How Well Do Sustainable Funds Deliver on Their Goals?

Although most were in alignment, some of the largest ESG funds voted against ESG resolutions.

Sustainability-focused investors aren’t always sure whether their funds stack up well on environmental, social, and governance metrics. In our recent 2023 U.S. Sustainable Funds Landscape, we assessed the extent to which ESG funds were delivering on these goals. Read on for the highlights.

ESG Funds Delivered Lower Exposure to ESG Risk

The consideration of material ESG risks is becoming more common in traditional investing, and on average, U.S. asset owners apply ESG considerations to more than one third of their assets under management. Still, sustainable funds continue to best peers at delivering lower levels of ESG risk.

ESG Risk in Sustainable Funds

The Morningstar Sustainability Rating rolls up company and sovereign ESG Risk Ratings to the portfolio level, then ranks each portfolio within its global peer category. At the end of 2023, nearly three fourths of sustainable funds received the highest ratings, 4 or 5 globes, compared with 28% of funds overall. At the other end of the scale, less than one tenth of sustainable funds received the lowest ratings, 1 or 2 globes, compared with close to one third of funds overall.

For example, John Hancock Global Environmental Opportunities JACDX ranks in the first percentile relative to peers in the global equity large-cap Morningstar Category. Top holdings include software companies Synopsys SNPS and Cadence Design Systems CDNS, which are classified as having Low ESG Risk, in part due to strong management of human capital and data security. As of Feb. 2, Morningstar viewed Synopsys as fairly valued and Cadence Design Systems as trading at a slight premium.

Sustainability-Themed Funds Delivered Greater Exposure to Environmental and Social Impact

Some sustainable funds focus on a specific theme, such as renewable energy or affordable housing. To identify these funds, we look to Morningstar’s Sustainable Attributes, which include subcategories that highlight funds focused on five environmental and social themes: Climate Action, Resource Security, Healthy Ecosystems, Human Development, and Basic Needs.

On average, these funds achieved greater exposure to positive impact associated with their areas of focus, compared with category peers, based on analysis using Impact Metrics from Sustainalytics and Morningstar.

Sustainability Themed Funds’ Average Excess Exposure to Impact, Compared With Category Peers

Sustainalytics’ Impact Metrics reflect the percentage of a company’s revenues that are associated with impact-related activities, such as providing renewable energy to consumers or offering affordable housing to low-income populations. Morningstar’s Portfolio Impact Metrics aggregate those revenues to the fund level.

In all five categories, sustainability-themed funds delivered greater exposure to environmental and social impact, compared with peers. The excess was greatest among Basic Needs funds, but the sample size was small. On average, Resource Security funds (those that focus on responsible use of natural resources through activities like reducing water intensity, recycling, and forest conservation) delivered 30 percentage points more exposure to impact associated with the Resource Security theme, compared with peers.

Thematic Offering From Fidelity Delivered Above-Average Exposure to Impact

Out of more than 20 Resource Security funds, Fidelity Water Sustainability FLOWX stands out. Nearly 99% of its covered portfolio holdings can be connected to Resource Security impact.

Resource Security Funds With High Exposure to Impact

Two of Fidelity Water Sustainability’s top holdings are highly involved in Resource Security, and Sustainalytics attributes more than 99% of these companies’ revenues to impact associated with the theme. For instance, Energy Recovery ERII develops technology for activities such as seawater desalination and industrial wastewater management. On the other hand, Pennon Group PEGRF, is a U.K.-based environmental utility company that provides clean water and wastewater management to more than 3 million residents. As of Feb. 5, both stocks were viewed as fairly valued by Morningstar.

Support for Environmental and Social Shareholder Proposals Fell Dramatically in 2023

The number of resolutions focused on environmental and social topics increased in 2023, but support for these resolutions fell sharply. In 2023, Morningstar identified 337 such resolutions, up 23% from the 273 seen in 2022. On average, these resolutions gained support from 20% of shareholders, down significantly from the 30% average support seen in 2022.

Majority-Supported Environmental and Social Shareholder Resolutions

In 2023, just 10 resolutions gained majority support, down from 40 in 2022. Half of the well-supported resolutions focused on workplace equity.

