Markets Brief: Brace Yourself for the Worst Quarterly Earnings Season in Three Years

Still, investors can expect pockets of good news among travel, industrials, and energy stocks.

Check out our weekly markets recap at the bottom of this article.

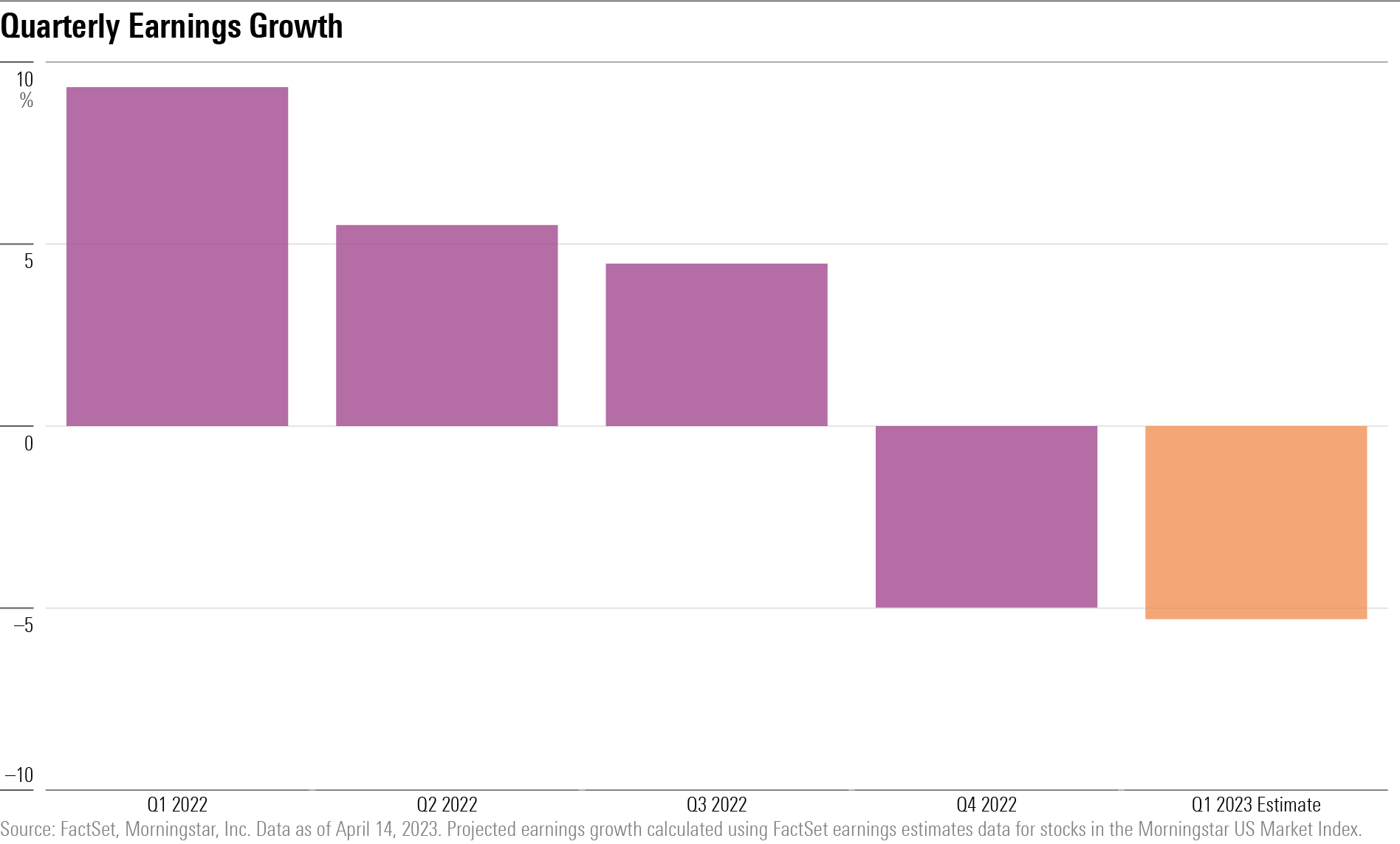

Even as stocks hover well above bear-market lows, corporate earnings are expected to come in at their biggest declines since the start of the coronavirus pandemic.

