5 Funds That Increased Their Energy Stakes in 2023

These managers haven’t given up hope in the energy sector despite a mediocre 2023.

Despite recent energy price volatility, some managers are optimistic about the sector. Energy stocks tend to be volatile and highly dependent on the price of oil but can be a source of diversification for managers. We looked at a few open-end, actively managed mutual funds that have increased their energy exposure in 2023. Here is what we found and what’s noteworthy.

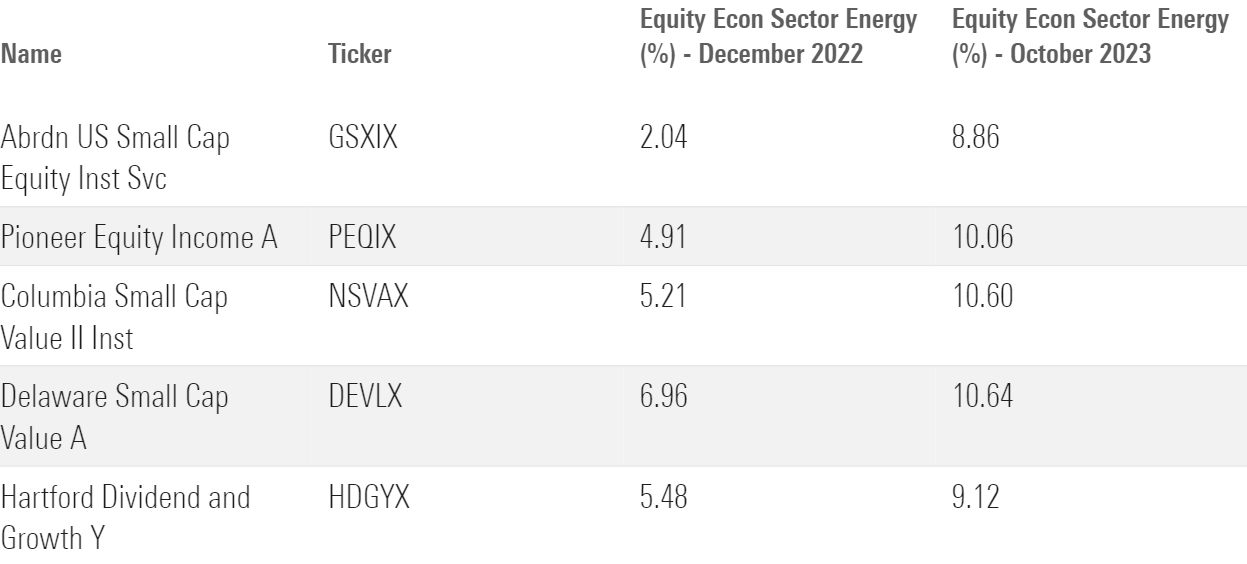

These 5 Funds Have Increased Their Energy Stakes in 2023

Abrdn U.S. Small Cap Equity GSXIX

Abrdn U.S. Small Cap Equity had 2.0% of its assets in energy stocks at the end of 2022, but by October 2023, that stake had increased to 8.9%. The increase occurred as the fund went through a slew of manager changes starting in mid-2022. In June 2023, Christopher Colarik took over and has used an approach similar to that of his predecessors: focusing on companies with predictable cash flows and profitable histories.

Colarik has put his stamp on the fund. When he took over in June 2023, the portfolio’s 2.5% energy stock helping was 6 percentage points less than the Russell 2000 Value Index’s. Since then, the fund has added three energy stocks—Magnolia Oil & Gas MGY, SM Energy SM, and Callon Petroleum CPE. Magnolia Oil & Gas was a top 10 holding in October, and the other two stocks took up about 2.6% of the fund’s assets. As of October, the portfolio’s 8.9% energy allocation was 2.0 percentage points lower than the index’s.

Pioneer Equity Income PEQIX

Pioneer Equity Income’s managers upped the portfolio’s energy stake from 4.9%, or about 3.5 percentage points less than the Russell 1000 Value Index’s helping, to 10.1% at the end of October 2023, 1 percentage point more than the index.

Manager John Carey has been adding to existing energy holdings and adding new ones. The fund’s top holding, Exxon Mobil XOM, has been in the portfolio since 2021′s third quarter and represented 4.0% of the October 2023 portfolio’s assets. Carey also added Coterra Energy CTRA and Shell PLC SHEL in 2023′s first quarter.

Columbia Small Cap Value II NSVAX

Like Pioneer Equity Income, Columbia Small Cap Value II came into the year underweight energy companies but entered the fourth quarter overweight. However, in November 2023, Columbia replaced managers Christian Stadlinger and Jarl Ginsberg with Jeremy Javidi and Bryan Lassiter. It remains to be seen if the new team will be as bullish on the sector as their predecessors. Before the changes, Stadlinger and Ginsberg doubled the fund’s commitment to energy, raising the allocation to 10.6% in October 2023 from 5.2% at the end of 2022.

Javidi and Lassiter plan on using their predecessors’ approach, focusing on companies with turnaround potential, but it’s not clear what the new managers’ portfolio will look like. That said, Stadlinger and Ginsberg added seven energy stocks in 2023, including Permian Resources PR and Murphy Oil MUR at roughly 1.3% of assets each.

Delaware Small Cap Value DEVLX

Managers Kelley Carabasi and Kent Madden increased their portfolio’s energy stake to 10.6% by October 2023 from 7.0% at the end of 2022, nearly matching the Russell 2000 Value Index’s 10.9%.

New purchases and additions to existing holdings fueled the increase. The managers added EnLink Midstream ENLC, Patterson-UTI Energy PTEN, and Liberty Energy LBRT in 2023. Meanwhile, the managers have been adding to their stakes in Matador Resources MTDR and OGE Energy OGE.

Hartford Dividend and Growth HDGYX

Manager Matt Baker, who has run this strategy since July 2020, had 9.1% of its assets in energy stocks in October 2023, nearly 4 percentage points more than the fund’s stake at the end of 2022 and in line with the Russell 1000 Index’s 9.0%.

Baker tends to use the fund’s primary prospectus benchmark, the S&P 500, as his portfolio construction guide, but he isn’t afraid to deviate from it, either. The fund’s 2.6% ConocoPhillips COP position was 2 percentage points more than the S&P 500′s; its 1.91% Chevron CVX helping exceeded the benchmark’s by more than a percentage point; and its 1.4% Diamondback Energy FANG stake was 1.4 percentage points more than the index’s. The portfolio also had 2.4% in France’s TotalEnergies, which is not in the U.S-focused S&P 500.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ac242d77-42e4-4165-951a-b300b089a834.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/FGC25JIKZ5EATCXF265D56SZTE.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ac242d77-42e4-4165-951a-b300b089a834.jpg)