U.S. Sustainable Fund Flows Contract Again in Q2, but Outflows Ease

Climate funds attract cash. Fidelity expands its sustainable offerings.

Investors pulled money from U.S. sustainable funds during the second quarter of 2023, although the pace of withdrawals moderated from the first quarter of 2023. Sustainable bond funds were the principal collectors of inflows. For more detail, download the full report here.

Sustainable Funds Fared Worse Than Conventional Peers ... Once Again

Investors pulled $635 million from sustainable funds in the second quarter, bringing net redemptions from these funds for the past year to $11.4 billion. The decline eased from $5 billion-plus losses in each of the two previous quarters but marked the third-consecutive quarter of outflows. Global macroeconomic pressures, including persistent inflation, climbing interest rates, and fears of recession, drove this retreat.

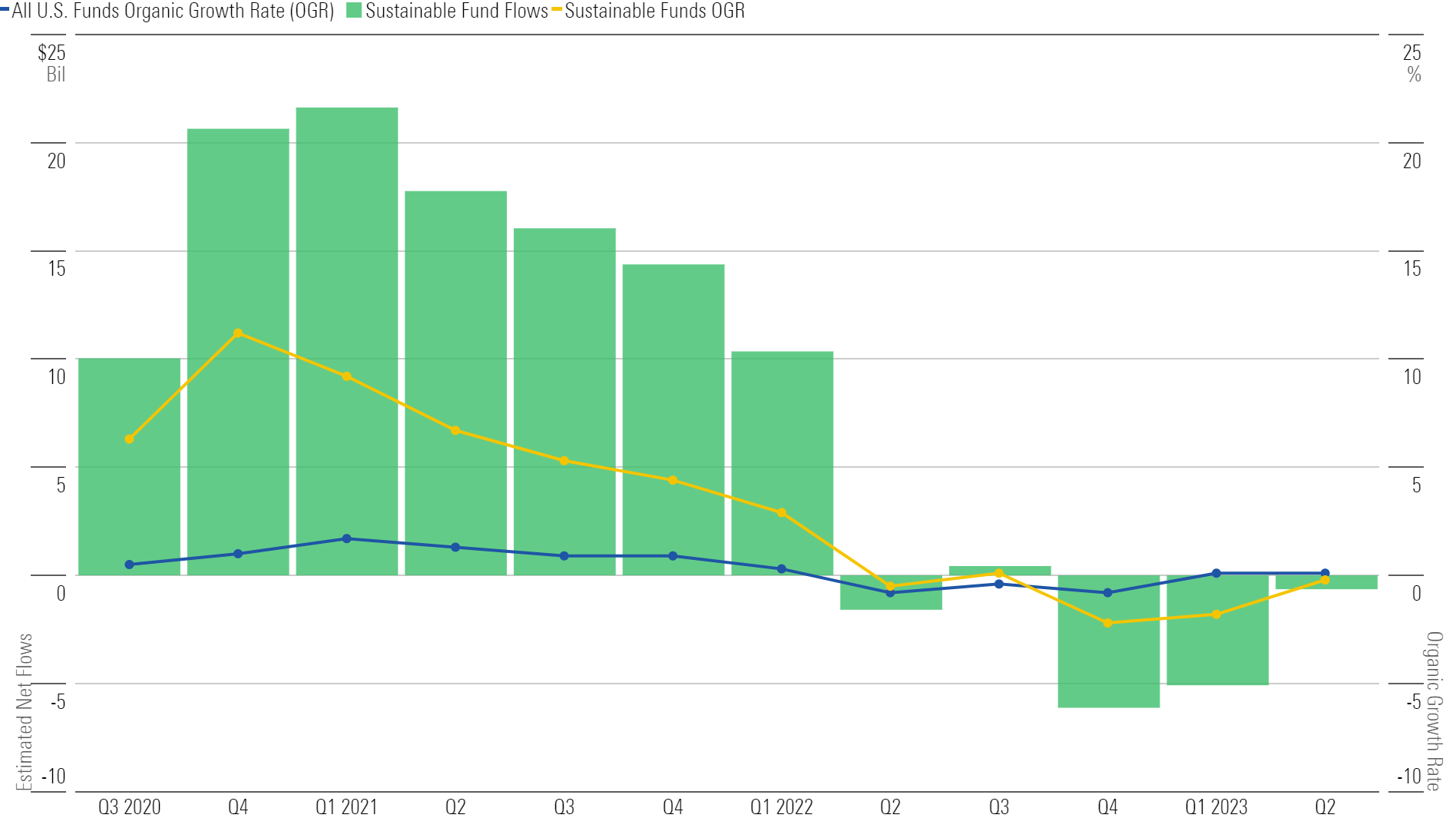

U.S. Fund Flows: Sustainable vs. All U.S. Funds

By contrast, the total universe of U.S. open-end and exchange-traded funds saw $20 billion in net inflows during 2023′s second quarter—down from their typical $100 billion-plus quarterly haul, but positive nonetheless.

Consequently, for the third quarter in more than five years, the U.S. sustainable funds segment saw a lower organic growth rate than the total U.S. fund universe. Calculated as net flows as a percentage of total assets at the start of a period, the organic growth rate puts the magnitude of fund flows into perspective. During the second quarter, sustainable funds contracted by a modest 0.2% compared with a tiny 0.08% growth in the overall U.S. funds landscape.

