What’s Ahead for Clean Energy?

The sector is about very specific names. Here are two stocks our analyst likes.

The transition to clean energy demands financing, in which investable stocks play a big part. But the renewable energy market has faced a tough slog, despite tailwinds from the Inflation Reduction Act, and during the first quarter, investors redeemed renewable energy funds.

We sat down with Brett Castelli, who follows the sector for Morningstar, to chat about what’s ahead for the IRA and for the sector. Here’s what he said.

Norton: The Inflation Reduction Act of 2022 collided with a bear market for a lot of these stocks. Where are we now?

Castelli: The IRA was expected to provide tailwinds for the clean energy sector. However, this has largely not been the case. The key reason is interest rates, which have generally trended upward since the signing of the IRA. Coupled with that, some of these companies in the clean energy space are earlier stage. That makes them even more sensitive to interest rates because they’re reliant on external funding until they generate positive cash flow. The capital markets over the past two to three years have become increasingly unfavorable toward not yet profitable companies.

Norton: Has the outlook changed?

Castelli: We began the year with optimism around rate cuts that hasn’t really played out yet. As a result, you haven’t seen a dramatic bounce in many clean energy stocks.

The second thing is obviously going to be the US election and what happens there around the IRA and incentives for clean energy adoption. Publicly, former President Trump has said that he would repeal the IRA if elected. In reality, I think it’s unlikely to be repealed in full. While there will be noise around the presidential election, history has shown the energy transition will continue despite which party is in the White House.

Norton: What parts of the IRA might be repealed?

Castelli: The electric vehicle tax credit could be among the more exposed to a change in administration. In contrast, incentives focused on reshoring clean energy manufacturing to the US seem more safe. China has long dominated manufacturing of clean energy technologies, and both parties seem interested in breaking this heavy reliance.

Norton: Which companies were the IRA’s biggest beneficiaries?

Castelli: First Solar FSLR, which is a US-based solar panel manufacturer. They’d faced an uphill battle for the past 15 years based on low-cost Chinese supply. The IRA includes domestic manufacturing tax credits, which have been a huge boom for US producers of solar panels.

Norton: What else could drive growth?

Castelli: As part of the IRA, there was a first-of-its kind green hydrogen tax credit, but uncertainty regarding final requirements has limited investment to date. We expect clarity on that sometime this year, so that is something to watch.

Separately, a big topic currently is rising electricity demand on the back of electric vehicles and data centers and artificial intelligence. In particular, electricity demand from power-hungry data centers could provide upside to long-term electricity demand expectations. This would be a positive for clean energy companies by requiring more wind, solar, and battery generation to be built and benefits companies across the value chain.

Norton: How large is the renewable market?

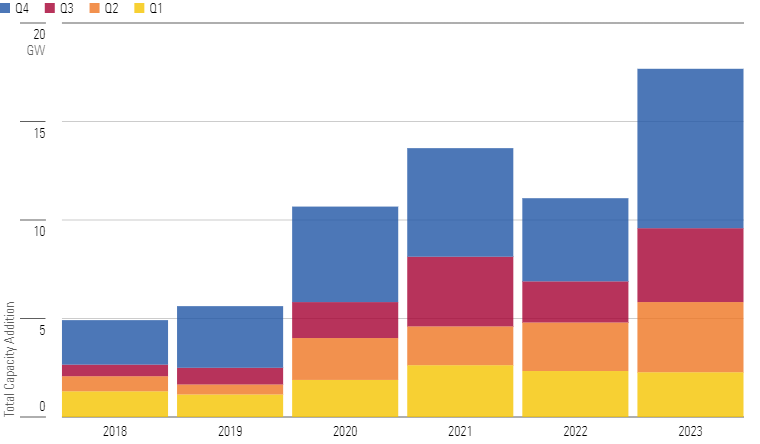

Castelli: Wind and solar currently represent about 15% of US power generation, excluding hydroelectricity. Solar accounted for 3.5% of utility-scale generation in the fourth quarter, and wind for 12.5%. We think that’s going to grow to about 45%, or 3 times current levels by the early 2030s. Solar installations rose 60% in 2023, rebounding after trade uncertainty challenges in 2022. Onshore wind installations fell in 2023, but the IRA provides a long-term extension of the wind tax credit, which should drive a rebound.

Solar Set a New Record in 2023 ... Which We Expect to be Surpassed in 2024

Norton: Let’s talk about the California rooftop solar market. What happened in 2023?

