10 Clean Energy Funds to Freshen Up Your Portfolio

These funds are well regarded by Morningstar’s analysts and deliver high exposure to climate impact.

Clean energy funds have been pummeled so far in 2023, and 2022 was no smooth ride either. Still, the long-term outlook is bright for a handful of strategies. This article seeks to ease the search.

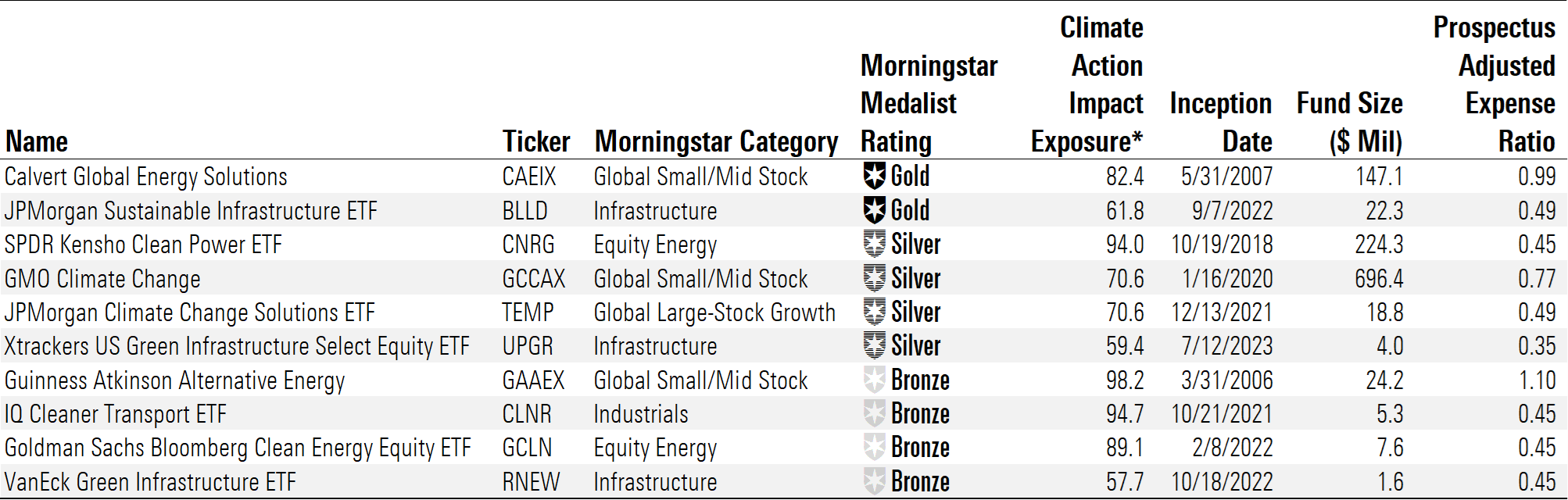

Topnotch Clean Energy Funds

To narrow the hundreds-strong universe of sustainable funds, we looked for those funds that are highly rated, focused on key clean energy themes, and successful at delivering positive climate impact. We combined a number of factors including the Morningstar Medalist Rating, proprietary climate and thematic categories, and Sustainalytics’ Impact Metrics to accomplish this exercise.

Below are the top 10 U.S. clean energy funds to consider.

Top Clean Energy Funds to Consider

All 10 funds are essentially pure plays when it comes to investing in clean energy and the energy transition, which leads to fairly concentrated portfolios. At the high end in terms of concentration, Goldman Sachs Bloomberg Clean Energy Equity ETF’s GCLN latest portfolio included more than 200 companies, with more than one third of assets in the top 10 holdings. On the other end of the spectrum, Guinness Atkinson Alternative Energy GAAEX counts just 33 holdings and allocates half of its assets to the top 10. Investors should take care to use such strategies wisely as part of a diversified portfolio.

As illustrated by the Morningstar Medalist Rating, these funds are all well regarded by Morningstar’s analysts. As Morningstar’s Don Phillips says, the Morningstar Medalist Rating is an aptitude test, while the Morningstar Rating for funds is an achievement award. All funds that earn medals are worthy of consideration, but Calvert Global Energy Solutions CAEIX and JPMorgan Sustainable Infrastructure ETF BLLD stand out as the two Gold Medalists on the list.

