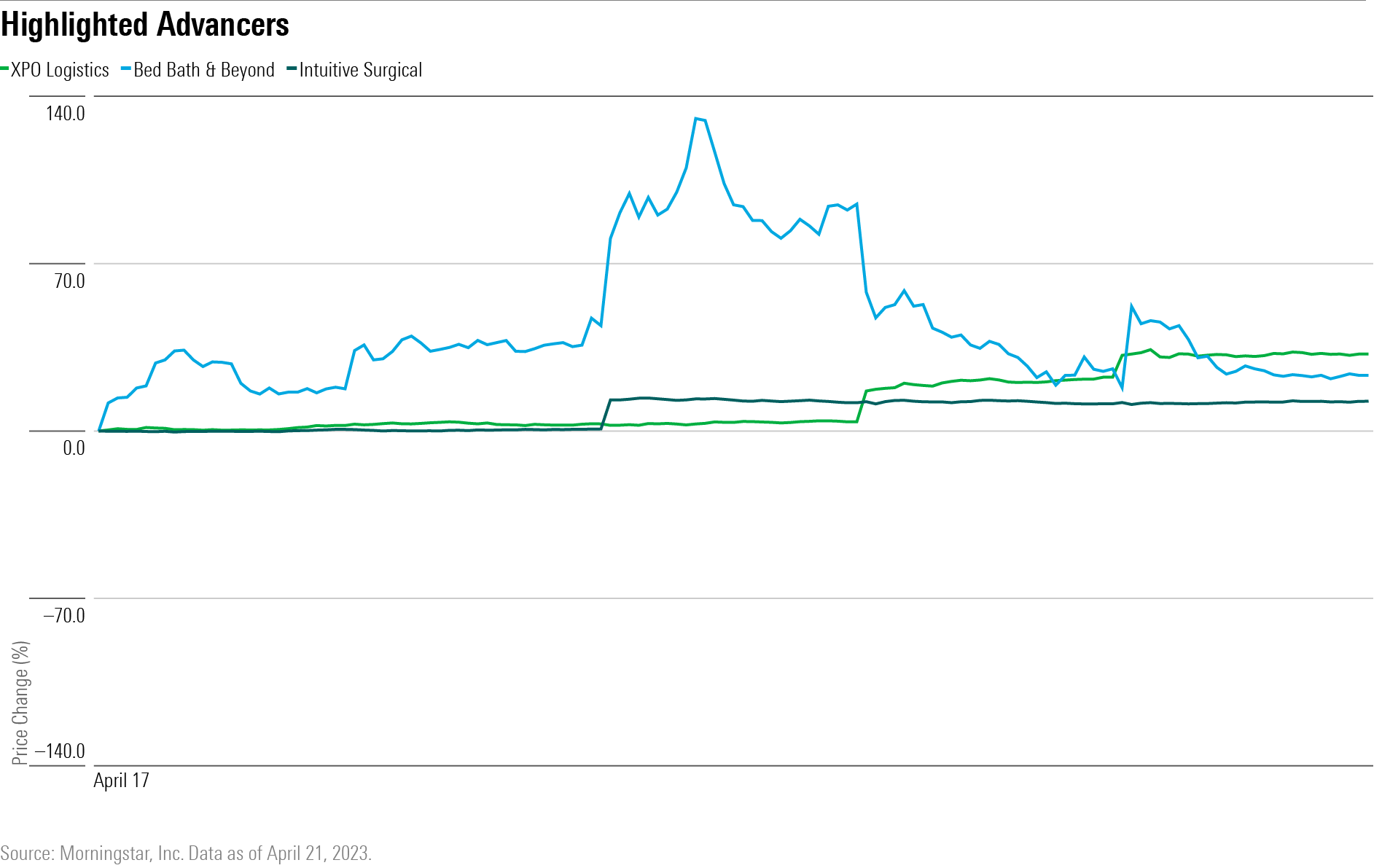

Shares of XPO XPO rallied after the trucking company announced a new chief operating officer, Dave Bates, would be joining the company from competitor Old Dominion.

Intuitive Surgical ISRG shares rose after the company’s first-quarter results beat expectations. “Intuitive Surgical’s first-quarter results easily surpassed our expectations with 26% growth globally,” writes regional director Alex Morozov. “Robust procedures growth was a surprise not just for us but also for the company,” he adds. He expects to increase the stock’s $204 fair value estimate.

Bed Bath & Beyond BBBY shares were volatile throughout the week but end the week substantially higher even as the threat of bankruptcy looms. Senior equity analyst Jaime M. Katz writes, “We don’t plan to alter our $0 per share fair value estimate on no-moat Bed Bath & Beyond and still expect the firm will eventually declare bankruptcy.”

What Stocks Are Down?

