Top Stocks for Climate-Focused Investors

These stocks are highly rated by Morningstar analysts and commonly held in climate funds.

Assets in climate funds topped $500 billion globally for the first time in the first half of 2023. Even in the United States, where appetite for sustainable funds has declined in recent quarters, climate-focused strategies collected more than $2.5 billion in net new money through October. In this article, we examine the top-rated stocks commonly held by U.S. climate funds.

What Are Climate Funds?

Climate funds represent a wide and growing range of strategies that aim to meet varying investor preferences, from decarbonizing a portfolio to investing in climate solutions. Our universe of climate funds is subdivided into five mutually exclusive groups based on investment objective and policy, diversification, and sector exposure: Low Carbon, Climate Transition, Climate Solutions, Green Bond, and Clean Energy/Tech. In this article, we focus on Clean Energy/Tech and Climate Solutions funds—the two equity-focused categories that lean most heavily into areas like electric vehicles, critical raw materials for the energy transition, carbon capture and storage, and renewable energy sources like hydroelectric and wind power. For our latest research on global climate funds, see the full report, “Investing in Times of Climate Change.”

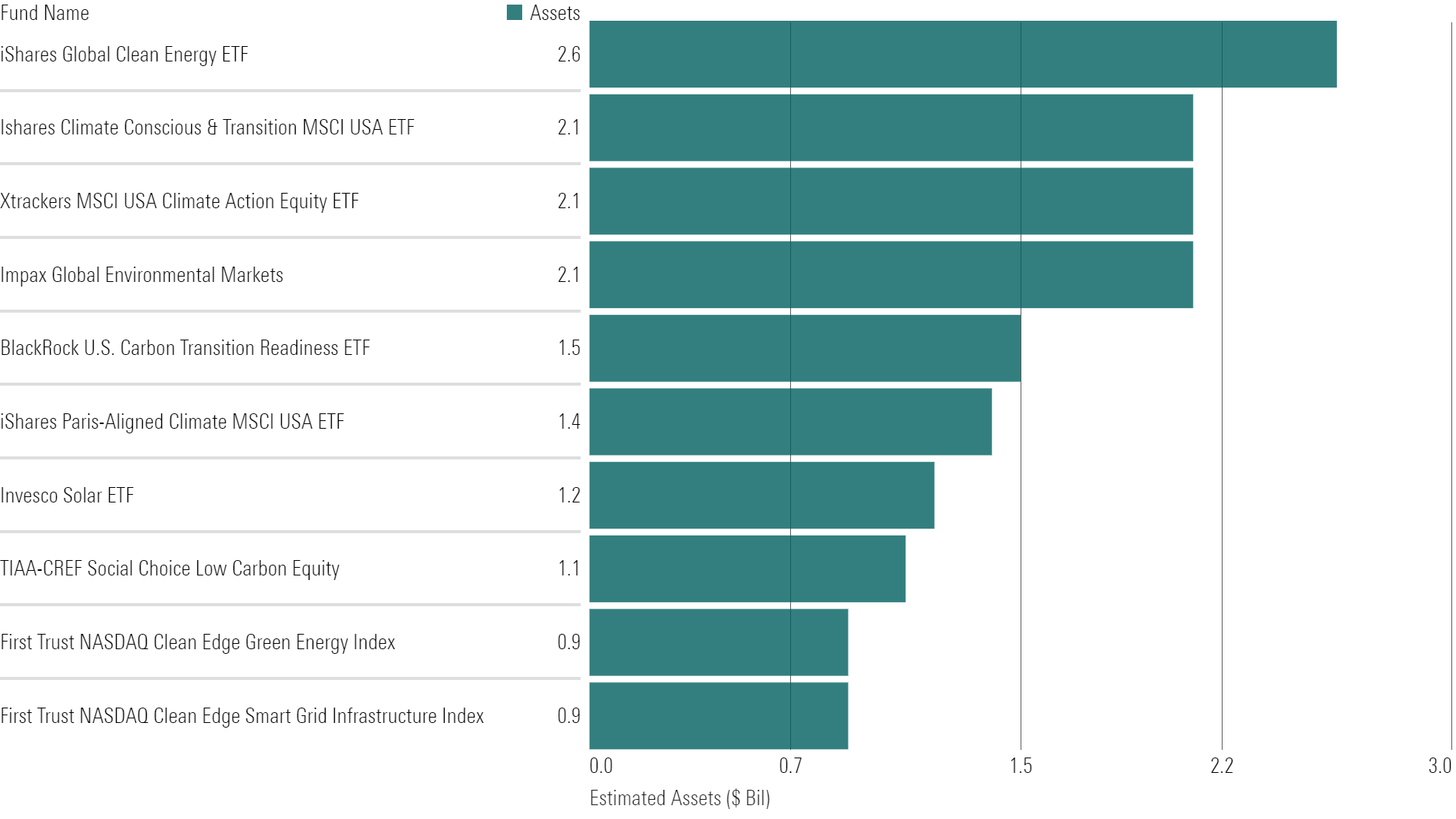

The exhibit below shows the 10 largest U.S. Clean Energy/Tech and Climate Solutions funds as of October 2023.

Largest Clean Energy/Tech and Climate Solutions Funds

At the top is iShares Global Clean Energy ETF ICLN, which launched in 2008 and counted $2.6 billion in assets at the end of October. The fund seeks to invest in companies deriving significant revenues from renewable energy activities, which drives its high exposure to the climate action impact theme (at 94% of the covered portfolio). This fund has also suffered recently in terms of returns and investor demand: Through October, it posted a 34% loss and shed $971.1 million (the worst of any U.S. climate fund).

