Which Popular Funds Could Hand Their Shareholders Big Tax Bills?

A handful of Vanguard strategies will distribute more than 5% in gains in December.

Get ready for capital gains distribution season, mutual fund investors. It’s that time of year when fund companies try to give their investors an idea of what their 2023 tax bills might look like by estimating how much their funds will distribute in income and capital gains later this year.

The broad market’s roughly 18% decline in 2022 provided fund managers plenty of opportunities to harvest some losses to offset potential gains. Some areas of the market, such as large-cap growth, however, have rebounded more than others through mid-October 2023, and many funds still have long-term winners on the books thanks to the long bull market before 2020. Since investors continued to pull money from traditional actively managed funds in the first nine months of 2023, many managers had to realize gains to meet redemptions. Funds must pass those long- and short-term proceeds to shareholders who, if they own their funds in taxable accounts, must pay taxes.

Fund families are still releasing their estimates, which they can still revise, but a preliminary look shows many strategies from value to growth Morningstar Categories will make sizable distributions.

Fund companies have begun publishing distribution estimates on their websites, and most will make the actual payouts between late November and the end of the year.

Here’s a survey of some larger fund families’ distribution estimates. This report, which we will update in mid-November as more firms like Vanguard release estimates, focuses on strategies with at least 4% in estimated distributions. Funds from Champlain, FPA, Lord Abbett, and Oakmark estimate they’ll distribute less than 4% of their net asset values in capital gains. Only one retirement fund from BlackRock will distribute more than 4%. Here’s a compendium of funds from other families that expect to make larger payouts.

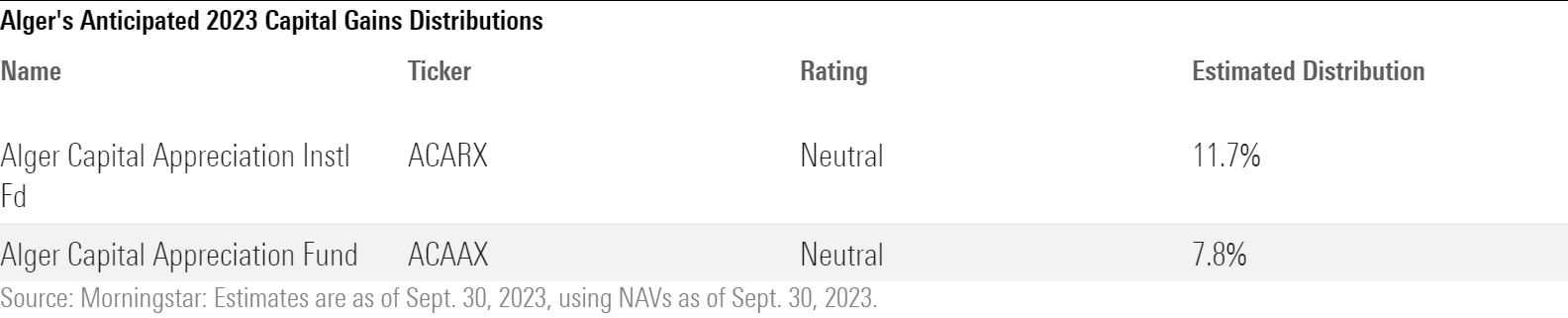

Alger

Large growth Alger Capital Appreciation will likely make a sizable distribution in mid-December.

Alger

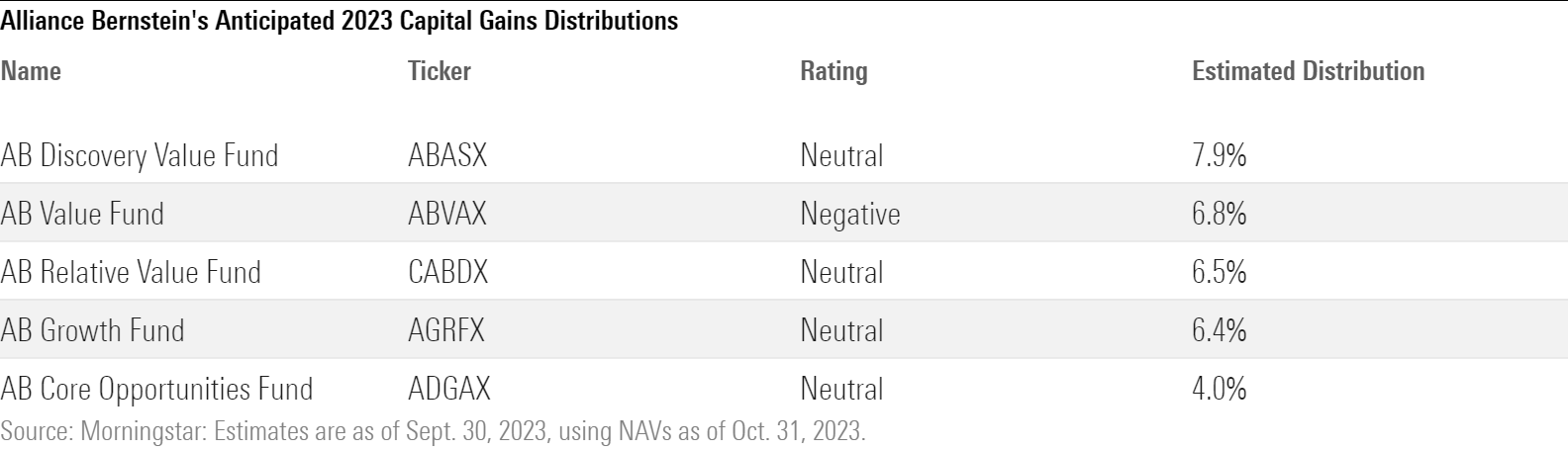

Alliance Bernstein

A handful of Alliance Bernstein strategies will distribute mid-single-digit distributions in mid-December.

AB

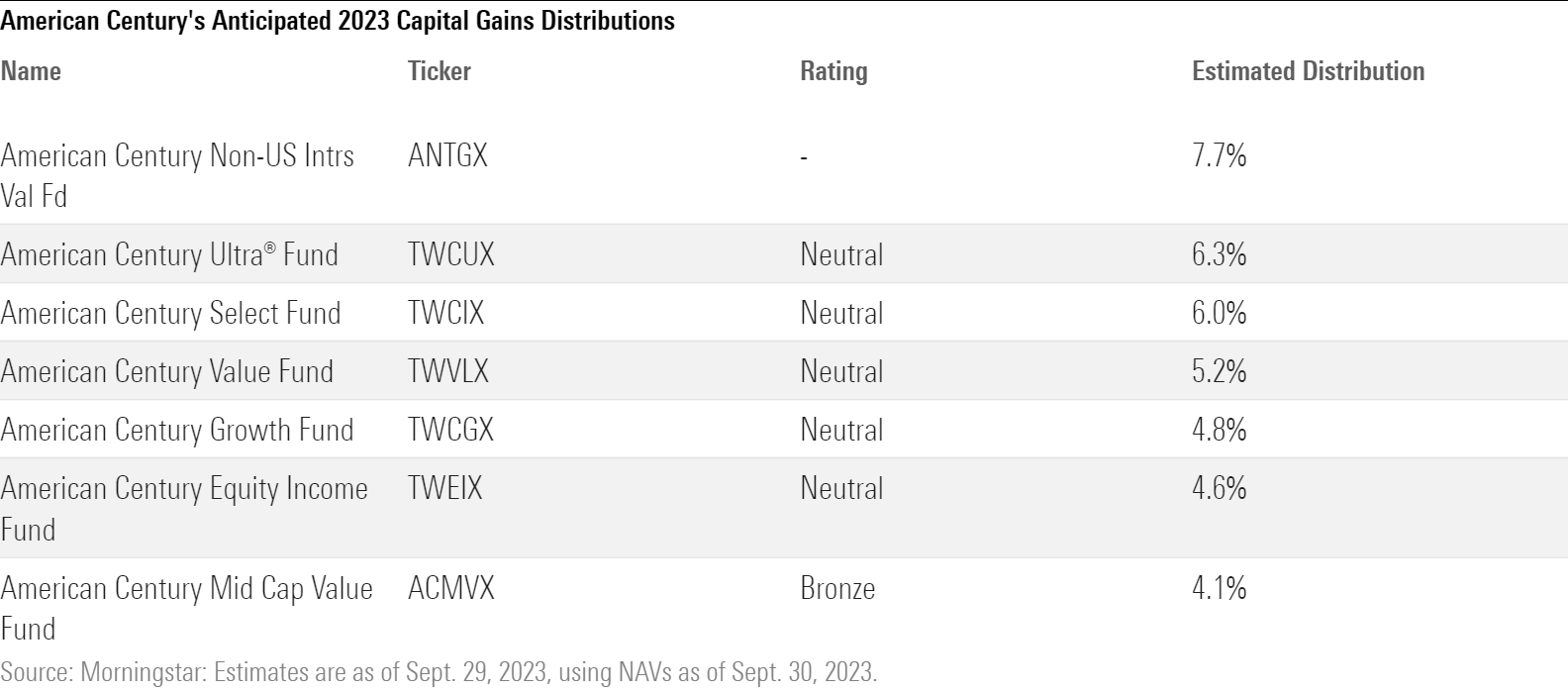

American Century

American Century’s funds will distribute less than they did last year, with a handful of value and growth strategies making mid-single-digit distributions. Gains are mostly long-term.

American Century

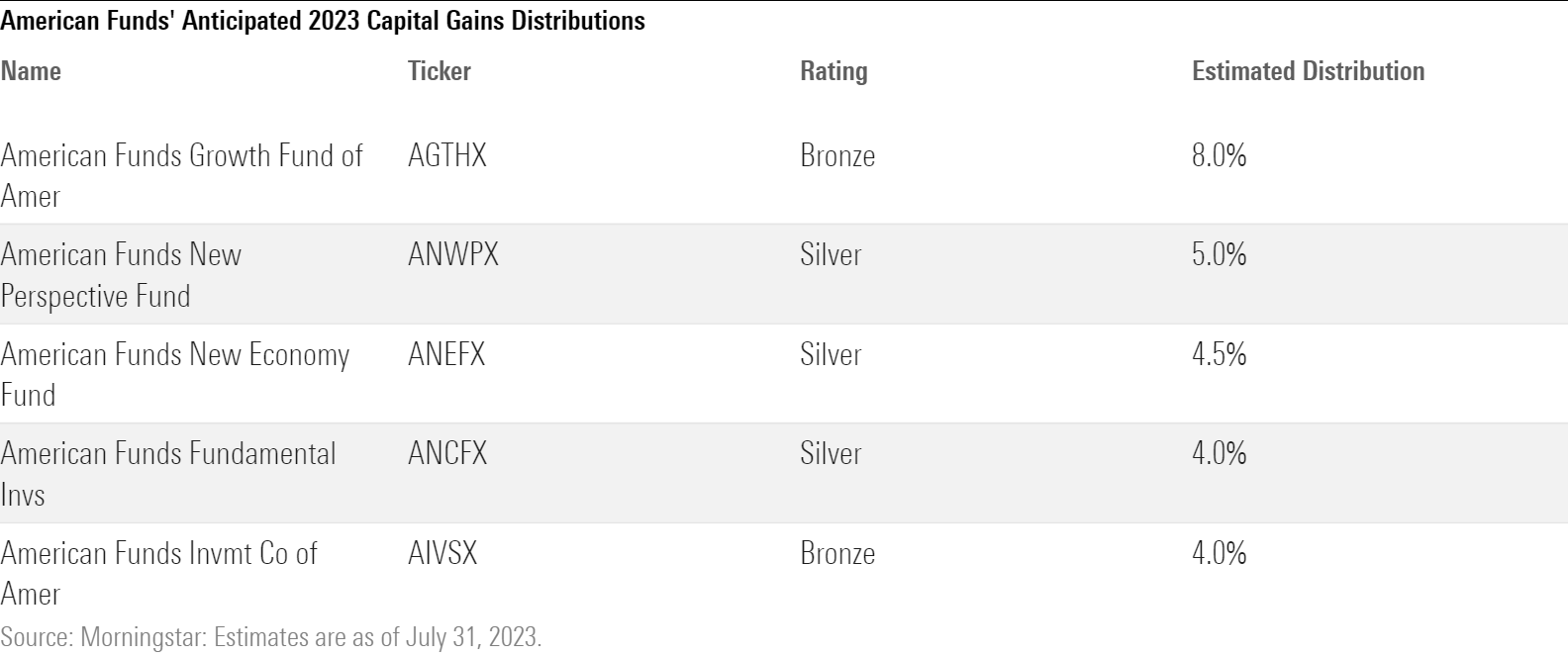

American Funds

Most American Funds also will pay out less capital gains in 2023 relative to their peer groups. The firm provides a range of estimates, and Growth Fund of America AGTHX tops the list at roughly 8%. Fundamental Investors ANCFX and Investment Company of America AIVSX both come in at roughly 4%, while New Economy ANEFX and New Perspective ANWPX estimate roughly 4.5 and 5.0%, respectively.

