How Mutual Funds Are Valuing TikTok, Twitter, and Other Private Companies

Have valuations changed in the 2023 market rally?

Mutual funds that own privately held companies have a unique opportunity that rivals that own only publicly traded companies do not: They can name their own prices for their private holdings. We’ve examined the popularity of private equity in mutual fund portfolios and firm pricing practices before, but we’re taking a fresh look after the market’s appetite for growth stocks—which would include the most commonly held private equity companies in mutual funds—rebounded in the first half of 2023.

We looked at a half-dozen of the most popular private companies in mutual funds to get a sense of how different firms are valuing them given the current market conditions. We found that in some cases, fund companies have mirrored the market, pricing private companies close to their publicly traded peers. In other instances, though, fund company private valuations continue to deviate significantly from public competitors.

X (Formerly Known as Twitter)

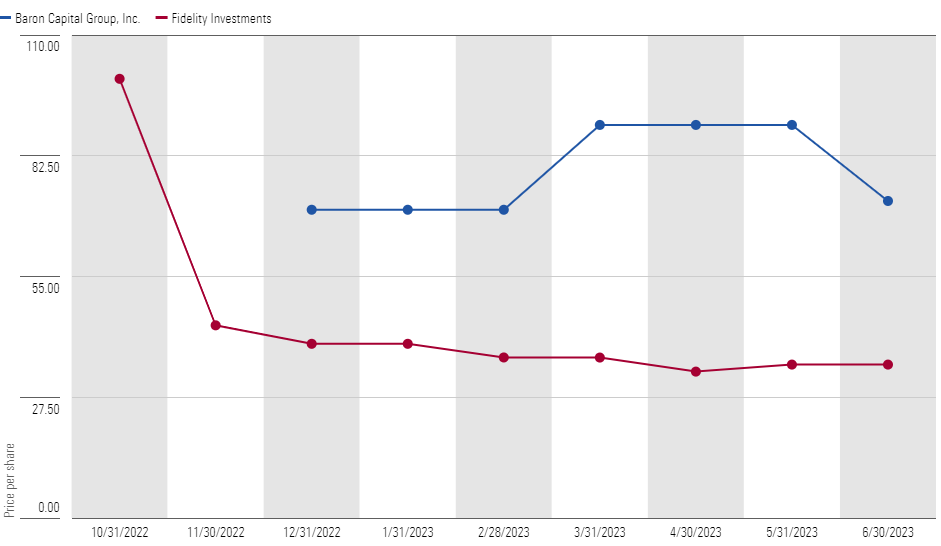

Mutual Fund Valuations of X Holdings (Twitter)

Twitter, now known as X, was publicly traded until October 2022 when Elon Musk took the company private for $44 billion. Funds from Fidelity and Baron Partners were among the largest owners of the stock when it went private and have continued to stick around to see Musk’s vision through. Fidelity was quick to write down its stake, though. At the end of 2022, Fidelity valued its shares at $39.60, two thirds less than their valuation just two months prior. Baron Partners was much more optimistic at the time, valuing its shares at $70.20. Since then, Musk has stepped down as CEO and Meta Platforms META has launched a competing app, Threads, but valuations have barely budged. Baron remains bullish about Musk’s company and currently values its shares at $72.20, nearly twice as much as Fidelity’s $33.34 valuation. Baron has long been a big fan of Musk; many of its portfolio managers own Tesla TSLA or SpaceX in their funds, but the valuation gap between Baron and Fidelity is significant.

ByteDance (Parent Company of TikTok)