Clean Energy/Tech and Climate Solutions funds tend to be more concentrated at the sector level than any other category of climate funds. These funds also have the highest exposure toward “pure-plays” in the renewable energy sector, such as solar photovoltaic system manufacturer First Solar FSLR and hydropower producer Brookfield Renewable BEPC. Because clean energy funds tend to be highly concentrated and subject to volatile market swings, investing in the sector isn’t for everyone. Diversification remains key.

What’s Inside Climate Funds?

We dissected the portfolios of U.S. Clean Energy/Tech and Climate Solutions funds to highlight the commonly held stocks that are rated favorably by Morningstar’s equity analysts. Unsurprisingly, based on these funds’ strategies, these companies tend to be providers of renewable energy solutions, precious metals required for the electrification of the economy, and electric and/or autonomous vehicles. On average, each of these stocks accounted for more than 2.5% of the portfolios in our sample. Two stocks appeared in the top holdings list for both Clean Energy/Tech funds and Climate Solutions funds—Tesla TSLA and SolarEdge Technologies SEDG.

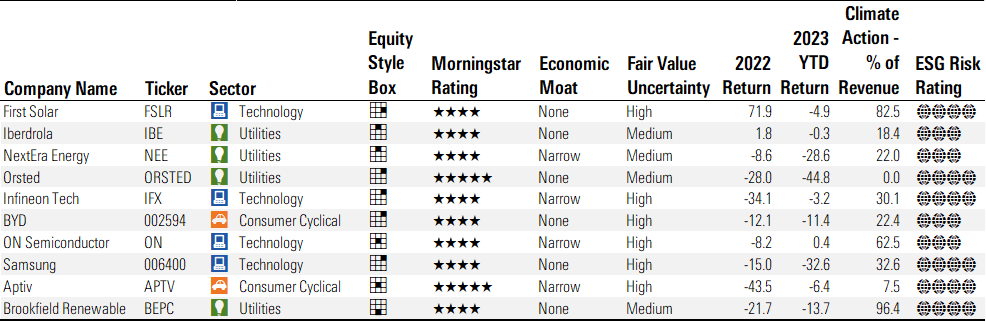

In the following exhibits, we highlight various Morningstar metrics that illustrate our equity analysts’ opinions of these companies’ prospects for future performance. Namely, companies that earn 4 and 5 stars under the Morningstar Rating are trading at a discount relative to Morningstar’s estimate for the stock’s fair value. We also showcase Sustainalytics’ Impact Metrics, which represent the portion of each company’s revenue that is aligned to Climate Action, defined as the global effort to curb the Earth’s temperature rise and cope with unavoidable consequences.

Below are the 4- and 5-star companies most commonly held in solutions-oriented climate funds.

Top-Rated Stocks Commonly Held by Clean Energy/Tech and Climate Solutions Funds

The clean energy providers on our list have taken a pummeling so far in 2023. Even so, the outlook remains bright for First Solar, driving a 4-star Morningstar Rating. According to analyst Brett Castelli, First Solar may be the biggest renewable energy winner from the Inflation Reduction Act of 2022 by selling to utility fields and expanding capacity in the U.S. to take advantage of domestic manufacturing incentives. From the climate solutions perspective, more than 80% of First Solar’s revenue is aligned to Climate Action impact because of its heavy focus on solar power generation.

Brookfield Renewable tops the list with nearly 100% of its revenue mapped to Climate Action impact. Most of this is due to the company’s leadership in hydroelectric power generation, but wind and solar have been growing as a percentage of the company’s energy mix in recent years. Brookfield Renewable’s diversification across clean energy assets contributes to a strong competitive position and a 4-star rating.

Orsted ORSTED and Aptiv APTV stand out as the two most highly rated stocks on the list. Orsted, which pioneered the offshore wind business and has a solid record in the industry, has faced some challenges in expanding its footprint in the United States. Among other factors, supply chain constraints and high interest rates caused the company to cancel a few projects, which negatively affected Morningstar’s fair value estimate for the stock. However, analyst Tancrede Fulop sees the company’s shares as materially undervalued, driving a 5-star rating.

Aptiv is a major supplier of components that make up a vehicle’s electrical systems, ranging from autonomous driving technology to the systems that distribute electric power in hybrid and electric vehicles. According to analyst Richard Hilgert, the company enjoys relatively sticky market share, supported by highly integrated customer relationships and long-term contracts. These factors contribute to the company’s narrow economic moat and 5-star rating.

Despite pressure from policymakers across the world to accelerate the transition to a low-carbon economy, clean energy and other climate-related stocks may still suffer periods of underperformance. As such, to lessen the chances of surprise, investors should take care to understand the risks and opportunities they court in their portfolios. Balancing fundamental financial metrics with emerging climate solutions data is one way to do this.

For our latest research on global climate funds, see the full report, “Investing in Times of Climate Change.”

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/987376c2-20a0-406b-b3ec-df530324b39c.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RFJBWBYYTARXBNOTU6VL4VSE4Q.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WYB37DY4NVDTVNZTSBDENH3GMI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/JPJHXR5CGSNR4LKQF5ZKLCCVYQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/987376c2-20a0-406b-b3ec-df530324b39c.jpg)