“Earnings season is going to be dreadful,” says Philip Orlando, chief equity market strategist at Federated Hermes.

Companies represented in the Morningstar US Market Index are expected to see their earnings decline by about 5.3% from a year ago based on aggregated FactSet earnings estimate data. Should that estimate hold up, it will mark the worst decline in earnings since the second quarter of 2020, when earnings plunged 32.4%.

Bright spots exist in pockets, as earnings growth is still expected for travel services, industrials, energy, and financial-services companies.

But still, Orlando says, “Investors should be wary of a nasty shock, as there’s a major disconnect between recent stock rallies and company earnings results.” Stocks have rallied 7.4% since the start of the year and are up 14.9% from their last low on Oct. 14. “Stock prices are ultimately meant to represent corporate earnings,” but right now, Orlando says, “we’re looking at the worst revenues and worst earnings we’ve seen since the pandemic.”

Why Stock Prices Are Up (for Now) While Estimates for Earnings Growth Are Down

The likely reasons for the recent gains in the market, Orlando says, are that investors are overlooking bad earnings results as they’re expecting positive gross domestic product growth and a less aggressive Federal Reserve by the end of the year.

But Orlando and his team don’t see things that way. Federated Hermes anticipates GDP to be negative from the second quarter of 2023 through the fourth quarter.

Should Federated Hermes’ outlook be correct in that the fourth-quarter 2023 GDP is negative and should its expectation of full-year earnings decline of 10%-15% in 2023 hold true, Orlando expects that current market levels are around 20% higher than they should be. “I think there’s a tremendous amount of optimism and enthusiasm built into the market for the wrong reason.”

Which Sectors Will See Earnings Growth?