Calvert, well known for its sustainability credentials, has strong ESG-related requirements for companies included in Calvert Global Energy Solutions’ portfolio. The fund seeks to invest in companies that are significantly involved in renewable energy activities such as solar, wind, biomass, geothermal, and hydropower. One of its top holdings is Infratil IFT, a New Zealand-based utility and infrastructure investment company. More than two thirds of its revenue comes from generating energy from wind turbines and hydropower plants. Altogether, more than 80% of the covered securities in Calvert Global Energy Solutions’ portfolio are involved in Climate Action impact. Compared with peers in the global small/mid-stock Morningstar Category, the fund’s renewable energy mandate drives some sector biases, notably significant overweightings to industrial and utility companies.

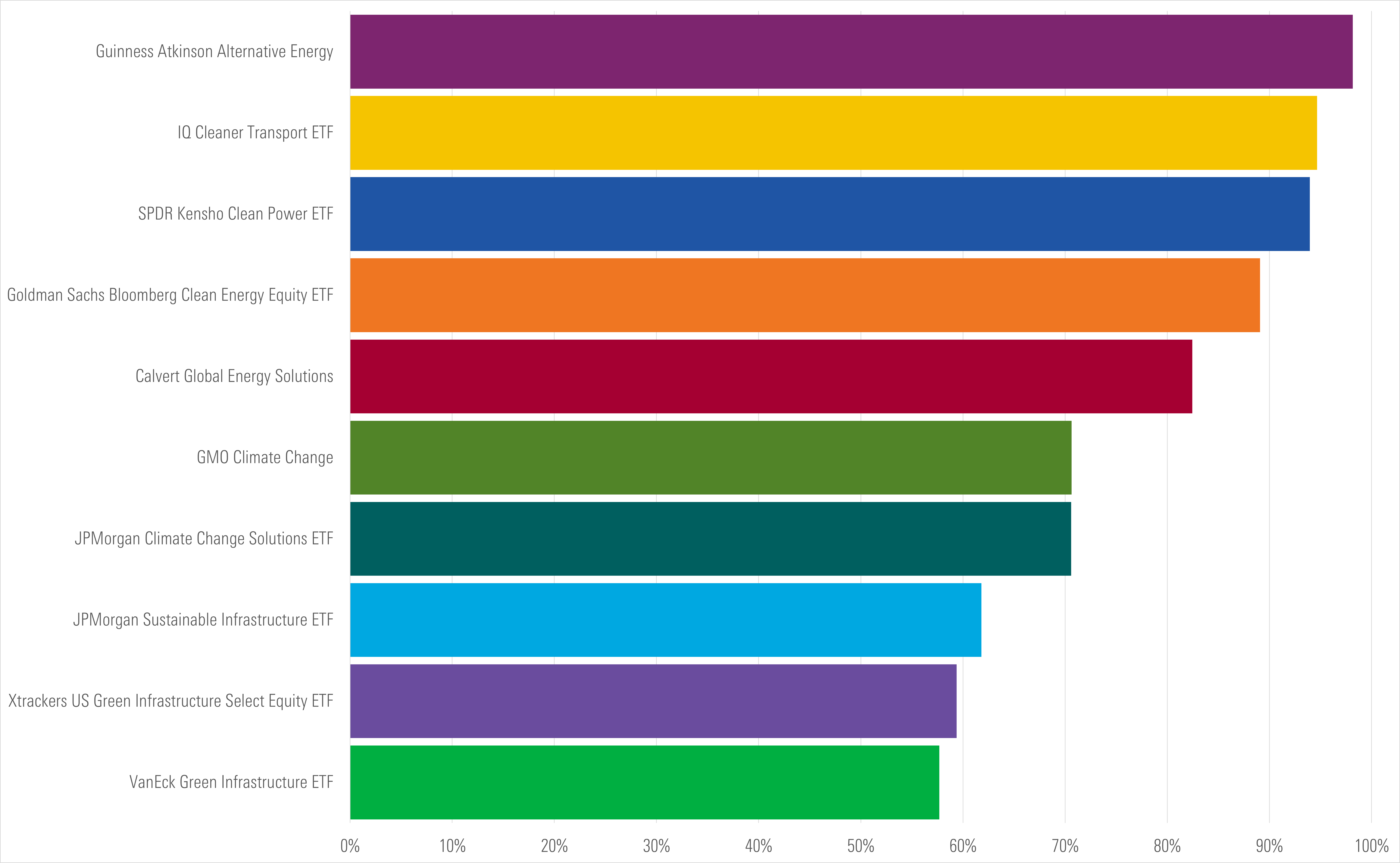

Delivering Climate Action Impact

Each of the topnotch clean energy funds delivers strong exposure to positive impact. The exhibit below shows each portfolio’s involvement in Climate Action, defined as the global effort to curb the Earth’s temperature rise and cope with unavoidable consequences. Sustainalytics calculates the percentage of a given company’s revenues that are associated with climate action through activities such as green building and renewable energy, which are then aggregated to the fund level.

Clean Energy Funds: Exposure to Climate Action Impact

With more than 98% of the covered portfolio involved in Climate Action, Guinness Atkinson Alternative Energy ranks at the top of the list for impact exposure. One of its top holdings is Trane Technologies TT, a manufacturer of residential HVAC systems and refrigeration solutions. Many of the company’s operations are associated with green buildings, a subtheme of climate change mitigation and adaptation. According to the International Energy Agency, cooling is the fastest-growing use of energy in buildings, and Trane has strong programs in place to improve the energy efficiency of its products, encourage the transition to more environmentally friendly refrigerants, and facilitate the reduction of its customers’ emissions footprints.

