Markets Brief: Why Schwab’s Sonders Thinks Stocks Are ‘In a Trickier Phase’

After the big rally, consolidation is needed, but Sonders sees opportunities among quality stocks.

Check out our weekly markets recap at the bottom of this article, with a look at the stocks making some of the past week’s biggest moves, including Capri Holdings and Eli Lilly.

Investors may be enjoying double-digit gains this year, but Charles Schwab chief investment strategist Liz Ann Sonders cautions against complacency.

She cites risks from the lagged impact of the Federal Reserve’s massive increase in interest rates, a weak landscape for corporate revenue in second-quarter earnings, and still-lofty stock valuations. “We’re not out of the woods yet,” Sonders says.

Sonders explains that “We’re in a trickier phase right now” compared with the start of the year when sentiment was buoyed by expectations of an end to Fed rate hikes, along with corporate earnings that weren’t as bad as had been feared.

A Healthy Pause, but Concerns Linger

Halfway through the third quarter, the market is up 17.3% in 2023 as measured by the Morningstar US Market Index, and up 25.9% from its October bear market low.

Most of those gains were chalked up prior to mid-July. In those first five months of the year, almost all the market’s returns came from the largest group of stocks, dubbed the “Magnificent Seven.” More recently, a wider array of stocks have participated in the rally, which analysts have seen as a positive sign for its durability.

The broadening of the rally can be seen by comparing returns on the most-watched indexes, where stocks are weighted by market size, and equal-weighted indexes, where each stock is given the same weighting. After lagging for much of the year, the Morningstar US Target Market Exposure Equal Weighted Index outperformed the capitalization-weighted Morningstar US Market Index in June and July.

Equal Weighted vs. U.S. Market Monthly Returns

However, since mid-July, the overall market has bounced within a relatively narrow range, with the US Market Index up 1.4% over the past month and the equal-weighted index up 1.1%.

“All else being equal, that’s a healthy thing,” says Sonders, with the market consolidating those first-half gains.

In the background, however, Sonders sees reasons for investors to tread carefully. For example, she points to a downgrade of bank ratings by Moody’s Investors Service, as well as signs of tighter credit across the economy. Combine this with the delayed impact of the Fed’s rate hikes on the economy, and there remains the risk of the credit markets sparking a surprise.

The Worst May Not Be Over for Earnings

While corporate earnings weren’t as bad as feared in the first quarter, Sonders sees some warning signs in second-quarter results. “The hope is that the worst is over for earnings, but that may be a bit too complacent,” Sonders says.

She points to signs that companies that have beaten their earnings estimates aren’t seeing their stocks pop higher as much as might be expected. “I think the attention has shifted to the revenue side of the story versus the earning side,” Sonders says.

“For the most part, the companies that have been beating on the bottom line have done it via cost cutting,” rather than growing revenue, she explains. The issue is that “there’s no revenue growth in nominal terms, and it’s negative in real terms” once revenue is adjusted for inflation.

Prior to this quarter, many companies saw revenue benefit from the jump in inflation, which allowed them to raise prices. Now that the economy has shifted to a disinflationary environment, Sonders says that “we’re starting to see who has actual pricing power versus who just rode the wave of inflation.”

Markets Overly Optimistic on Fed, Economy

Sonders thinks many in the markets are overly optimistic about Fed policy and the economy. Sentiment has swung from widespread expectations for a recession to the belief in a “soft landing” or “no landing,” where growth remains solid but inflation pressures continue to abate.

“This makes no sense in my mind,” she says. “The economy will always land; it’s just a question of the elongated process and contribution from what the Fed does.” Should there be no landing, “that will mean the Fed will either stay more aggressive or stay higher for longer.”

On that front, Sonders says expectations for Fed policy also seem misplaced. While the Fed is widely expected to keep interest rates steady through the rest of this year, the bond market is priced for more than five interest rate cuts in 2024—which she says is “part of the really optimistic narratives.”

“If the economy hangs in there, what is going to push the Fed to aggressively cut rates starting in early 2024?” Sonders asks. “It’s possible, but it would probably only be because of the combination of more disinflation with hits to the economy and/or labor market that justify easing and not just a pause.”

At Schwab, the view has been that the economy has been going through a series of rolling recessions across different sectors, such as housing and manufacturing. “If and when services get hit, that in turn will feed into more labor market weakness,” she says. “That’s the way I think about the best-case scenario, as opposed to the black-and-white idea of recession versus no recession.”

