3 ESG Firms Leading the Way to a More Sustainable Future

A peek behind the curtain of the Morningstar ESG Commitment Level.

Some asset managers truly walk the walk when it comes to environmental, social, and governance investing. Three strong examples are Boston Trust Walden, Calvert, and Parnassus. Their ESG roots date back to the 1990s (earlier in some cases), and their brands remain synonymous with sustainable investing.

Since Morningstar embarked on rating money managers’ commitment to ESG in 2020, it has become clearer what separates the leaders from the laggards. This is the first article in a series of four that seeks to delineate those differences by profiling firms from each tier of the Morningstar ESG Commitment Level: Leader, Advanced, Basic, and Low.

The Morningstar ESG Commitment Level for Asset Managers is based on three pillars: Philosophy and Process, Resources, and Active Ownership. The best ESG asset managers base their processes on sound philosophies, implement them with strong teams, and actively spur the companies they own to be better stewards of all their stakeholders’ interests.

Leading the Way

This installment puts the spotlight on three firms with Morningstar ESG Commitment Levels of Leader: Boston Trust Walden, Calvert Research & Management, and Parnassus. All three boast long track records of sustainable investing, but they haven’t rested on their laurels. Since signing the United Nations-backed Principles for Responsible Investment in the mid-2000s, they have bolstered their resources, deepened the integration of ESG criteria into their processes, and backed up their philosophies with ESG-aligned proxy voting records. They continually raise the bar for other asset managers.

Not All Leaders Are the Same

Although there are some ESG best practices, one size does not fit all. For example, the absolute size of an ESG team matters less than the research they undertake and the division of responsibilities. Boston Trust Walden’s eight-member ESG team oversees all ESG research for its $3 billion in assets under management, while Calvert dedicates a dozen professionals to its $32 billion mandate (as of July 2022). Parnassus’ four ESG analysts share the load with the firm’s fundamental analysts, who also contribute to ESG research for the firm’s $40 billion in AUM.