American Funds

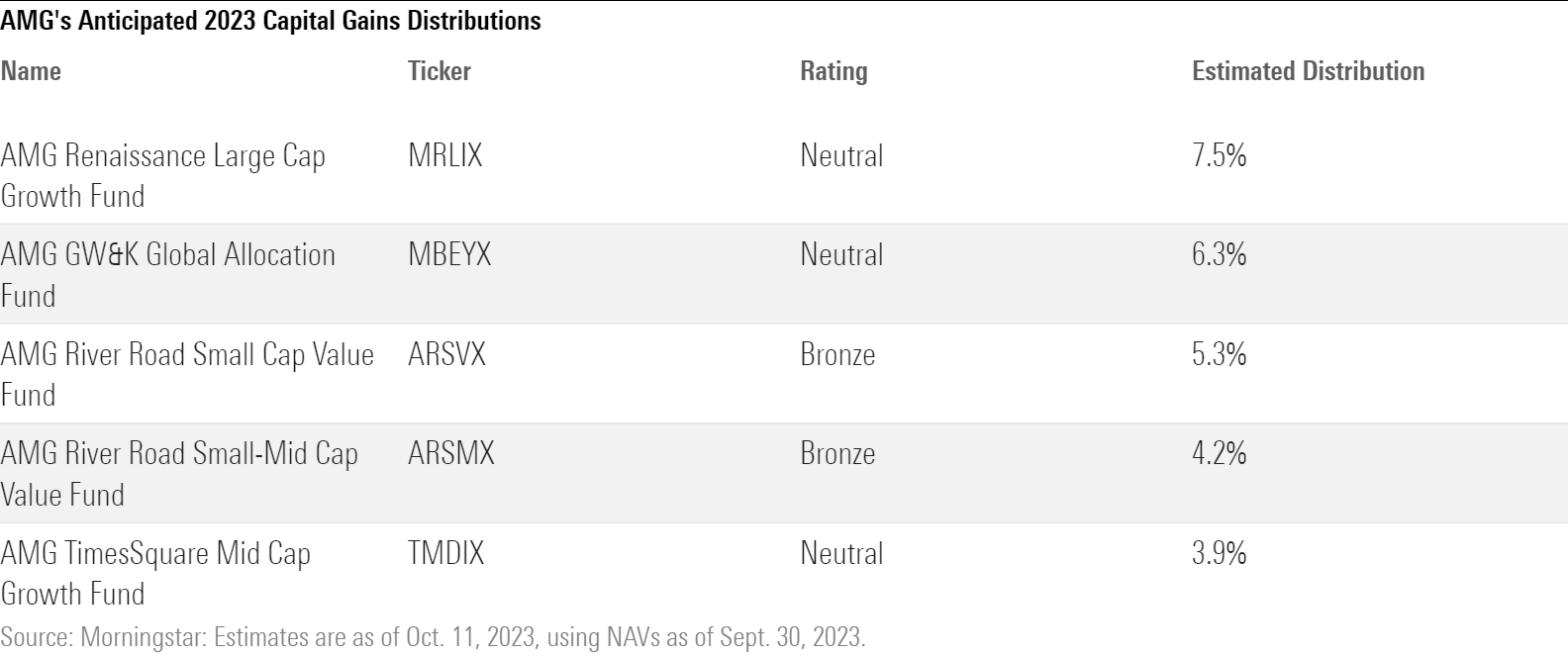

AMG Funds

A handful of AMG funds expect to pay out mid-single-digit distributions. AMG will make payments in mid-December.

AMG

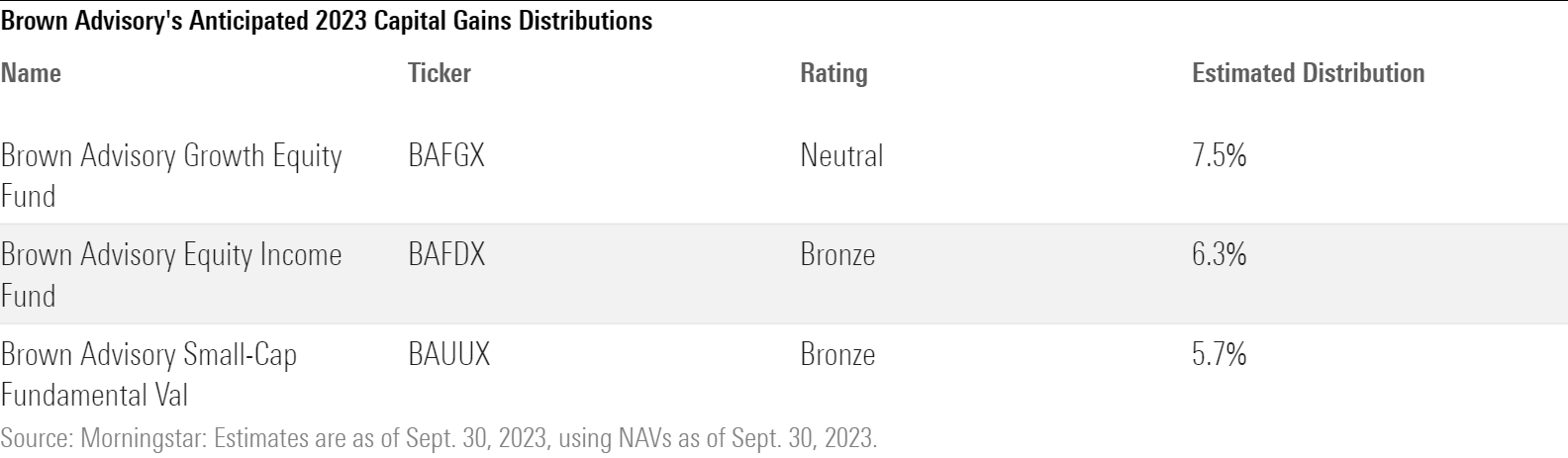

Brown Advisory

Low double-digit outflows from Brown Advisory Growth Equity BAFGX and Equity Income BAFDX contributed to mid-single-digit capital gains estimates. The boutique will pay its distributions in mid-December.

Brown

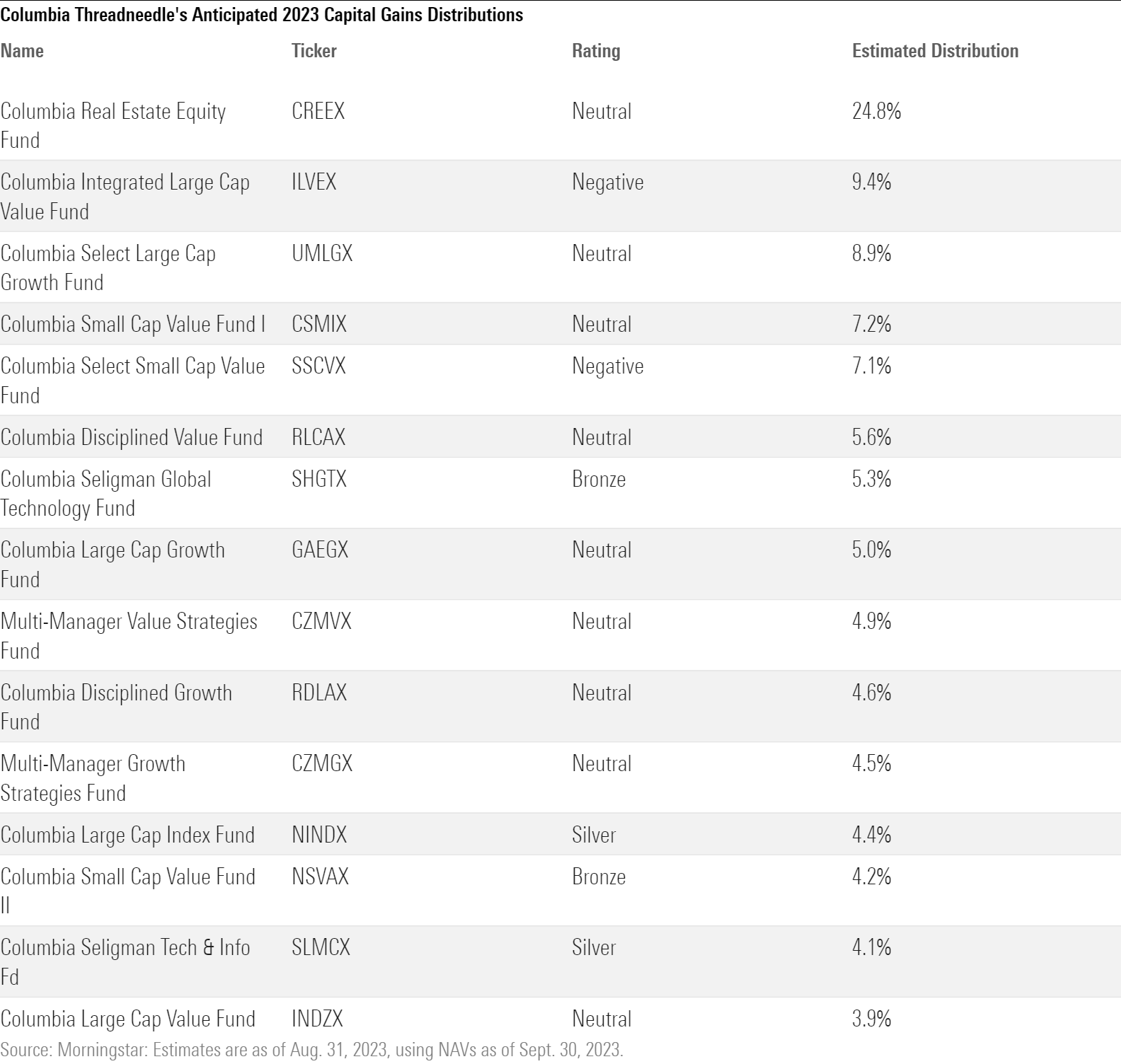

Columbia Threadneedle

A handful of Columbia Threadneedle’s value-oriented strategies expect to make moderate 2023 payouts. Columbia Integrated Large Cap Value ILVEX has a new comanager, which may have contributed to its moderate payout. Columbia Real Estate Fund CREEX will pay out roughly 25% (by law REITs have to pay out 90% of income to shareholders so this distribution isn’t out of the ordinary), while Columbia Seligman Tech & Info will make a 5% distribution.

Columbia

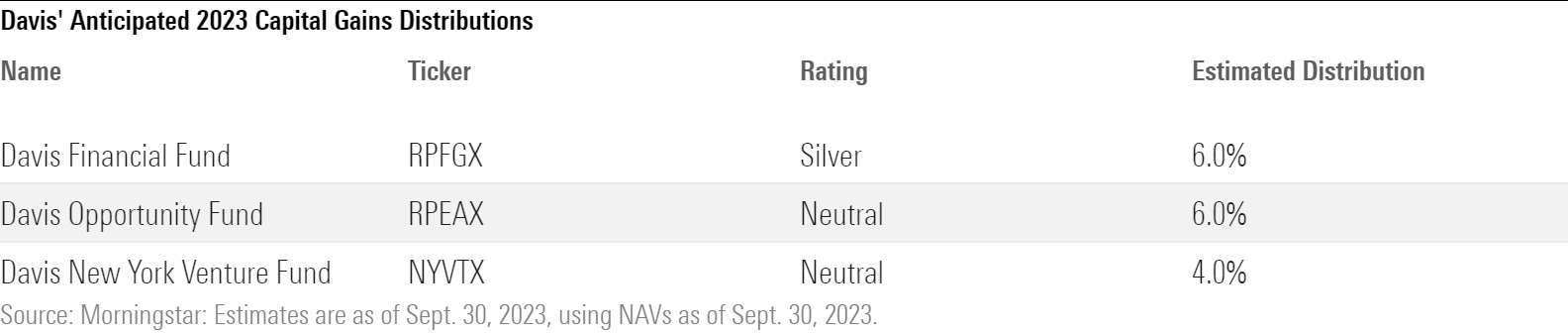

Davis

A handful of this boutique’s strategies will make roughly 5% estimated distributions.

Davis

Diamond Hill

Diamond Hill Small Cap Fund DHSCX will likely make a whopping 23% distribution. In the 12 months ending in September, the fund’s assets have shrunk by nearly 25% owing to outflows.