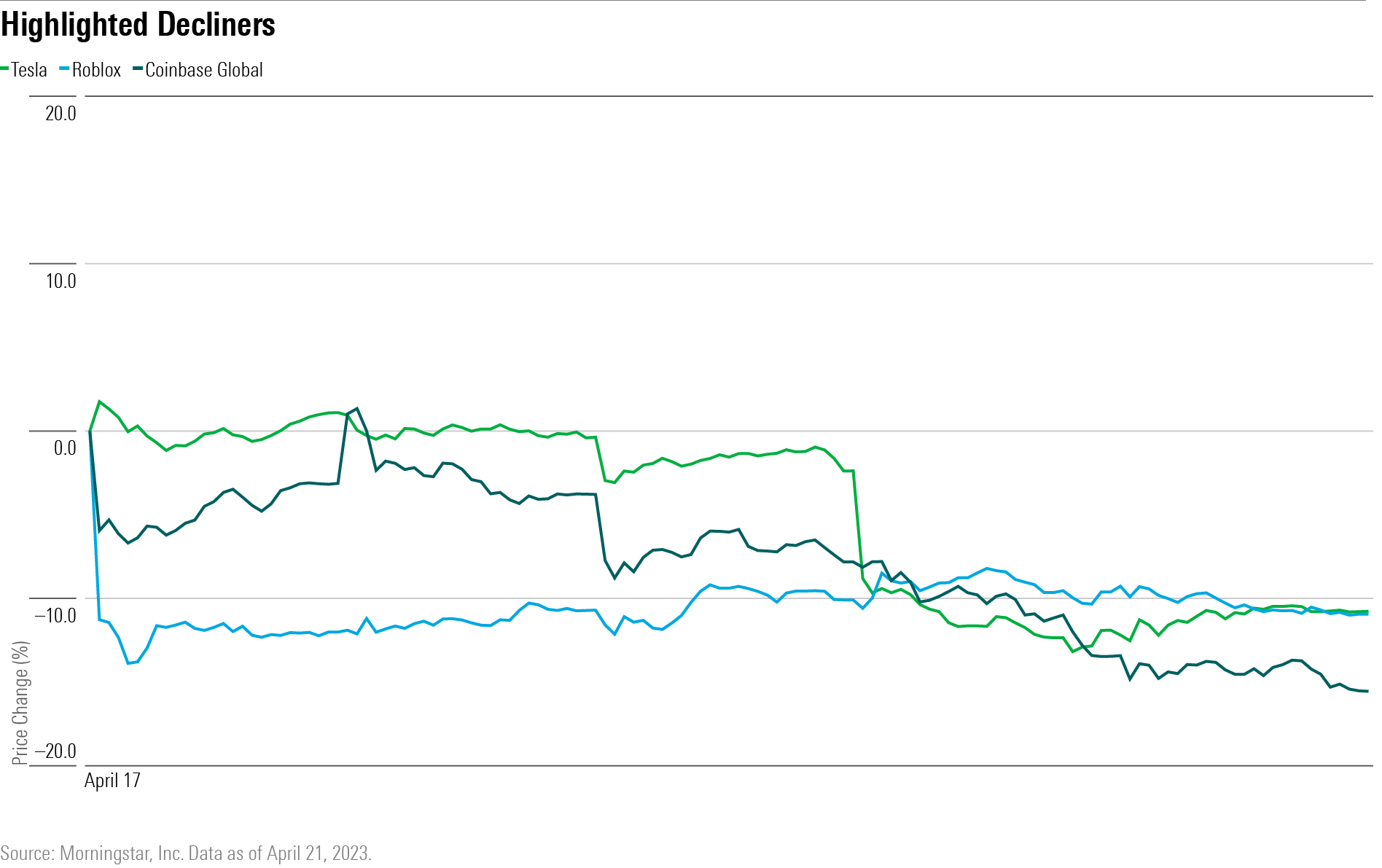

Tesla TSLA shares sunk after the company announced first-quarter results that disappointed investors. “We reduce our Tesla fair value estimate to $215 per share from $225 to reflect higher near-term margin compression as the company is pursuing a volume-over-unit profit strategy in the near term by cutting prices to spur demand,” writes strategist Seth Goldstein.

Roblox RBLX reported mixed first-quarter results, but investors reacted negatively. “The long-term picture for the firm remains impressive as Roblox had only 23.6 million DAUs (daily active users) in the first quarter of 2020. We are maintaining our $65 fair value estimate,” writes senior equity analyst Neil Macker.

Coinbase COIN shares tumbled as U.S. regulators investigate the firm and it looks to expand overseas.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ed529c14-e87a-417f-a91c-4cee045d88b4.jpg)

/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/AGAGH4NDF5FCRKXQANXPYS6TBQ.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZYJVMA34ANHZZDT5KOPPUVFLPE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/QFQHXAHS7NCLFPIIBXZZZWXMXA.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ed529c14-e87a-417f-a91c-4cee045d88b4.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)