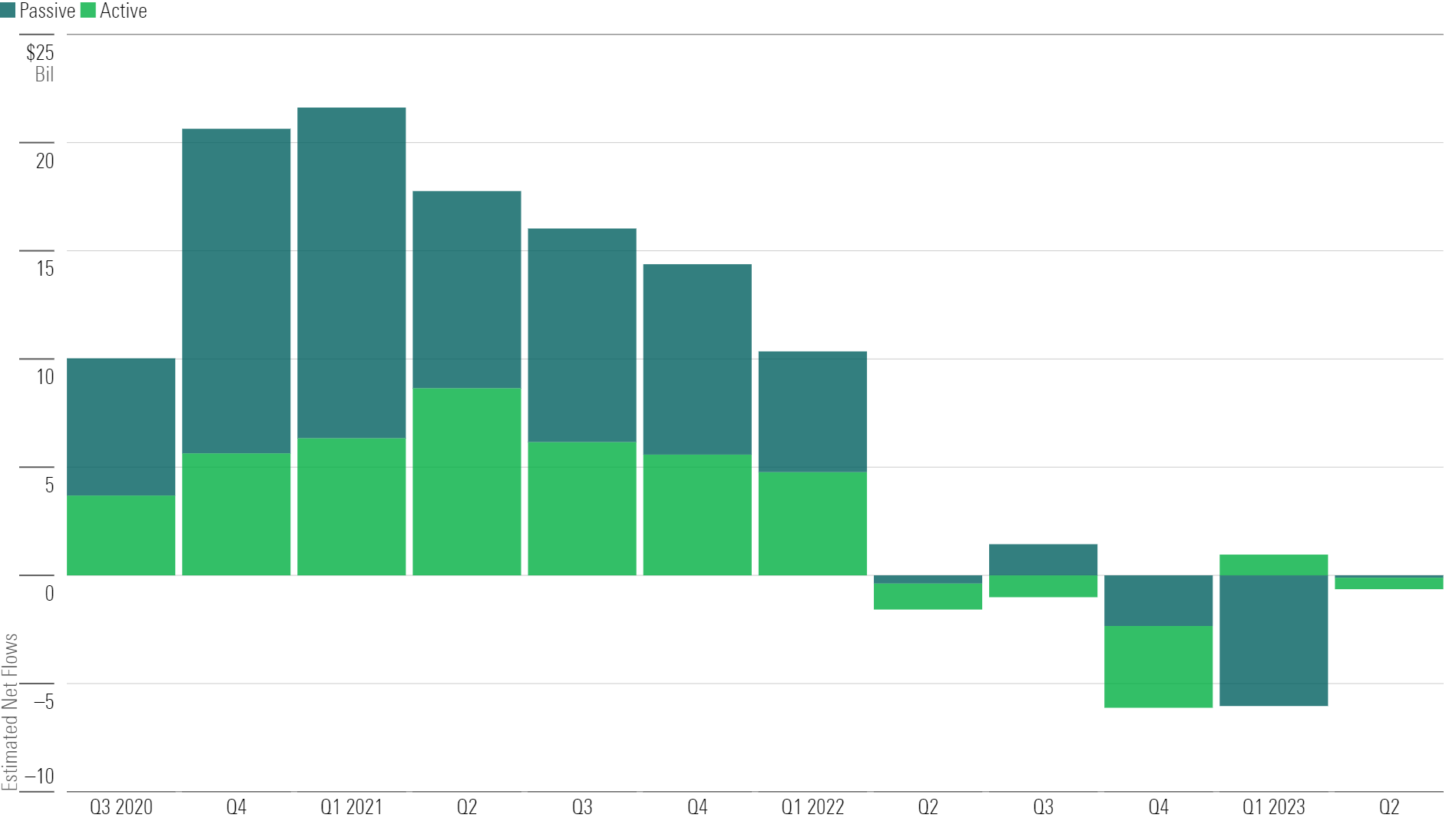

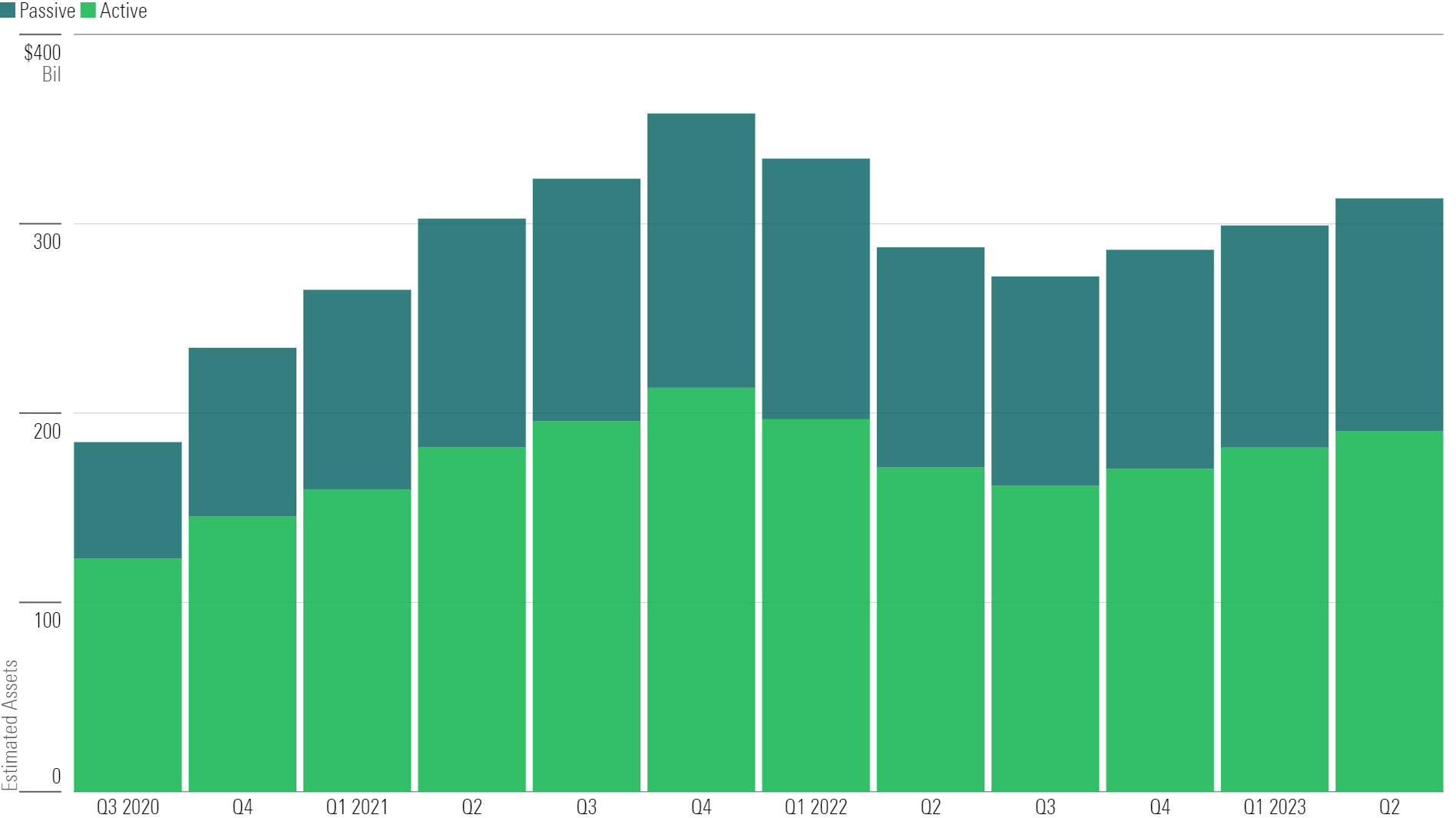

Active Funds Drove Outflows From Sustainable Funds

Sustainable actively managed funds accounted for most of the second quarter’s outflows, shedding $528 million during the period. Except for 2023′s first quarter, actively managed funds have suffered outflows in every period since the first quarter of 2022.

U.S. Sustainable Fund Flows

Meanwhile, passive funds shed roughly $100 million in the second quarter of 2023, easing up from significant outflows in the first quarter of 2023. The top four funds in terms of quarterly outflows were all passive equity strategies.