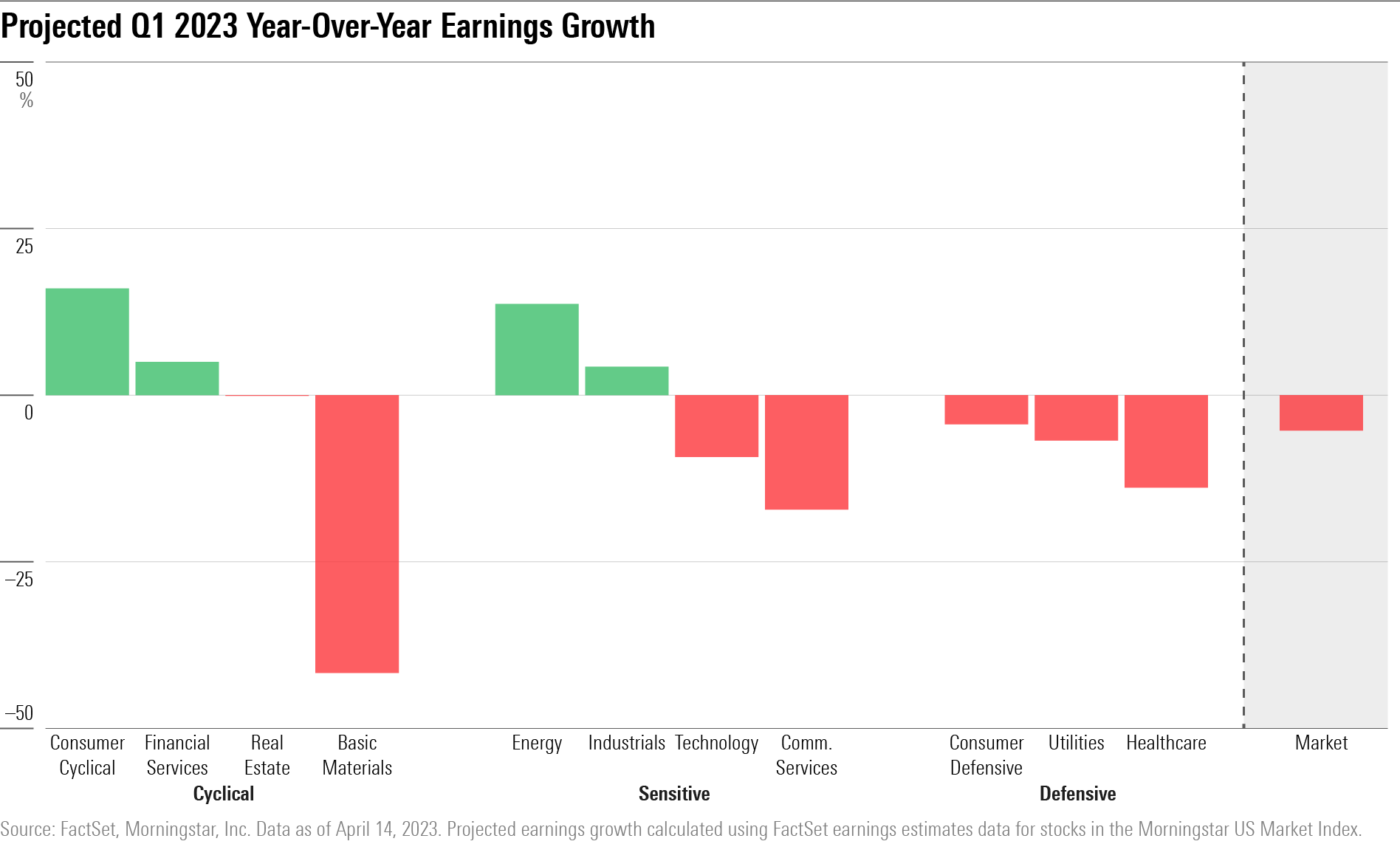

Datawise, very few sectors are expected to see year-over-year earnings growth. Based on earnings consensus estimates from FactSet, consumer cyclical companies are forecast to see the most growth, followed by energy, industrials, and financial services.

Expectations of continued recovery in travel demand have buoyed earnings growth estimates for both the consumer cyclical and industrials sector. During late 2021 and early 2022, travel firms faced major demand headwinds as the omicron coronavirus variant resurfaced travel restrictions and consumer anxiety.

However, now more than a year later, those anxieties and restrictions have largely been put to rest, and investors expect travel companies to see a recovery in sales and, subsequently, their bottom lines. Companies in the consumer cyclical sector—which includes travel stocks—are expected to see their earnings grow 16% year over year.

“A human-ingrained desire to travel, service consumption share of wallet, remote work flexibility, and China’s reopening continue to aid the appetite for trips,” writes Morningstar senior equity analysts Dan Wasiolek and Jaime M. Katz in a travel industry pulse report. Consumer-spending habits are shifting to services over goods, a trend expected to continue to benefit travel-related companies, say Wasiolek and Katz.

Which Stocks Will See the Biggest Earnings Growth?

Among the companies expecting the largest improvements to net income over the last year are cruise-line operators such as Norwegian Cruise Lines NCLH, Royal Caribbean RCL, and Carnival CCL, according to FactSet estimates. Since the first quarter of 2022, these firms have reported substantial sequential increases to their quarterly earnings as travel rebounded. However, despite improvements, the cruise lines are still expected to report losses on the quarter.

Leisure stocks such as Caesars Entertainment CZR and Las Vegas Sands LVS also are expected to see a bounce in earnings. FactSet estimates now peg Las Vegas Sands to turn a profit for the first time since its December quarter in 2019.

Because of industrials’ airline exposure, that sector earnings are likewise being pulled up 4.3% year over year by the rebound in travel. American Airlines AAL, United Airlines UAL, and Delta Air Lines DAL are among the largest contributors to the sector’s earnings growth. All three airlines returned to profitability in the second quarter of 2022, which is expected to continue in first-quarter 2023 results.

Earnings for the energy sector are expected to continue at a pace of 13.7% year over year. The sector has performed strongly over the last two and a half years because of its sensitivity to oil prices, which averaged $75.93 per barrel during the first quarter of 2023. While that’s lower than the average oil price of $95.18 during the first quarter of 2022, energy companies have focused their efforts on efficiency and cost-reduction initiatives, which contributed to operating margins trending higher over the past several quarters.

Valero Energy VLO, Exxon Mobil XOM, and Marathon Petroleum MPC are expected to see the largest increases in net income over the last year.