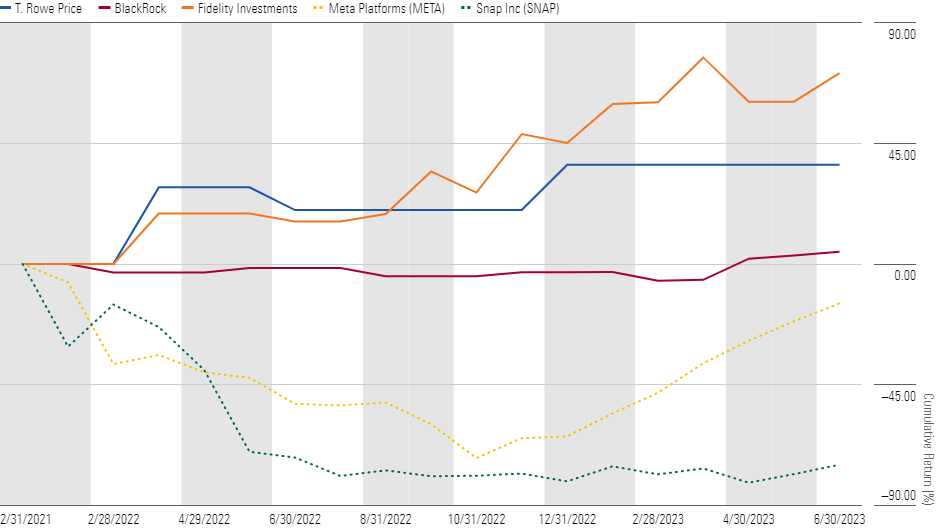

Cumulative Gain/Loss on Mutual Fund Positions in ByteDance Versus Public Comps

Mutual fund companies have long been enamored of ByteDance, the parent company of popular social-media app TikTok. Even as the market walloped its publicly traded competitors Meta and Snapchat SNAP in 2022, mutual fund companies shrugged off the volatility. BlackRock and T. Rowe Price kept their ByteDance valuations flat throughout 2022, but Fidelity took its estimate from $124 per share to $180, a nearly 50% increase. The environment has shifted since then. Meta’s stock was up 140% in 2023 through July as growth stocks roared back into favor. T. Rowe responded by doing nothing; its ByteDance valuation as of April 2023 was unchanged from December, while BlackRock upped its mark by just 5%. Fidelity remains bullish and increased its valuation by an additional 18%.

SpaceX

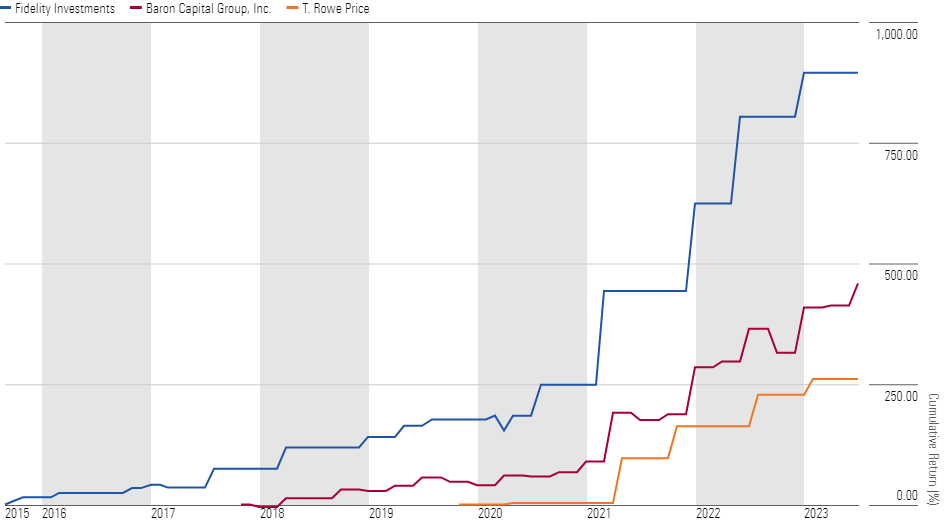

Cumulative Gain/Loss on Original Investments in SpaceX

SpaceX, another of Musk’s companies, develops rockets and spacecraft with the quixotic goal of one day colonizing Mars. For now, though, it makes most of its money ferrying satellites and astronauts into space for governments. It has come a long way since Musk founded it in 2002. A January 2023 financing round valued it at $137 billion. Fidelity was the first fund company to invest in SpaceX when it participated in a 2015 financing round, while Baron Partners and T. Rowe Price each bought stakes in 2018 and 2019, respectively. Since then, SpaceX had its first successful human spaceflight in 2020 and continues to make strides toward its goal of regularly sending humans into space. As a result, valuations have continued to rise. At the end of 2022, Fidelity and Baron each valued its shares at $73.56. By May 2023, Fidelity increased its value to $77; by June 2023, Baron marked up its shares to $80.85. Fidelity is sitting on a nearly 1,000% gain on its original investment, though it also participated in later financing rounds at higher valuations, which would take a little of the air out of those gains.