Diamond Hill

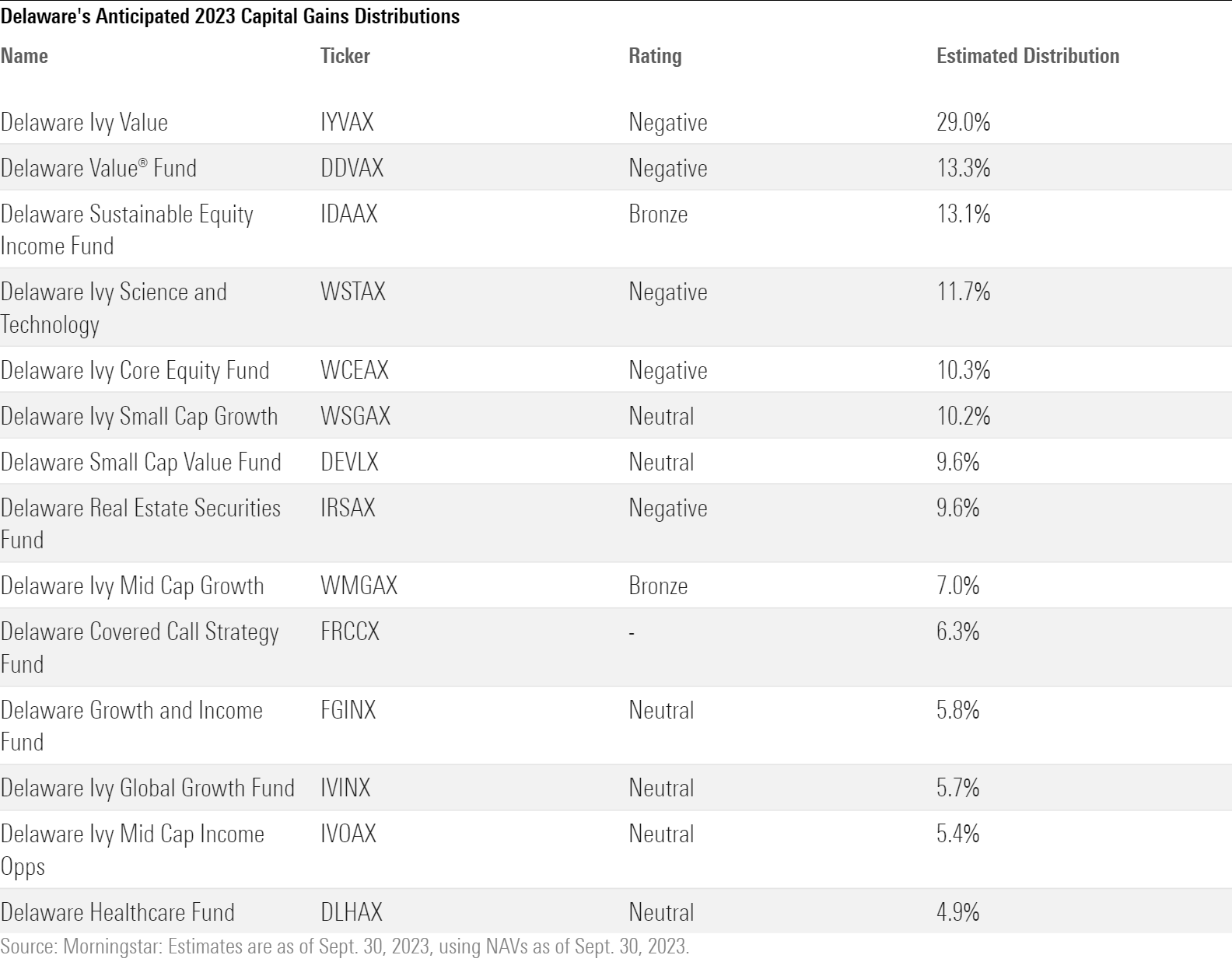

Delaware Funds

Several Delaware funds will make some of the biggest distributions, including six that likely will pay distributions of 10% or more. Delaware Ivy Value IYVAX has suffered outflows of almost 50% this year, which has contributed to almost a 30% estimated distribution. The firm has made its estimates based on Sept. 30 figures and will make payments in early to late December.

Delaware

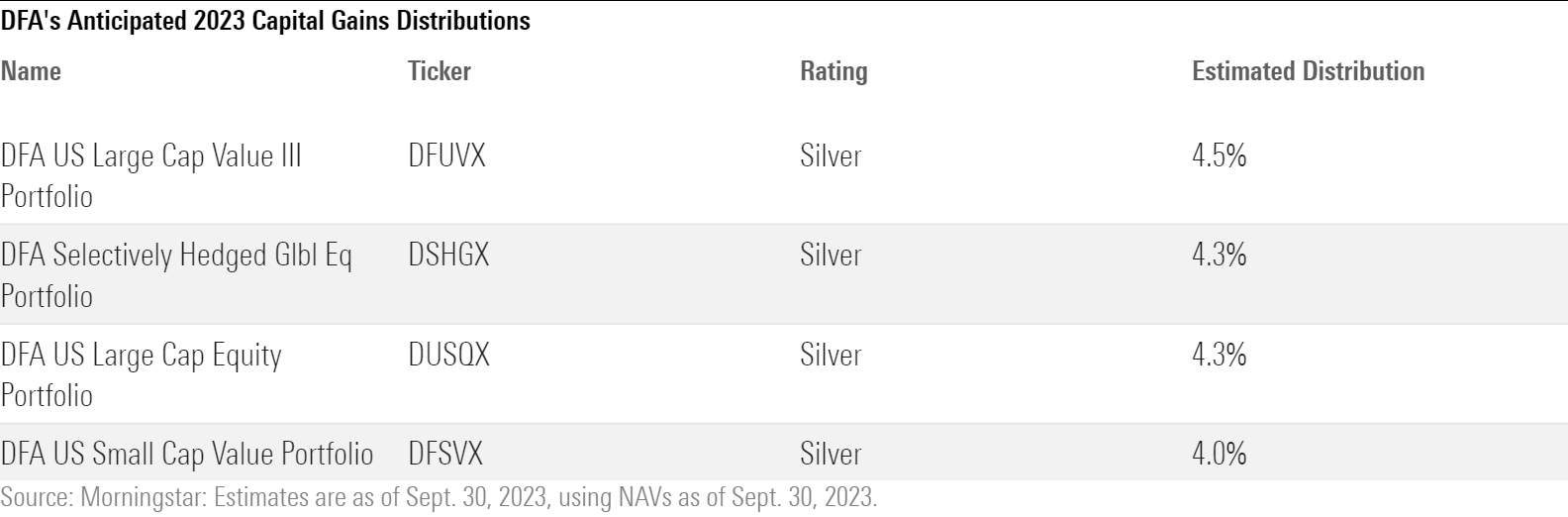

DFA

Most DFA strategies will make modest distributions, with only a few coming in around 5%.

DFA

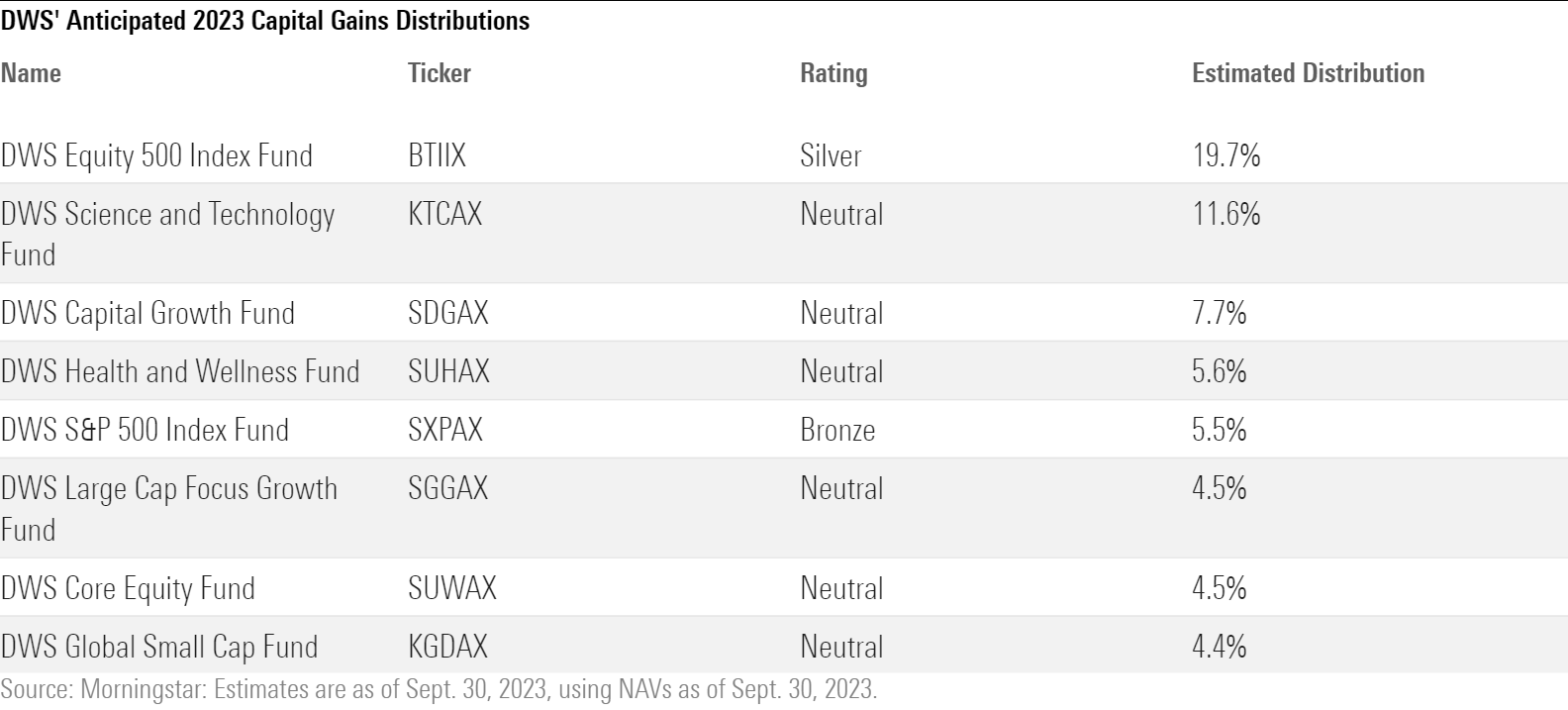

DWS

DWS Equity 500 Index BTIIX saw an estimated 35% of assets leave as outflows, which will push its estimated capital gains to roughly 20%.

DWS

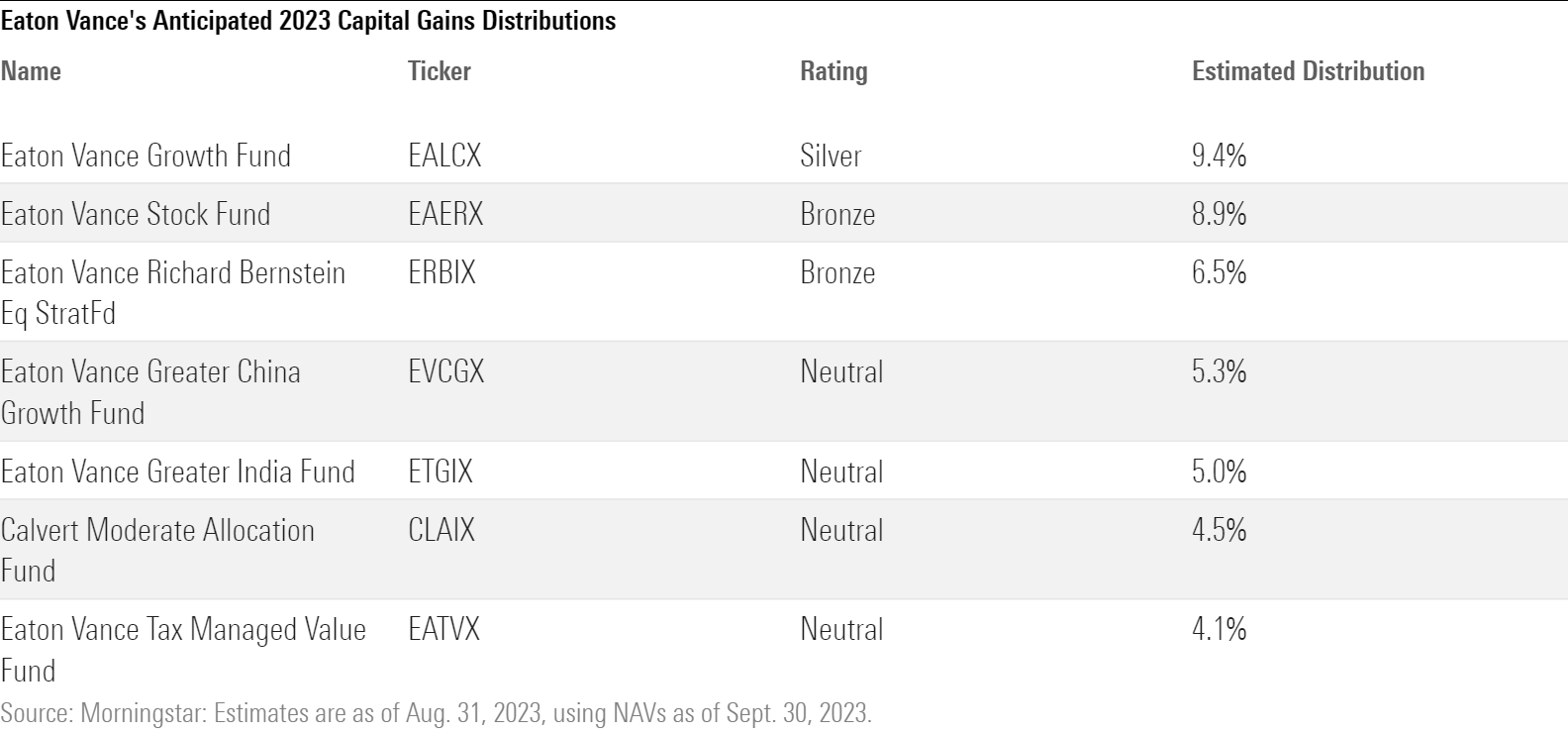

Eaton Vance

Two Eaton Vance strategies, Eaton Vance Growth EALCX and Eaton Vance Stock EAERX, will likely distribute roughly 9% in capital gains.

