Markets Brief: Will the Fed Really Cut Rates 5 Times Next Year?

It all depends on the inflation data.

Check out our weekly markets recap at the bottom of this article, with a look at the stocks making some of the past week’s biggest moves, including PDD Holdings and Dollar General.

We may be savoring the final days of summer, but market watchers are looking ahead to 2024 for clues about the path interest rates will take. That will depend largely on the trajectory inflation takes. Economists expect the Federal Reserve to begin cutting interest rates at some point next year, but there’s no clear consensus on when, or by how much.

The Fed began a steady campaign of rate hikes in March 2022, when inflation was approaching its highest level in four decades. Now, with more than 5 percentage points of hikes in the rearview mirror and a target federal-funds rate between 5.25% and 5.5%, the picture looks much healthier. August jobs data released Friday showed signs of cooling in the labor market, which is another sign that the Fed’s hiking campaign is having its intended effect.

When will the central bank start pumping the brakes? Traders and economists generally agree that cuts aren’t coming this year, but next year is a different story.

“2024 is supposed to be the year when the Fed will not be aggressively raising rates anymore, and will in fact be more accommodative,” says Lawrence Gillum, chief fixed-income strategist at LPL Financial. He says traders are already trying to get ahead of rate cuts, and their bets on rates in 2024 are already reflected in futures trading.

U.S. Treasury Yields and Federal-Funds Rate

How Much Will the Fed Cut Interest Rates In 2024?

As of Sept. 1, futures prices indicate that traders anticipate about 1.2 percentage points of rate cuts next year, according to Bank of America rates strategist Meghan Swiber. If the Fed lowers rates a quarter-point at a time, that would mean roughly five cuts over the course of the year. In contrast, strategists at Bank of America are anticipating just 0.75 percentage points of cuts in 2024. Swiber attributes the difference to the risk baked into futures markets.

Traders are still accounting for the possibility that the U.S. economy may enter a recession in 2024, which could prompt swifter and larger rate cuts from the central bank. On the other hand, Swiber explains, “A more resilient economy means the Fed is going to have to hold rates higher for a longer period of time.” Bank of America recently revised its view that a recession was likely in 2024, and its experts currently expect a soft landing.

Traders are also more confident that “the inflation story is over,” she adds. As a result, predictions for the futures market are skewed toward a 2024 scenario in which the central bank isn’t as worried about keeping policy tight to bring down prices.

Other economists believe inflation might remain higher than the Fed wants next year, which would call for even fewer rate cuts.

Expectations for the Federal Reserve Meeting on Dec. 13, 2023

The Futures Market Can Be Wrong

Gillum points out that futures traders aren’t always right when predicting the path of interest rates.

“Markets were expecting about 2 percentage points of rate cuts only a couple of months ago,” he says. “We thought that was a bit aggressive.”

Trader predictions can change rapidly based on new economic data. Gillum explains that data they view as weaker than what the Fed is looking for might increase the number of cuts they predict, while stronger data could produce the opposite result.

What Would Prompt Fed Rate Cuts in 2024?

Morningstar’s senior U.S. economist Preston Caldwell anticipates roughly 3 percentage points of cuts between February 2024 and the end of 2025, which would mean five or more rate cuts would be possible during the first year.

