Ocado Shares Soar on Amazon Takeover Talk

With a fair value estimate of GBP 15.50, Ocado is one of the most significantly undervalued European stocks covered by Morningstar.

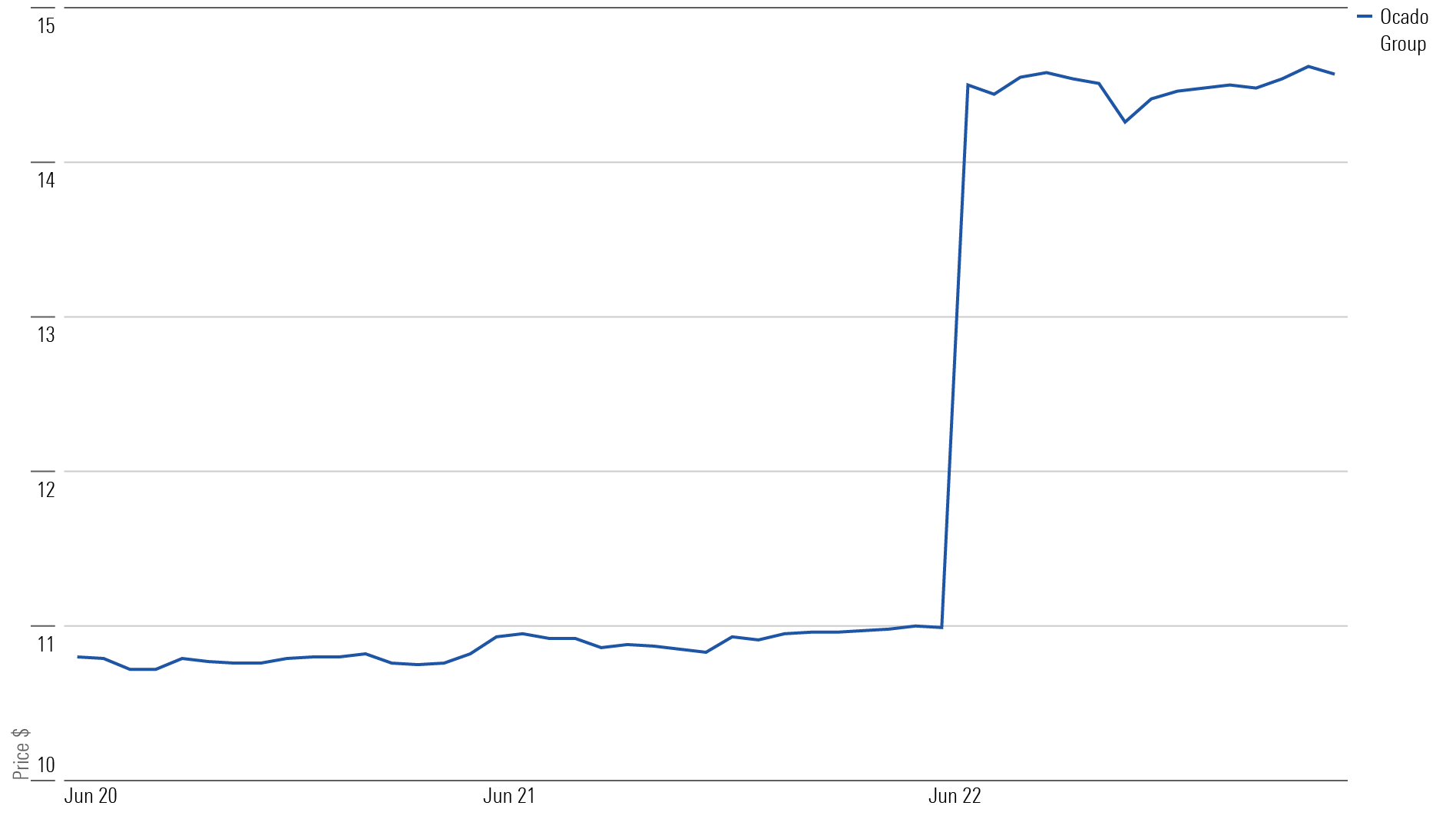

Shares in Ocado Group OCDO surged 35% in London on Thursday on media reports of takeover interest from Amazon.com AMZN.

Amazon declined to comment on a report in The Times that suggested the retail giant is looking to pick up the U.K. online grocer at a cheap valuation. But the report was enough to lift Ocado shares significantly.

Ocado shares have been sliding since they peaked in February 2021 at GBP 28, and they were recently trading below GBP 4. Investors have lost patience with the company’s path to profitability, especially after it reported a crashing GBP 500 million loss in February of this year. With food prices soaring, the cost-of-living crisis has also turned Britons toward cheaper grocery alternatives like Aldi and Lidl. An already-competitive supermarket sector has been put under significant pressure to avoid accusations it is using “greedflation” tactics, and the U.K. government has been in talks with retailers about ways to restrain price increases.

Ocado Group Stock Price

All this creates difficulties for Ocado’s premium-priced offering, which delivers Marks & Spencer groceries and Ocado-branded goods to households via Ocado liveried brands. M&S took a 50% share in Ocado’s retail business in February 2019, effectively ending the tie-up with Waitrose that had been in place since the company was founded.

Ocado stopped selling Waitrose products in September 2020, with Waitrose operating rival “click and deliver” services. Some customers have complained that prices have risen during the transition to M&S—a period in which prices for basic foodstuffs have hit multidecade highs.

Ocado Stock at a Glance

- Fair Value Estimate: GBP 15.50

- Morningstar Rating: 5 stars

- Morningstar Uncertainty Rating: Very High

- Morningstar Economic Moat Rating: None

Amazon’s Intentions

Amazon already has a foothold in the U.K. grocery market via a venture with Morrisons, which was taken private in 2021. In certain postcodes and metropolitan areas like London and Birmingham, customers ordering via Amazon Fresh receive Morrisons groceries.

Still, Morningstar senior equity analyst Ioannis Pontikis says, “A potential acquisition of Ocado by Amazon would be rather surprising, given the established and strong partnership Ocado has built with Kroger in the United States since 2018.”

He continues: “While it is understandable to contemplate Amazon’s desire to utilize Ocado’s proprietary technology for its own retail operations, including any non-U.S. licensing agreements with other grocers, it would certainly be intriguing to observe Kroger’s reaction, considering its position as a direct competitor to Amazon in the U.S. grocery market. The implications of such a deal remain uncertain due to the presence of exclusivity clauses within the U.S. agreements between Ocado and Kroger.”

The rally on the report has still not lifted Ocado shares close to their fair value according to Morningstar metrics. Morningstar assigns Ocado a fair value estimate of GBP 15.50, and it’s one of the most significantly undervalued European shares under the site’s coverage.

Correction: (June 22, 2023): A previous version of this article included an incorrect Morningstar Rating for Ocado. It is trading at 5 stars, not 3.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/31386fbf-60e6-4ce6-aad8-4a4cb1fc6847.jpeg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ECVXZPYGAJEWHOXQMUK6RKDJOM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KOTZFI3SBBGOVJJVPI7NWAPW4E.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/V33GR4AWKNF5XACS3HZ356QWCM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/31386fbf-60e6-4ce6-aad8-4a4cb1fc6847.jpeg)