A Consolidating Market With Opportunities

In terms of the outlook for stocks, Sonders says some continued consolidation—wherein the overall market moves largely sideways—would be a positive. That’s especially the case if stocks that lagged the first part of the rally catch up, “and the former high-flyers get hit a little bit more.” She calls that “a beneficial outcome.”

U.S. Market Performance

But in this environment, there are still opportunities for investors. Sonders says Schwab is sticking to the “sector-neutral” view of the market, which means returns won’t be determined by, for example, winners in just the technology or energy sectors.

For the past year and a half, Schwab has been more focused on factors that will shape returns. “The factors we’ve been emphasizing have kind of a quality wrapper around them,” Sonders says. They include strong balance sheets, high free cash flow, self-funding companies, true pricing power, expanding or stable profit margins, positive earnings revisions, and positive earnings surprises.

“We’ve been emphasizing, and have said to our investors, that you can screen for those factors across the spectrum of sectors,” Sonders says.

For the Trading Week Ended Aug. 11

• The Morningstar US Market Index fell 0.46%.

• The best-performing sectors were energy, up 3.3%, and healthcare, up 2.1%.

• The worst-performing sectors were technology, down 3%, and basic materials, down 1%.

• Yields on 10-year U.S. Treasuries increased to 4.17% from 4.05%.

• West Texas Intermediate crude prices rose 0.45% to $83.19 per barrel.

• Of the 862 U.S.-listed companies covered by Morningstar, 397, or 46%, were up, and 465, or 54%, were down.