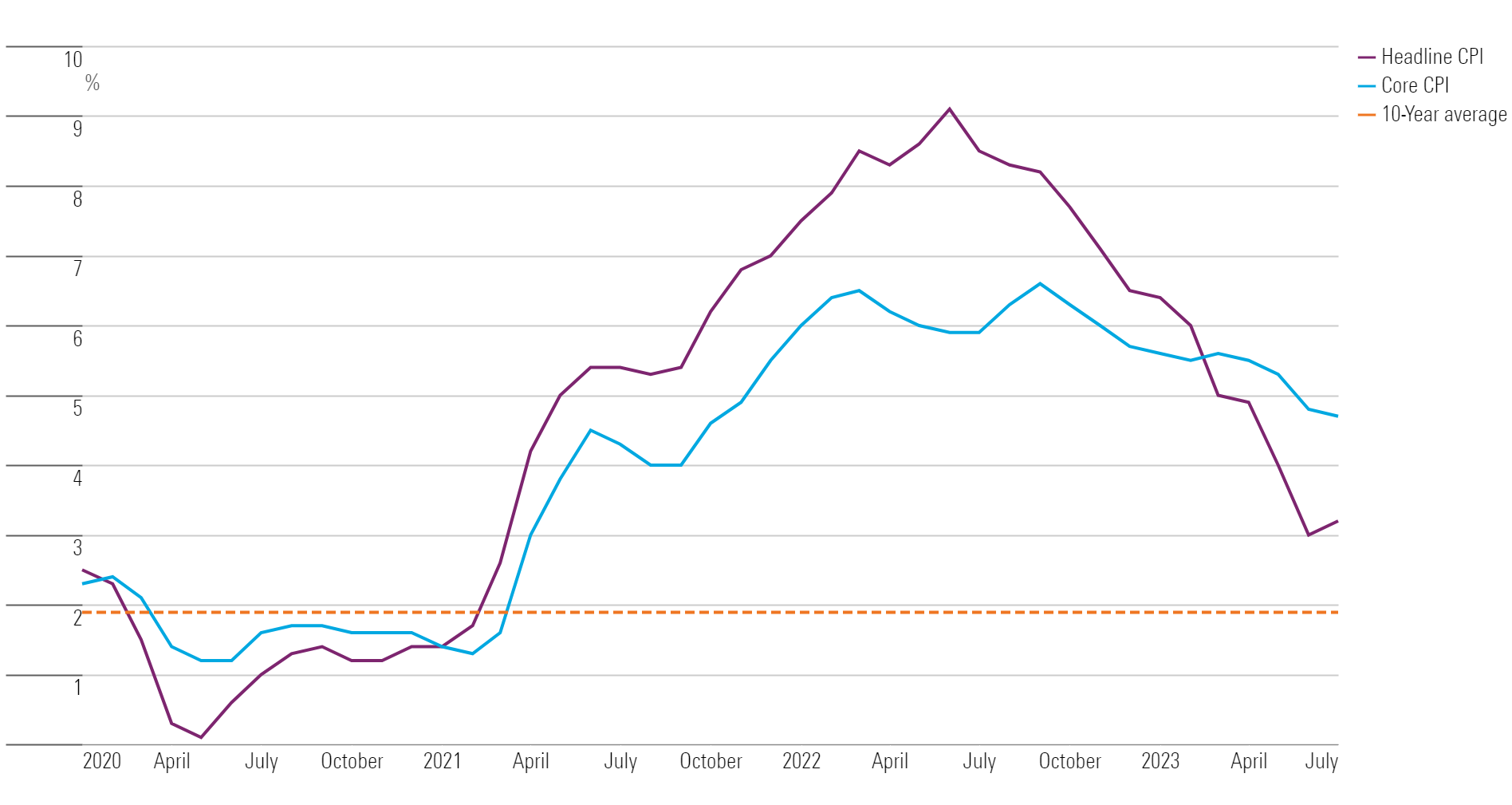

Caldwell anticipates that inflation will drop below the Fed’s 2% target in the first quarter of 2024, which would “clear the way for the Fed to start cutting at their February meeting.” Adding slowing economic growth to the equation could prompt even more dramatic cuts, he says.

No one has a crystal ball for the economy, even when it seems like the data is moving in the right direction. Swiber says, “The issue is the Fed doesn’t know whether this disinflation we’ve seen is short-lived.”

In a closely watched speech in Jackson Hole, Wyoming, last week, Fed Chair Jerome Powell acknowledged as much.

“We can’t yet know the extent to which these lower readings will continue or where underlying inflation will settle over coming quarters,” he said, adding that there is “substantial further ground to cover to get back to price stability.”

If the Fed can get a handle on inflation, it will be able to deliver on the rate cuts the market is expecting, says Swiber. “But if inflation does prove stickier … the Fed is going to have to hold rates at a higher level for a longer period of time.”