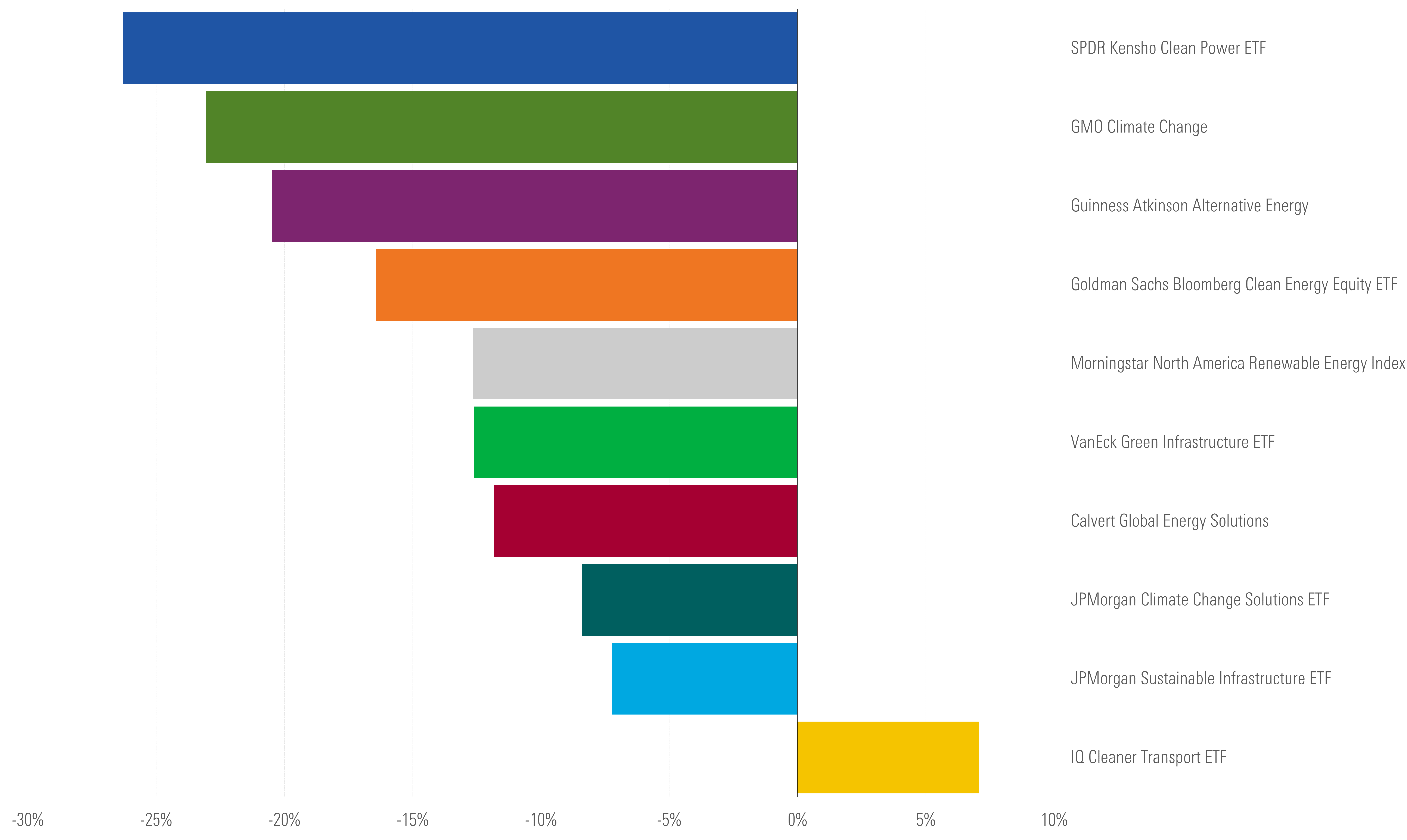

Recent Performance Has Suffered

The Inflation Reduction Act of 2022—the biggest climate law in U.S. history—contained a wide array of initiatives to support the development and buildout of clean energy, but these incentives haven’t offset the macroeconomic headwinds facing funds in the sector. Instead, high interest rates have hit demand for new solar development, and disappointing earnings have driven valuations down sharply.

The exhibit below shows year-to-date returns for each fund’s cheapest share class, as well as the performance of the Morningstar North America Renewable Energy Index for comparison. Xtrackers US Green Infrastructure Select Equity ETF UPGR is excluded, as it only launched in July 2023.

Clean Energy Funds: Year-to-Date Returns

Year-to-date returns varied widely for funds in the group, from IQ Cleaner Transport ETF’s CLNR 7% gain to SPDR Kensho Clean Power ETF’s CNRG 26% drop. Morningstar North America Renewable Energy Index’s 13% fall places it squarely in the middle of the group. One of the top holdings in IQ Cleaner Transport ETF’s portfolio is Nvidia NVDA, which soared nearly 180% in 2023 (through October). The company manufactures energy-efficient graphic processing units, which are used as semiconductors in artificial intelligence and in turn support the development of autonomous electric vehicles.

At the other end of the spectrum is SPDR Kensho Clean Power ETF. Eletrobras EBR is among the fund’s top holdings and lost 13% in the first 10 months of the year. Eletrobras, which is headquartered in Brazil, is Latin America’s biggest power utility company and one of the largest clean energy companies in the world. The company’s top executive resigned somewhat suddenly in the third quarter, which has contributed to the stock’s poor recent performance. Still, despite pockets of underperformance, the fund’s Silver Medalist Rating signals our analysts’ favorable view of the strategy’s prospects moving forward.

Because clean energy funds tend to be highly concentrated and subject to volatile market swings, investing in the sector may not be for the faint of heart. However, when incorporated sensibly into a broader portfolio, some options are worthy of consideration. The list of funds meeting at least one of the above criteria is much larger than the 10 strategies highlighted above. Clients of Morningstar Direct can use these data points to filter the universe as they see fit.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/987376c2-20a0-406b-b3ec-df530324b39c.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NNGJ3G4COBBN5NSKSKMWOVYSMA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6BCTH5O2DVGYHBA4UDPCFNXA7M.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EBTIDAIWWBBUZKXEEGCDYHQFDU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/987376c2-20a0-406b-b3ec-df530324b39c.jpg)