These Growth Funds Continued to Shine in Q1 2024

Funds with more exposure to AI stocks tended to fare better than peers.

Equity funds extended their winning streak into 2024′s first quarter. After the average large-growth Morningstar Category fund rose 36.7% in 2023, the group averaged an 11.9% gain through the first three months of 2024.

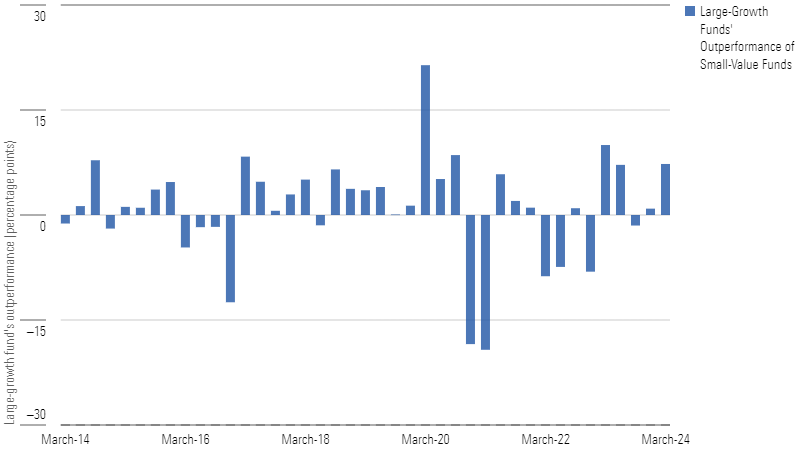

Though the eight other Morningstar Style Box categories posted respectable gains over the period, the disparity between large-growth and small-value performance widened. The buzz around artificial intelligence and the continued dominance of tech giants such as Nvidia NVDA and Microsoft MSFT drove the Russell 1000 Growth Index to all-time highs. Meanwhile, traditional value industries such as regional banks, utilities, and REITs trailed the broader market.

The Gap Between Large-Growth Funds and Small-Value Funds Widened

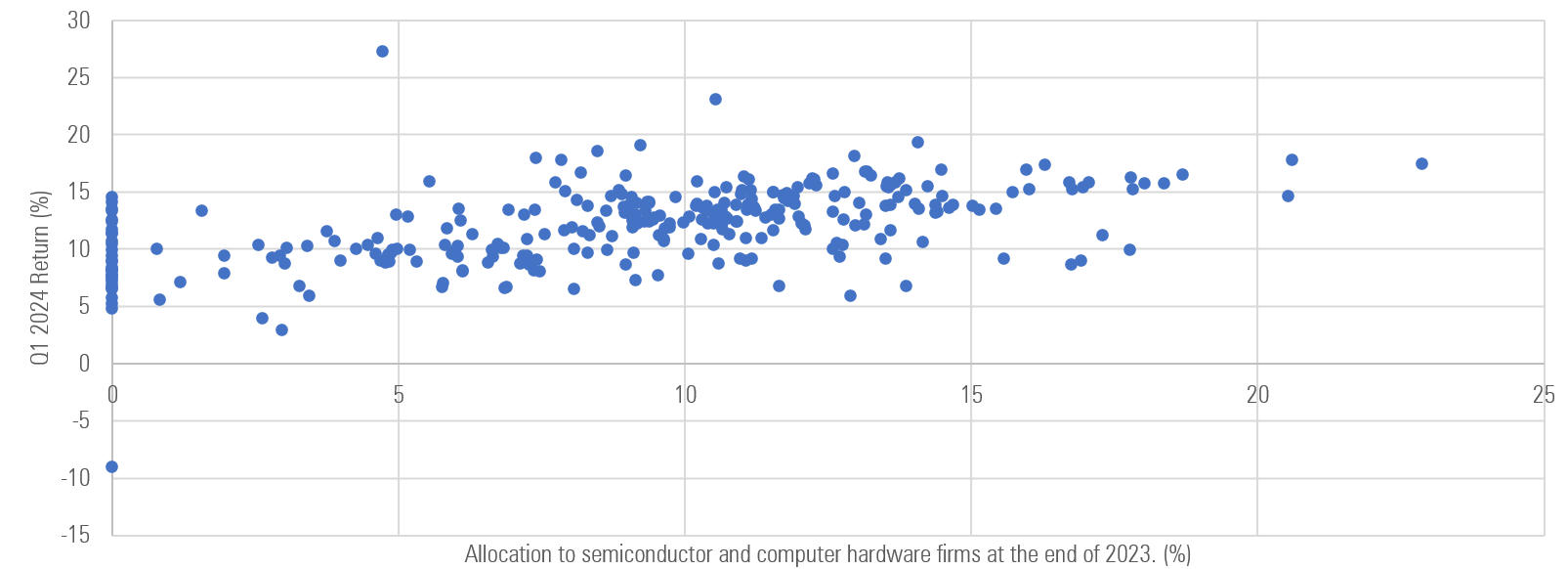

AI continued to dominate market headlines. The hype around AI-related stocks pushed large-cap tech higher, especially semiconductor and computer hardware stocks. A fund’s exposure to those two industries was a pretty good indicator of how it performed in the first quarter.