CPI vs. Core CPI

For the Trading Week Ended Sept. 1

- The Morningstar US Market Index rose 2.73%.

- The best-performing sectors were technology, up 4.6%, and energy, up 3.8%.

- The worst-performing sector was utilities, down 1.5%.

- Yields on 10-year U.S. Treasuries decreased to 4.18% from 4.23%.

- West Texas Intermediate crude prices rose 7.17% to $85.55 per barrel.

- Of the 862 U.S.-listed companies covered by Morningstar, 684, or 79%, were up, and 178, or 21%, were down.

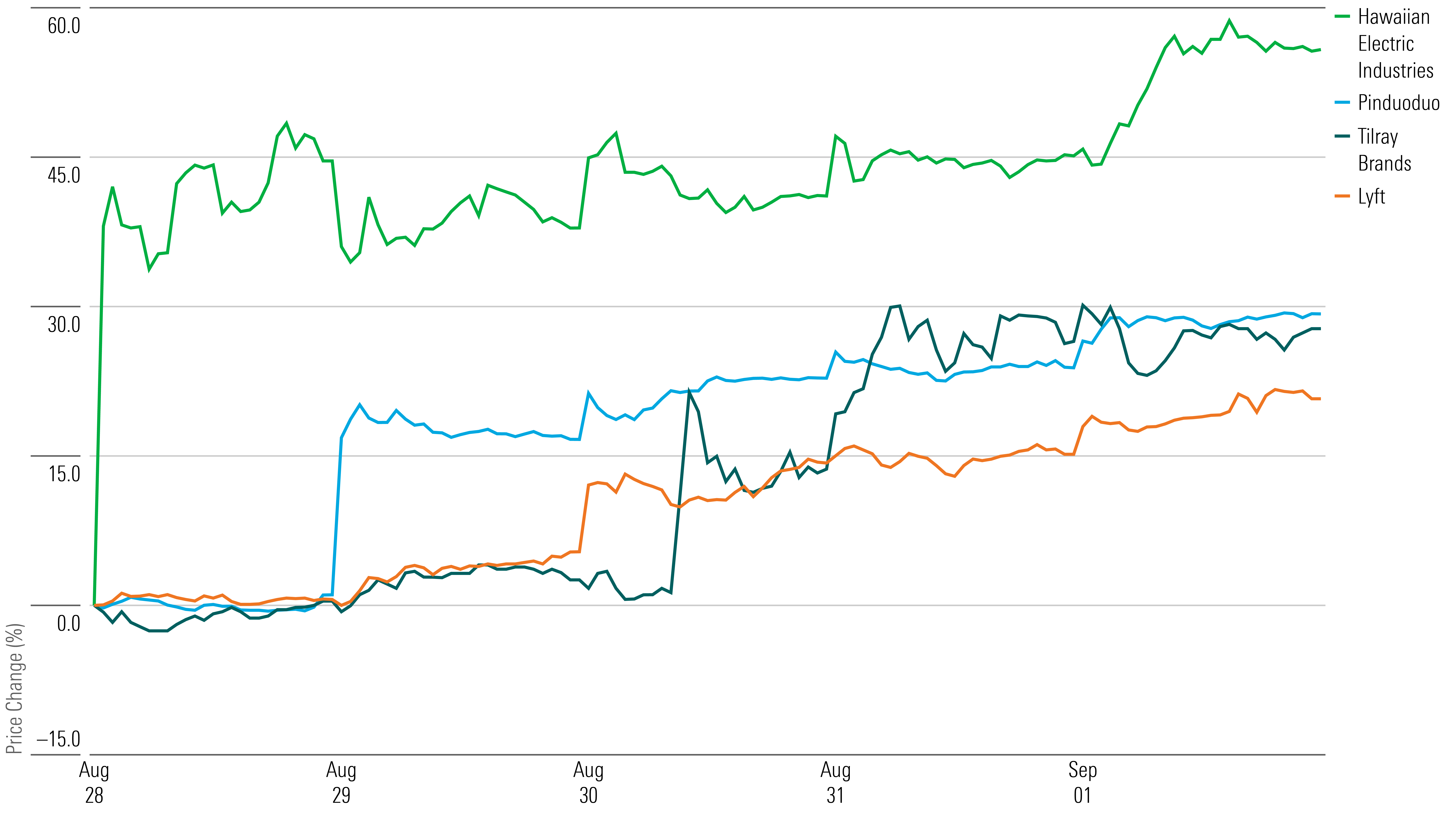

What Stocks Are Up?

