How Much of Your Portfolio Is Addressing Climate Change?

Use Morningstar’s new impact metrics tools to find out.

As climate-focused funds continue to grow in popularity, one question keeps investors up at night: How much of my portfolio is actually addressing climate change?

In a recent study, we found that climate funds in the U.S., which we define as those with a branded, climate-focused investment mandate, offer more bang for the buck in terms of addressing climate change. Leading the pack in delivering exposure to climate action are clean energy/tech funds, followed by climate solutions funds.

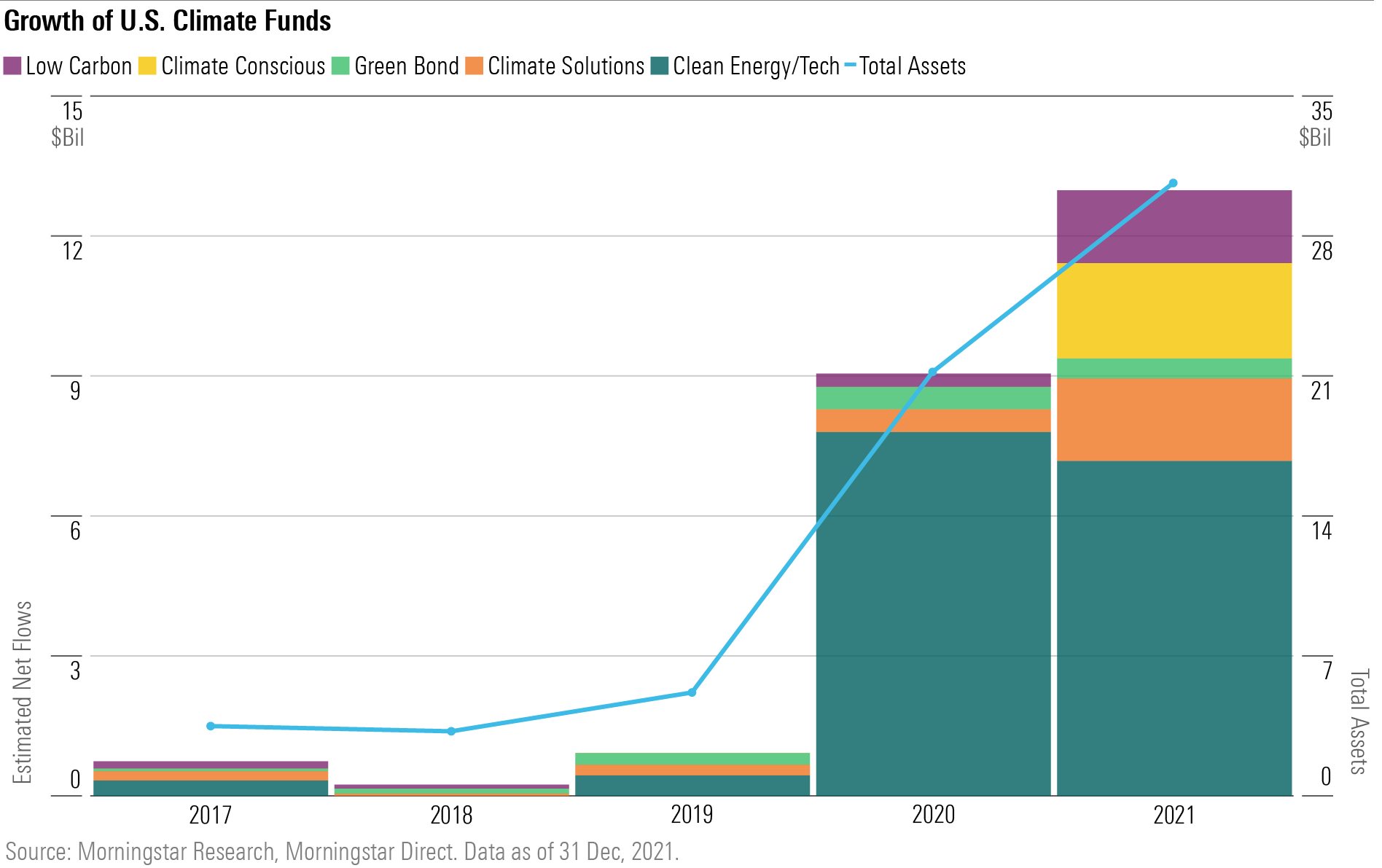

In the U.S., interest in climate funds has shot up. In 2021, investors poured nearly $13 billion into these funds—a 43% increase over 2020′s record and 18 times greater than the total seen five years ago. Increasingly, regulators, too, are asking public companies to report on climate-related risks. Clean energy/tech funds, which target companies driving the renewable energy transition, remain the most popular, but other categories are gaining ground.

We examined Morningstar’s climate fund universe through the lens of the Sustainalytics ESG Impact Framework to understand how aligned the portfolios are to Climate Action, defined as the global effort to curb the Earth’s temperature rise and cope with unavoidable consequences. Sustainalytics’ Impact Metrics calculate the percentage of a given company’s revenues, which are associated with climate action through activities such as green building and renewable energy. Morningstar’s Portfolio Impact Metrics aggregate those revenue exposures to the fund level.

Overall, as expected, our study found that climate funds in the U.S. have higher exposure to Climate Action than their Morningstar Category peers and higher exposure to Climate Action than to other impact themes. Eight of the top 10 climate funds with exposure to Climate Action fall into our clean energy/tech category.

Morningstar’s Universe of Climate Funds

To help investors navigate what can be a confusing mix of offerings, we subdivide the universe into five mutually exclusive categories. Low-carbon and climate-conscious funds tend to focus on decarbonizing portfolios (by reducing exposure to energy-intensive industries) and investing in companies that positively align with the transition to a low-carbon economy (such as technology companies that use renewable energy to power data centers). On the other hand, climate solutions and clean energy/tech funds target companies whose products, services, or projects directly or indirectly address climate challenges and opportunities.

Green-bond funds invest in debt instruments that finance projects facilitating the transition to a green economy. Green bonds are an outlier in our study because they often target impact through the “use of proceeds” rather than revenue exposure. Our study does not include data related to the use of proceeds.

