Markets Brief: What’s Wrong With Dividend Stocks?

Income-focused strategies have missed out on the year’s rally, but dividends still look promising.

Check out our weekly markets recap at the bottom of this article, with a look at the stocks making some of the past week’s biggest moves, including U.S. Cellular and EVgo.

Even as the stock market has roared back in 2023, many dividend stocks have floundered.

Their struggles reflect the year’s narrow rally, which has been focused on names in artificial intelligence. Sectors with many of the highest-quality durable dividends—healthcare, energy, and financial services—have suffered in comparison.

“The big winners this year haven’t been the dividend champions,” says Dan Lefkovitz, a strategist for Morningstar Indexes.

The Morningstar Dividend Composite Index—a broad measure of dividend stock performance—has risen 7.7% through July. That’s less than half of the wider market’s 20.6% gain as measured by the Morningstar US Market Index.

Meanwhile, the Morningstar High Dividend Yield Index, which focuses on the higher-yielding half of the U.S. dividend-paying market, is up just 3.9% for the period. In addition, the Morningstar Dividend Leaders Index—a collection of the 100 highest-yielding stocks with a consistent history of paying their dividends and a demonstrated ability to sustain their dividends going forward—has mostly flatlined, up only 0.9% for the same period.

2023 Dividend Performance

“Overall, dividend performance this year has been lackluster,” says Lefkovitz. The returns on dividend stocks this year mark a dramatic reversal from 2022, when dividend payers shined as the broader market fell into bear territory.

Lefkovitz cautions investors against reading too much into the short-term underperformance. “The great thing about dividend investing is that it’s got a great track record. Plus, investors get paid while they wait for performance to turn around,” he says.

Dividend Stocks Missed Out on the (Tech) Rally

Through the first half of 2023, nearly all the returns in the Morningstar US Market Index came from the very largest technology stocks, including Apple AAPL, Microsoft MSFT, and Nvidia NVDA—none of which are known for their dividend payouts.

“The equity income section of the market has suffered from lack of exposure to artificial-intelligence-related businesses and too much exposure to underperforming banks, biopharma stocks, and the energy sector,” writes Lefkovitz in his recent look at 2023′s dividend doldrums.

Among the highest-quality dividend stocks, only 4.8% come from the technology sector. The group is heavily weighted among financial services (21.9% of the index), energy (17.0%), and healthcare (16.0%).

By comparison, the U.S. stock market is made of 28.4% technology stocks by weight as of July 31, as measured by the Morningstar US Market Index. Because of this, when tech stocks do well, the market benefits disproportionately, but dividend stocks may not be along for the ride.

Technology Sector Allocations

The Morningstar US Dividend Growth Index—a collection of stocks with a history of increasing their dividends steadily over several years, plus a healthy margin to continue growing those dividends—carries 17% technology stocks by weight.

The broader dividend composite index carries a similar-size weighting of 16.1% technology stocks. That’s more than the dividend leaders group, but still 11 percentage points lower exposure to technology stocks than the broader U.S. stock market.

Both the dividend growth and the dividend composite indexes are up 7.7% for the calendar year through July, ahead of the dividend leaders but far behind the Morningstar US Market Index.

(Lack of) Competition From Bond Yields

Conventional wisdom about the performance of dividend stocks holds that rising bond yields are bad for dividend payers. However, Lefkovitz says the historical connection between dividends and rising rates is not straightforward.

“Interest rates are just one variable out of many for dividend performance,” he explains. “We’ve seen dividend payers both outperform and underperform in rising rate environments.”

Lefkovitz believes it’s not worth putting much emphasis on rates when it comes to income-focused investing. “It’s really more about what has been in and out of favor in the equity market,” he says.