Hawaiian Electric Industries HE stock ended the week up over 50% from the previous week after the utility company defended itself against accusations that it was liable for recent deadly wildfires in Maui.

A lawsuit against the firm claims it did not shut down service ahead of strong winds, leading power lines to fall over and ignite brush fires. The company released a statement saying it shut down power hours before the deadly fires began.

“We were surprised and disappointed that the County of Maui rushed to court even before completing its own investigation,” CEO Shelee Kimura said.

Shares for PDD Holdings PDD soared after second-quarter results showed solid growth. The internet retail company’s revenue increased 66% year over year to $1.75 billion, beating the Refinitiv estimate by 18%.

“Management observed solid recovery in consumption on Pinduoduo, the Chinese e-commerce platform, in the quarter,” Morningstar senior equity analyst Chelsey Tam writes. “Encouragingly, categories such as electronics and handsets, which are JD.com’s JD stronghold categories, and cosmetics, which is Douyin and Alibaba’s BABA strong category, grew well in the quarter at Pinduoduo.”

Shares for Canadian cannabis goods retailer Tilray Brands TLRY rallied following news that the U.S. Department of Health and Human Services recommended that the Drug Enforcement Administration reclassify the substance from a Schedule I to a Schedule III drug. Cannabis is currently listed as a dangerously abusable substance with no medical value; such a reclassification would define it as one with low abuse potential and some medical value.

“Lower scheduling would not necessarily be a panacea for the cannabis industry, but it could be enough to bring some important benefits to U.S. multistate operators, including paying normal tax rates, improved banking access, and potential listing on a major U.S. stock exchange,” Morningstar strategist Kristoffer Inton writes.

Lyft LYFT stock rose after Prashant Aggarwal bought about $1 million worth of shares. An early investor in the ride-hailing company, Aggarwal is a member of its board of directors. Earlier in August, CEO David Risher purchased stock in the company for $1.15 million, while CFO Dave Stephenson bought shares worth $100,000.