Eaton

Federated Hermes

Two Federated Hermes strategies, Federated Hermes Kaufmann Large Cap KLCKX and Federated Hermes Max Cap Index FMXKX, will likely distribute roughly 25% in capital gains. Federated Hermes Kaufmann large Cap has seen an estimated 22% of its assets leave as outflows so far in 2023.

Federated

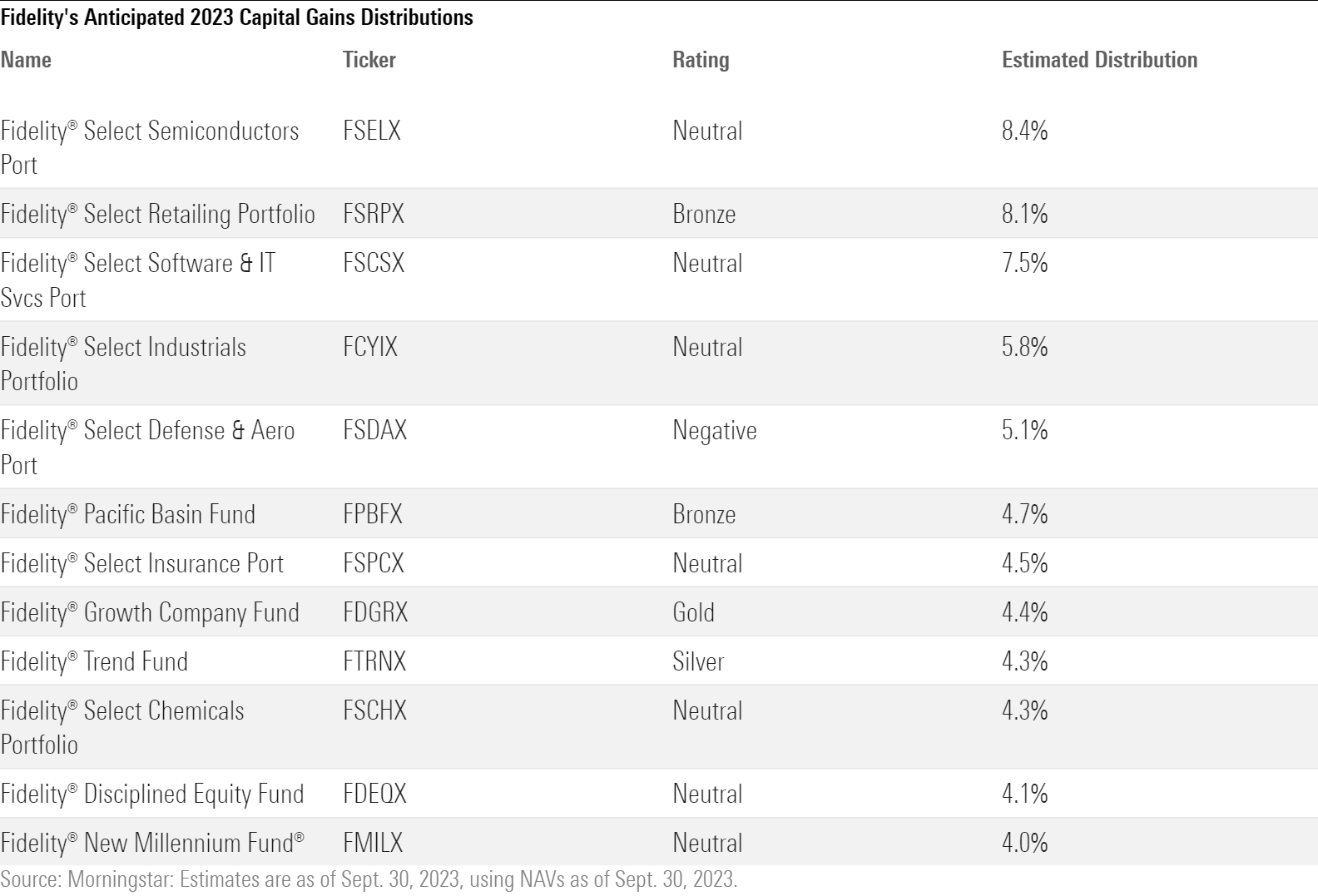

Fidelity

Only a handful of Fidelity funds expect to pay distributions of more than 4% of NAV in December. Topping the list are some sector strategies like Fidelity Select Semiconductors Portfolio FSELX and Fidelity Select Retailing Portfolio FSRPX with 8% payouts each.

Fidelity

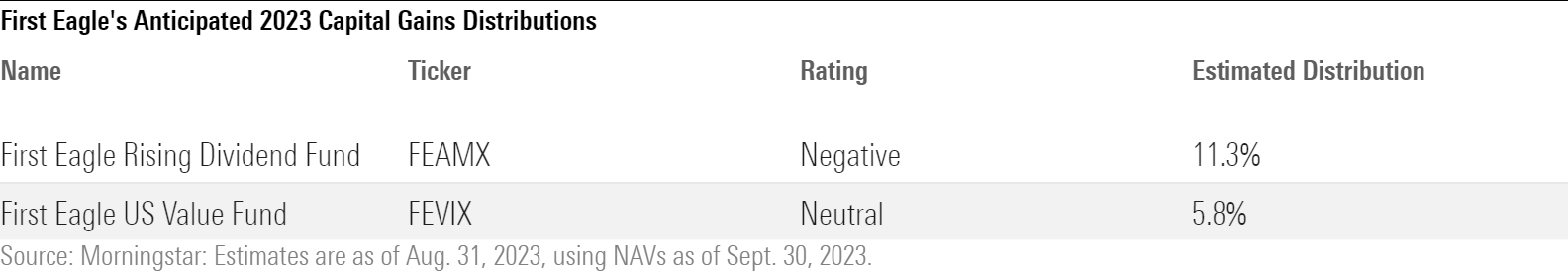

First Eagle

A few value-oriented First Eagle strategies will likely make at least 5% distributions this year, with First Eagle Rising Dividend Fund FEAMX topping 10%.

First Eagle

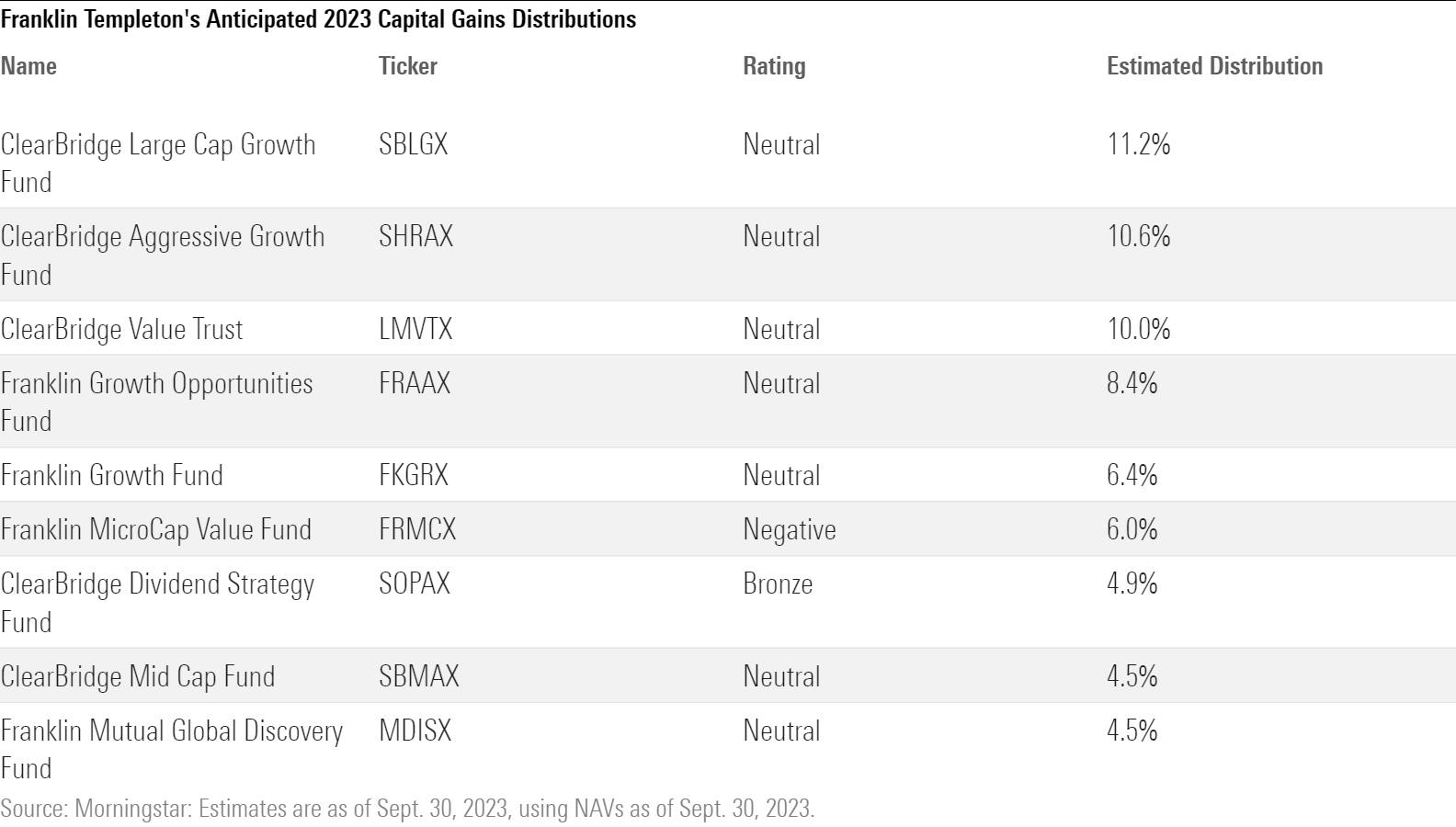

Franklin Templeton

A few Franklin Templeton Clearbridge strategies will make low-double-digit distributions. The firm, which continues to suffer outflows, will make most of the payments in mid-December.