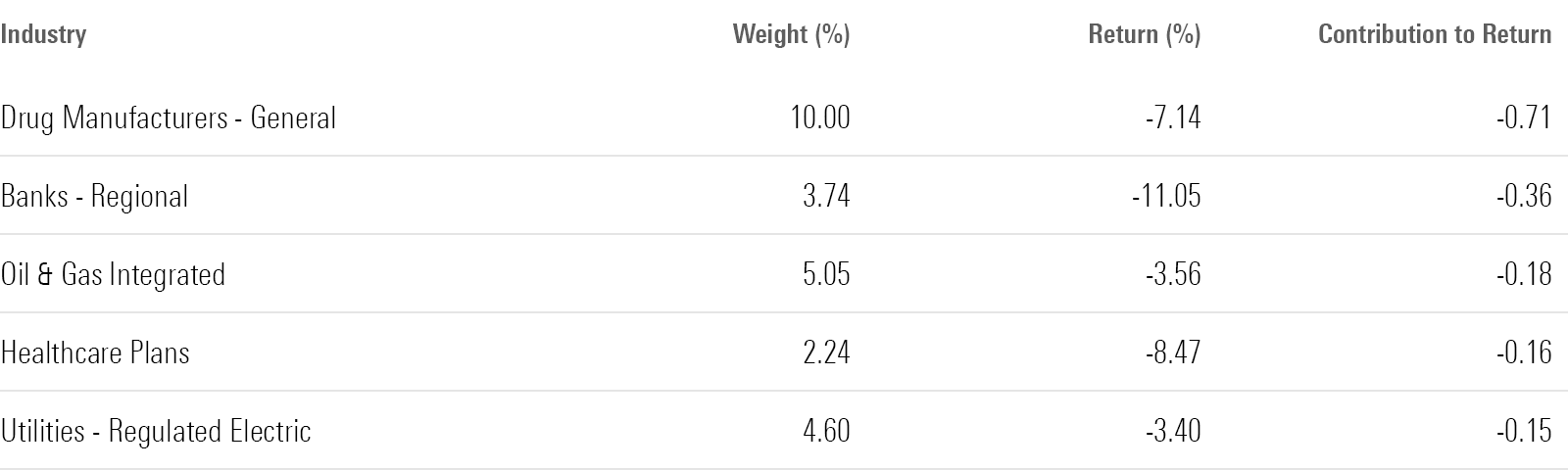

Which Dividend Stocks Underperformed?

Healthcare, utilities, and energy stocks were among the key detractors within the dividend universe as measured by the Morningstar US Dividend Composite Index.

Pharmaceutical giant Pfizer PFE dragged the index down the most, with losses of 27.2% in 2023 through July. Next was the wireless service provider and index heavyweight Verizon Communications VZ, whose 2.1% weighting in the dividend composite index meant its 10.8% loss in 2023 had a sizable impact on the index’s overall performance. Oil and gas companies Chevron CVX and Devon Energy DVN, as well as utilities company NextEra Energy NEE, also made the list of the 10 most impactful detractors.

Dividend Composite - Detracting Industries

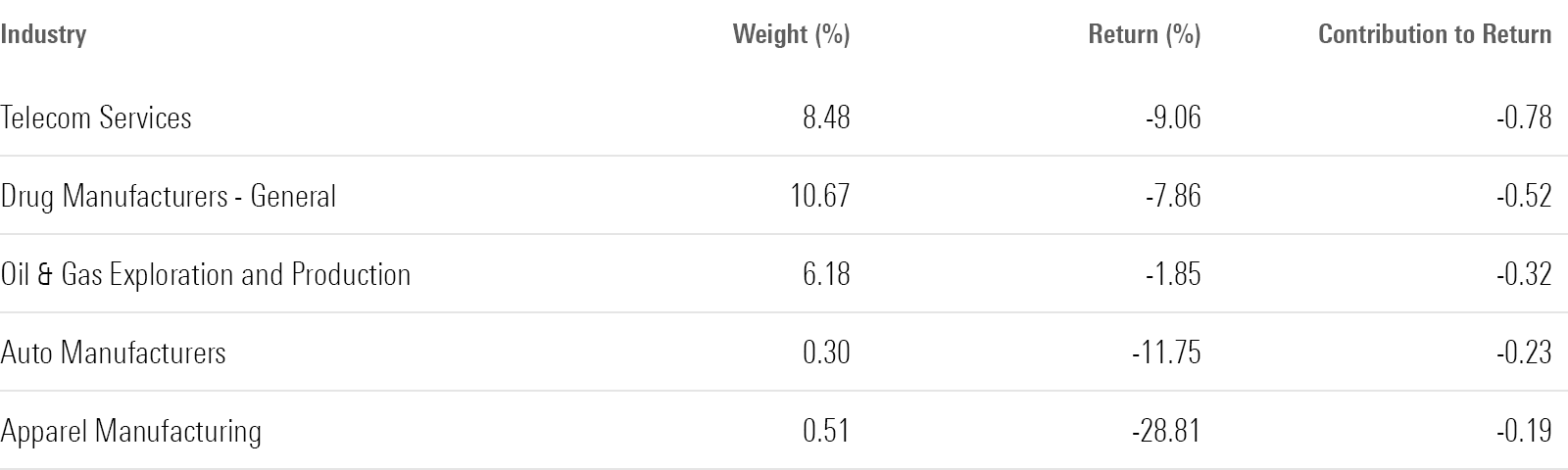

Which Dividend Leaders Fell Furthest?