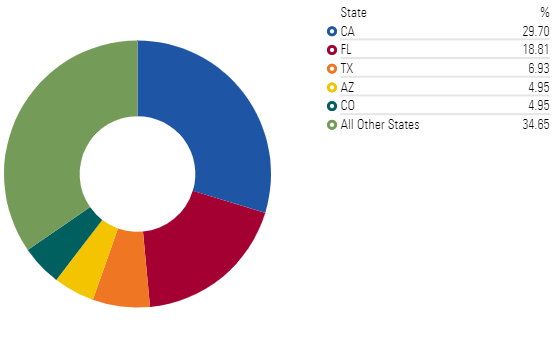

Castelli: The rooftop solar market saw a demand slowdown in 2023 due to higher interest rates. In addition, California enacted a policy change, known as net energy metering 3.0. In short, this change dramatically reduced the compensation homeowners receive when they sell excess solar generation back to the grid during periods of excess production. While we expect this to slow rooftop solar installations in the state, it will also spur battery adoption. Nationwide battery attachment rates are around 10%, but following this change, California has seen attachment rates of roughly 30%, and we expect this to continue to rise in the near future. As always in clean energy, California is a harbinger of things to come, and we expect further states to enact a similar policy to California in the years to come, spurring home battery adoption.

In the Past, California Led Solar Demand

Norton: What does it mean for the stocks?

Castelli: It’s going to be a headwind for California rooftop solar adoption in the near future. I expect roughly 50% lower rooftop solar demand in ‘24 versus ‘23. But the offset is you’re now going to be seeing higher revenue per installation. Think of it as if you’re a fast-food restaurant. The number of customers will shrink. But the average ticket size is rising. People aren’t just buying a Big Mac—they’re buying a milkshake and other things. So you’re going from solar only to solar and batteries. That’s a volume decline but a price benefit.

Norton: What’s happening with the global solar panel market?

Castelli: In 2023, the global solar panel market entered significant oversupply, with prices dropping about 50%. The one area that hasn’t seen as much oversupply is the US, which is the highest-priced solar panel market globally due to trade barriers. So the global solar module price is about $0.12 a watt, and in the US, it’s about $0.30 a watt. Does that delta compress? We think it will compress somewhat but not entirely. The buildout of US-based solar panel capacity thanks to IRA incentives will help ease this.

Norton: What’s in store for this sector? Is more underperformance underway?

Castelli: If interest rates go sharply higher, or if there were a significant repeal of the IRA, yes. But in general, the sector has underperformed the broad market. To a certain extent, you’re waiting for interest rates to fall. But this is very much a stock-picking space. Clean energy is about very, very specific names.

Norton: Fair. Which are your favorites?

Castelli: First Solar is the leading US solar module manufacturer. It’s the biggest beneficiary of the IRA, and we don’t see the incentives around reshoring solar manufacturing going away under a change in administration. In some cases, it could even get better for First Solar under a change in administration: It might be a beneficiary under a Republican sweep scenario because you could get even tougher restrictions on Chinese solar. In some ways, it’s more of a US-China policy company than a solar company. There is limited policy risk, given the reshoring theme. Some of the fears around this pricing gap for solar modules closing between the US and rest of world are overdone. First Solar has the best balance sheet in the industry. My fair value estimate is $185.

Norton: What else?

Castelli: Brookfield Renewable BEP is a global developer and owner of renewable projects. It has a different risk/reward profile than some of higher-risk companies that I cover. It has a 6% dividend yield, 5% dividend growth, and an attractive valuation. The renewable development space has been among the most impacted by higher interest rates. Should those ease, this would be one of the first spaces to recover. We like Brookfield Renewable’s contrarian investment approach and give it an Exemplary Capital Allocation Rating.

Norton: What would you avoid?

Castelli: We think some industrials stocks have risen too far on the energy transition theme. One example is Quanta Services PWR. We like the company and think it is well-positioned to benefit from grid spending by utilities. However, the valuation has risen sharply in recent years. With shares currently trading at roughly 18.5 times earnings before interest, taxes, depreciation and amortization, it leads us to believe that the shares are overvalued.

Norton: Thanks, Brett.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/d53e0e66-732b-4d50-b97a-d324cfa9d1f8.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RFJBWBYYTARXBNOTU6VL4VSE4Q.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WYB37DY4NVDTVNZTSBDENH3GMI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/JPJHXR5CGSNR4LKQF5ZKLCCVYQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/d53e0e66-732b-4d50-b97a-d324cfa9d1f8.jpg)