Best-Performing Stocks for the Quarter

Q1′s winning stocks are a surprising list of more than just Nvidia and AI names.

While the poster child for the current bull market has been semiconductor giant Nvidia NVDA and other expected winners of the artificial intelligence boom, the lists of the best-performing stocks during the first quarter cast a much wider net.

Nvidia made the top five overall among US-listed companies covered by Morningstar analysts, with an 82.5% jump in its stock price, but that list also features three retailers and a utility stock. The best stocks for the quarter also include a restaurant chain, a venerable packaged food company, and an auto parts company.

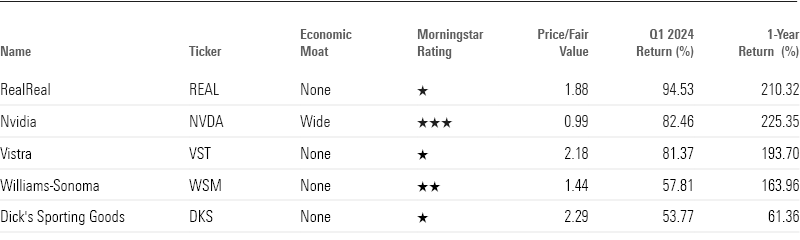

Best-Performing Stocks for Q1

Top-Performing Undervalued Stocks for Q1

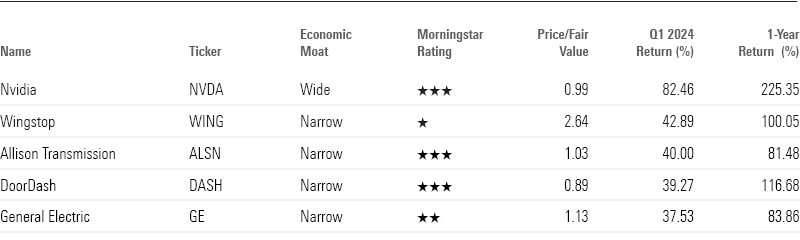

Best-Performing Moat Stocks for Q1

Top-Performing Stocks

Through much of the quarter, attention has been fixed on the stocks seen as most likely to benefit from the revolution in artificial intelligence. Nvidia, whose semiconductor chips are in heavy demand for use in training AI models, has perhaps had the brightest spotlight. Its stock price rose 82.5% in the first quarter, bringing its 12-month gain to north of 225%.

But Nvidia wasn’t the top-performing stock in the quarter. That title instead goes to luxury retailer The RealReal, which gained 94.5%. The catalyst was news that the company had restructured its debt and could stave off bankruptcy until at least 2028. However, Morningstar analyst Sean Dunlop is skeptical and believes the stock is significantly overvalued.

Q1 Best-Performing Stocks

In third place was utility Vistra, which rose 81.4% during the quarter. Morningstar strategist Travis Miller believes the stock is being helped by expectations that nuclear power plant owners will benefit from coming guidance from the Internal Revenue Service on profit margin floors stemming from the 2022 Inflation Reduction Act. In addition, he says some investors believe the AI boom will increase data centers’ electricity usage.

Rounding out the top five were a pair of retailers. Williams-Sonoma rose 57.8%, helped by solid fourth-quarter earnings and an increase in the outlook for its long-term operating margins. Dick’s Sporting Goods gained 53.8% on a combination of strong earnings and investor enthusiasm about its Dick’s House of Sports concept stores and GameChanger, its youth sports app.

Top-Performing Stocks

The RealReal REAL

- Morningstar Rating: 1 star

- Fair Value Estimate: $2.08

- Morningstar Economic Moat Rating: None

- Forward Dividend Yield: 0.00%

“We believe The RealReal is in poor financial health. While we don’t think bankruptcy is an immediate concern ($176 million in cash and equivalents at the end of 2023 seems sufficient to fund near-term investments), the firm carries negative equity and needs access to capital markets to remain solvent, at least until it pays back its 2028 and 2029 notes.”

Find more of Sean Dunlop’s coverage here.

Nvidia NVDA

- Morningstar Rating: 3 stars

- Fair Value Estimate: $910.00

- Morningstar Economic Moat Rating: Wide

- Forward Dividend Yield: 0.02%

“Looking at cloud capex, we believe that much of the rise in Nvidia’s share price in 2024 ... and future earnings growth stems from hyperscaler and enterprise capex. These firms expect to spend incrementally more capex on AI GPUs in 2024, while also shifting the mix of “maintenance” capex away from traditional networking and server gear toward AI GPUs. Nvidia has captured a much larger piece of the data center capex pie in recent quarters, and we anticipate that this mix shift will be the new normal for IT departments. Along these lines, we remain impressed with Nvidia’s ability to elbow into additional hardware, software, and networking products and platforms.”

