Markets Brief: These Stocks Led Us Into a New Bull Market

Tech giants like Microsoft and Apple dragged the market into bear territory, then lifted it back up.

Check out our weekly markets recap at the bottom of this article, with a look at stocks making some of the past week’s biggest moves—such as Cava and UnitedHealth Group—and a calendar of the coming week’s economic and corporate news.

The end of the bear market may have been a case of “What comes down must go up.”

The stocks that battered the market in 2022—including mega-cap tech giants Microsoft MSFT, Apple AAPL, and Nvidia NVDA—are the same ones that have led the current rally and (by some definitions) kicked off a new bull market.

Last year brought the worst losses for U.S. stocks since 2008, leading the market into bear territory from its high on Jan. 3, 2022. There’s no official scoring of what constitutes a bull or bear market. A bear market is generally defined as one that’s declined more than 20% from its peak. When the Morningstar US Market Index hit its most recent low on Oct. 14, 2022, it was down 25.4% from its Jan. 3 high.

Stocks have broadly pushed higher from that low, leading to what some are calling a new bull market. Many consider a rise of 20% from a market trough to be the start of a bull period, and the rally in the Morningstar US Market Index crossed that threshold on June 6, 2023, when it closed up 20.4% from its October low point.

Some argue that a new bull market doesn’t start until an old high-water mark is reached. Until then, they view any rise—even ones over 20%—as rallies within a bear market. With the US Market Index still down roughly 10% from its 2022 peak, that would mean stocks are not yet in a bull period.

Based on the more commonly used definition of a bull market, here’s a look at the sectors, industries, and individual stocks that led the bear market, along with those that have paced the rally back into bull territory.

Morningstar US Market Index Performance

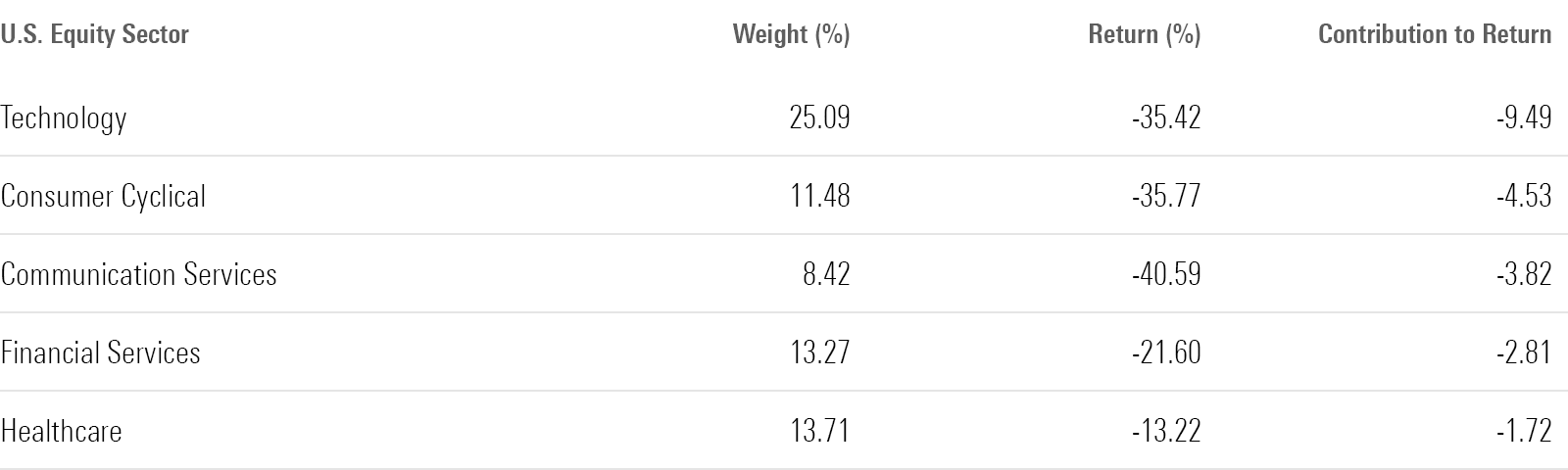

Which Sectors Were Hit Hardest in the 2022 Bear Market?

It was mostly technology and consumer cyclical stocks that dragged the market down. From Jan. 4 through Oct. 14, 2022, technology companies in the Morningstar US Market Index fell 35.4% as a group, contributing 9.5 percentage points (or 37%) of the 25.4-point loss during the period. During the same time, consumer cyclical stocks in the index lost 35.8% as a group, contributing 4.5 percentage points (18%) of the total loss.

