Sustainable Funds Hit by Weaker Demand in Q3 2023

Investors pulled $2.7 billion from U.S. sustainable funds, for fourth consecutive quarter of outflows, amid rising energy prices and political backlash.

Investor appetite for sustainable funds waned in the third quarter. U.S. sustainable funds endured their fourth-consecutive quarter of net withdrawals. Sustainable bond funds stood alone in registering net inflows. For more detail, download the full report here.

Weaker Demand for Sustainable Funds Persisted Through a Fourth Straight Quarter of Outflows

Investors pulled $2.7 billion from U.S. sustainable funds in 2023′s third quarter, for a total of $14.2 billion over the past 12 months. For the year to date through September, investors withdrew nearly $8.2 billion from U.S. sustainable funds.

Although the motivations behind outflows cannot be perfectly quantified, many factors are in play. These include rising energy prices, high interest rates, concerns about greenwashing, and political backlash. U.S. equity and fixed-income markets fell by 3.2% in the third quarter, as illustrated by the Morningstar US Market Index and Morningstar US Core Bond Index, respectively.

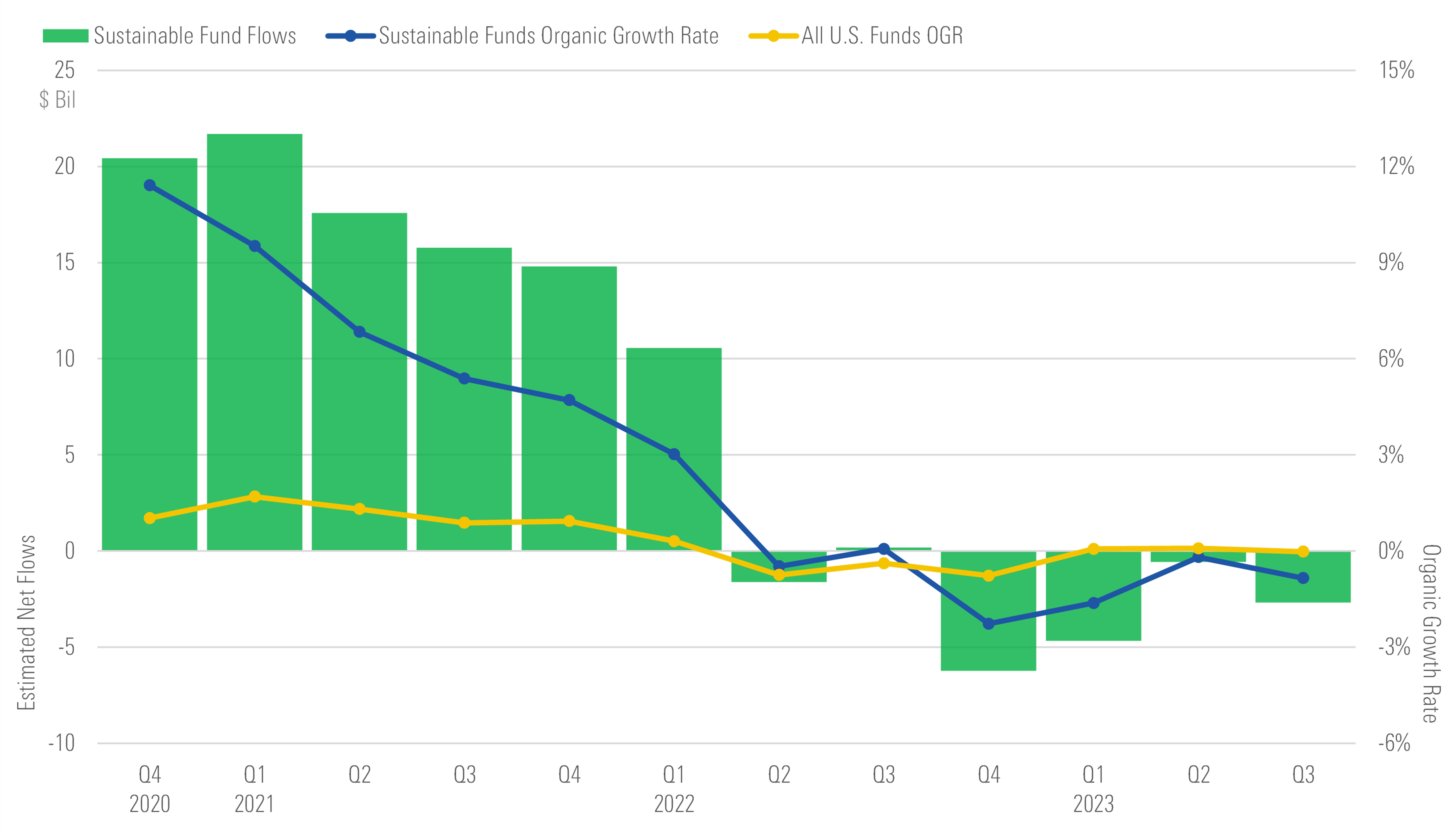

U.S. Fund Flows: Sustainable vs. All U.S. Funds

The overall percent of U.S. long-term open-end and exchange-traded funds, encompassing conventional funds as well as sustainable funds, also lost nearly $3.9 billion over the period. However, the relative decline in demand was more significant for sustainable funds, compared with conventional peers.

The organic growth rate of sustainable funds, which is calculated as net flows as a percentage of total assets at the start of a period, puts the magnitude of redemptions into perspective. During the third quarter, sustainable funds contracted by 0.85%. By comparison, overall U.S. funds were flat, declining 0.02% during the period.