Franklin

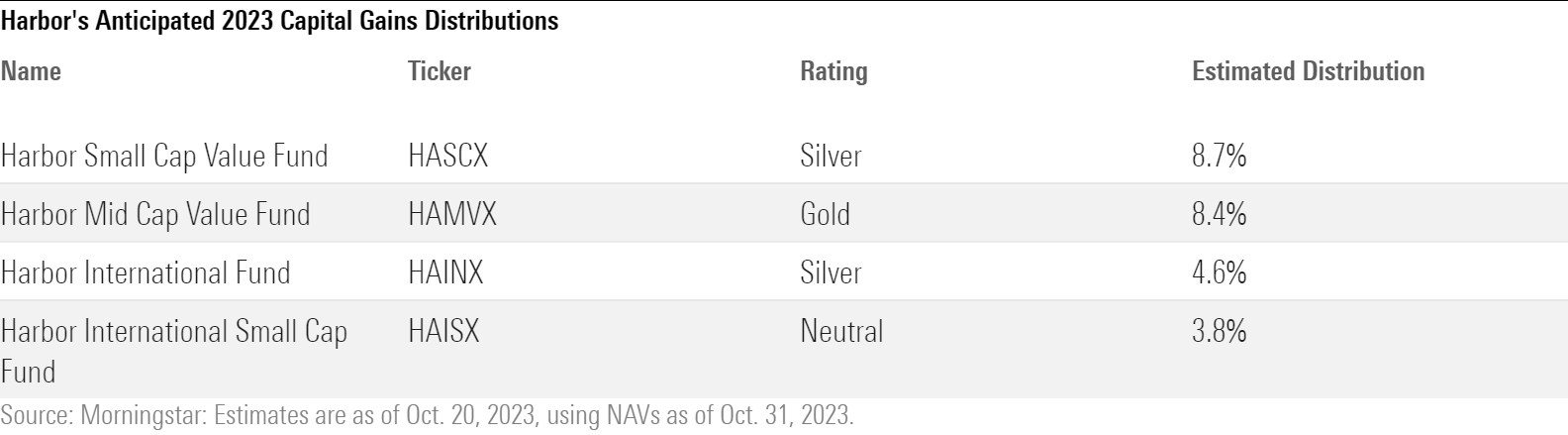

Harbor

Two Harbor strategies will distribute roughly 8% in mid-December. Harbor Mid Cap Value HAMVX saw roughly 20% in outflows for the year through October.

Harbor

Harding Loevner

Harding Loevner Emerging Markets HLEMX will likely make a 6% distribution in mid-December.

Harding Loevner

Hartford

Two value-oriented Hartford strategies will make roughly 5% distributions in mid-December.

Hartford

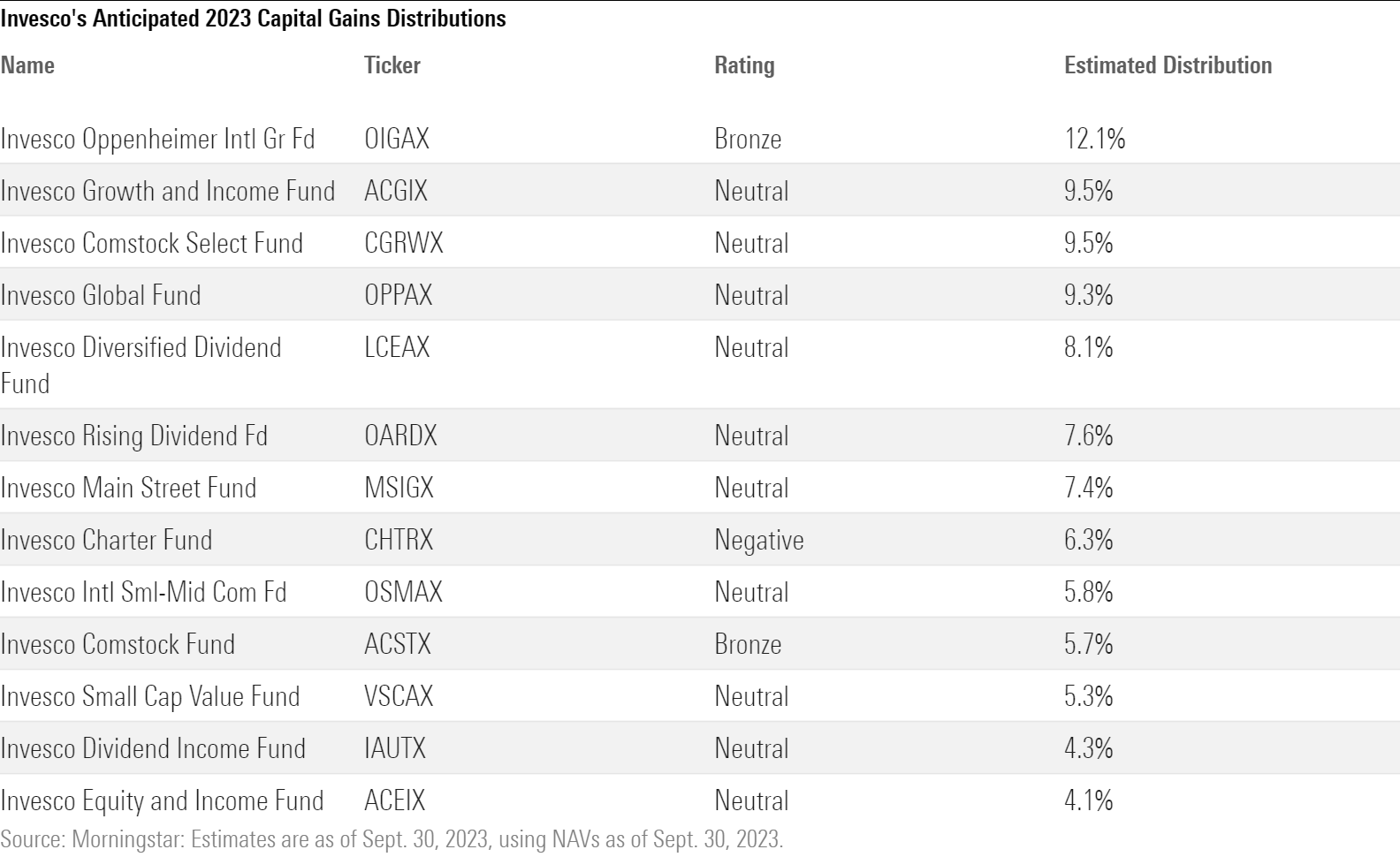

Invesco

Several Invesco strategies will likely distribute more than 5% in capital gains this December, with Invesco Oppenheimer International Growth OIGAX topping the list at roughly 12%.

Invesco

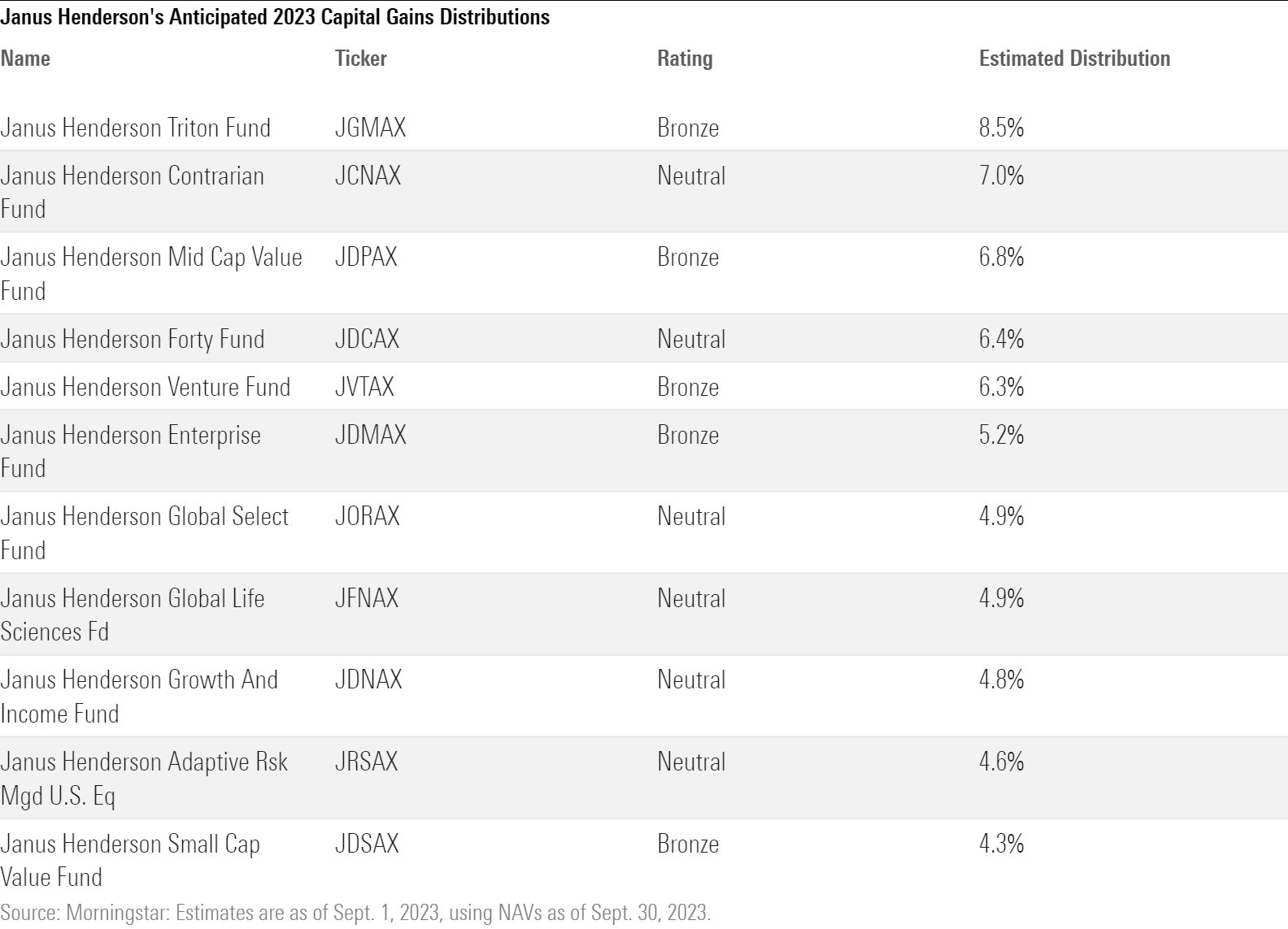

Janus Henderson

A handful of Janus Henderson funds will make 5% to 10% capital gains distributions in December.

Janus

Jensen

Jensen Quality Growth JENIX will distribute roughly 7% of NAV in December.

Jensen

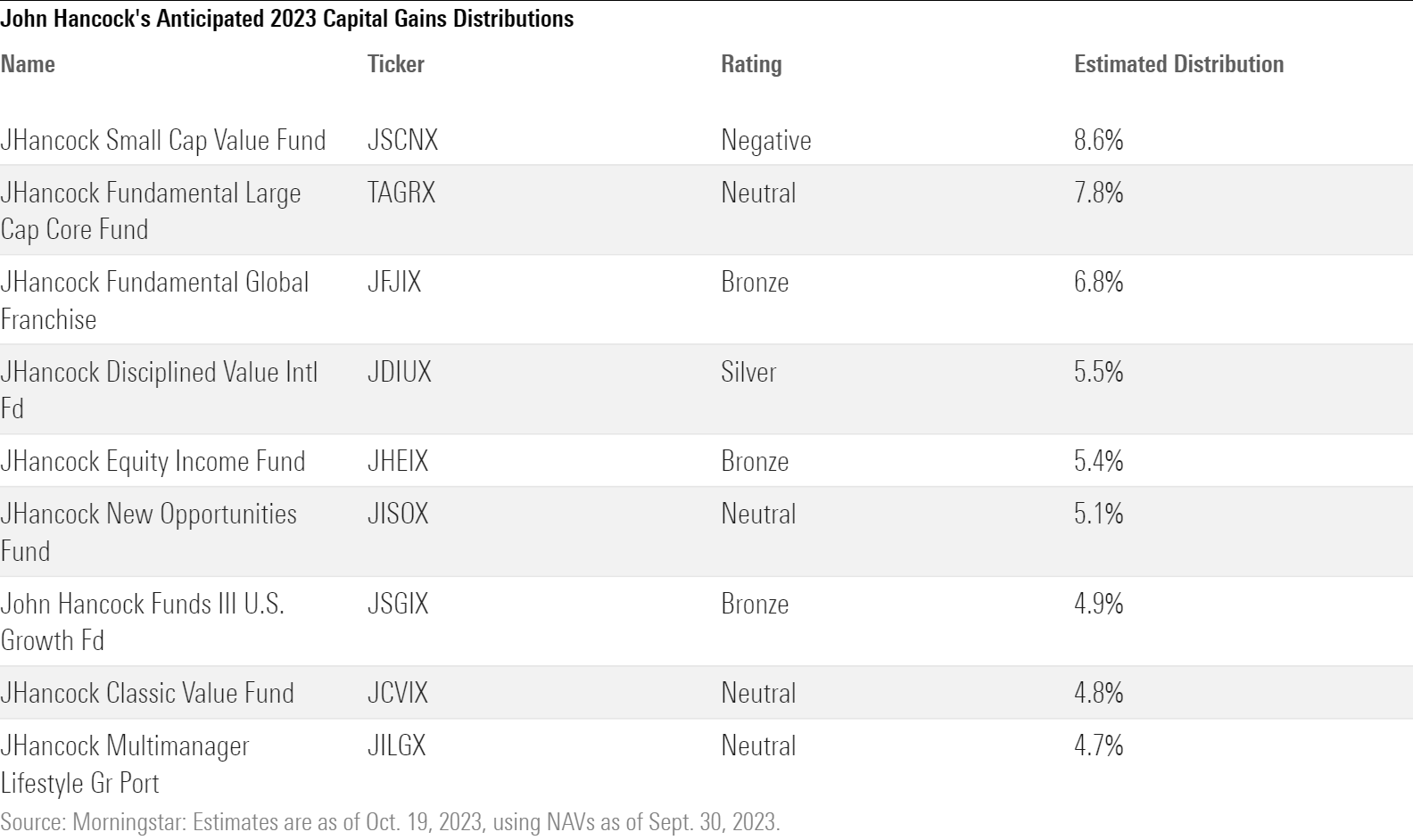

John Hancock

Several John Hancock funds will pay more than 5% in capital gains distributions in mid- to late December, with a few of those being value-oriented strategies.