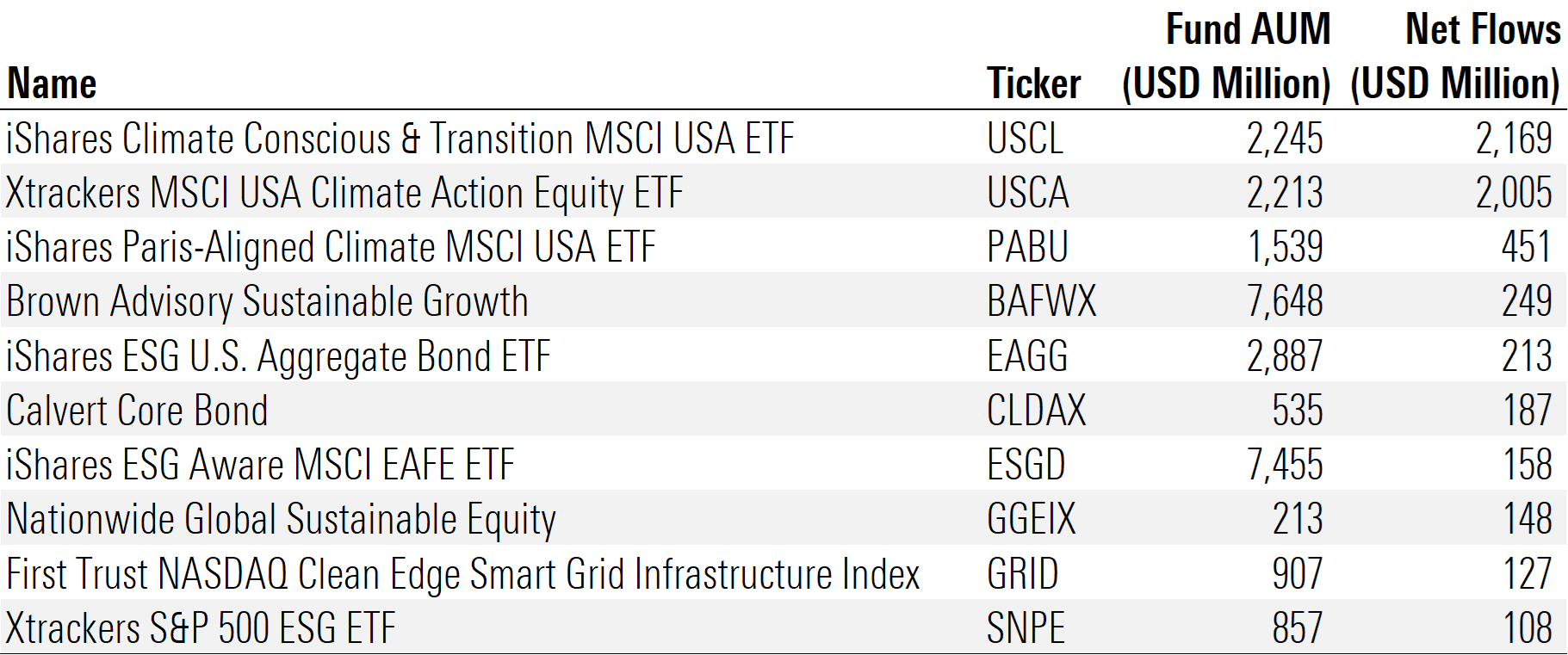

Climate Funds Led the Top 10 Flow Recipients

Passive fund providers BlackRock and DWS both launched climate-focused ETFs during the second quarter, and they quickly catapulted to the top two spots in terms of second-quarter flows. IShares Climate Conscious & Transition MSCI USA ETF USCL and Xtrackers MSCI USA Climate Action Equity ETF USCA track indexes that lean into companies that are well-positioned for the transition to a low-carbon economy or that are actively engaging in the climate transition, relative to peers.

Top 10 Sustainable Fund Flows in Second-Quarter 2023

Two more climate-focused funds landed among the top recipients of flows: iShares Paris-Aligned Climate MSCI USA ETF PABU and First Trust Nasdaq Clean Edge Smart Grid Infrastructure Index GRID. Just one fund—iShares ESG U.S. Aggregate Bond ETF EAGG—has landed among the top 10 for each of the past four quarters.