iShares and Parnassus Hit by Redemptions

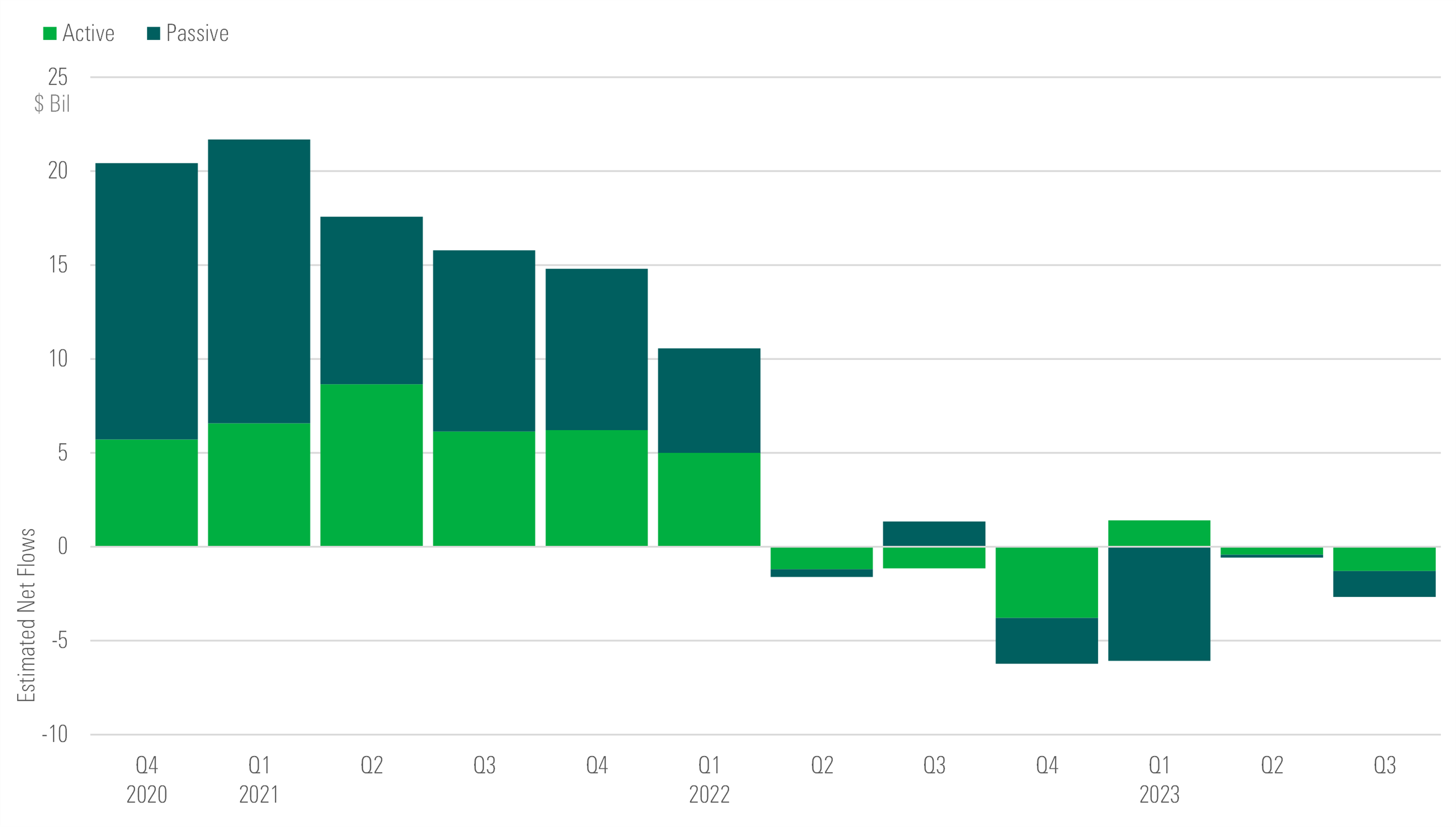

Outflows were split almost evenly between actively managed funds and index-tracking counterparts. Both groups shed more than $1.2 billion apiece during the period. Sustainable actively managed funds and their passive peers have suffered outflows in five of the past six quarters. As shown in the exhibit below, passive funds saw inflows during 2022′s third quarter, and actively managed funds collected funds in 2023′s first quarter.

U.S. Sustainable Fund Flows

One passive fund—iShares ESG Aware MSCI USA ETF ESGU—lost nearly $2.1 billion during the period. Without this fund, sustainable passive funds would have seen minor gains. Similarly, one fund accounted for nearly half of the quarter’s withdrawals from actively managed offerings. Parnassus Core Equity PRBLX lost more than $600.7 million during the third quarter, marking its eighth consecutive quarter of outflows.