Click here for Brian Colello’s research on Nvidia.

Vistra VST

- Morningstar Rating: 1 star

- Fair Value Estimate: $32.00

- Morningstar Economic Moat Rating: None

- Forward Dividend Yield: 1.23%

“Vistra’s stock traded near our previous fair value estimate in July but has skyrocketed 120% since then. Although it still has close to a 12% free cash flow before growth yield, we think the market might be overestimating Vistra’s organic growth potential.”

Find Travis Miller’s research on Vistra here.

Williams-Sonoma WSM

- Morningstar Rating: 2 stars

- Fair Value Estimate: $220.00

- Morningstar Economic Moat Rating: None

- Forward Dividend Yield: 1.42%

“We think the change in language around long-term profitability signals improved confidence that the firm’s operating strategy is resonating with consumers. However, we remind investors that performance can change rapidly across retail.”

Jaime Katz’s complete outlook for Williams-Sonoma can be found here.

Dick’s Sporting Goods DKS

- Morningstar Rating: 1 star

- Fair Value Estimate: $98.00

- Morningstar Economic Moat Rating: None

- Forward Dividend Yield: 1.96%

“Dick’s Sporting Goods’ shares jumped … after the no-moat firm reported fourth-quarter results that exceeded our expectations. While we think the firm is executing very well in a tough marketplace, we view the shares as very overvalued after roughly doubling over the past four months.”

Click here for the full commentary from David Swartz on Dick’s Sporting Goods.

Top-Performing Undervalued Stocks

Even with big gains, many stocks under Morningstar’s coverage remain undervalued. Nearly three dozen posted better returns than the 10.1% gain in the US Market Index but continue to trade well below their fair value estimates.

The best performer in this group was cereal maker WK Kellogg, formed as part of an October 2023 spinoff from Kellogg, which changed its name to Kellanova K. WK Kellogg gained 44.2% in the first quarter, fed by better-than-expected fourth-quarter results.

Undervalued Top-Performing Stocks

WK Kellogg KLG

- Morningstar Rating: 5 stars

- Fair Value Estimate: $27.00

- Morningstar Economic Moat Rating: None

- Forward Dividend Yield: 3.40%

“After digesting WK Kellogg’s fiscal 2023 results, we’re holding the line on our $27 per share fair value estimate. WK Kellogg has been challenged by competitive pressures from other leading brands, as well as smaller, niche cereal operators and numerous breakfast alternatives for years, and we anticipate the cereal aisle will remain intensely competitive and promotional over the next decade.”

More on WK Kellogg from Erin Lash and Grace Na is available here.

Hanesbrands HBI

- Morningstar Rating: 5 stars

- Fair Value Estimate: $17.30

- Morningstar Economic Moat Rating: Narrow

- Forward Dividend Yield: 0.0%

“We believe the company is progressing on its key initiatives, including product enhancements and reductions in debt, inventory, and costs, and rate shares as very undervalued.”

David Swartz’s reports on Hanesbrands can be found here.

Tapestry TPR

- Morningstar Rating: 4 stars

- Fair Value Estimate: $60.00

- Morningstar Economic Moat Rating: Narrow

- Forward Dividend Yield: 2.95%

“Led by Coach, Tapestry’s sales and non-GAAP earnings surpassed our expectations in its (December-ended) fiscal 2024 second quarter. These results support our narrow moat rating on Tapestry, which is based on Coach’s brand value. Tapestry’s shares have rallied strongly over the past three months but remain well below our $60 fair value estimate.”

For more research on Tapestry from David Swartz, click here.

Lyft LYFT

- Morningstar Rating: 4 stars

- Fair Value Estimate: $25.00

- Morningstar Economic Moat Rating: Narrow

- Forward Dividend Yield: 0.00%

“In the US market, Lyft has emerged as the number-two ride-sharing player, a position we think it will keep for years to come. It is currently having difficulty maintaining its market share against the market leader, Uber, in pursuing riders in a highly lucrative addressable market (including taxis, ride-sharing, bikes, and scooters). In our view, Lyft warrants a narrow economic moat rating, thanks to the network effect around its ride-sharing platform and intangible assets associated with riders, rides, and mapping data, which we think can drive the firm to profitability and excess returns on invested capital.”