Juul

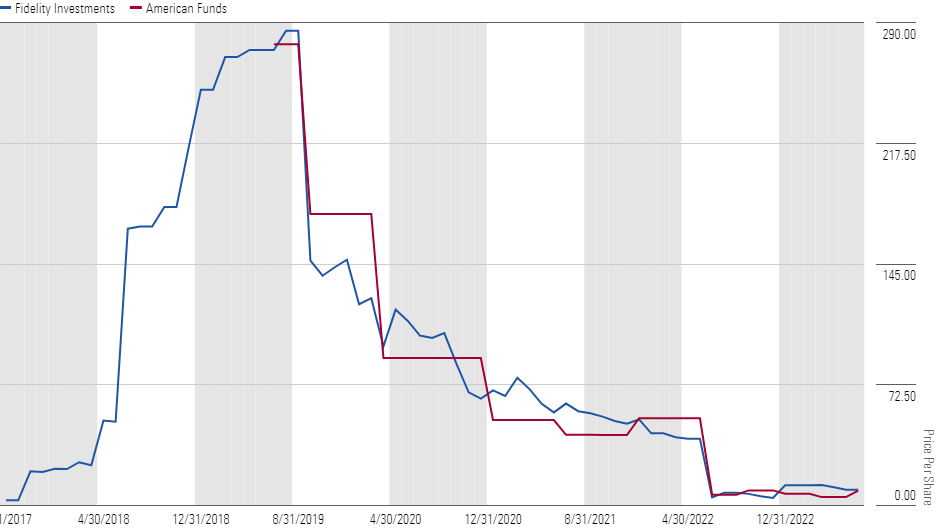

Mutual Fund Valuations of Juul Labs

Juul Labs, the maker of electronic cigarettes and vaping products, has been one of private equity’s biggest duds in the last few years. The company’s product gained mass popularity among young users in the late 2010s, and mutual fund companies wanted a hit. Fidelity participated in a 2017 funding round and initially valued it at $3.10 per share. By July 2019, Fidelity was marking its position at $285 per share, a whopping 9,094% paper gain. American Funds first bought Juul shares around that time, valuing its stake at $277 a share.

By October 2019, though, Altria MO, which owned 35% of Juul, wrote off about a third of its investment in it. Mutual funds followed suit, and in June 2022 the U.S. Food and Drug Administration banned the sale of Juul’s most popular flavored products in the United States. By 2022′s end, Fidelity dropped its valuation to $12.11 per share, American Funds to $7.05. For Fidelity, that still meant a paper gain on its initial investment. American Funds’ investment, however, which came later at a much steeper price, was nearly vaporized; it lost 97% on paper by the end of last year. Juul is seeking FDA approval for a device that can detect and block use by underage vapers, which has encouraged American Funds to write up its stake to $8.94 per share in June 2023. That’s a 77% increase from May but still lower than Fidelity’s $9.45.

Fanatics

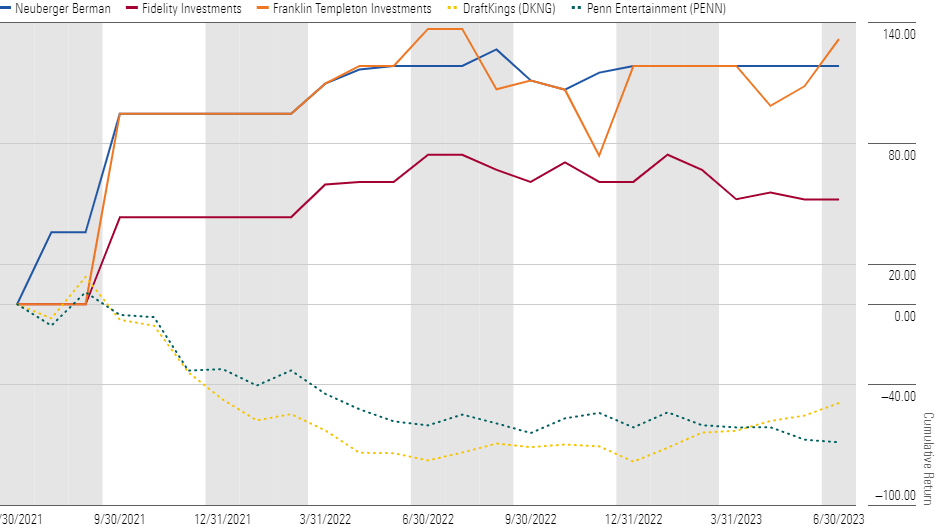

Cumulative Gain/Loss on Mutual Fund Positions in Fanatics Versus Public Comps

Fidelity, Franklin Templeton, and Neuberger Berman bought shares of Fanatics, an online sports apparel retailer with sports betting aspirations, in August 2020 when the firm was worth $6.2 billion, or $17.29 per share. By June 2021, each firm valued Fanatics at $34.87, a handsome 100% paper profit. The company declared its sports gaming business ambitions around then, helping it raise more money in August 2021 at an $18 billion valuation.