Stocks from the communication services, healthcare, and consumer cyclical sectors dragged the Morningstar Dividend Leaders Index down furthest.

Alongside Verizon and Devon Energy, North Carolina-based regional bank Truist Financial TFC (down 20.4% in 2023) and pharmaceutical firm AbbVie ABBV (which only lost 4.7% but carries 7.4% of the index’s weight) were the leading detractors.

Ford Motor F, developer of infectious disease treatments Gilead Sciences GILD, and retail pharmacy chain Walgreens Boots Alliance WBA were also key detractors.

Dividend Leaders - Detracting Industries

Dividend Stocks Look Cheap

“The good news is that a lot of dividend-rich areas of the market are attractively valued right now—financial services and healthcare among them,” Lefkovitz says.

The weighted-average valuation of the Morningstar US Financial Services Index stood at 0.87 on July 31, well below its fair value of 1.00 and discounted compared to the Morningstar US Market Index, which carried a weighted-average valuation of 0.94 as of July 31. Several large dividend-paying healthcare stocks are currently in deep discount territory, including CVS Health CVS, Pfizer, Medtronic MDT, and Gilead.

For the Trading Week Ended Aug. 4

- The Morningstar US Market Index fell 2.22%.

- The best-performing sector was energy, up 1.3%.

- The worst-performing sectors were utilities, down 4.5%, and technology, down 3.9%.

- Yields on 10-year U.S. Treasuries increased to 4.05% from 3.97%.

- West Texas Intermediate crude prices rose 2.78% to $82.82 per barrel.

- Of the 848 U.S.-listed companies covered by Morningstar, 224, or 26%, were up, and 624, or 74%, were down.