JHancock

J.P. Morgan

A handful of J.P. Morgan funds are on track to make mid-single-digit capital gains distributions in December. Two strategies will likely pay out more than 10%. Bronze-rated J.P. Morgan US Large Cap Core Plus JLCAX, which is a leveraged strategy, could make a roughly 12% distribution, coming on the heels of a big distribution last year. Ironically, J.P. Morgan Tax Aware Equity JPDEX will likely distribute at least 20%; the $828 million in assets fund has seen more than $240 million in outflows in 2023.

JP Morgan

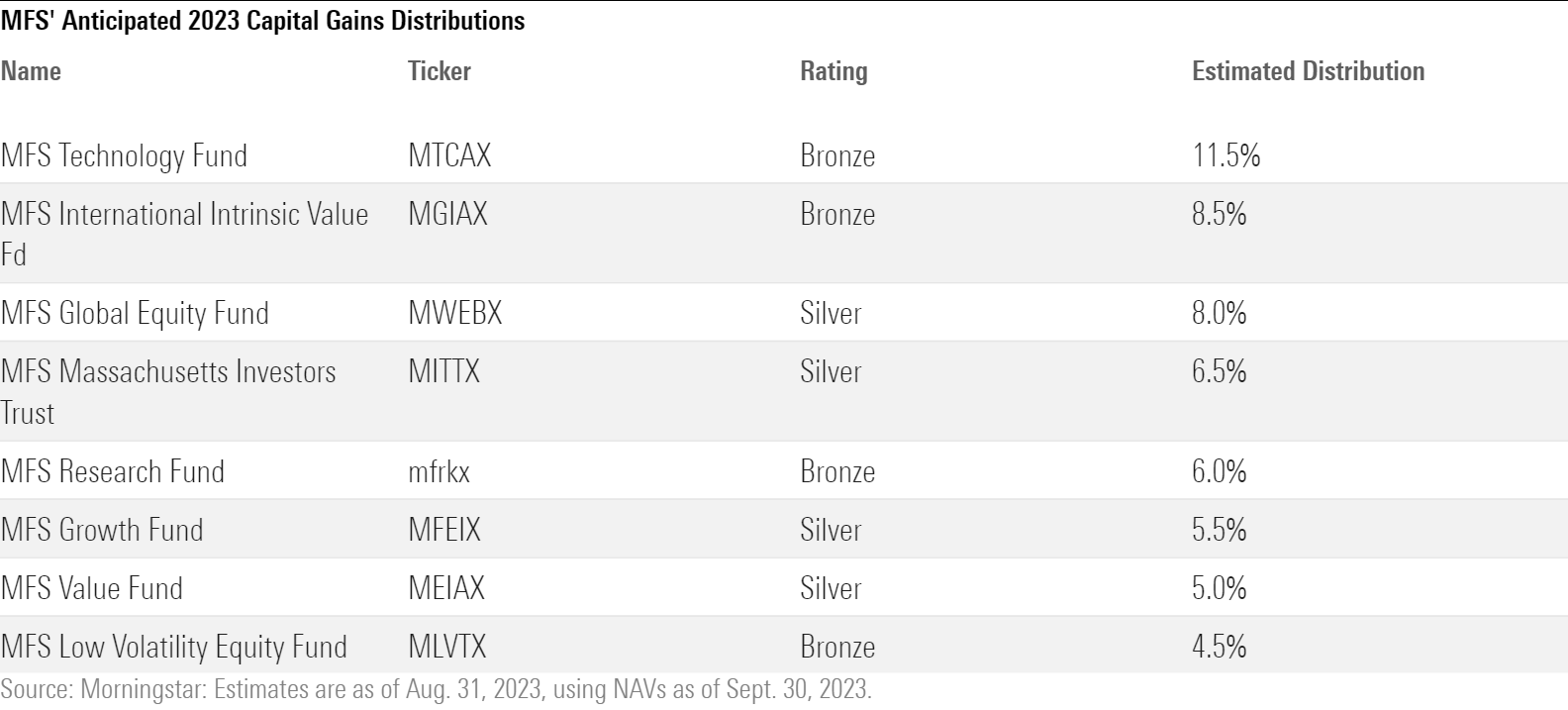

MFS

MFS’ Bronze-rated Technology Fund MTCAX will likely make a double-digit distribution due in part to a manager transition. Bronze-rated MFS International Intrinsic Value MGIAX and MFS Global Equity MWEBX will also make roughly 8% distributions. The firm’s estimates as of Aug. 31 mostly comprise long-term capital gains.

MFS

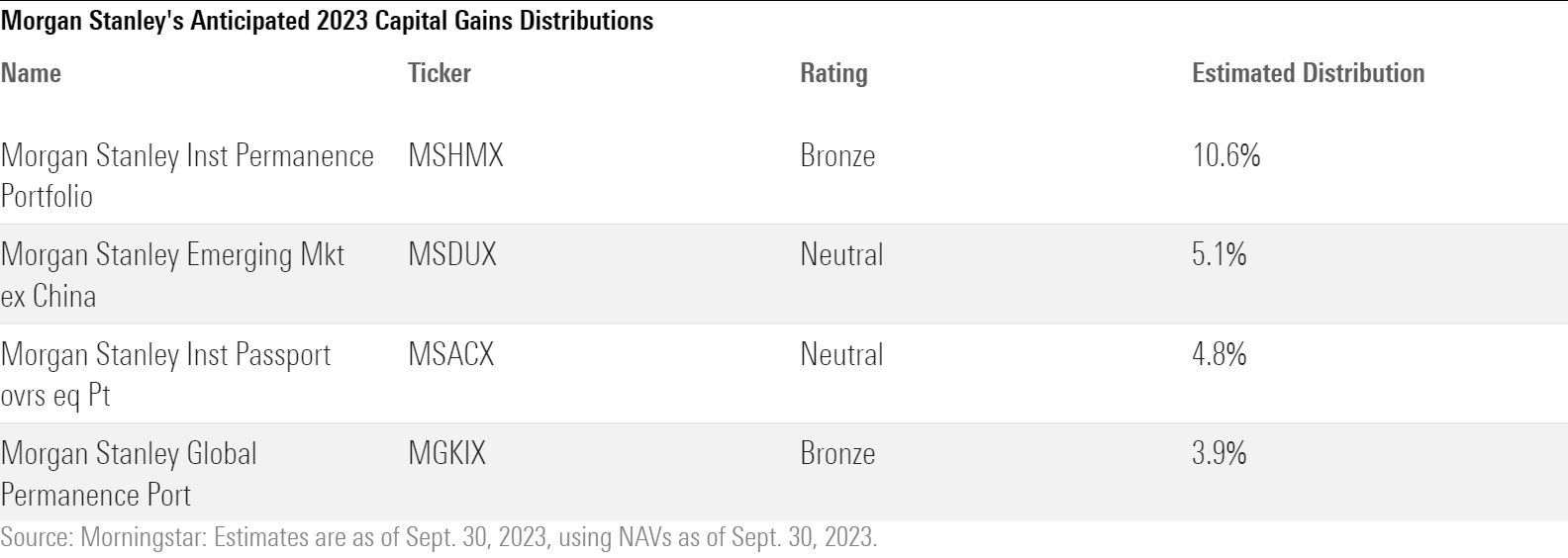

Morgan Stanley

A few Morgan Stanley strategies will distribute mid-single-digit gains, while Morgan Stanley Permanence MSHMX will make a roughly 11% distribution.

MS

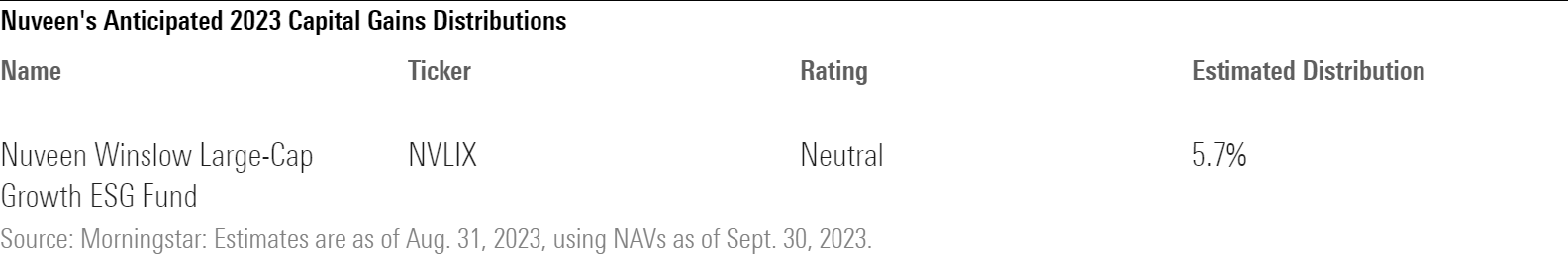

Nuveen

Only one Nuveen strategy will make a roughly 5% capital gains distribution in December. The firm has made its estimates based on Aug. 31 figures and will make payments in late December.

Nuveen

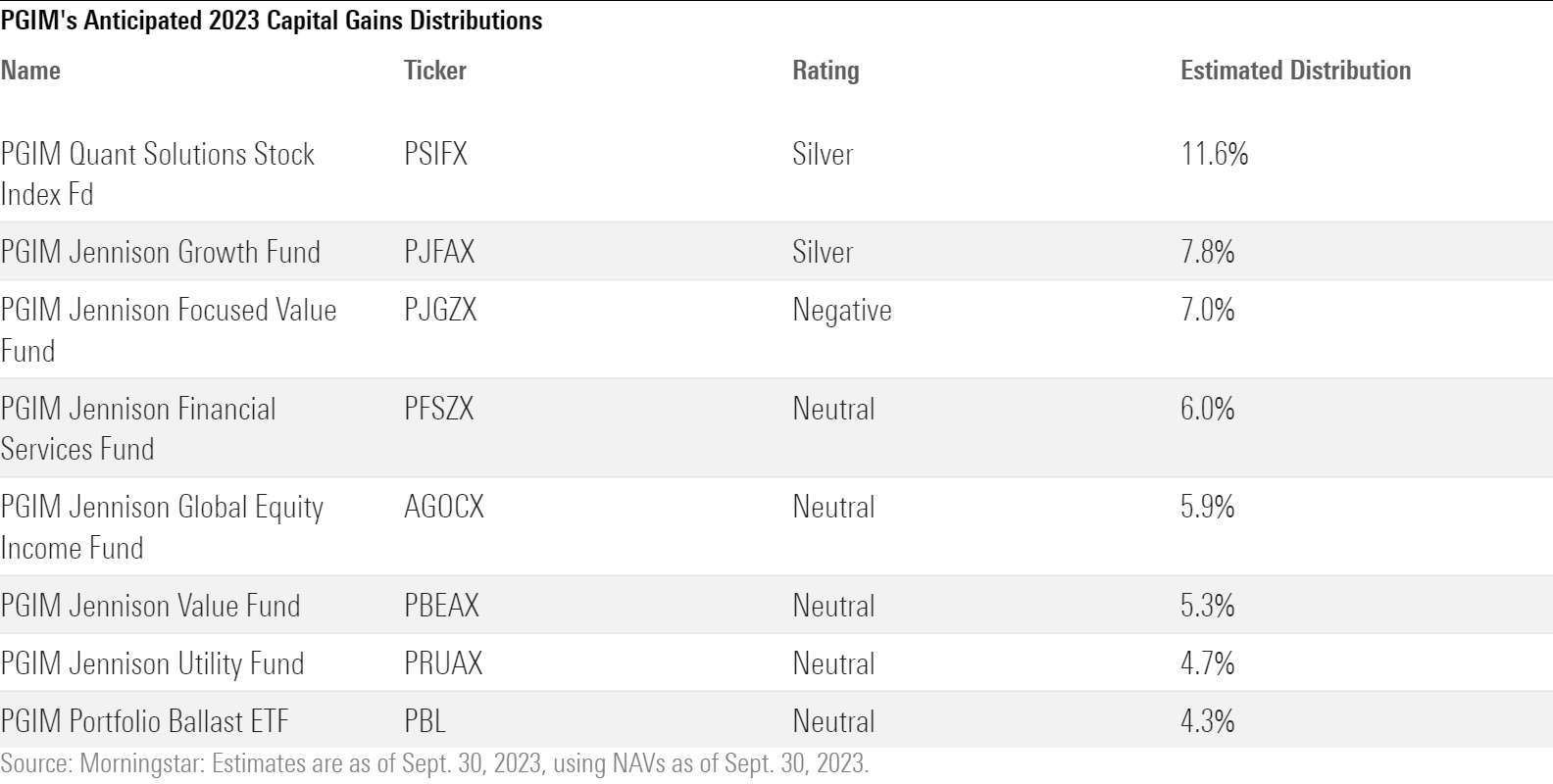

PGIM

A few PGIM value- and blend-oriented strategies will likely make high-single-digit to double-digit distributions in mid-December. The firm has made its estimates based on Sept. 30 figures and will make payments in mid-December.

