Top-Rated ESG Funds You Haven’t Heard of ... Yet

Early signs indicate these sustainable funds have promise.

As the year comes to a close, investors are taking stock of their portfolios—reflecting on what worked well and didn’t in 2023, exploring ideas to mix things up in 2024. If you’re thinking of adding a sustainability-focused strategy to your portfolio and want to know what’s new in the space, keep reading for some top picks.

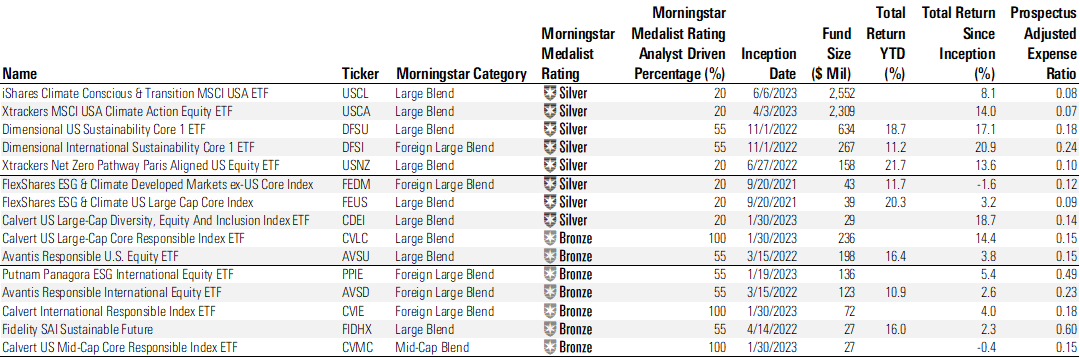

Best New Sustainable Funds

Sustainable fund launches have slowed along with net flows in 2023, but opportunities exist for investors who want to steer a portion of their portfolios toward social and environmental progress and away from related risks. The 15 funds listed below all earn medals under the Morningstar Medalist Rating despite being less than 3 years old. The Morningstar Medalist Rating leverages both qualitative insights and quantitative measures to indicate a strategy’s likelihood of outperforming its respective Morningstar Category index and/or peers.

Top-Rated New Sustainable Funds: “Blend” Holdings

A few of the new offerings on our list come from dedicated sustainable-investing shops. Calvert launched Silver-rated Calvert US Large-Cap Diversity, Equity and Inclusion Index ETF CDEI, Bronze-rated Calvert US Large-Cap Core Responsible Index ETF CVLC, Bronze-rated Calvert International Responsible Index ETF CVIE, and Bronze-rated Calvert US Mid-Cap Core Responsible Index ETF CVMC in early 2023. Although Morgan Stanley acquired Calvert in 2021, Calvert’s strength as a pioneer in sustainable investing remains compelling. Drawing on a roughly 40-year legacy, Calvert’s funds all abide by the firm’s Principles for Responsible Investment, which seek companies that lead on issues such as environmental sustainability and resource efficiency, promotion of equitable societies and respect for human rights, and transparency. Calvert’s passive offerings (those with “Index” in their names) invest in a broad basket of stocks and take steps to minimize sector bets, resulting in relatively strong diversification.

The largest core offering on this list is also the newest: Silver-rated iShares Climate Conscious & Transition MSCI USA ETF USCL. Launched in June 2023, this fund kicked off with a bang and became the top flow recipient among U.S. sustainable funds for the second quarter. The fund’s low expense ratio, straightforward index-tracking process, and deep resources at parent firm BlackRock drive its Silver Medalist Rating. It tracks a climate-focused index that includes securities based on criteria such as carbon emissions intensity and “green” revenue (renewable energy and clean tech, among others).