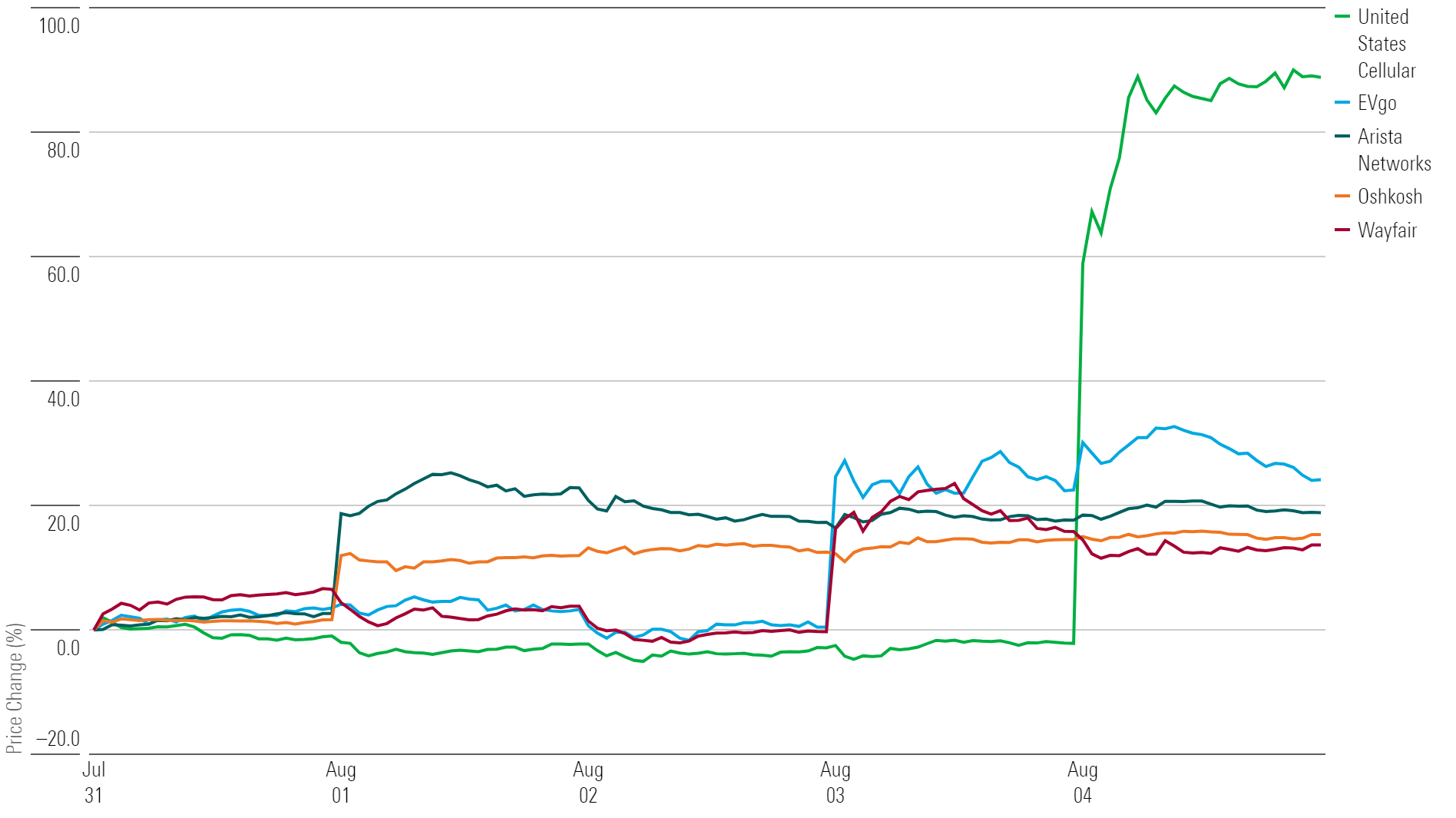

What Stocks Are Up?

Shares for U.S. Cellular USM soared more than 90% on Aug. 4 after the company announced that it is exploring “strategic alternatives” with Telephone and Data Systems TDS, which owns an 83% stake in the mobile network operator. While both companies say there is no definitive timetable for this review and no assurance regarding its outcome, it may mean TDS is considering a sale or merger for U.S. Cellular, which reported lower-than-expected results for its second quarter.

EVgo EVGO stock surged in reaction to the electric vehicle manufacturer’s second-quarter revenue increasing 457% from the same period in 2022. Management raised its full-year outlook for revenue, and now expects to generate between $120 million and $150 million. The company also showed 147% year-over-year growth in its network throughput, which is attributed to rising EV adoption.

Shares for Arista Networks ANET rose after the computer networking company posted strong second-quarter results. Revenue increased 39% year over year to $1.46 billion, with the firm expected to grow more in the coming years due to enthusiasm for artificial intelligence. Arista’s outcome is attributed to the demand for cloud services and strong spending across its user base.

Oshkosh OSK stock jumped in reaction to the truck manufacturer’s earnings per share of $2.69 coming about 64% above FactSet consensus estimates. Sales grew close to 36% year over year to $1.3 billion. “Demand in access equipment was strong, thanks to increased infrastructure and mega project spending,” Morningstar equity analyst Dawit Woldemariam says. “On top of that, access fleet ages are currently elevated, which is pushing construction contractors to replace their equipment.”

Wayfair W stock rose after the company posted better-than-expected results for the second quarter, with its earnings per share of $0.21 surpassing the forecast $0.72 loss. The home furniture retailer also showed improvement in its ability to lower costs with a reported loss of $46 million, down from $379 million in the same period in 2022.