PGIM

Primecap

All three Gold-rated Primecap strategies will distribute at least 5% estimated capital gains, with Primecap Odyssey Growth POGRX distributing roughly 12%.

Primecap

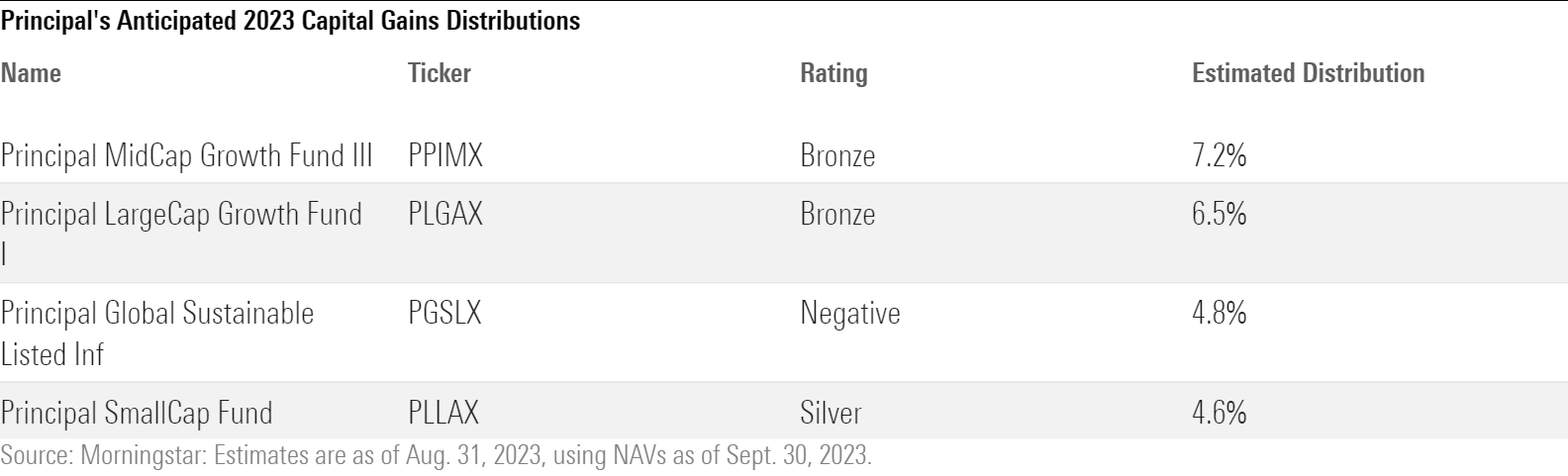

Principal

A few Principal growth-oriented strategies, such as MidCap Growth Fund III PPIMX, will likely make at least 5% distributions in mid-December. The firm has made its estimates based on Sept. 30 figures and will make payments in late December.

Principal

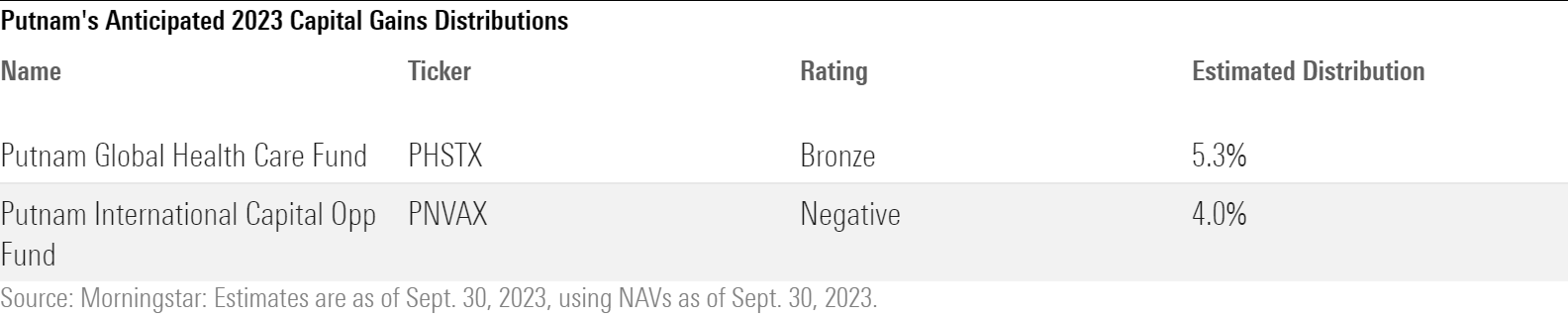

Putnam

Two Putnam strategies will likely make mid-single-digit distributions in mid-December.

Putnam

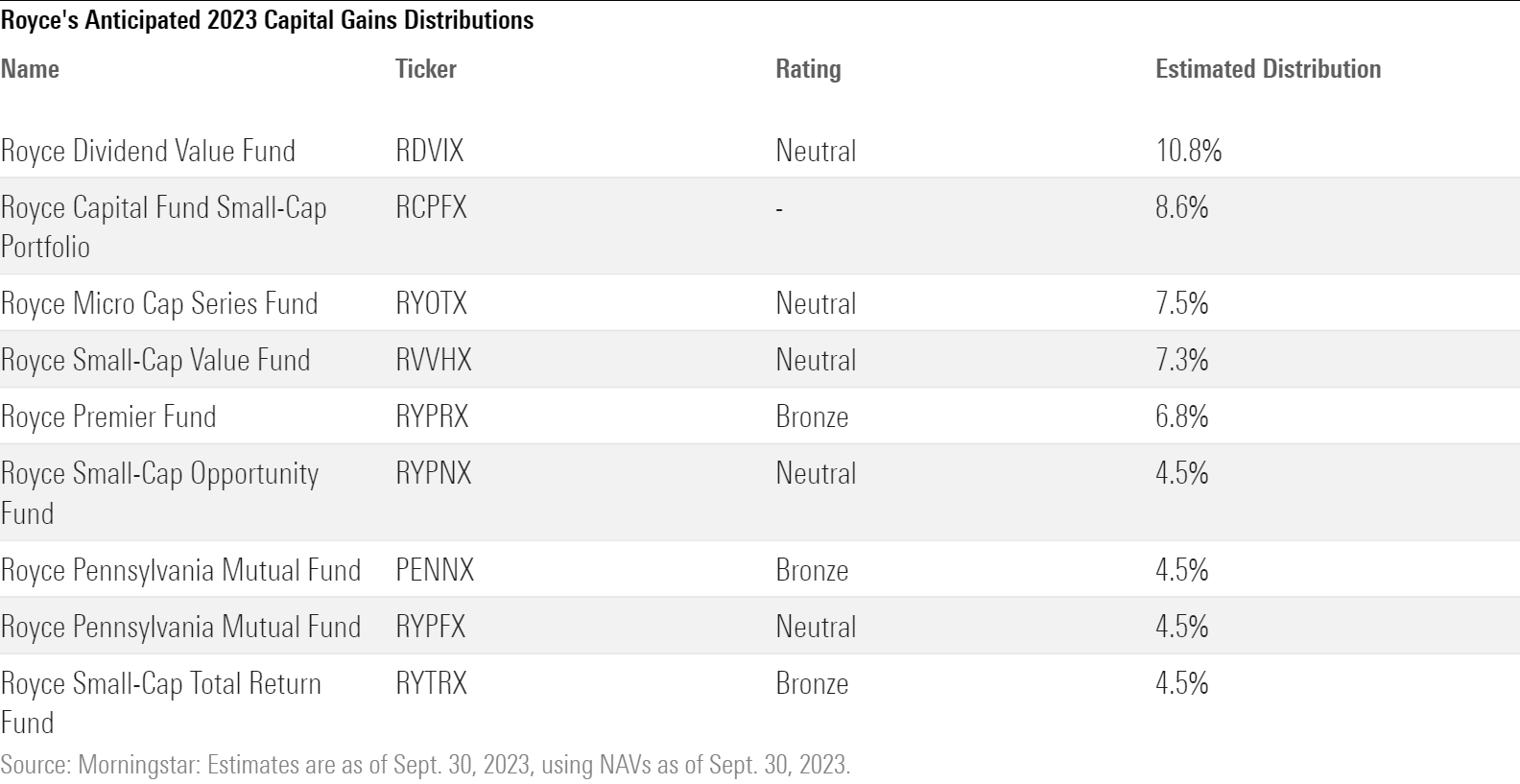

Royce

A handful of Royce strategies will likely make mid-single-digit distributions in mid-December. The firm has made its estimates based on Oct. 23 figures and will make payments in mid-December.

Royce

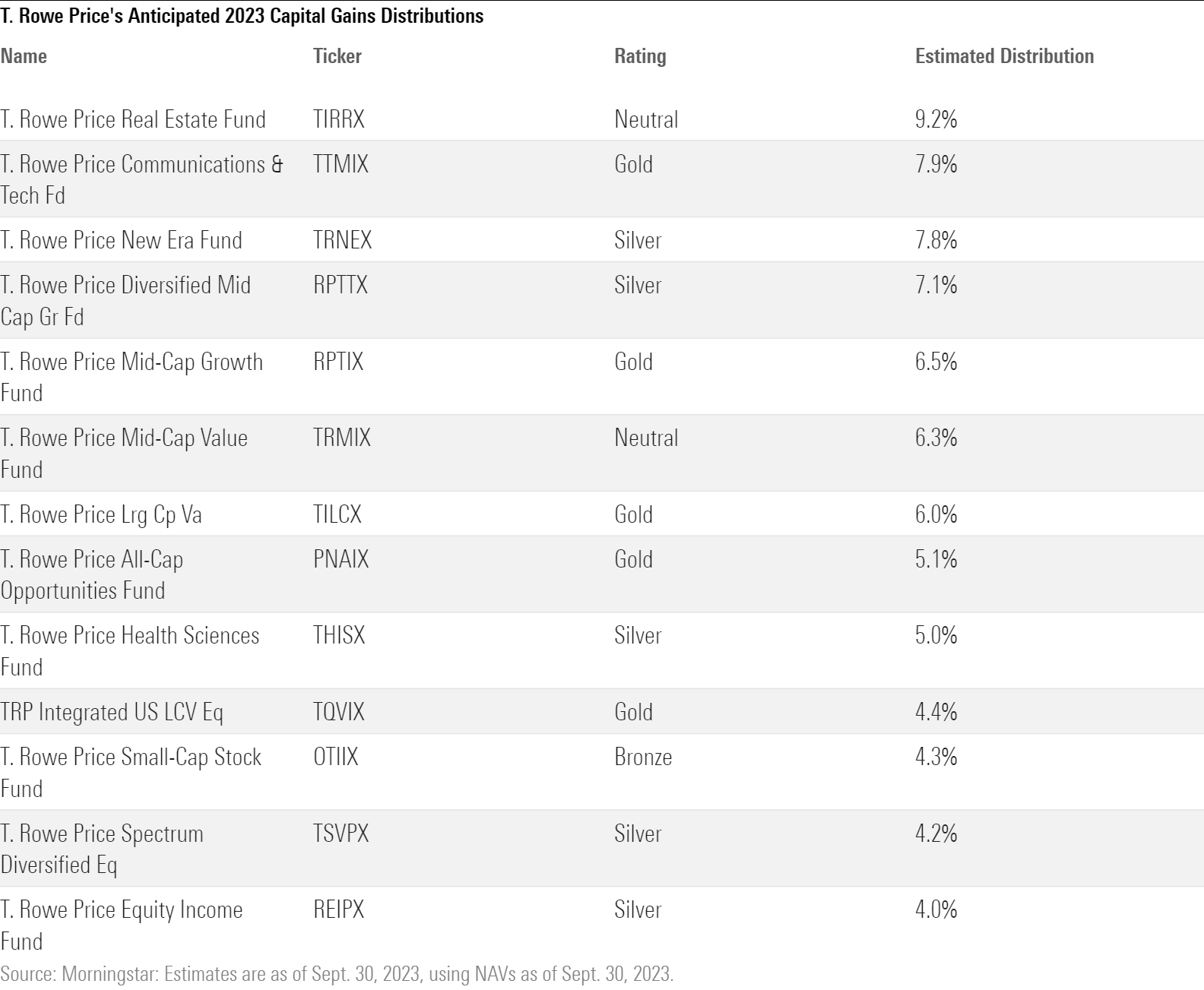

T. Rowe Price

Several T. Rowe Price funds will make meaningful distributions. T. Rowe Price Real Estate TIRRX will make a roughly 9% distribution, due in part to an estimated 26% outflow for the year through September.