Among industries, software infrastructure—companies that build and support operating systems, cloud storage, and networking solutions—contributed most to the losses. The industry fell 34.3% during the full bear market period.

The second-worst-performing industry was internet content and information—a grouping of companies that provide social media, search engines, and networking platforms. This includes Google parent company Alphabet GOOGL, Facebook parent company Meta Platforms META, and food delivery platform DoorDash DASH. The industry lost 43.9% as a group over the course of the bear market.

U.S. Market Detracting Sectors

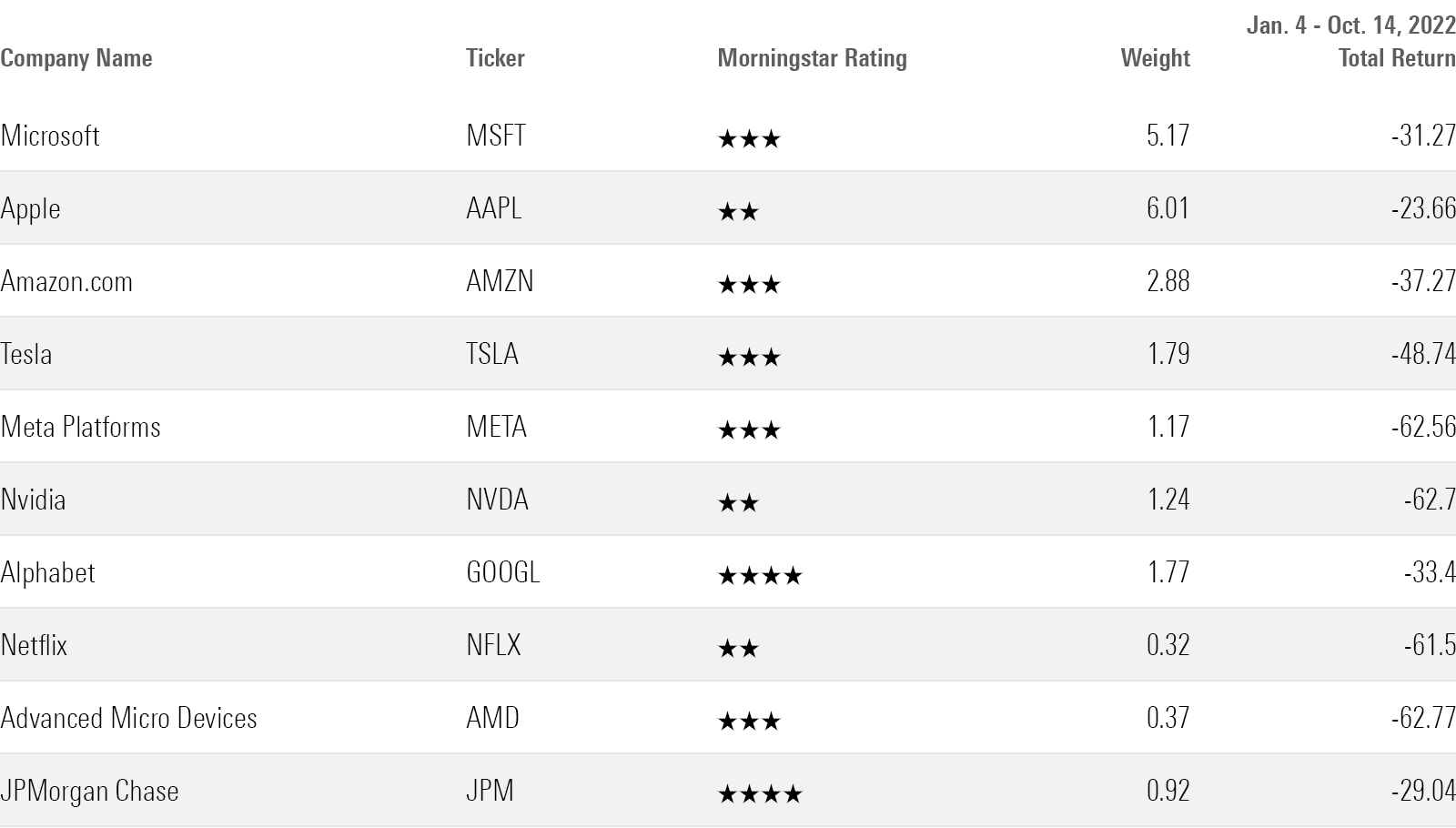

Which Stocks Dragged the Market Into Bear Territory?