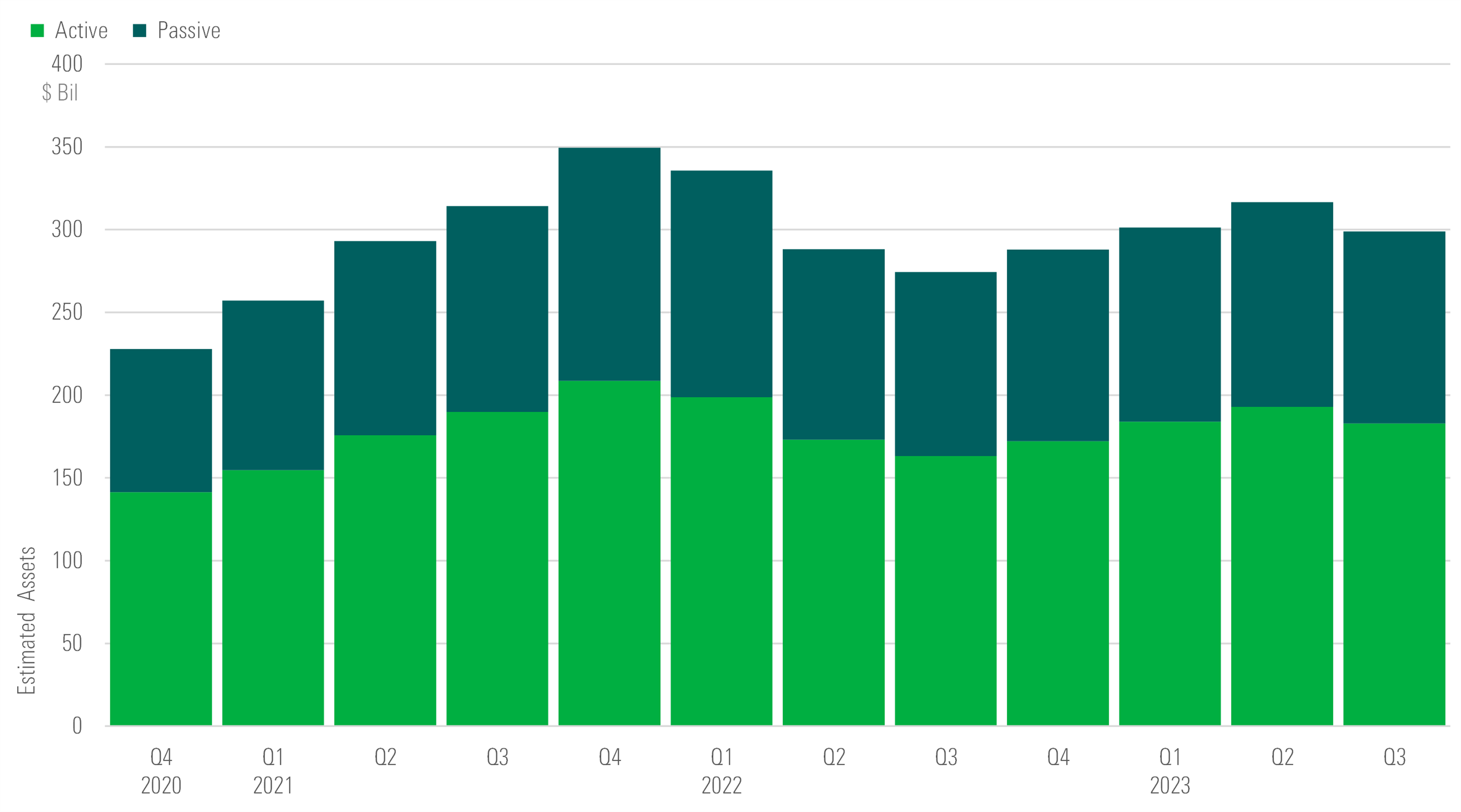

Assets in Sustainable Funds Shrink

Driven by withdrawals and poor performance, assets in sustainable funds shrank back below the $298.8 billion mark at the end of 2023′s third quarter. This represents a 17% decline from the all-time record of $358.2 billion at the end of 2021 but a 10% increase from the recent low of $272.2 billion in 2022′s third quarter. By comparison, assets in the broader U.S. funds landscape also peaked at the end of 2021 and slid by 14% through to the end of September 2023.

U.S. Sustainable Fund Assets

Volatile markets further drove assets downward. The median sustainable large-blend equity fund lost 3.3% during the quarter, slightly below the Morningstar US Market Index’s 3.2-percentage-point fall.