T. Rowe

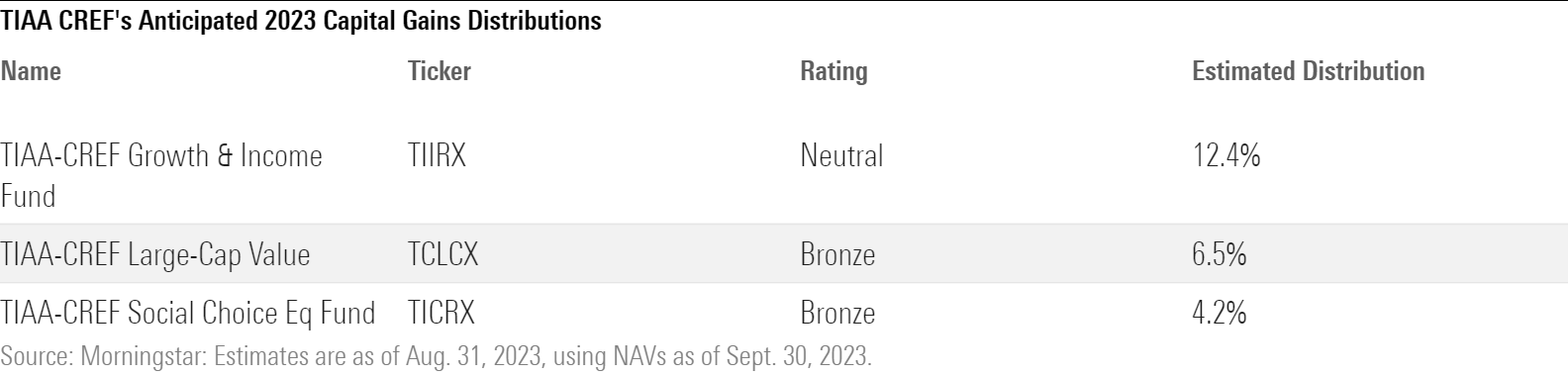

TIAA-CREF

Neutral-rated large-blend TIAA-CREF Growth & Income TIGRX will likely make a 12% capital gains distribution. Two other strategies will likely distribute mid-single-digit gains.

TIAA-CREF

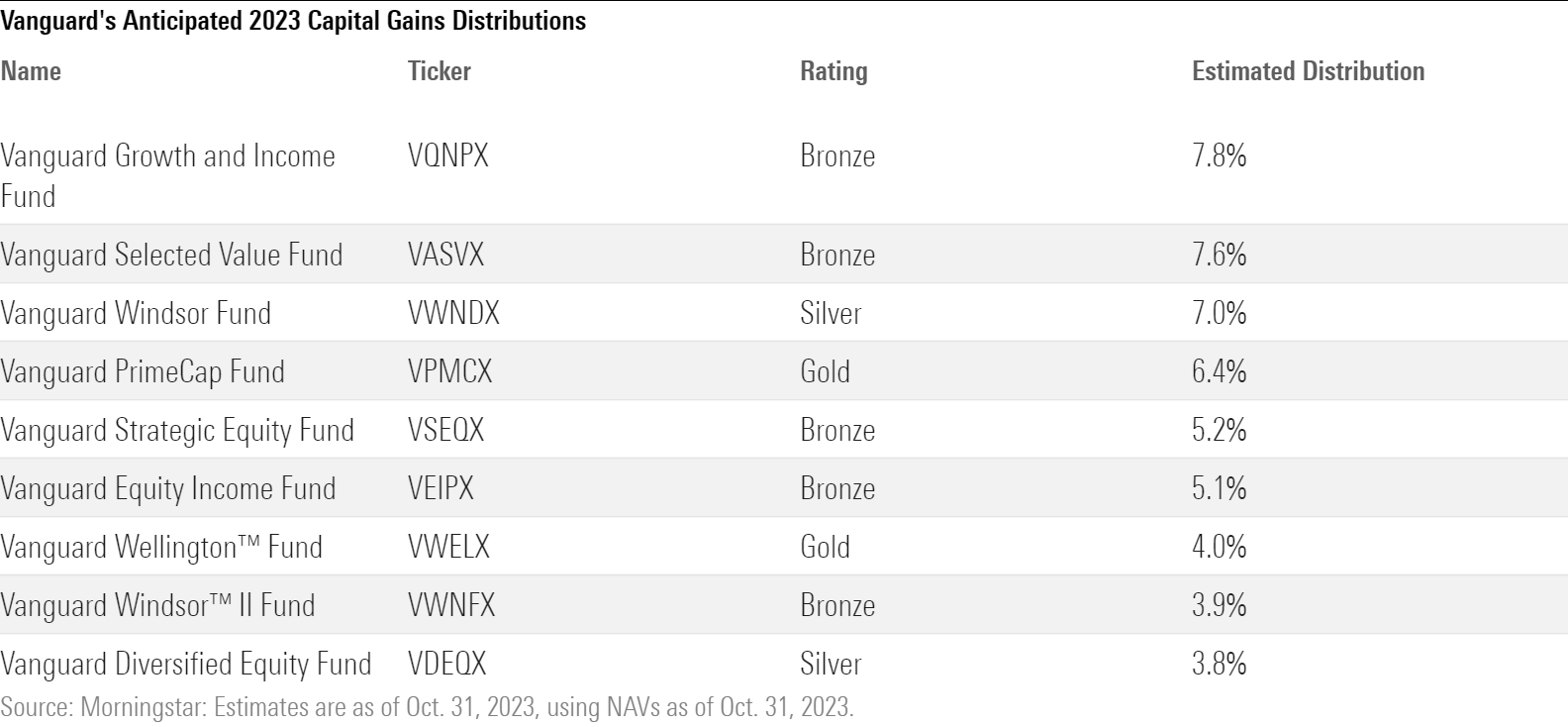

Vanguard

A handful of Vanguard strategies will distribute more than 5% in gains in December.

Vanguard

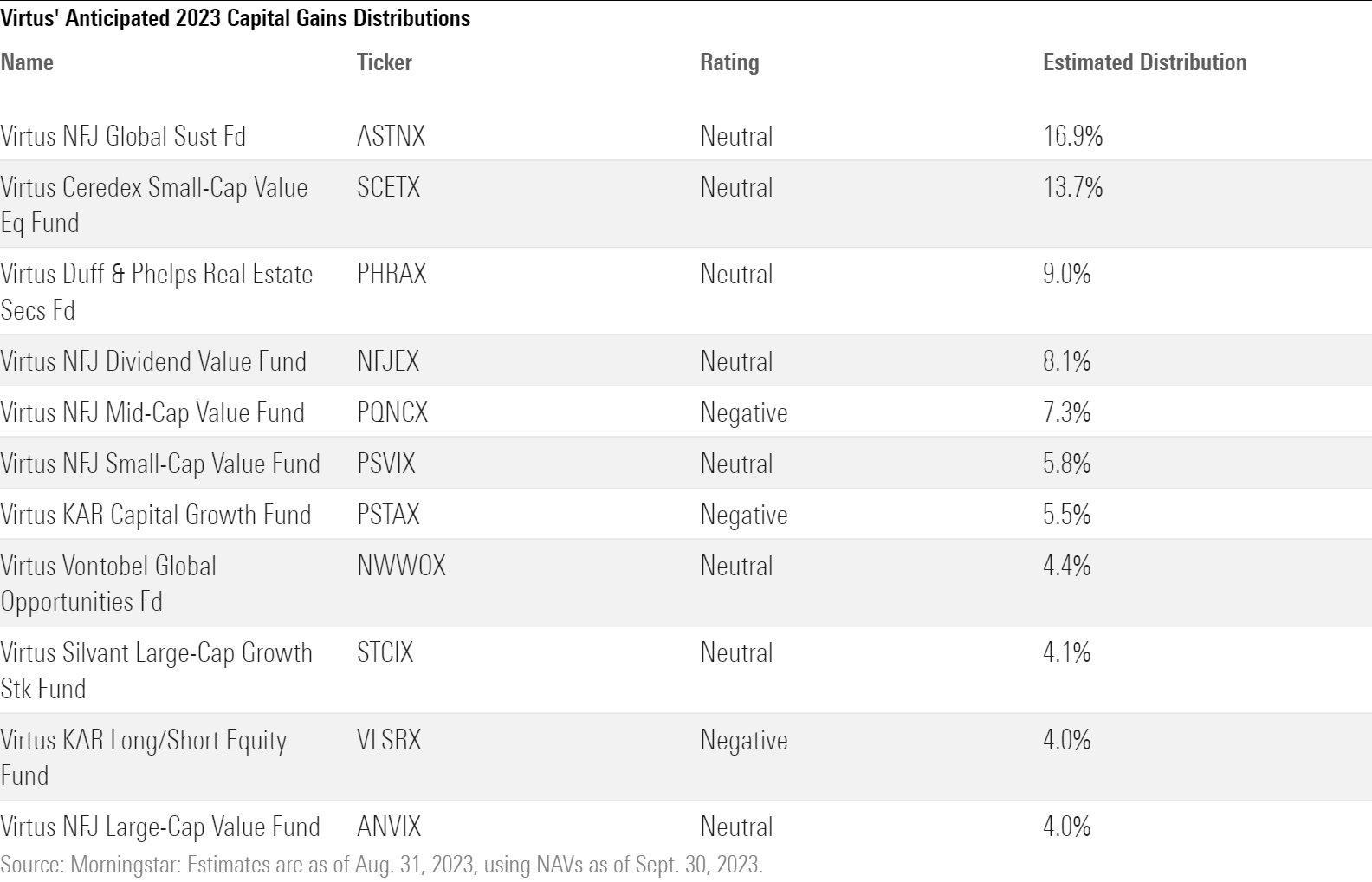

Virtus

Funds from across Virtus’ stable of boutiques will likely make more than 5% distributions with two, Virtus NFL Global Sustainable ASTNX and Virtus Ceredex Small-Cap Value SCETX, making more than 10% distributions in December.

Virtus

Why You Should Pay Attention to Capital Gains Distribution Estimates

If you invest in a tax-sheltered account, such as a 401(k) or an IRA, and you’re reinvesting your distributions, distribution previews seem like a nonevent because you won’t owe taxes until you sell your holdings in retirement and maybe not at all if you invest in a Roth IRA.

There are good reasons to pay attention to them, though. Investors with taxable accounts owe taxes on distributed gains even if they reinvested them, unless they’ve sold losing positions to offset the gains.

Reinvested capital gains help increase your cost basis, which could reduce the capital gains taxes you owe when you eventually sell the fund. So, if you hold a serial capital-gains-distributing fund, selling it in the future may cost less than you anticipated, owing to all the cost-basis step-ups that the regular distributions triggered.

Taxable investors considering buying a fund that has predicted it will make a distribution also may consider delaying the purchase until after the payout to avoid getting distributions without the benefit of any gains.

Tax considerations, of course, are just one of many factors in an investment decision. Check with a tax advisor before trading.

Correction: The original Vanguard table had two repeated entries. It has been fixed.

The author or authors own shares in one or more securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/c52d2eba-3a3c-478f-b3bd-c3ca80a5100f.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/FGC25JIKZ5EATCXF265D56SZTE.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/c52d2eba-3a3c-478f-b3bd-c3ca80a5100f.jpg)