Markets Brief: The ‘Magnificent Seven’ Stocks Have Driven the Rally, but Are They Too Expensive Now?

The nascent bull market could run out of steam unless gains broaden beyond stocks like Nvidia and Meta.

Check out our weekly markets recap at the bottom of this article, with a look at stocks making some of the past week’s biggest moves—including Ocado and Dollar Tree—as well as a calendar of the coming week’s economic and corporate news.

A select group of stocks seems to have pulled equities out of the bear market. But with these high-profile names for the most part no longer trading at attractive prices, the question is what’s next for the investors who hold them, as well as the durability of the current move higher in the overall market.

Heading into the middle of 2023, the Morningstar US Market Index is up 23.0% from its bear market low set on October 14, 2022 and up 14.6% so far in 2023. However, the market’s overall gains have been driven by just a handful of stocks.

The group of gunslingers dominating the rally have been dubbed by some as the “Magnificent Seven.” The stocks leading the charge are are Nvidia NVDA, Tesla TSLA, Meta Platforms META, Apple AAPL, Amazon.com AMZN, Microsoft MSFT, and Alphabet GOOGL.

At the start of the year, these stocks were all down more than 25% from the market’s peak on Jan. 3, 2022, with Tesla taking the worst of the bear market beating, losing 65%. But that also meant these high-profile growth stocks were trading at much more attractive levels than before the market took its tumble.

With the exception of Amazon, these seven stocks are now either considered fairly valued or trading in overvalued territory, according to Morningstar analysts’ fair value estimates.

“This indicates to us that this trend has essentially run its course for now,” says David Sekera, chief U.S. market strategist at Morningstar. “In order for the market rally to continue in the second half of the year, we would expect to see that rally broaden out into other sectors and categories.”