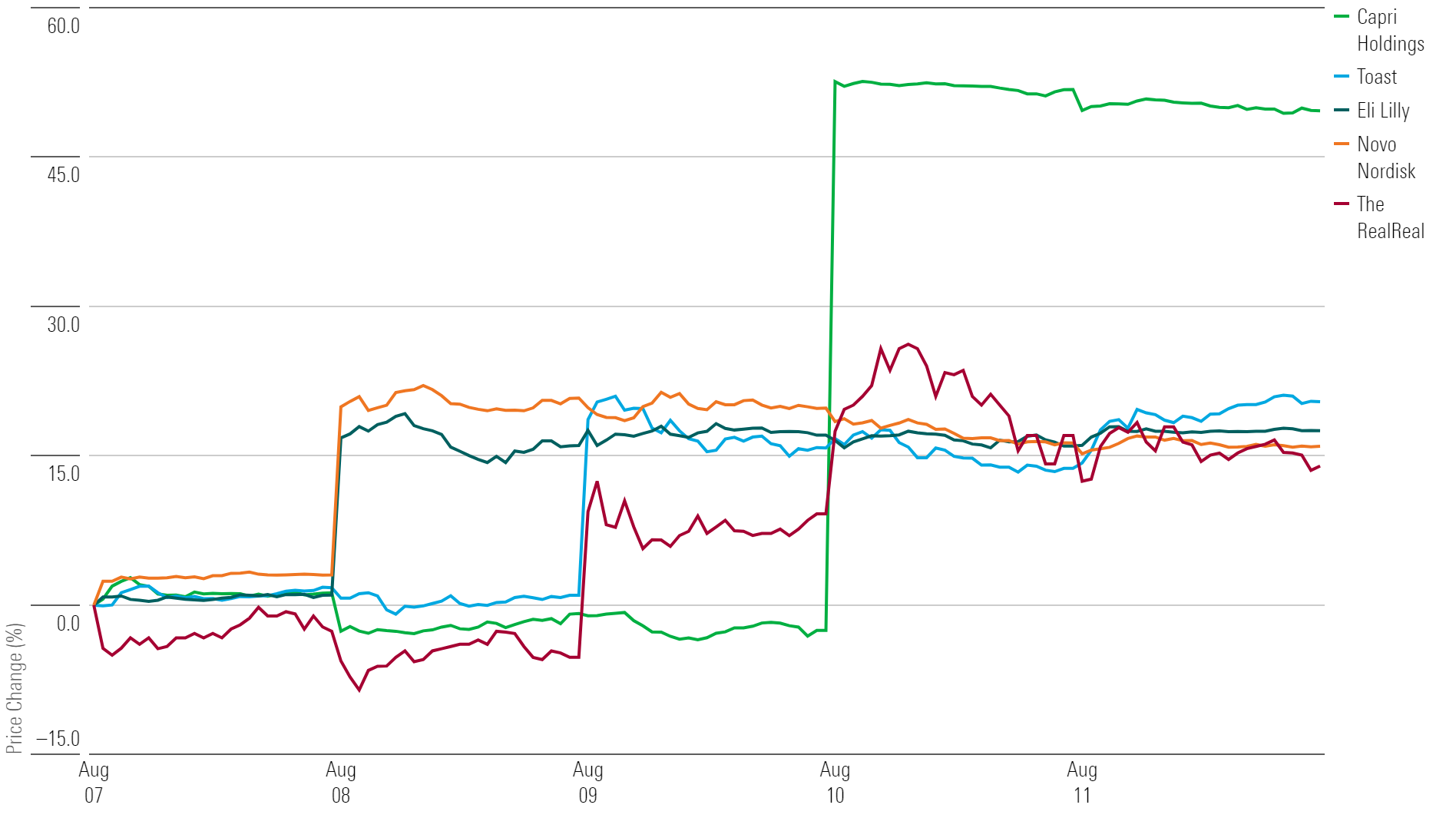

What Stocks Are Up?

Capri Holdings CPRI stock soared close to 50% following news that Tapestry TPR had acquired the firm. Luxury fashion brands owned by Capri, which include Michael Kors and Versace, will join those owned by Tapestry, such as Coach and Kate Spade. The companies combined generated $12 billion in sales and $2 billion in profit in the prior fiscal year.

Despite The RealReal’s REAL poor second-quarter results, its stock rose, as the market seemed to like the firm’s efforts to shrink its first-party sales business and boost profitability, according to Morningstar equity analyst Sean Dunlop. The luxury consignment platform’s $0.41-per-share loss fell below Dunlop’s estimate of $0.37, but the firm beat his estimate for revenue by $3 million.

Novo Nordisk NVO stock jumped after a study into its weight-loss drug Wegovy showed benefits for people with cardiovascular disease. The outcome also boded well for shares of Eli Lilly LLY, but Morningstar sector strategist Karen Andersen says that “the market is overly enthusiastic regarding the potential of these drugs.” The rally in Lilly’s stock was also driven by solid second-quarter results, which were supported by a lack of patent losses and the launch of new products—a trend Andersen says is expected to help accelerate growth for the rest of the year.

Shares of Toast TOST rose after the restaurant software provider posted strong sales for its second quarter. The firm generated $1.1 billion in sales due to new locations and growth in average revenue per unit in software. Both reported numbers beat Dunlop’s forecast, but he did note the company’s decline in processed payments per store.