Highlighted Advancers

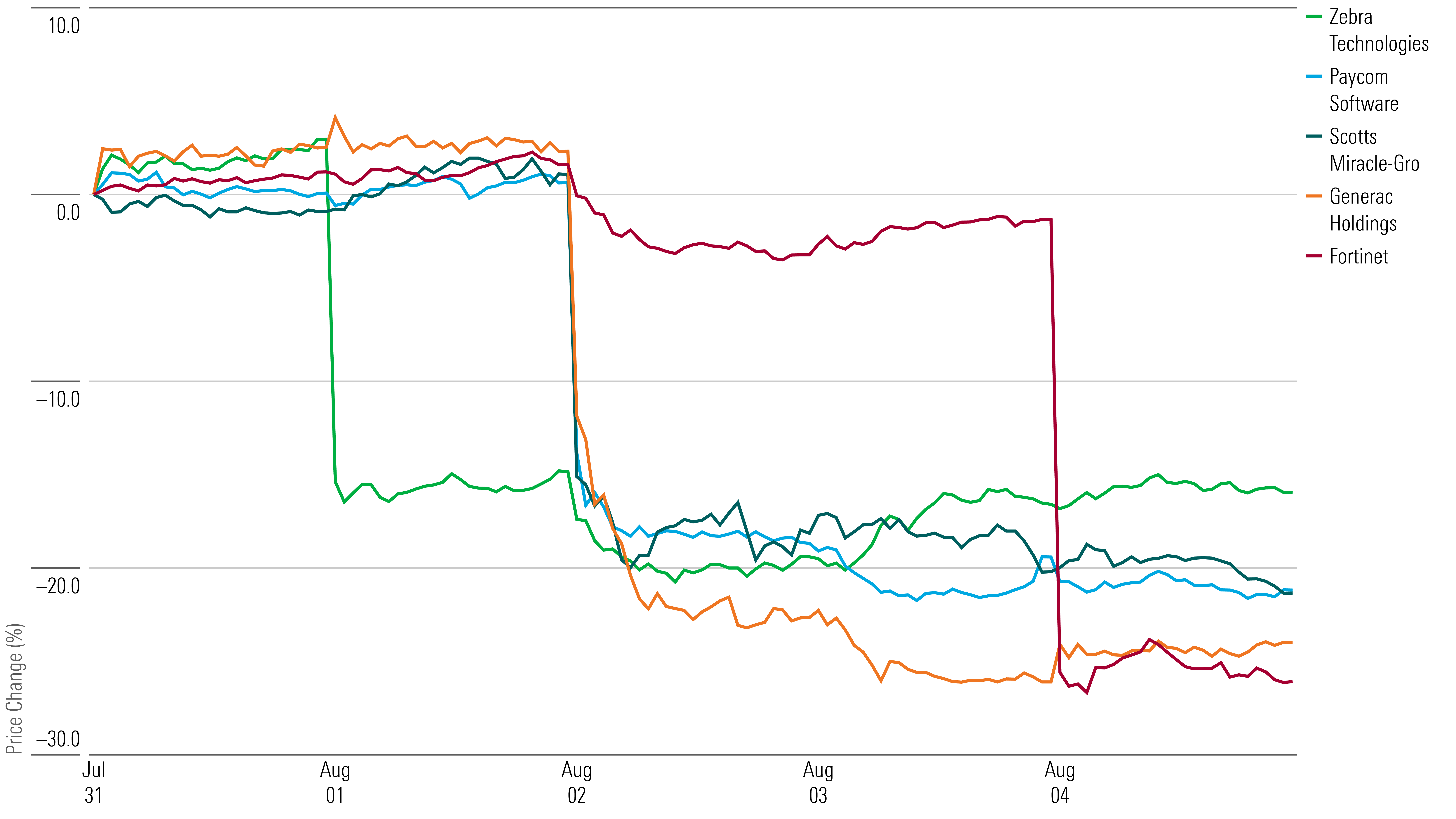

What Stocks Are Down?

Shares for Fortinet FTNT fell after investors were let down by the cybersecurity firm’s mixed second-quarter results. The company’s quarter was marred by a slowdown in billings, showing waning demand for its products. While macroeconomic headwinds may have given investors reason to trade the stock in the near term, Morningstar analyst Malik Ahmed Khan says the reaction was overly punitive, as Fortinet “stands to be a long-term winner in the security space.”

Generac Holdings GNRC stock sank in reaction to the company’s reduced sales outlook for the rest of the year and growing investor expectations amid heat waves putting pressure on power grids. The backup generator manufacturer expects sales to decline between 10% and 12%, up from the prior forecast of 6%-10%. Morningstar equity analyst Brett Castelli says that the primary driver is “weakness for the company’s residential products, namely home generators and clean energy,” as Generac blames the macroeconomic environment for lower-than-expected closed rates for generators.

Paycom Software PAYC stock declined after the firm posted a disappointing near-term profitability outlook, which overshadowed sales growth. The result stemmed from the slower-than-expected conversion to the software provider’s self-service payroll processing system. Morningstar equity analyst Emma Williams suspects that “constrained budgets and elongated approval processes at existing clients amid uncertain macroeconomic conditions” hindered efforts, but believes that “the market is overreacting to these cyclical headwinds.”

Scotts Miracle-Gro SMG showed little progress in its efforts to restore profitability during its fiscal 2023 third quarter, sending its stock down. Profits for the gardening products manufacturer were hurt by a combination of cost inflation, lower volumes, and reduced plant capacity utilization, leading Morningstar strategist Seth Goldstein to reduce his near-term outlook.

Shares for Zebra Technologies ZBRA fell after the mobile computing company missed second-quarter expectations and reduced its full-year outlook. Sales dropped 17% year over year to $1.2 billion due to weakened demand “in the wake of growth and customer inventory build up as the pandemic subsided,” Morningstar analyst William Kerwin says.

Highlighted Decliners

The author or authors own shares in one or more securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/AGAGH4NDF5FCRKXQANXPYS6TBQ.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZYJVMA34ANHZZDT5KOPPUVFLPE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/QFQHXAHS7NCLFPIIBXZZZWXMXA.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)