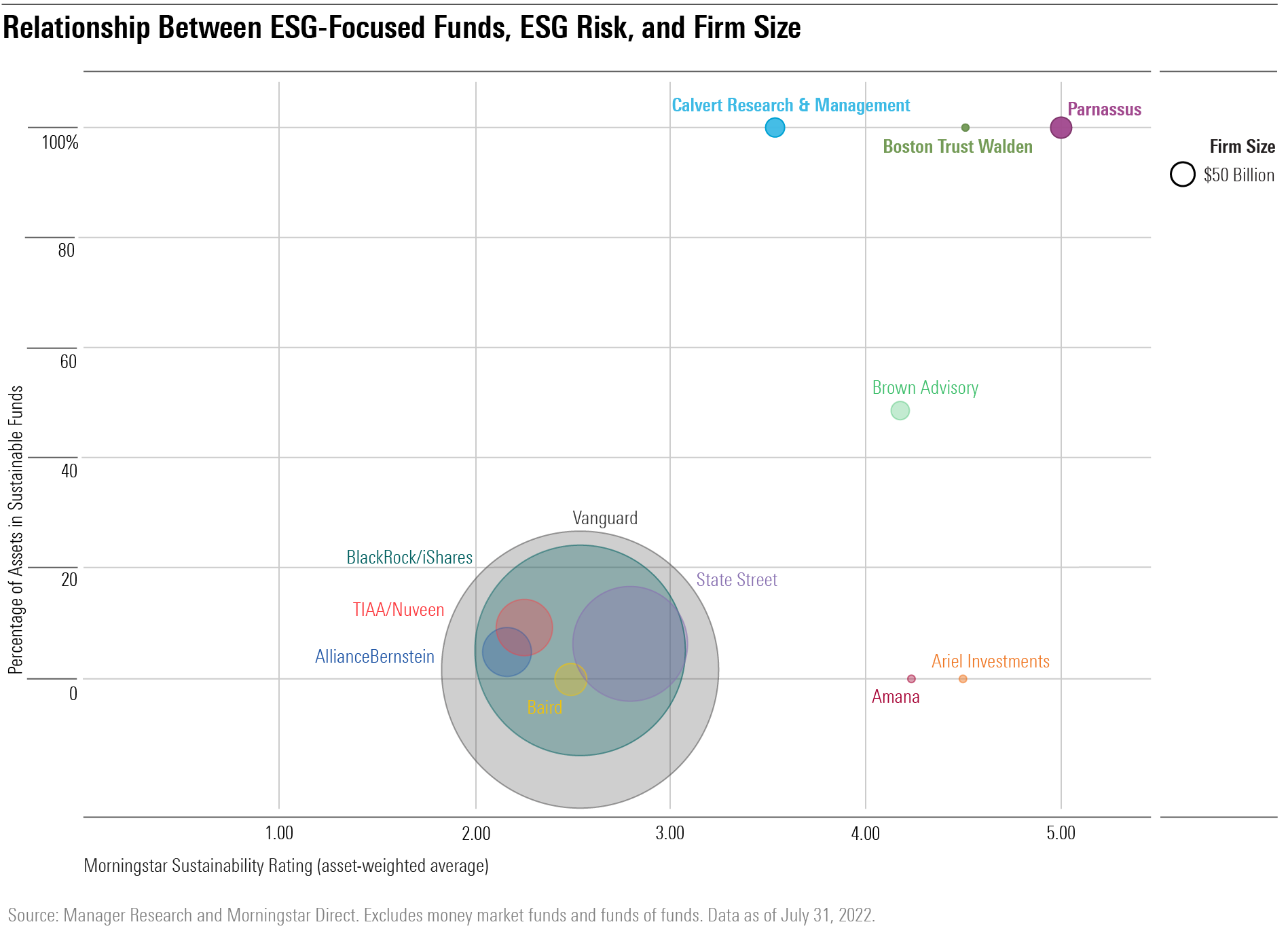

The exhibit below demonstrates the relationship between a firm’s total assets, percentage of assets in ESG-focused funds, and the asset-weighted Morningstar Sustainability Rating. The 12 firms featured here are the ones we will highlight in this four-part series.

These firms’ active ownership approaches also differ. For instance, Calvert and Boston Trust Walden publish best-in-class proxy voting guidelines and regularly engage with companies on issues like climate risk and equality. Parnassus starts off with a softer approach, sending letters to companies outlining positive aspects of each firm and highlighting areas for improvement. Parnassus will ramp up engagements, however, with firms that continue to lag.

The firms are most similar when it comes to philosophy and process, but distinctions appear there, too. For example, Parnassus has the most uniform approach to integrating ESG into its funds: All five of its funds abide by the same exclusionary criteria and research standards. By comparison, Boston Trust Walden leverages ESG research in all 10 of its funds but dials up the exclusionary screens in six of them. Finally, Calvert’s 31 funds adhere to its proprietary Principles for Responsible Investment but run the gamut from light-touch index-based offerings to impact investing.

Boston Trust Walden

Boston Trust Walden has built a topnotch active ownership program on the back of its 40-year legacy of sustainable investing. The firm makes its environmental and social priorities clear through thorough proxy voting and engagement guidelines, and it backs this up through a robust stewardship program. Boston Trust Walden frequently sponsors shareholder resolutions, many of which have proved successful in improving company practices. For example, the firm withdrew a resolution seeking increased diversity at Home Depot after management took steps to improve its practices.

Calvert Research & Management

Calvert also leads on active ownership, and the firm’s six-member engagement team often files shareholder resolutions when conversations with company management fall short. For instance, when Tesla’s 2021 diversity, equity, and inclusion report revealed that Tesla’s leadership was mostly male and white, despite claiming a “majority minority workforce,” Calvert filed a shareholder resolution calling for disclosure of its full Equal Employment Opportunity (EEO-1) report along with details on its internal DEI efforts.

Parnassus

Parnassus runs a tight ship when it comes to ESG investing. It integrated its ESG research bench more fully with its fundamental analyst team in mid-2021, shoring up an already collaborative, ESG-centric investment process. The firm’s compact lineup of five concentrated ESG-focused funds also allows analysts to delve deeply into the material risks and opportunities of their holdings. Furthermore, discussions of material ESG issues go all the way up the chain, with the CIO making the final call on a prospective investment’s eligibility or lack thereof.