Among individual stocks, tech giants Microsoft, Apple, and Amazon.com AMZN knocked the Morningstar US Market Index down the furthest during the bear market. Other key detractors included Tesla TSLA, Nvidia, and Alphabet.

U.S. Market Leading Detractors

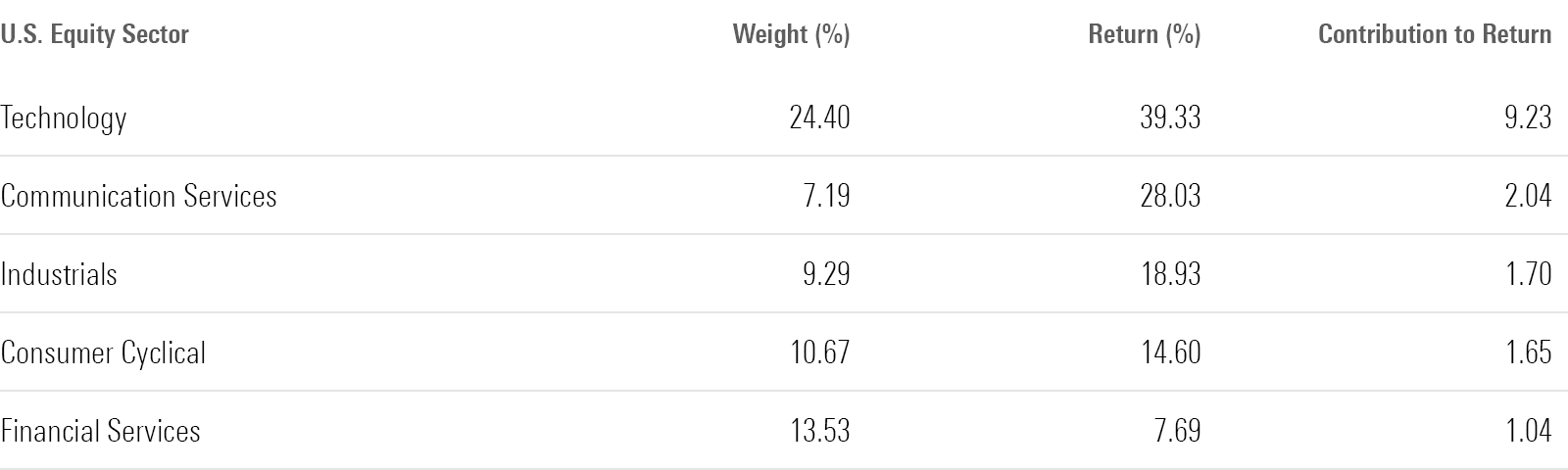

Which Sectors Have Led the Bull Market Rally?

Technology stocks have been the leaders in the Morningstar US Market Index’s rally since the Oct. 14 low and for the year to date through June 9. The sector, which composes 24.4% of the total index, has returned 39.3% since the low, contributing 9.23 percentage points to the U.S. market’s 20.7 percentage-point return. In 2023, the Morningstar US Technology Index has gained 35.6% for the year through June 9.

At the industry level, semiconductor stocks—encompassing companies that design, build, and sell microchips, integrated circuits, memory chips, solar power systems, and the parts and tools used to make them—have contributed most to the rally, with returns totaling 84.1% since the low. In 2023, the Morningstar US Semiconductors Index has risen 64.2% through June 9.

The software infrastructure industry also made a sizable contribution, as the group gained 40.4% since the Oct. 14 low through June 9. The Morningstar US Software Infrastructure Index is up 35.2% in 2023.

U.S. Market Leading Sectors

Which Stocks Have Led the Rally?