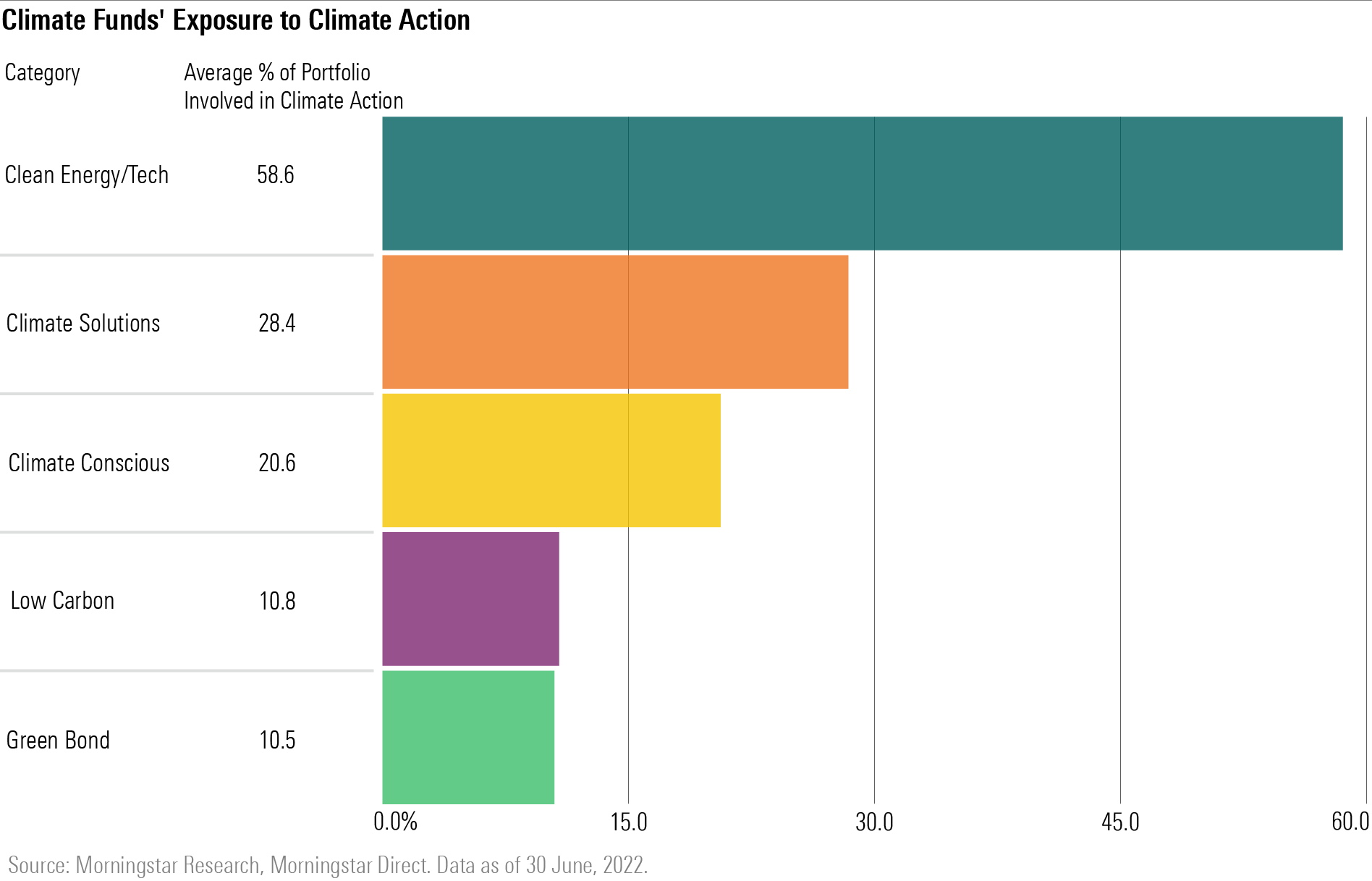

Since funds in the climate solutions and clean energy/tech categories have a stronger focus on investing in solutions, an area of positive impact, we would expect them to have higher exposure to impact, compared with funds in the low-carbon or climate-conscious categories.

Indeed, clean energy/tech funds lead the pack with nearly 60% of assets allocated to companies with exposure to Climate Action. This is followed by Climate Solutions, then Climate Conscious and Green Bond, and finally Low-Carbon funds.