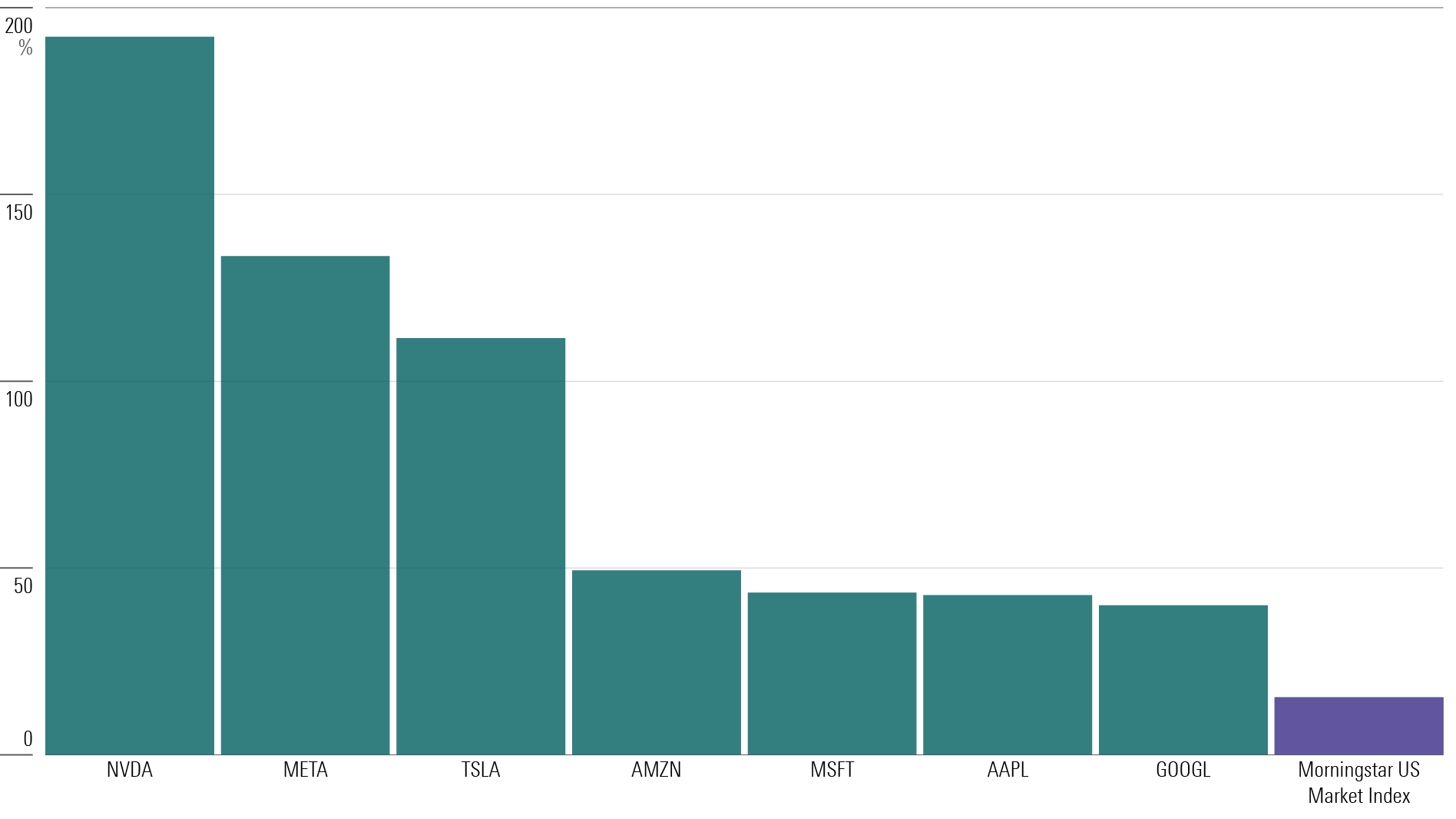

'Magnificent Seven' 2023 Stock Price Returns

Magnificent 2023 Returns

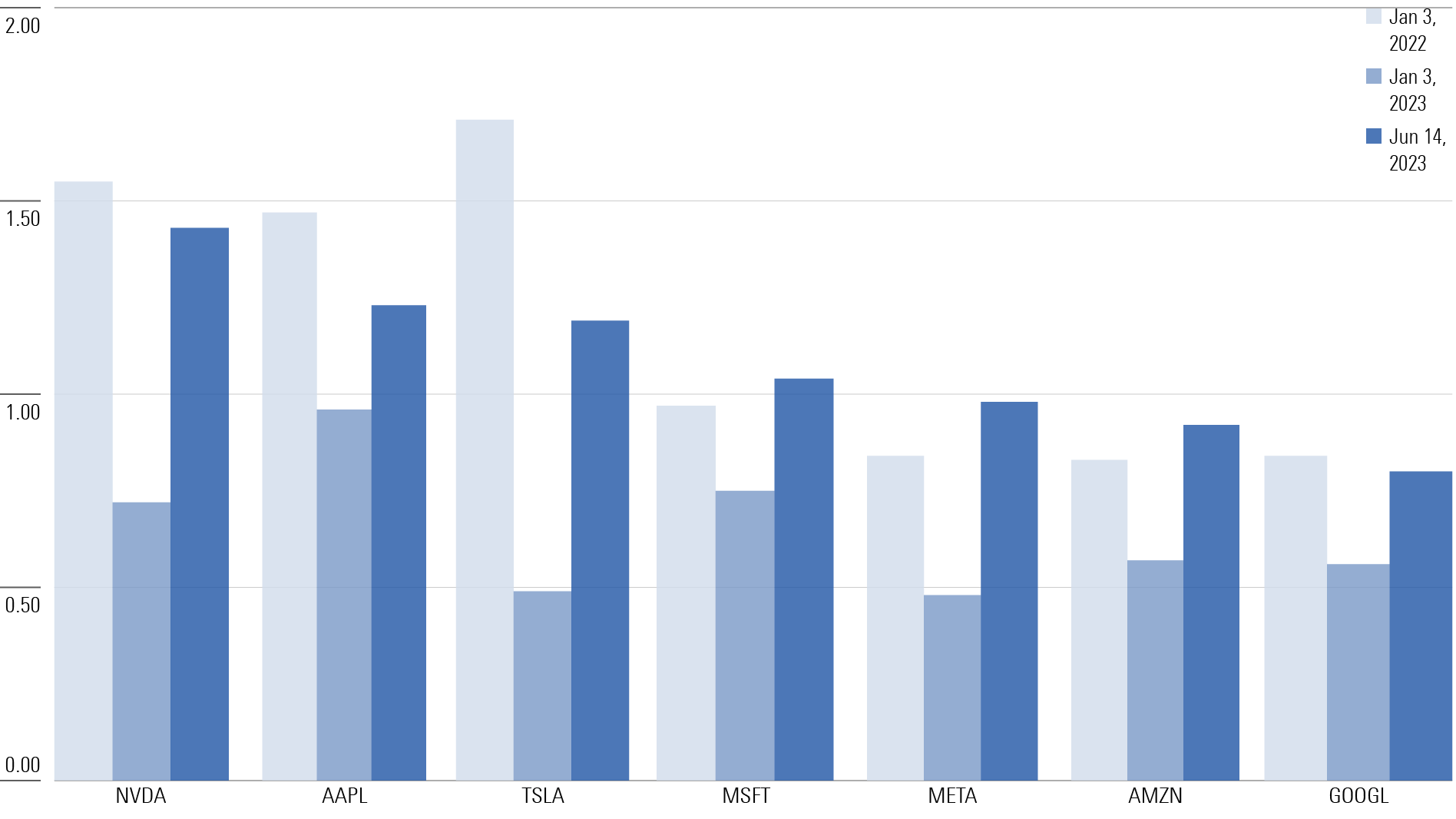

At the start of 2022, Apple, Nvidia, and Tesla had a Morningstar Rating of 2 stars, meaning they were trading at prices Morningstar stock analysts deemed overvalued compared to their fair value estimates. Microsoft was a 3-star stock, meaning it was fairly valued. Amazon, Google, and Meta were undervalued with Morningstar Ratings of 4 stars.

The previous year, these stocks surged in the wake of the COVID-19 pandemic, profiting from booming e-commerce sales and demand for technological devices. But as 2022 progressed, their share prices took big hits along with other high-priced growth stocks as inflation surged and the Federal Reserve aggressively raised interest rates.

At the individual company level, Nvidia and Apple faced challenges with their business in China. The United States barred two of Nvidia’s chips from export, while Apple dealt with supply chain constraints stemming from COVID-19 disruptions and the chip shortage.

The advertising outlook for Alphabet and Meta dimmed, with the latter also facing competition from other social media companies. Tesla shares tumbled amid concerns about chief executive officer Elon Musk selling his shares in the automaker to fund his acquisition of Twitter.

All seven stocks closed 2022 with deeply negative returns. Tesla took the worst hit, falling 65%, and Meta was close behind, down 64%. Nvidia and Amazon both lost 50%, while Alphabet declined 39%. Shares for Microsoft and Apple suffered the least, losing close to 25%.

Now these stocks have made a U-turn. As of June 20, Nvidia stock is up 192% in 2023, Tesla stock is up 112%, and Meta stock is up 134%. The shares for the other four firms are clocking gains north of 40%.

For some of the stocks, a key driver of this year’s rally has been investor excitement over these firms’ investments in generative artificially intelligent software. Nvidia saw its stock rally due to heightened demand for its chips, which have been used to train programs like Open AI’s ChatGPT. Microsoft, Alphabet, Apple, and Meta have ventured into using AI tools for their products and services.

Tesla saw its stock rally at the start of June following news of its partnerships with Ford Motor F and General Motors GM for their electric vehicles.

Valuations Now Less Attractive