Malik Ahmed Kahn’s commentary on Lyft is available here.

Revolve Group RVLV

- Morningstar Rating: 4 stars

- Fair Value Estimate: $29.00

- Morningstar Economic Moat Rating: None

- Forward Dividend Yield: 0.00%

“The Revolve Group has carved out an interesting competitive niche in the attainable luxury category, leaning heavily into the strengths of the e-commerce channel—breadth of selection, scalability, and ubiquity of access—to reach a mobile-first, millennial and Gen Z audience … We take a positive view of the firm’s strategy, with an ongoing shift toward mobile and e-commerce channels figuring to provide meaningful growth tailwinds in the medium term.”

Sean Dunlop and Grace Na have more on Revolve stock and the company’s outlook.

Best-Performing Moat Stocks

Morningstar analysts assign economic moats to companies with durable competitive advantages. Those with narrow moats are expected to fend off rivals for 10-20 years, while firms with wide moats are expected to do so for more than 20 years.

Nvidia was the best-performing moat stock in the first quarter. Ranking second was the fast food company Wingstop. The narrow-moat stock jumped 42.9% in the quarter and has gained 100.1% over the last 12 months. However, Sean Dunlop calls Wingstop “staggeringly expensive.”

Top-Performing Moat Stocks

Wingstop WING

- Morningstar Rating: 1 star

- Fair Value Estimate: $139.00

- Morningstar Economic Moat Rating: Narrow

- Forward Dividend Yield: 0.24%

“Wingstop’s growth prospects are electric, its sub-two-year payback periods drive a durable development narrative, and the expansion of its digital business and delivery partnerships offer a viable roadmap to average unit volumes of $2.0 million to $2.5 million at high-20s restaurant margins. Nevertheless, its menu is less habitual than most quick-service competitors and it plays in a niche category that has yet to fully prove its international or even domestic portability, with more than half its domestic stores sitting in just three states. We’d love to own the chain at the right price. For now, we encourage investors to remain firmly on the sidelines.”

Sean Dunlop’s full take on Wingstop can be found here.

Allison Transmission Holdings ALSN

- Morningstar Rating: 3 stars

- Fair Value Estimate: $79.00

- Morningstar Economic Moat Rating: Narrow

- Forward Dividend Yield: 1.23%

“We believe Allison will continue to be the top supplier of truck transmissions, despite increasing regulation of emissions by government authorities. The company dominates the medium-duty market, commanding approximately 80% market share in some verticals (school buses, Class 6 to 7 trucks, and Class 8 straight trucks). Allison’s strong brand is underpinned by its high-performing and extremely durable transmissions. This has led to the company benefiting from pricing power.”

Dawit Woldemariam’s outlook for Allison is available here.

DoorDash DASH

- Morningstar Rating: 3 stars

- Fair Value Estimate: $155.00

- Morningstar Economic Moat Rating: Narrow

- Forward Dividend Yield: 0.00%

“DoorDash holds the number one position as an online food order aggregator in the US, ahead of Uber Technologies’ Uber Eats and Grubhub. The firm is at the early stages of attracting a larger piece of what we estimate could be $1 trillion worth of goods and services by 2025 to its platform.”

The full report from Malik Ahmed Khan can be found here.

General Electric GE

- Morningstar Rating: 2 stars

- Fair Value Estimate: $156.00

- Morningstar Economic Moat Rating: Narrow

- Forward Dividend Yield: 0.18%

“We believe that Larry Culp has engineered a successful turnaround of General Electric and has helped position each of its businesses as leaders in mission-critical end markets. Driving GE’s turnaround process is a steadfast cultural commitment to lean tools. We believe GE has a line of sight to double-digit free cash flow margin in 2025 and beyond. We also think it can maintain healthy excess returns on capital in the future, which its business hasn’t delivered in many years.”

The most recent reports on GE can be found here.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ed529c14-e87a-417f-a91c-4cee045d88b4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RNODFET5RVBMBKRZTQFUBVXUEU.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LJHOT24AYJCHBNGUQ67KUYGHEE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/V33GR4AWKNF5XACS3HZ356QWCM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ed529c14-e87a-417f-a91c-4cee045d88b4.jpg)