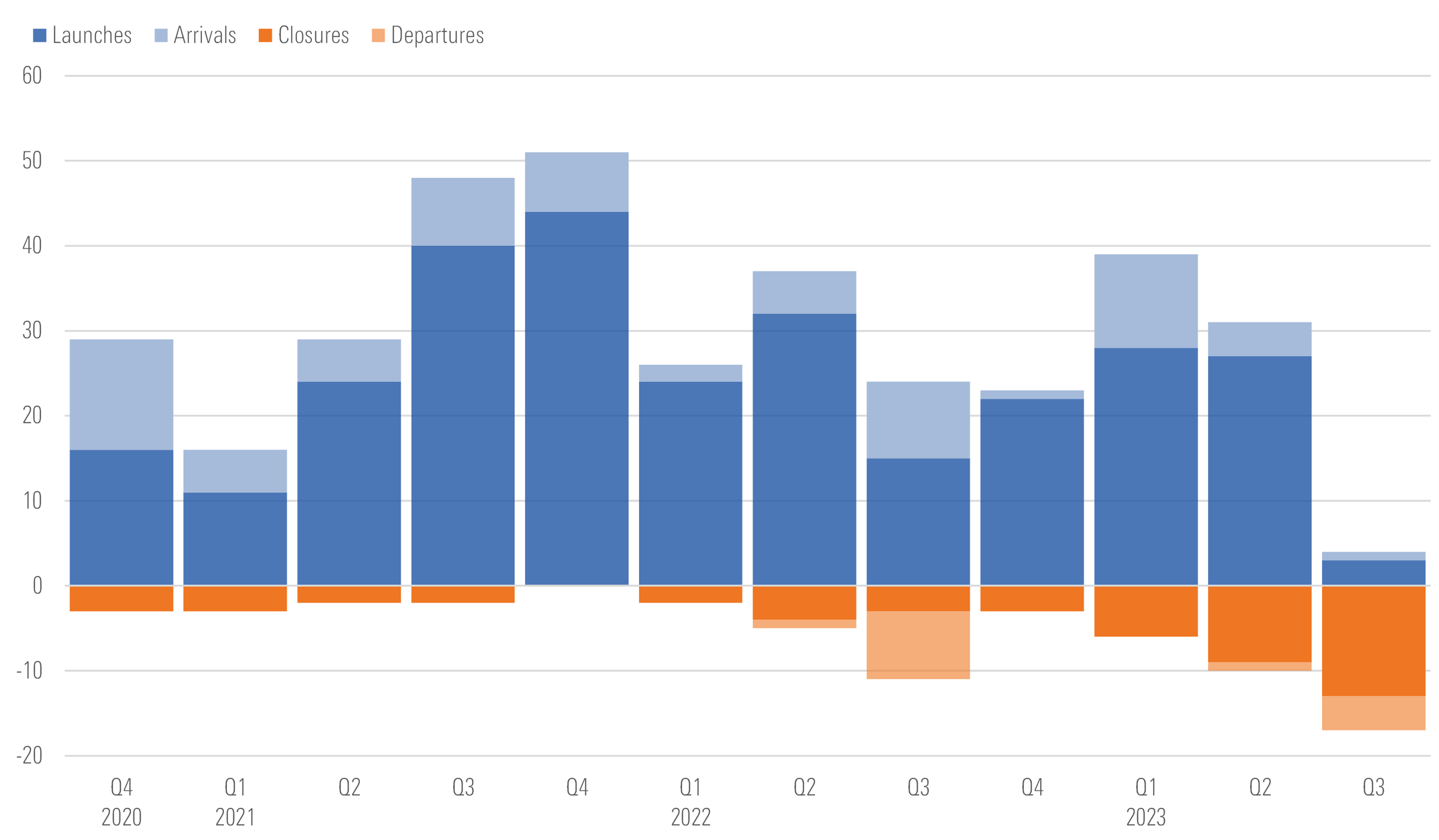

More Sustainable Funds Close

For the first time in recent history, sustainable fund departures outpaced arrivals. In the third quarter, three new sustainable funds were launched, and one existing fund was added to the sustainable funds landscape (labeled “Arrivals” in the exhibit below). During the same period, 13 sustainable funds closed and four funds moved away from ESG mandates (labeled “Departures”).

Sustainable Funds: New Arrivals & Departures

Out of the 13 sustainable funds liquidated during the third quarter, the largest (in terms of assets) came from Columbia Threadneedle, Hartford, and BlackRock. Columbia Threadneedle shuttered Columbia U.S. Social Bond Fund in August, which had amassed $35.8 million in its eight years on the market. Hartford closed the $9.8 million Hartford Schroders ESG US Equity ETF in July after roughly two years on the market. After three years on the market, BlackRock closed two smaller funds—BlackRock U.S. Impact Fund and BlackRock International Impact Fund—with $5.4 million and $4.2 million in assets, respectively.

The new offerings and repurposed funds brought the total number of sustainable open-end and exchange-traded funds in the United States to 661 at the end of the quarter.

List compiled on Oct. 11. Flows data pulled on Oct. 12. Revised totals as far back as first-quarter 2023 (inclusive).

Clarification: This article was updated to include U.S. sustainable funds' outflow figure ($8.2 billion) for year-to-date 2023 through September.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/987376c2-20a0-406b-b3ec-df530324b39c.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NNGJ3G4COBBN5NSKSKMWOVYSMA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6BCTH5O2DVGYHBA4UDPCFNXA7M.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EBTIDAIWWBBUZKXEEGCDYHQFDU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/987376c2-20a0-406b-b3ec-df530324b39c.jpg)