In the wake of this year’s gains, Morningstar’s overall rating and price/fair value ratios for four of the seven stocks have swung back to less-attractive levels.

Alphabet is the only one that is still rated as undervalued, trading in 4-star territory while Nvidia and Apple are rated as overvalued with 2 stars. Amazon, Tesla, and Meta have moved back into fairly valued territory, which means that in the case of Amazon and Meta, the stocks are deemed more expensive than they were even before the bear market.

Price/Fair Value Estimate Ratios for the ‘Magnificent Seven’ Stocks

The forward-looking P/E calculation for these stocks tells a similar story. Six have a narrow difference between their ratios at the start of last year and their ratios as of June 14. Tesla remains an outlier, with its current P/E ratio close to half of what it had at the start of last year.

Are the Magnificent Seven Buys Today?

The dynamic for the seven market-leading stocks mirrors that of growth stocks more broadly. At the start of this year, Morningstar’s valuation data suggested both value and growth stocks were undervalued. That dynamic has changed.

“Now is probably a good time to be taking profit out of your growth category, in particular the technology sector, which we now think is slightly overvalued,” Sekera says. “Then use those proceeds to reinvest in the value category, which remains undervalued.”

Sekera notes that the “Magnificent Seven” stocks that remain in the 3-star category—Amazon, Meta, Microsoft, and Tesla—are within the fair value range and thus not attractively priced. However, Alphabet is still considered undervalued, which Sekera believes suggests there’s enough margin of safety to buy its stock today.

Apple and Nvidia stocks are overvalued, and Sekera says it’s time to reevaluate owning those shares, particularly the latter. He recommends that investors sell “some of that position down and use those proceeds to be able to reinvest on other areas of the market that have lagged thus far this year.”

Events Scheduled for the Coming Week

- Monday: Carnival CCL reports earnings.

- Tuesday: Walgreens Boots Alliance WBA reports earnings.

- Wednesday: General Mills GIS and Micron Technology MU report earnings.

- Thursday: McCormick & Co. MKC, MSC Industrial Direct MSM, and Nike NKE report earnings.

- Friday: Constellation Brands STZ reports earnings.

For the Trading Week Ended June 23

- The Morningstar US Market Index fell 0.74%.