Financial-services earnings are expected to improve by 5%. The largest contributors to the sector’s earnings growth are banks. However, Morningstar equity strategist Eric Compton says the focus this earnings season for banks will be more on deposit levels and funding costs.

Which Stocks Will See the Worst Earnings Growth?

The sector expected to post the largest decline in earnings is basic materials, which is estimated to show earnings down 41.7%. Orlando attributes this drop to a pullback in demand amid worries about the potential for a recession. “Companies are cutting back in manufacturing and therefore their demand for basic materials,” he says.

Communication services stocks are projected to see earnings decline 17.2%, according to FactSet, thanks to expectations for lower net income for companies like Meta Platforms META and Alphabet GOOGL.

Healthcare earnings are also expected to drop 13.9%, with the largest declines in net income coming from biotech companies Pfizer PFE and Merck MRK.

Events Scheduled for the Coming Week:

- Monday: M&T Bank MTB

- Tuesday: Bank of America BAC, Netflix NFLX, and Johnson & Johnson JNJ report earnings.

- Wednesday: Tesla TSLA, U.S. Bancorp USB, Zions Bancorp ZION, United Airlines, and Kinder Morgan KMI report earnings.

- Thursday: AT&T T, Comerica CMA, Fifth Third Bancorp FITB, Huntington Bancshares HBAN, KeyCorp KEY, and Truist Financial TFC report earnings.

- Friday: Procter & Gamble PG and Regions Financial RF report earnings.

For the Trading Week Ended April 14

- The Morningstar US Market Index rose 0.84%.

- The best-performing sectors were financial services, up 2.6%, and energy, up 2.4%.

- The worst-performing sectors were real estate, down 1.6%, and utilities, down 1.3%.

- Yields on 10-year U.S. Treasuries fell to 3.52% from 3.29%.

- West Texas Intermediate crude prices rose 2.3% to $82.52 per barrel.

- Of the 844 U.S.-listed companies covered by Morningstar, 569, or about 67%, were up, and 277, or about 33%, declined.

What Stocks Are Up?