Most Sustainable Funds Supported 2023′s Key ESG Resolutions, but the Largest Voted Against

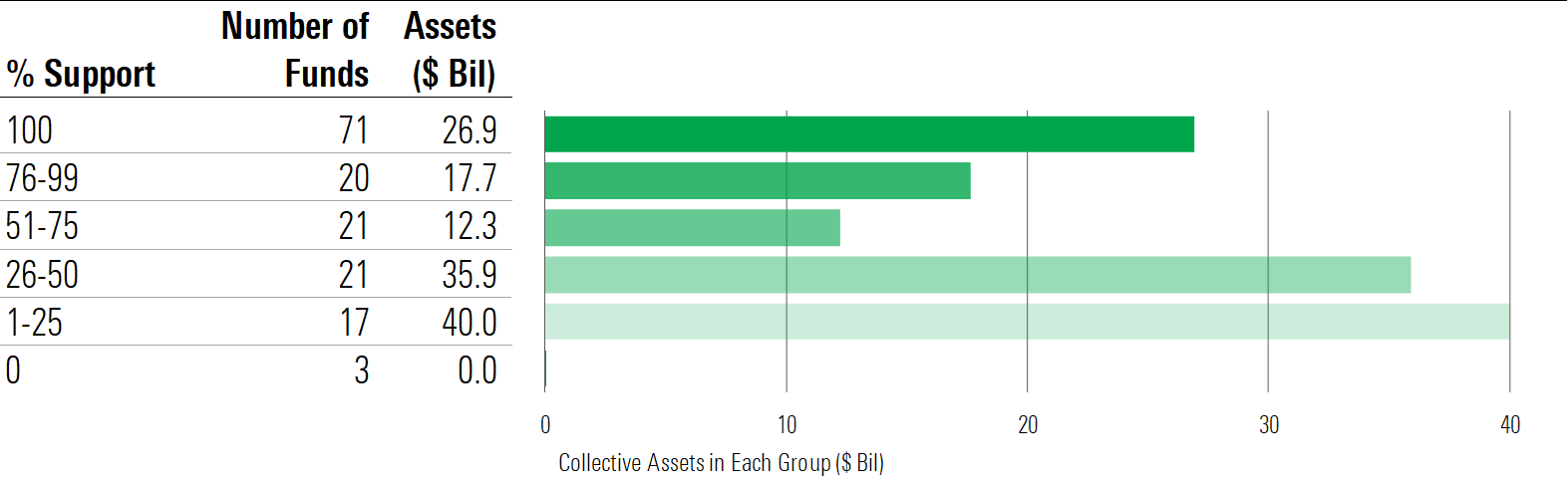

As expected, sustainable funds showed a higher rate of support for key environmental and social shareholder resolutions, compared with peers. Out of 153 sustainable funds with sufficient proxy-voting data, the average level of support was more than 70%.

Most funds exhibited strong support, but support ranged from 100% all the way down to zero. The largest group—71 funds—supported 100% of the key ESG resolutions they voted in 2023.

Sustainable Fund Support for Key ESG Resolutions in 2023

Still, size matters. Fund votes are cast in proportion to the value of their shares, meaning that a fund’s size is a key factor in determining the impact of its voting stance. In terms of collective assets, the largest group—representing $40 billion in assets—supported less than one fourth of 2023′s key ESG resolutions. The two largest passive sustainable funds—Vanguard FTSE Social Index VFTNX and iShares ESG Aware MSCI USA ETF ESGU—supported just 3% and 34% of 2023′s key ESG resolutions, respectively.

For more on flows, assets, performance, and sustainability characteristics, download the full report here.

Lindsey Stewart, CFA, contributed to this article.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/987376c2-20a0-406b-b3ec-df530324b39c.jpg)

/s3.amazonaws.com/arc-authors/morningstar/4295f84a-d866-4f43-8205-3fb777ae9f55.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RFJBWBYYTARXBNOTU6VL4VSE4Q.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WYB37DY4NVDTVNZTSBDENH3GMI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/JPJHXR5CGSNR4LKQF5ZKLCCVYQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/987376c2-20a0-406b-b3ec-df530324b39c.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/4295f84a-d866-4f43-8205-3fb777ae9f55.jpg)