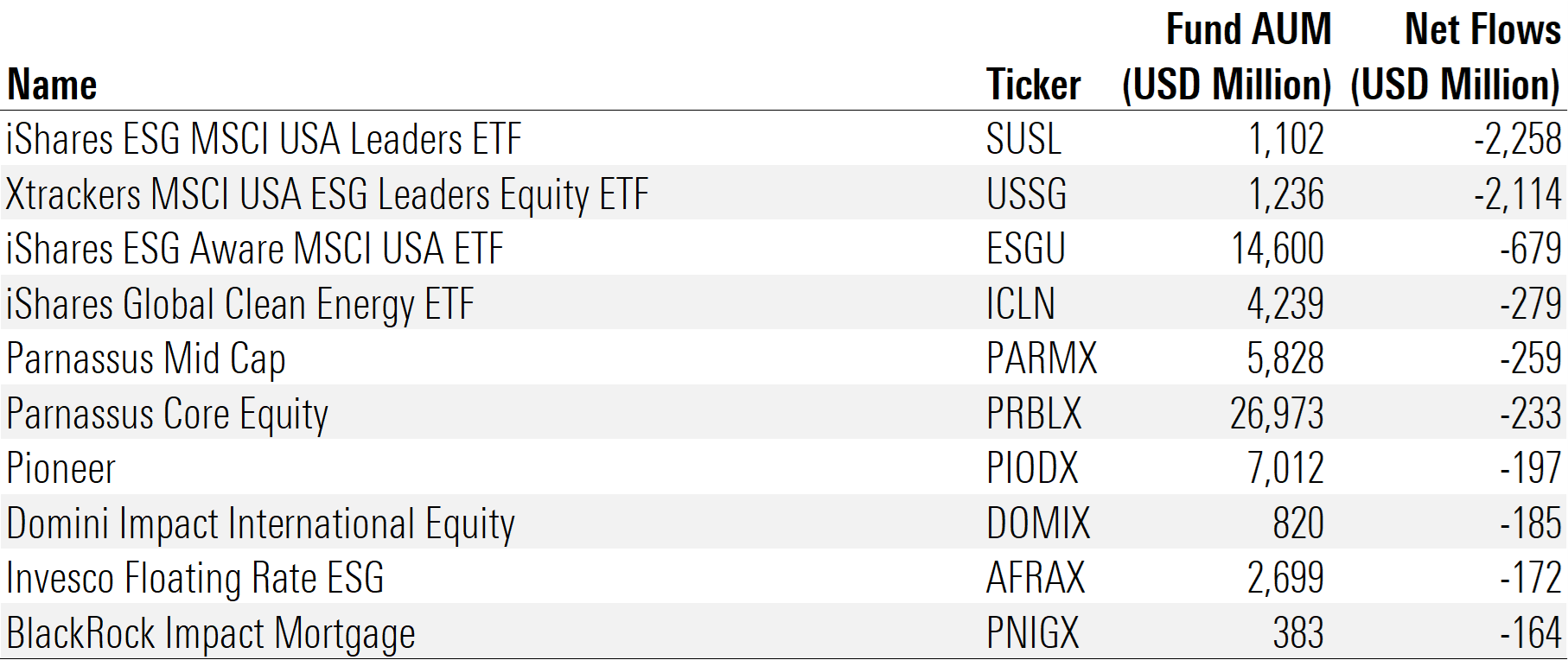

Passive Equity Funds Dragged on Quarterly Flows

The quarter’s four biggest losers were all passively managed, dominated by iShares ESG MSCI USA Leaders ETF SUSL and Xtrackers MSCI USA ESG Leaders Equity ETF USSG, each of which shed more than $2 billion during the period. Investors continued to pull money from iShares ESG Aware MSCI USA ETF, although outflows softened relative to the first quarter. Formerly the largest U.S. sustainable fund (at the end of 2022), persistent outflows have dropped this fund to third place in terms of assets.

Bottom 10 Sustainable Fund Flows in Second-Quarter 2023

Some of the funds in the bottom 10 have sustained outflows over multiple quarters. Three of these funds—Parnassus Core Equity PRBLX, Parnassus Mid-Cap PARMX, and iShares ESG MSCI USA Leaders ETF—were among 10 funds with the worst outflows in 2022. This marks the seventh-consecutive quarter for outflows from Parnassus Core Equity, though it remains the largest U.S. sustainable fund to this day. Parnassus attributes a portion of the fund’s outflows to the launch of a less-expensive collective investment trust and the subsequent conversion of investors from one vehicle to the other. Our data includes only open-end and exchange-traded funds.

Assets in U.S. Sustainable Funds Rose as Markets Appreciated

Despite outflows from sustainable funds, rising equity and bond markets drove assets in these funds to more than $313 billion, their highest point since the first quarter of 2022. This represents a 13% decline from the all-time record assets of $358 billion at the end of 2021 but a 15% increase from the recent low of $272 billion in 2022′s third quarter.