Large-Growth Funds' Exposure to AI-Related Industries vs. Performance

Nvidia has become synonymous with AI; it gained nearly 90% through the first three months of the year. Lord Abbett Growth Leaders LGLIX and Alger Spectra’s ASPIX respective 11.2% and 7.7% helpings of the stock at the end of 2023 fueled their top-decile returns among their large-growth peers. The former also had more than 54% of its assets parked in tech firms.

Small- and mid-cap growth funds also fared well but tended to lag their large-growth peers. Amy Zhang’s Alger Mid Cap Focus AFOZX, which had 45.9% of its assets in tech firms in December 2023, beat nearly 94% of its mid-growth peers after posting bottom-quartile returns in 2022 and in 2023. Fidelity Small Cap Growth FOCSX and Invesco Discovery Mid Cap Growth OEGYX also benefited from the growth rally and were among their respective categories’ top performers.

Not all growth funds fared well. Cathie Wood’s ARK Innovation ETF ARKK fell 4.5% and trailed nearly all its mid-growth peers. Healthy allocations to Roku ROKU, Tesla TSLA, and Roblox RBLX—which each fell more than 10% in the first quarter—dragged on performance.

Meanwhile, greater exposure to lagging industries like banks, REITs, commodities, and utilities hindered value indexes and funds. Contrarian funds such as Ariel Appreciation CAAPX and Royce Small-Cap Special Equity RYSEX were among the worst-performing funds in their respective categories. Ariel manager John Rogers’ preference for financials firms weighed on performance over the period, while Royce’s Charlie Dreifus and Steven McBoyle parked about 15% of their fund’s assets in cash, which held it back.

International Stocks

Non-US stocks got off to a decent start in 2024, but they lagged their US counterparts. The Morningstar Developed Markets ex-US Index recorded a respectable 4.5% gain in the first quarter.

Like the US market, international growth funds outpaced their value counterparts. The foreign large-growth category posted a 6.6% gain, which was nearly 3 percentage points more than the typical large-value fund. Foreign large-growth funds such as Goldman Sachs GQG Partners International Opportunities GSIMX and WCM Focused International Growth WCMIX each posted top-decile returns in the first quarter. Both portfolios had more than 5% of their assets in Novo Nordisk NVO, which gained more than 25% through March 2024.

Value-oriented funds, such as Oakmark International OAKIX and Dodge & Cox International Stock DODFX, trailed 92% and 66% of their foreign large-value peers, respectively. Both portfolios held Bayer AG BAYRY and Alibaba BABA, which weighed on performance.

Chinese equities continued their slide in 2024, damping emerging-markets funds’ returns. The Morningstar China Index fell 2.5% in the first three months of 2024, making it one of the worst-performing emerging-markets countries. Despite China’s poor performance, the Morningstar Emerging Markets Index eked out a 1.8% gain.

Because of China’s retreat, funds with greater exposure to the country tended to lag their emerging-markets peers. Matthews Emerging Markets Small Companies MSMLX, T. Rowe Price Institutional Emerging Markets Equity IEMFX, and Harding Loevner Institutional Emerging Markets HLMEX had more than 22% of their December 2023 portfolios’ assets in Chinese firms. All three finished in the bottom quintile in the diversified emerging-markets category.

Those that were underweight in China and skewed toward developed markets fared much better. GQG Partners Emerging Markets Equity GQGRX beat 99% of its peers partly because of the portfolio’s 6.6% allocation to China at the end of 2023. Ashmore Emerging Markets Frontier Equity EFEIX and Harding Loevner Frontier Emerging Markets HLFMX beat 99% and 96% of their diversified emerging-markets category peers, respectively, and had no exposure to China at the end of 2023.

The author or authors own shares in one or more securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ac242d77-42e4-4165-951a-b300b089a834.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

/d10o6nnig0wrdw.cloudfront.net/07-25-2024/t_56eea4e8bb7d4b4fab9986001d5da1b6_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/BU6RVFENPMQF4EOJ6ONIPW5W5Q.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ac242d77-42e4-4165-951a-b300b089a834.jpg)