Highlighted Advancers

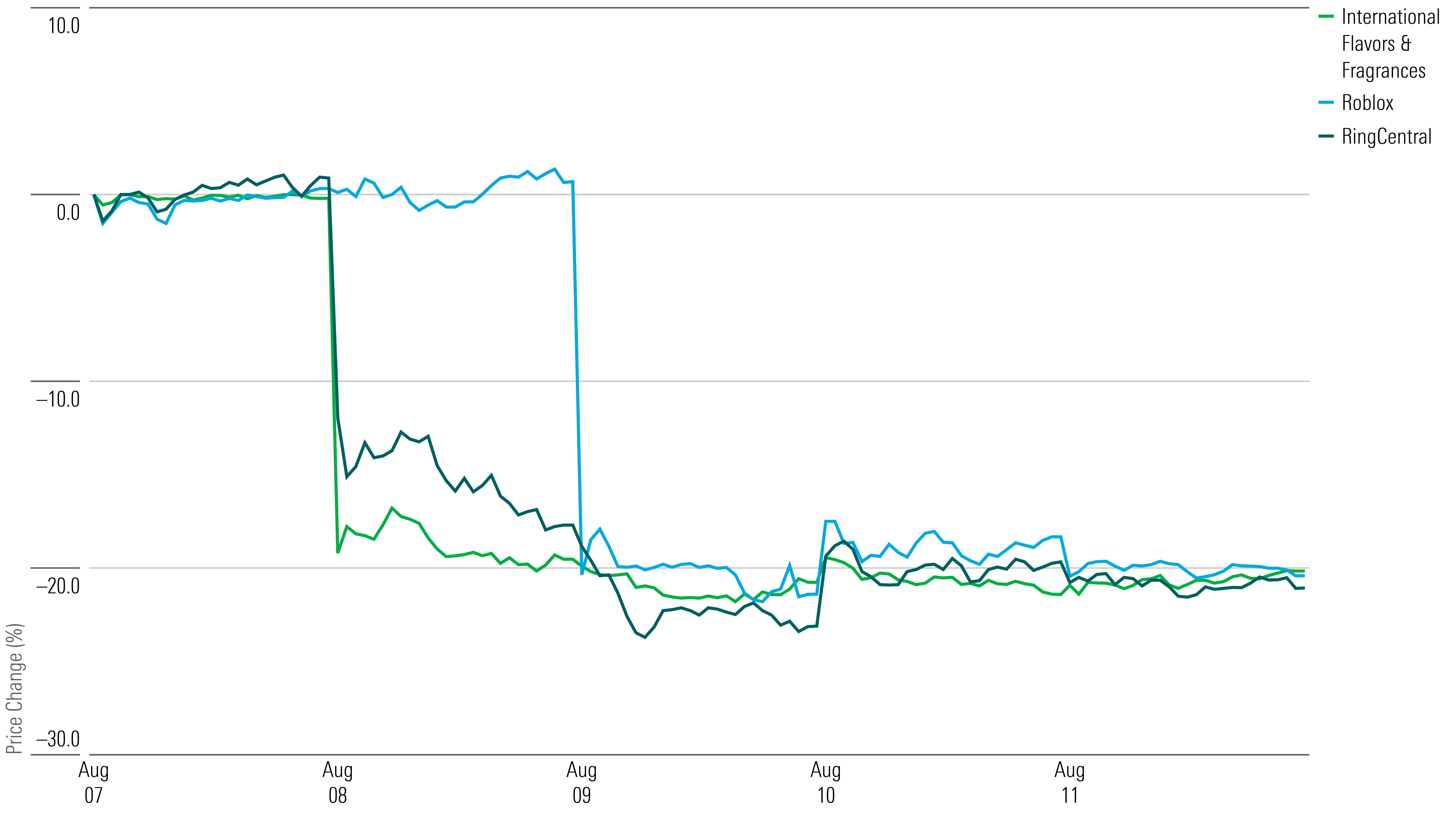

What Stocks Are Down?

PubMatic PUBM stock plummeted more than 45% after the advertising software publisher cut its guidance for the third quarter amid weakness in ad pricing and the bankruptcy of subsidiary MediaMath. Shares for Magnite MGNI initially fell in reaction in reaction to the company’s second-quarter report, but the advertising firm’s stock plunged after its own quarterly results showed weakness in connected TV ad buying. Morningstar senior equity analyst Ali Mogharabi, who covers both companies, expects the issues with ad sales to be short-lived as economic uncertainty lessens later in the year.

International Flavors & Fragrances IFF stock fell as investors showed skepticism over management’s ability to turn things around after cutting full-year guidance for the third time in recent quarters. The specialty chemicals producer’s second-quarter results revealed weakness in its functional ingredients business, which generates 25% of its total sales. The business also makes up half of the firm’s Nrevenuourish segment, which fell 50% year over year.

While RingCentral RNG reported solid but decelerating revenue growth for the second quarter, shares fell after the software provider announced Tarek Robbiati will succeed founder Vlad Shmunis as CEO. Robbiati previously served in executive positions at companies such as Hewlett Packard Enterprise HPE and Sprint. “While we see no issues with Robbiati, we think investors will question the logic of not bringing in a CEO with software roots,” says Morningstar senior equity analyst Dan Romanoff.

Roblox RBLX stock declined in response to mixed results for the video game company’s second quarter. The firm reported strong revenue growth but swelling operating losses. Morningstar senior equity analyst Neil Macker suspects that investors expected larger cost cuts.

Highlighted Decliners

Correction: (Aug. 14, 2023): A previous version of this article misspelled the name of Morningstar sector strategist Karen Andersen.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ed529c14-e87a-417f-a91c-4cee045d88b4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/GJMQNPFPOFHUHHT3UABTAMBTZM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZYJVMA34ANHZZDT5KOPPUVFLPE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LDGHWJAL2NFZJBVDHSFFNEULHE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ed529c14-e87a-417f-a91c-4cee045d88b4.jpg)