Fanatics, which in May of this year said it would acquire online sportsbook operator PointsBet, is still building its gaming business, but from its announcement in June 2021 through midyear 2023, mutual fund owners’ paper gains on their stakes have far exceeded the returns of publicly traded sports betting companies like DraftKings DKNG and Penn Entertainment PENN, which until August 2023 had owned Barstool Sportsbook. DraftKings was down 49%, and Penn had lost 69% over the period.

MapleBear (Instacart) and GoBrands (Gopuff)

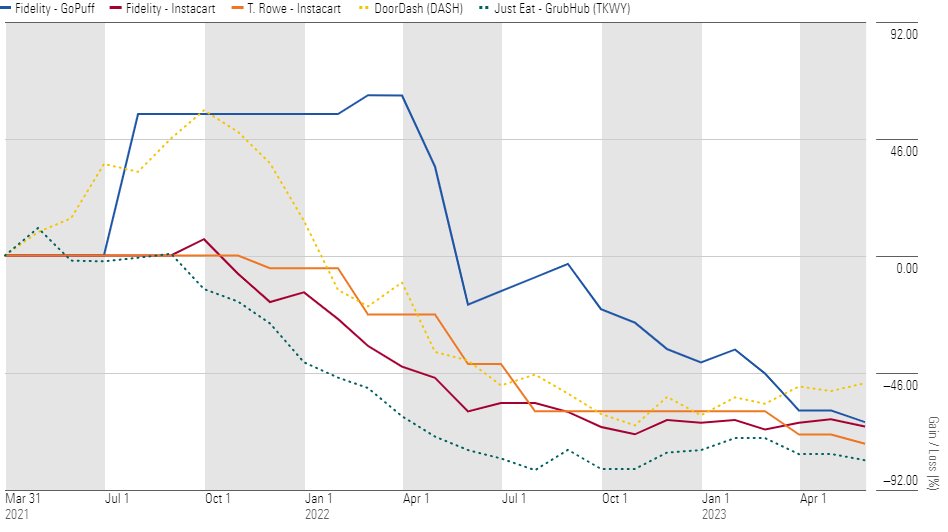

Cumulative Gain/Loss on Mutual Positions in Gopuff and Instacart Versus Public Comps

T. Rowe Price and Fidelity funds first took stakes in online grocery app Instacart’s parent MapleBear in 2020. By March 2021, Instacart’s valuation reached around $40 billion, and both T. Rowe and Fidelity had sizable paper gains. Stalling growth and legal issues led both firms to mark down their shares, though. Fidelity reduced its estimated value of the company to $48.43 by May 2022 and dropped it another 10% since, to $41.62 per share as of June 2023. T. Rowe moved slower at first, but it has recently gotten more conservative, valuing its shares at $32 each as of June.

Similarly, stiff competition and regulatory issues have dampened mutual fund companies’ optimism for GoBrands’ Gopuff sundry consumer goods delivery platform. After reaching a $15 billion valuation following a 2021 funding round, it needed a $300 million line of credit from an undisclosed lender in August 2022. Fidelity, the company’s lone mutual fund, valued Gopuff at $406.95 per share in February 2022, giving it a 60% gain on its initial investment at that time. By the end of 2022, Fidelity had cut its estimated price to $144.74, a 42% paper loss on its initial purchase. In 2023, Fidelity took its valuation down further to $86.08, nearly two thirds lower than what it first paid.

Instacart’s and Gopuff’s paper losses closely track those of publicly traded competitors DoorDash DASH and Just Eat TKWY, which have fallen hard since mid-2021.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/b0c51583-b9a2-49eb-9a8f-5f25a8bda4a3.jpg)

/s3.amazonaws.com/arc-authors/morningstar/ac242d77-42e4-4165-951a-b300b089a834.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

/d10o6nnig0wrdw.cloudfront.net/07-25-2024/t_56eea4e8bb7d4b4fab9986001d5da1b6_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/BU6RVFENPMQF4EOJ6ONIPW5W5Q.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/b0c51583-b9a2-49eb-9a8f-5f25a8bda4a3.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ac242d77-42e4-4165-951a-b300b089a834.jpg)