ESG Risk and Impact

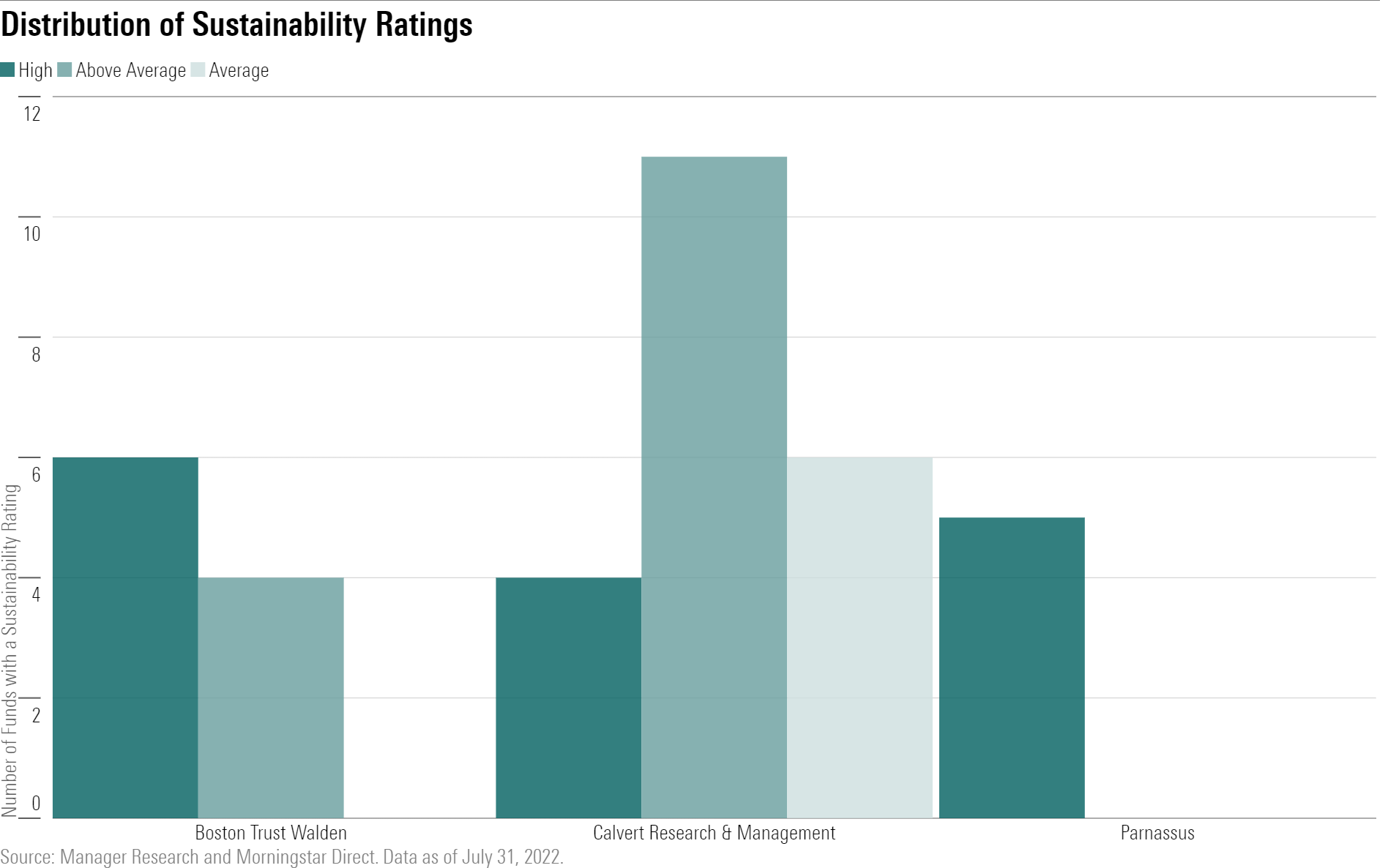

The three firms have diverse offerings that cater to different investor preferences in terms of ESG risk and impact. While these metrics are not a formal input to the Morningstar ESG Commitment Level methodology, the fact that these firms’ offerings score well on ESG risk and impact boosts our confidence in their roles as Leaders.

As shown in the exhibit above, funds offered by Parnassus and Boston Trust Walden do a topnotch job of mitigating material ESG risks in their portfolios. Consequently, all their funds earn Above Average or High Morningstar Sustainability Ratings (4 or 5 globes, respectively).