U.S. Sustainable Fund Assets

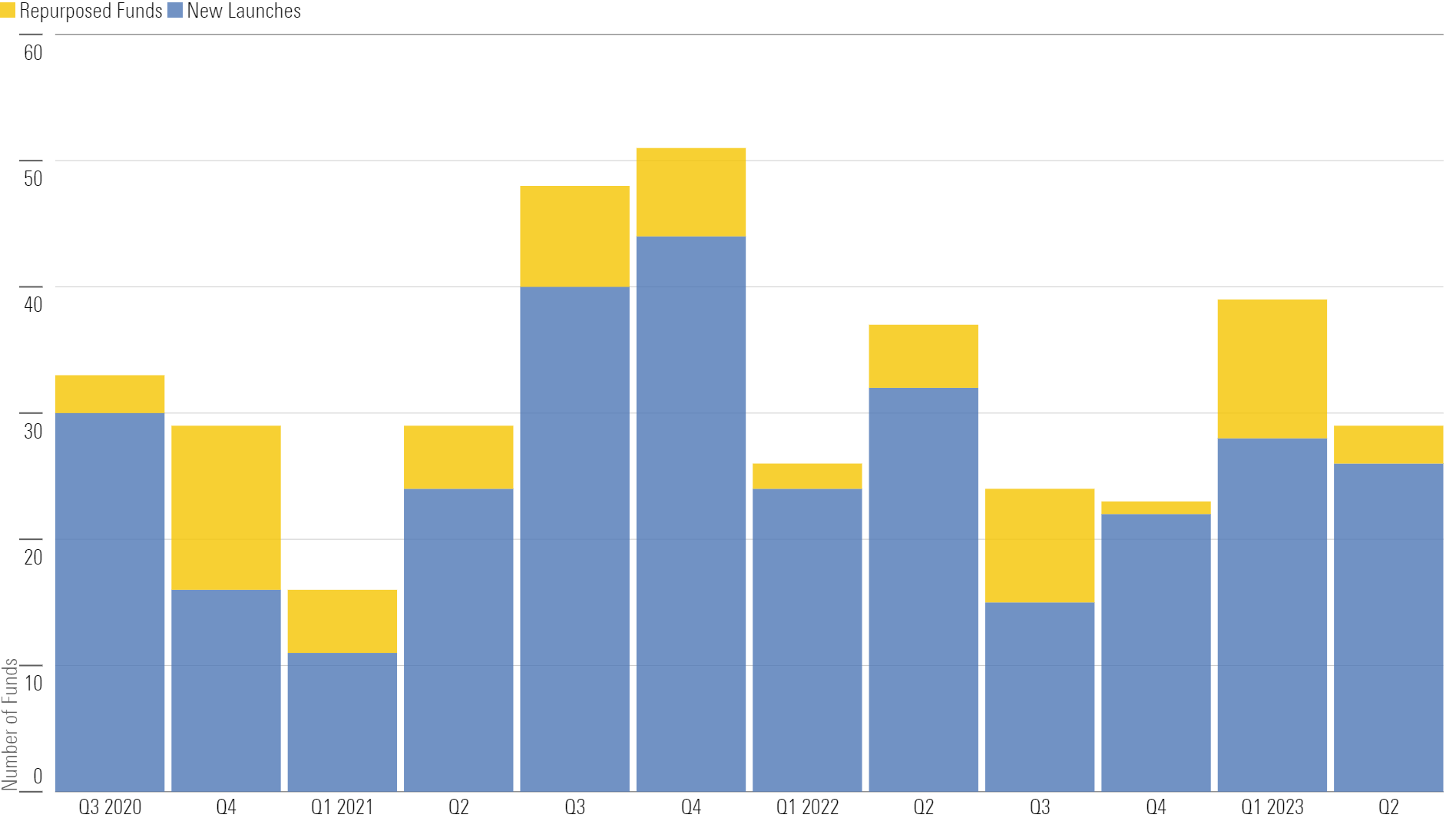

Despite Turbulent Demand, Product Development Held Steady

Some asset managers continue to see prospects for growth. During the second quarter, 26 new sustainable funds came to market, down from the record 44 in 2021′s fourth quarter but up from the latter half of 2022.

New U.S. Sustainable Funds

More than half of the new launches came from Fidelity, which launched its sustainable target-date strategy in addition to some stand-alone funds in May. Fidelity’s target-date strategy marks the fourth such option available to U.S. investors, following the Natixis Sustainable Future series from 2017, the BlackRock LifePath ESG Index series in 2020, and the Putnam Sustainable Retirement series from first-quarter 2023.

The new offerings and repurposed funds brought the total number of sustainable open-end and exchange-traded funds in the United States to 656 at the end of the quarter.

List compiled on July 11. Flows data pulled on July 14. Revised totals as far back as fourth-quarter 2022 (inclusive).

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/987376c2-20a0-406b-b3ec-df530324b39c.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RFJBWBYYTARXBNOTU6VL4VSE4Q.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WYB37DY4NVDTVNZTSBDENH3GMI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/JPJHXR5CGSNR4LKQF5ZKLCCVYQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/987376c2-20a0-406b-b3ec-df530324b39c.jpg)