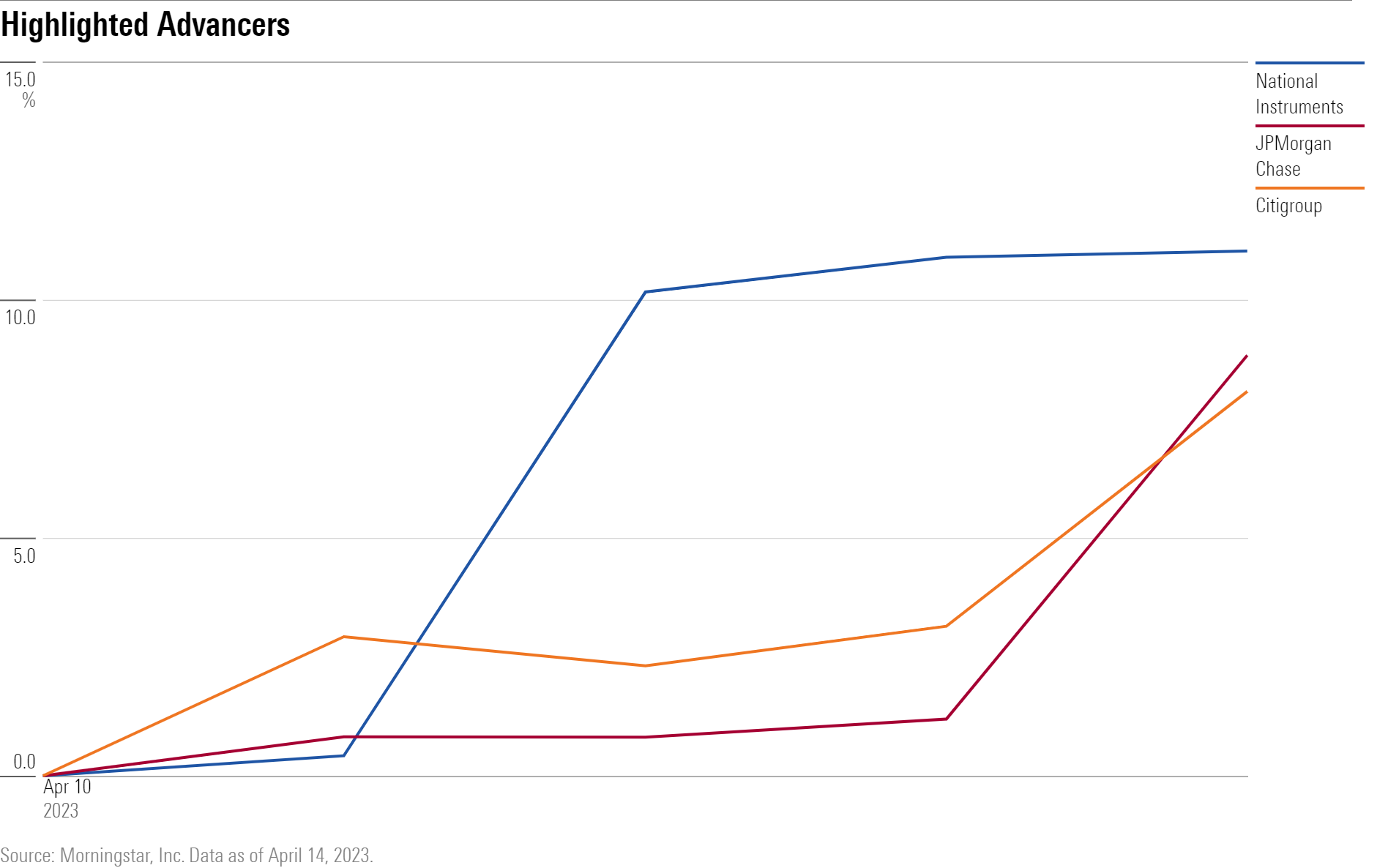

Shares of National Instruments NATI rallied over an agreement to be acquired by Emerson Electric EMR for $60 per share. “We think the $60-per-share deal is a home run for NI shareholders. It represents a 13% premium over the $53-per-share offer from Emerson disclosed in January 2023 and a 40% premium to our prior stand-alone fair value estimate of $43,” says Morningstar equity analyst William Kerwin.

Upbeat quarterly results from JPMorgan Chase JPM led its stock higher. “The big takeaway is that its earnings profile is not being negatively affected by the banking turmoil,” says Morningstar strategist Eric Compton. The largest U.S. bank increased its full-year net interest income outlook to $81 billion from $74 billion.

Citigroup C stock also jumped after reporting first-quarter earnings of $1.86, beating FactSet consensus of $1.65.

What Stocks Are Down?