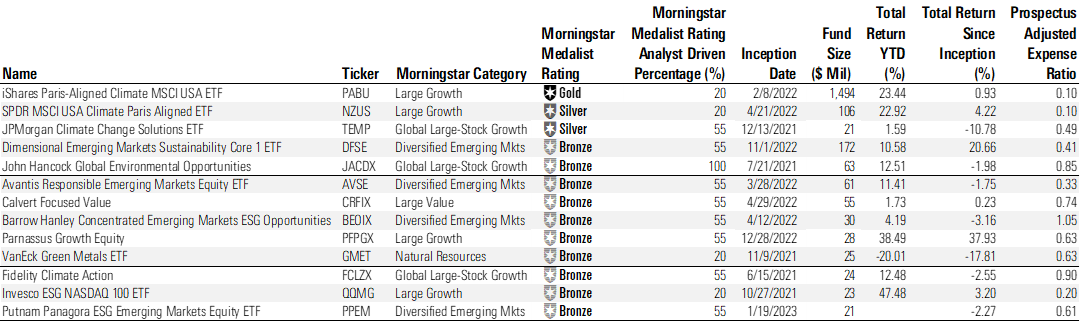

Stylish Satellite Strategies

Outside of Morningstar’s “Blend” categories lie more options to tilt an investor’s portfolio, be it into large-cap growth stocks, emerging-markets companies, or even natural resources.

Top-Rated New Sustainable Funds: Satellite Holdings

BlackRock again leads the list with iShares Paris-Aligned Climate MSCI USA ETF PABU, the only fund in this group to earn a Gold Medalist Rating. This fund tracks an index crafted with the Paris Agreement in mind. That agreement—an international treaty signed by dozens of countries that went into force in 2016—pushes for investment portfolios to decrease their greenhouse gas intensity by 7% year over year, all while generally replicating the performance of the broader market. These strategies took off in Europe shortly after the 2021 launch of Paris-aligned benchmarks, but iShares Paris-Aligned Climate MSCI USA ETF is one of only five such funds in the United States.

Sustainable-investing specialist Parnassus claims one fund on the list: Parnassus Growth Equity PFPGX. Parnassus earns a Morningstar ESG Commitment Level of Leader on the back of its wholesale, time-tested dedication to sustainable investing. All six of the firm’s funds follow sustainability-focused mandates, actively choosing investments based on their environmental and social credentials and supplementing that process with topnotch engagement with portfolio companies. This leads to relatively compact portfolios; for instance, Parnassus Growth Equity’s portfolio has just 40 holdings. But it’s a style of investing that Parnassus handles well, and that contributes to the fund’s Bronze Medalist Rating.

Bronze-rated VanEck Green Metals ETF GMET is the lone natural-resources fund on the list. The fund tracks an index composed of “green metals” companies, meaning companies involved in the production, processing, and recycling of rare-earth metals used in clean energy applications. For example, one of the fund’s top holdings is Albemarle ALB, the world’s largest lithium producer. Lithium is one of the most essential materials for building the batteries that power almost all electric vehicles.

Important to Keep in Mind

Although all types of investing court risk, many professionals steer clear of new, small funds (such as those that are less than 3 years old with less than $100 million in assets). On the one hand, asset managers are more likely to liquidate funds that aren’t gathering assets, which might push investors to rebalance at suboptimal points in time. Additionally, when portfolio managers (especially on concentrated, high-conviction strategies) are faced with massive, rapid inflows, it can push them to invest in securities that might not be their top picks. This latter concern is somewhat mitigated in broad-market, index-tracking funds, where new capital is relatively easy to deploy, and indeed many of the funds listed here are systematic or passive strategies.

Given these funds’ small asset bases and short track records, they might not be suitable for set-it-and-forget-it investors. However, in the evolving landscape of sustainable investing, the strategies mentioned here are worth watching. Early days point to their potential.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/987376c2-20a0-406b-b3ec-df530324b39c.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RFJBWBYYTARXBNOTU6VL4VSE4Q.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WYB37DY4NVDTVNZTSBDENH3GMI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/JPJHXR5CGSNR4LKQF5ZKLCCVYQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/987376c2-20a0-406b-b3ec-df530324b39c.jpg)