- Yields on 10-year U.S. Treasuries decreased to 3.74% from 3.78%.

- West Texas Intermediate crude prices fell 3.65% to $69.16 per barrel.

- Of the 848 U.S.-listed companies covered by Morningstar, 141, or 17%, were up, and 707, or 83%, were down.

What Stocks Are Up?

Ocado Group OCDO stock surged 35% following a report that suggested Amazon may buy the U.K. retail company, which licenses grocery technology. Amazon has not commented on its interest in the firm.

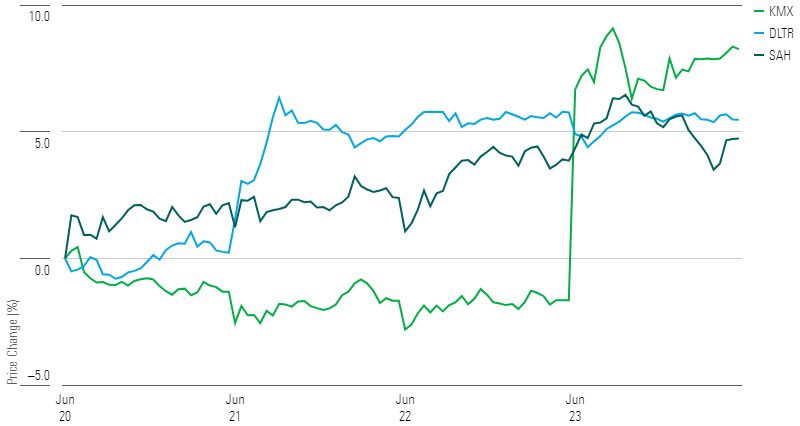

CarMax KMX stock jumped after the company posted its first-quarter results. The used car retailer generated $7.7 billion in sales. Although it’s down 17.4% from the previous year, the reported revenue beat FactSet estimates of $7.5 billion. The adjusted diluted earnings per share of $1.16 fell 26.6%, but it still exceeded the consensus of $0.79.

Sonic Automotive SAH stock gained after the automobile retailer announced it would refocus its EchoPark brand to address volatile conditions in the pre-owned car market. The firm aims to “allocate more vehicles to key markets and increase capacity to address current demand.” Sonic hopes the brand’s short-term financial performance improves, especially as the production of new vehicles increases in the next year, giving way for more pre-owned cars to become available.

Dollar Tree DLTR stock rose after its investor conference, during which the firm announced plans to make its supply chain process more efficient, upgrade existing technology, and increase employee wages.

Morningstar equity analyst Sean Dunlop notes that the company’s midterm forecasts of over $10 diluted earnings per share in 2026, as well as operating margins of 14%-15% at Dollar Tree and more than 5% at Family Dollar, largely align with his own predictions. The company’s target of $2.3 million in capital expenditures in 2024-2025 is approximately $1.3 billion higher than Dunlop’s prior estimate, offsetting the sales accretion.

“While we appreciate the potential same-store sales lift from multi-price inventory, we foresee heightened competition as the firm pushes into denser, urban markets, which suggests the target for mid-single-digit annual same-store sales growth is aggressive,” Dunlop says.

Highlighted Advancers

What Stocks Are Down?

GDS Holdings GDS stock declined after a class-action lawsuit was filed against it that claims “investors suffered damages” due to lack of transparency. The suit alleges the IT service management company gave “false and/or misleading statements” and failed to disclose company chair William Huang’s “undisclosed pre-paid forward sale contract transactions as early as May 2020.”

Squarespace SQSP stock fell after the company entered an agreement to acquire assets from Google Domains. Morningstar equity analyst Emma Williams says the website-building company’s deal would “expand the established domain registrar business and cross-sell complementary online presence solutions to millions of acquired customers at a lower acquisition cost,” but that the firm will still face competition from GoDaddy GDDY.

“The $180 million acquisition will be funded through cash and an extension of existing credit facilities, and we expect the deal to close in the third quarter of 2023 with no regulatory pushback,” Williams adds. “Despite an improved outlook, Squarespace shares continue to screen as overvalued relative to our updated fair value estimate.”

Intel INTC stock dropped after the firm announced a restructuring plan in an investor meeting. CFO David Zinser says the semiconductor company intends to create separate units focused on its manufacturing groups in the face of competitors in the chip market like Nvidia and Apple. Intel aims to save $8 billion to $10 billion in costs by 2025, though it did not provide a clear timeline for this plan.

Highlighted Decliners

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/GJMQNPFPOFHUHHT3UABTAMBTZM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZYJVMA34ANHZZDT5KOPPUVFLPE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LDGHWJAL2NFZJBVDHSFFNEULHE.jpg)