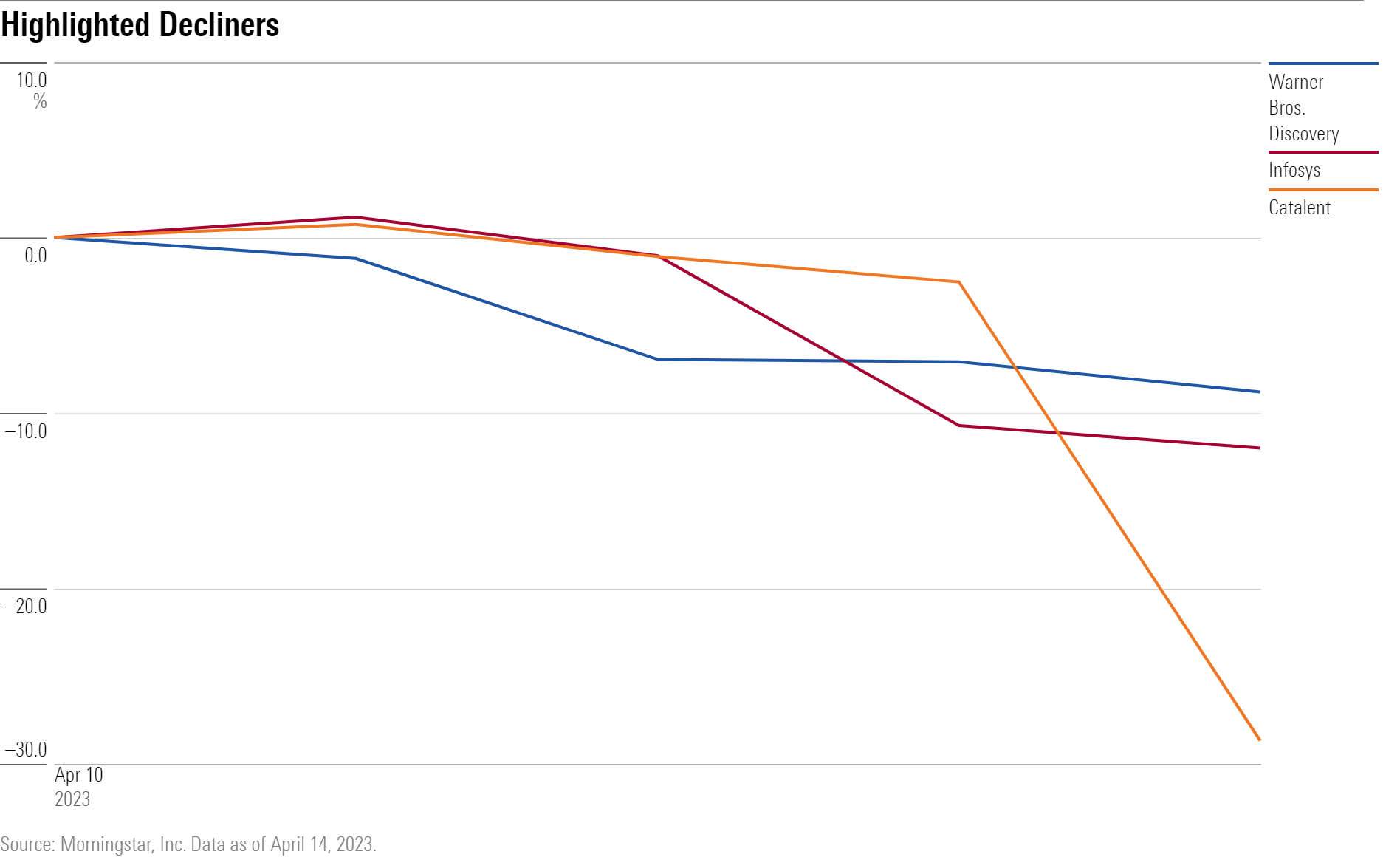

Shares of drug manufacturer Catalent CTLT plunged after the firm warned that productivity issues and higher-than-expected costs would hurt its fiscal 2023 third-quarter and full-year results. The news came alongside an announcement that the firm’s Chief Financial Officer Thomas Castellano left the firm. Ricky Hopson, the company’s head of clinical development and supply, would be serving as interim CFO.

Disappointing fourth-quarter earnings results pulled IT service provider Infosys’ INFY stock lower. “The company experienced unforeseen winding down of client projects. While the near-term weakness is occurring throughout the industry, we were caught off guard by Infosys’ significantly lower 2024 guidance than we were expecting,” says Morningstar equity analyst Julie Bhusal Sharma.

Prior to the earnings release, aggregated analyst estimates from FactSet pegged Infosys to generate $19.96 billion in sales during fiscal 2024. However, the firm set new guidance for full-year revenue to fall between $18.94 billion and $19.49 billion.

Warner Bros. Discovery WBD shares slumped after the firm revealed details about its streaming service, Max, which combines its former HBO Max and Discovery+ services. The service will charge $10 for its ad-supported subscription tier, $16 for its ad-free tier, and $20 for its 4K streaming resolution tier.

“By essentially matching the Netflix price structure, we are concerned that Warner Bros. Discovery is making a strategic error,” says Morningstar senior equity analyst Neil Macker. “The relatively equivalent price points for the top two price plans now set up Max to be directly compared with Netflix without any benefit from being cheaper.”

The author or authors own shares in one or more securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/GJMQNPFPOFHUHHT3UABTAMBTZM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZYJVMA34ANHZZDT5KOPPUVFLPE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LDGHWJAL2NFZJBVDHSFFNEULHE.jpg)