Most Climate Funds Beat Peers at Delivering Exposure to Climate Action

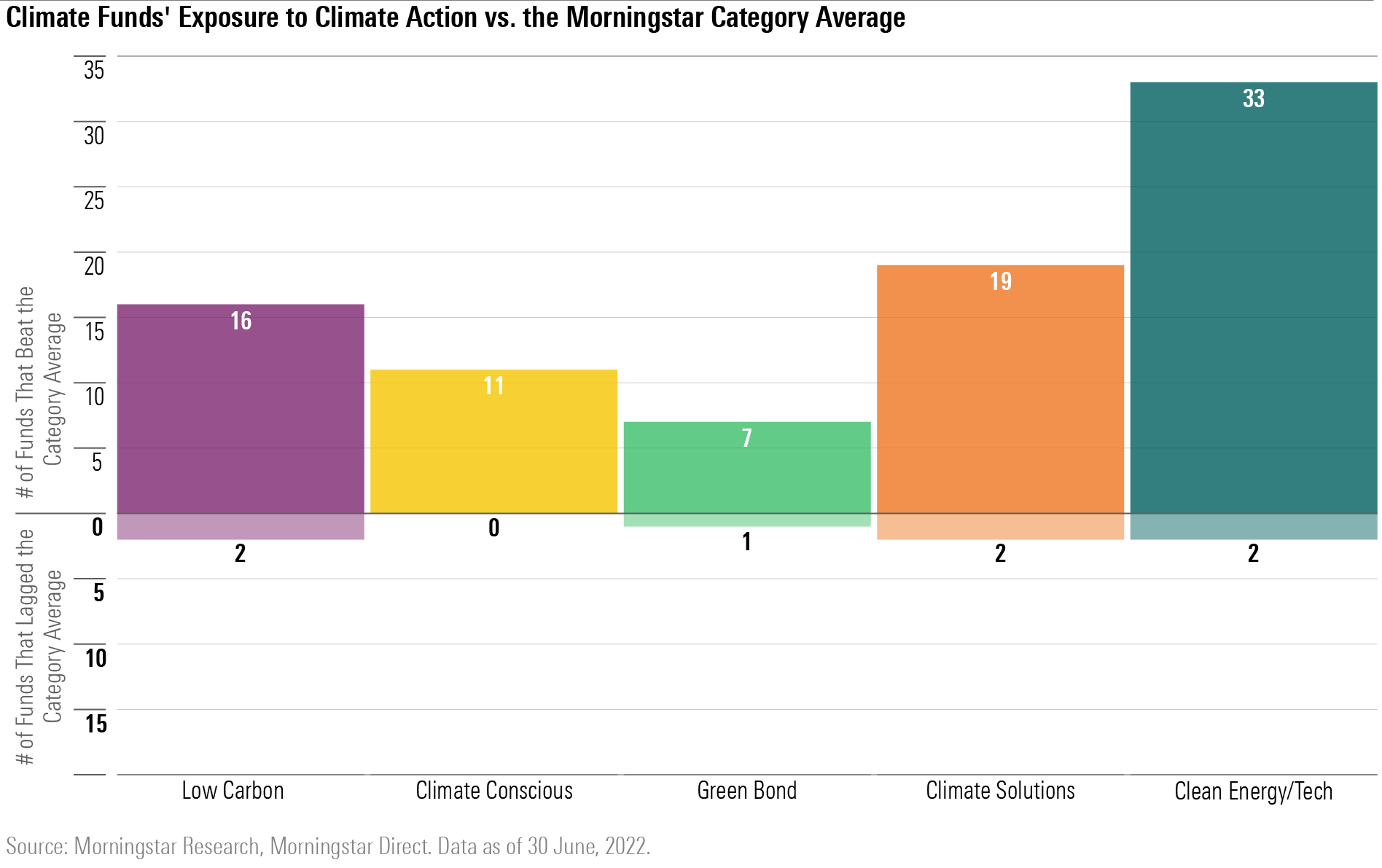

Across each of our climate categories, climate funds outperformed their typical Morningstar category peer in terms of exposure to Climate Action by a sizable margin. Remarkably, all 11 of the climate-conscious funds in our study achieved higher exposure to Climate Action than their respective Morningstar category peers.

At the high end of the spectrum is Engine No. 1 Transform Climate ETF NETZ, a climate-conscious fund that targets companies that are transitioning toward more sustainable business practices, as well as companies that provide technologies necessary to help others transition. More than 24% of Engine No. 1 Transform Climate ETF’s portfolio is involved in Climate Action, which tops the typical large-blend Morningstar category peer by 20 percentage points. On average, climate-conscious funds outpaced peers by more than 13 percentage points.