Highlighted Advancers

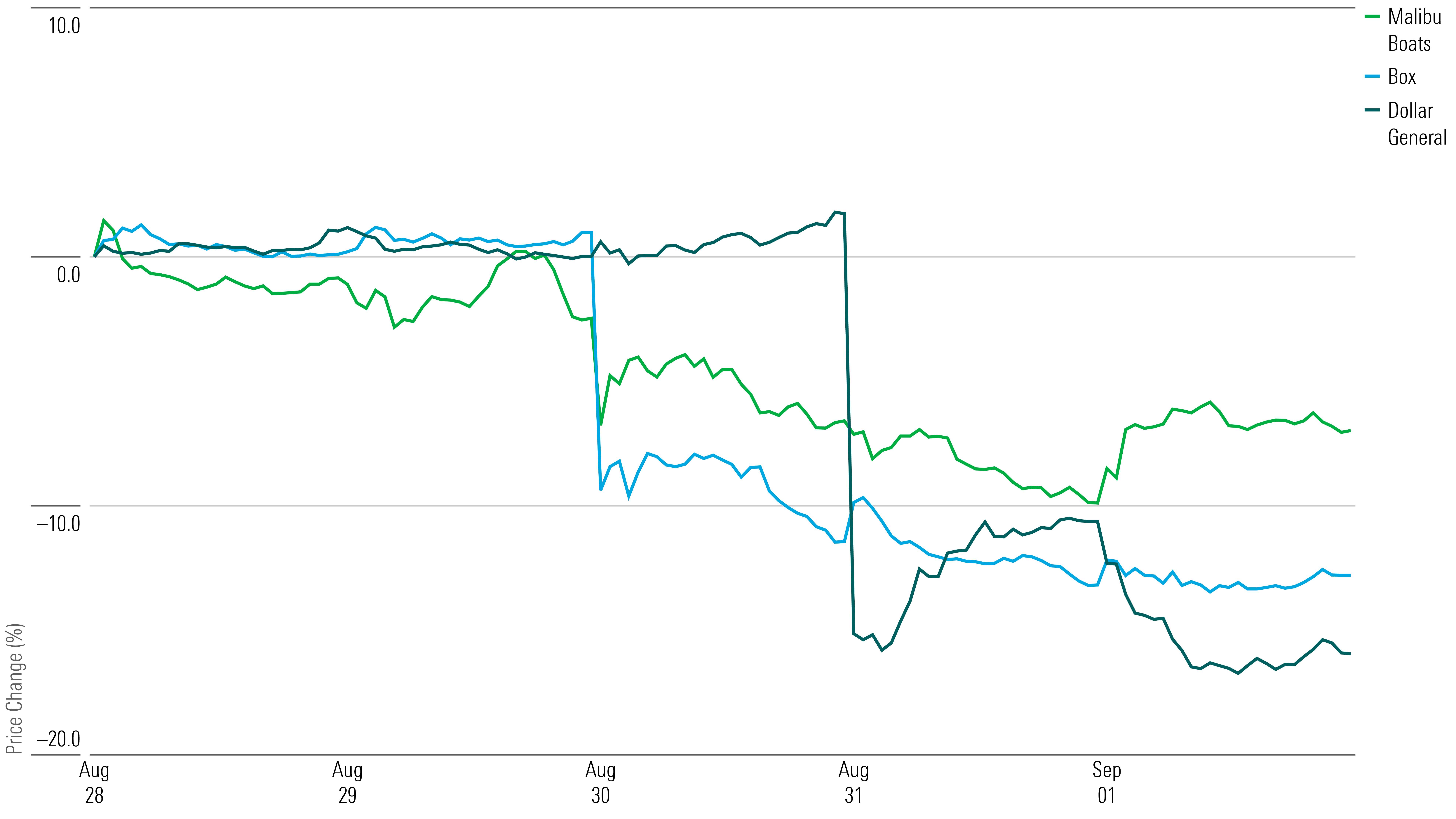

What Stocks Are Down?

For a second consecutive quarter, Dollar General DG reported lackluster results, reduced its outlook, and saw its stock fall as a result. Morningstar equity analyst Sean Dunlop explains that the discount retail chain’s target consumer “remains under pressure” as they refrain from buying seasonal discretionary items, home goods, and clothing. The company cut its full-year revenue outlook to a range of 1.3%-3.3% from 3.5%-5%. “The direction of the pressure is unsurprising, with consumers favoring lower-margin consumables (up 6%), but the magnitude surprised ourselves and management, driving the market’s reaction,” Dunlop adds.

Shares for Box BOX fell after fiscal second-quarter results showed weakened consumer spending. The software company’s sales rose 6% year over year to $261 million, but that still came below Morningstar analyst Malik Ahmed Khan’s expectations. Given the lack of “confidence in the firm’s ability to generate returns above its costs of capital in the long run,” Khan views Box as a “small fish in a large content collaboration pond, with the firm facing a tough competitive landscape.”

Malibu Boats MBUU stock declined after the company gave a weakened full-year sales outlook. The recreational boat retailer expects sales to fall to a percentage in the mid- to high teens. “The backlog at dealers has largely been remedied and the firm is taking a defensive stance on shipments, given consumer uncertainty,” Morningstar senior equity analyst Jaime M. Katz adds.

Highlighted Decliners

3 Top Stocks for the Next 10 Years

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PKH6NPHLCRBR5DT2RWCY2VOCEQ.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/FGC25JIKZ5EATCXF265D56SZTE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/AGAGH4NDF5FCRKXQANXPYS6TBQ.png)