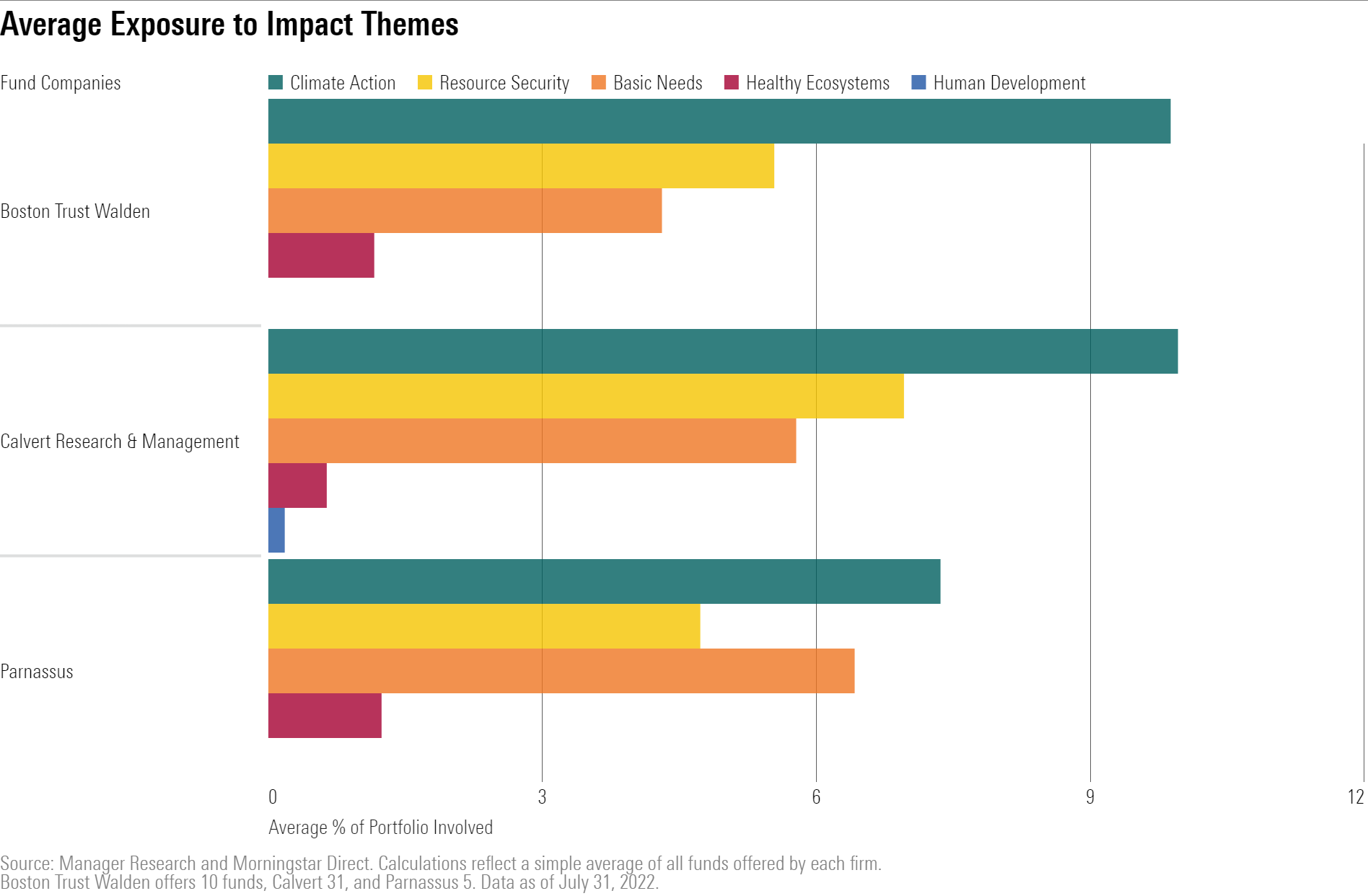

On the other hand, impact measures a company’s contribution to positive societal change. Morningstar Sustainalytics’ Impact Metrics calculate the percentage of a given company’s revenues that are associated with one of five impact themes, and Morningstar’s Portfolio Impact Metrics aggregate those revenue exposures to the fund level.

Calvert’s lineup includes some funds that offer more exposure to impact themes like Climate Action and Resource Security. For example, Calvert Global Energy Solutions holds First Solar and Siemens Gamesa Renewable Energy SA, which derive 100% of revenues from solar and renewable energy activities. See the full breakdown of the firms’ impact theme exposures in the exhibit below.

These three firms demonstrate that there is no one way to be an ESG Leader, but there are several blue-ribbon approaches that help a firm’s cause. Solid resources, robust active ownership, and comprehensive integration of ESG into the firm’s culture and investment philosophy are a few best practices that set firms apart.

Raj Modi contributed to this story.

The author or authors own shares in one or more securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/987376c2-20a0-406b-b3ec-df530324b39c.jpg)

/s3.amazonaws.com/arc-authors/morningstar/ac242d77-42e4-4165-951a-b300b089a834.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NNGJ3G4COBBN5NSKSKMWOVYSMA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6BCTH5O2DVGYHBA4UDPCFNXA7M.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EBTIDAIWWBBUZKXEEGCDYHQFDU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/987376c2-20a0-406b-b3ec-df530324b39c.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ac242d77-42e4-4165-951a-b300b089a834.jpg)