Clean Energy/Tech Funds Win the Impact Race

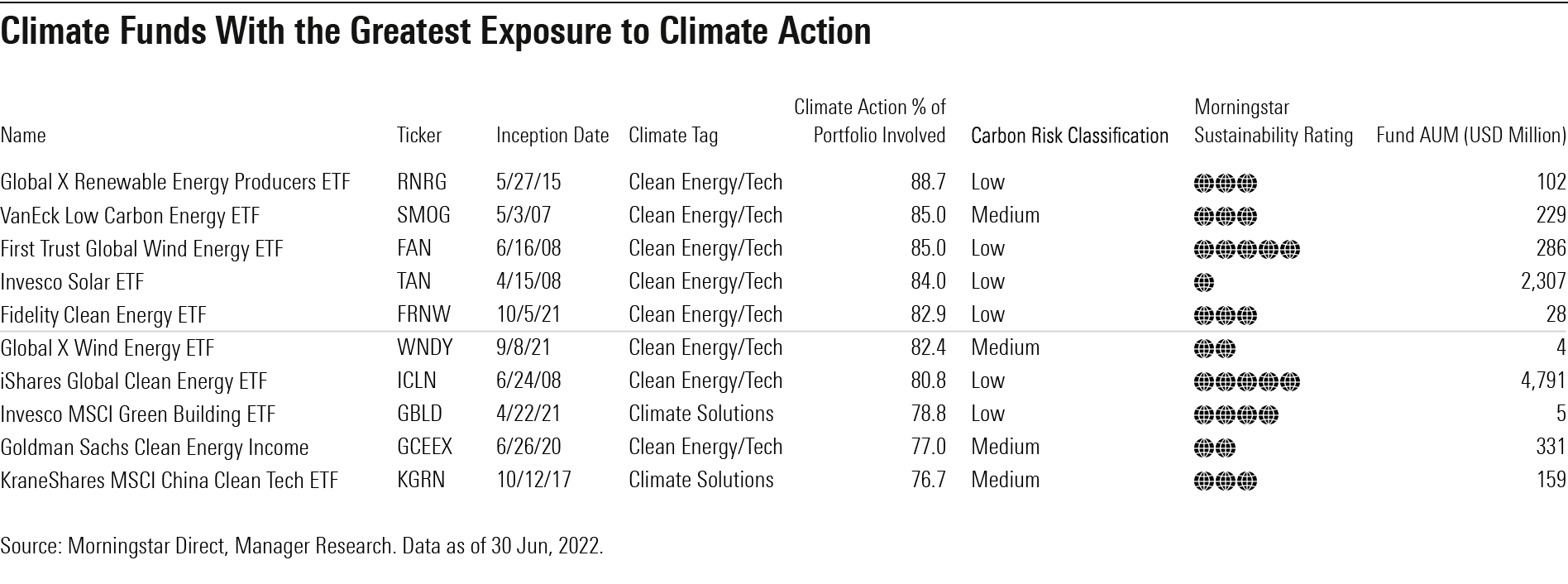

More than other categories of climate funds, clean energy/tech funds deliver exposure to the Climate Action theme. Of the top 10 climate funds with the greatest exposure to the Climate Action theme, eight are clean energy/tech funds.

The largest of these funds is iShares Global Clean Energy ETF ICLN, with nearly $4.8 billion in assets as of June 2022. The fund prioritizes companies with the highest clean energy exposure scores (according to the index provider) while limiting carbon intensity of the underlying holdings. This process can lead to a relatively concentrated portfolio; as of June 2022, the fund held approximately 100 securities.

Interestingly, some climate funds with higher exposure to Climate Action also have higher exposure to environmental, social, and governance risk (as measured by lower Morningstar Sustainability Ratings). Some of the most impact-aligned companies, those which are innovating technologies to drive the transition to a low-carbon future, operate in industries that suffer greater risks related to stranded assets or ethical breaches along the value chain.

Still, the sample size is too small to draw a strong conclusion, and funds exist that satisfy both metrics: high exposure to Climate Action and low exposure to ESG risk. In the table above, two options stand out: First Trust Global Wind Energy ETF FAN and iShares Global Clean Energy ETF. Both funds have greater than 75% of assets exposed to Climate Action and both earn a High Morningstar Sustainability Rating.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/987376c2-20a0-406b-b3ec-df530324b39c.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NNGJ3G4COBBN5NSKSKMWOVYSMA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6BCTH5O2DVGYHBA4UDPCFNXA7M.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EBTIDAIWWBBUZKXEEGCDYHQFDU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/987376c2-20a0-406b-b3ec-df530324b39c.jpg)