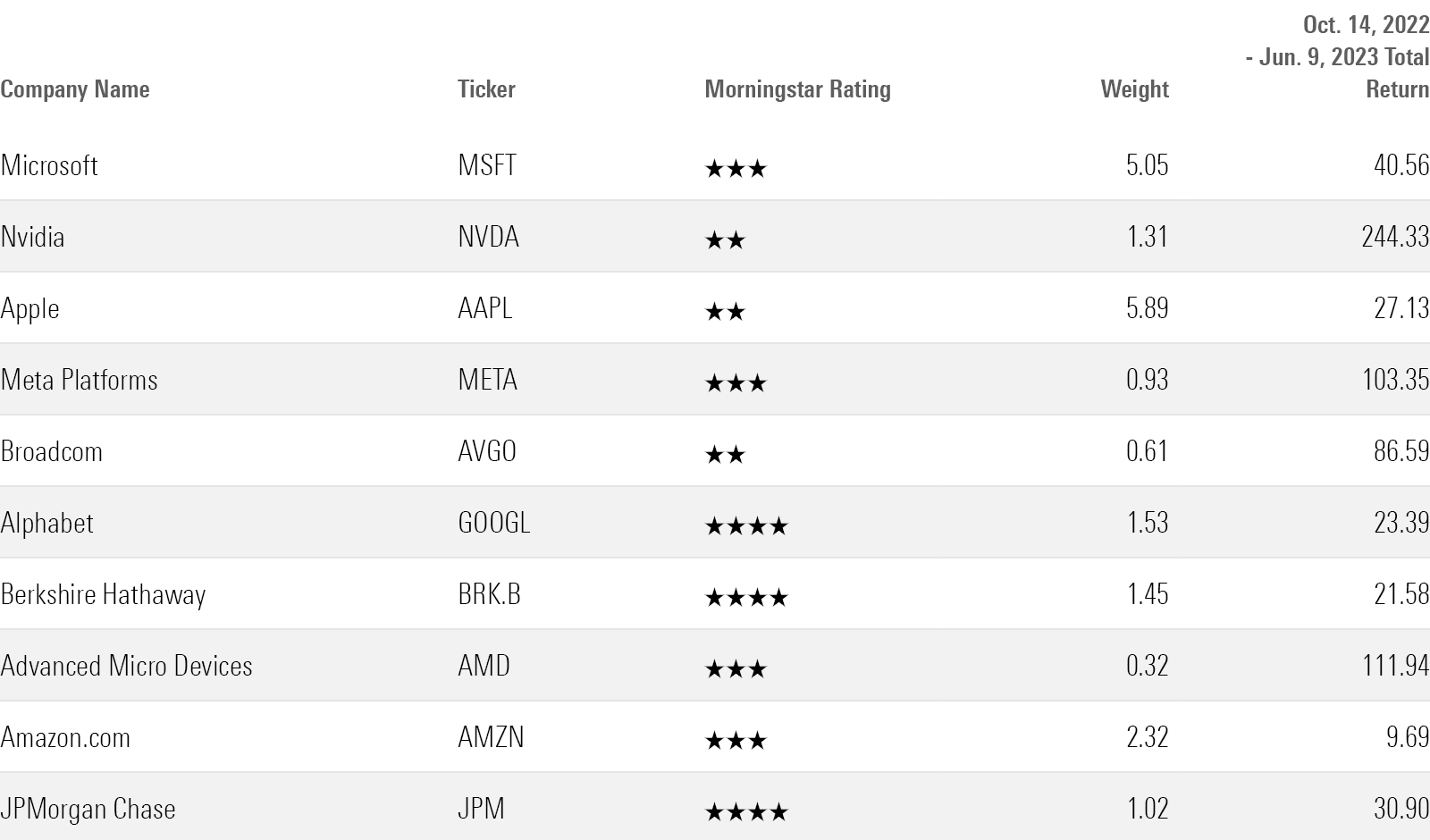

Looking at the performance of individual stocks, Microsoft and Nvidia have been the leading contributors to the new bull market. Microsoft has returned 40.6% since the low on Oct. 14, 2022—36.9% in 2023 alone. Nvidia is up a whopping 244.3% since the low and 165.4% for the year to date.

Apple, the largest stock in the Morningstar US Market Index with a weighting of 6.6% as of May 31, has also been a market-moving driver of returns with its gain of 27.1% since the October 14 low through June 9. Meta, which made up 1.5% of the U.S. market index as of May, also helped lift stocks into the new bull market with its gain of 103.4%.

U.S. Market Leading Contributors

Events Scheduled for the Coming Week

- Monday: Markets closed in observance of Juneteenth.

- Tuesday: FedEx FDX and Winnebago Industries WGO report earnings. New Residential Construction report for May releases.

- Wednesday: Federal Reserve Chair Jerome Powell testifies to Congress about Fed policy and the economy.

- Thursday: Accenture ACN, Darden Restaurants DRI, and FactSet Research Systems FDS report earnings.

- Friday: CarMax KMX reports earnings.

For the Trading Week Ended June 16

- The Morningstar US Market Index rose 2.57%.

- The best-performing sectors were technology, up 4.5%, and consumer cyclical, up 3%.

- The worst-performing sector was energy, down 0.5%.

- Yields on 10-year U.S. Treasuries increased to 3.78% from 3.74%.

- West Texas Intermediate crude prices rose 2.29% to $71.78 per barrel.

- Of the 850 U.S.-listed companies covered by Morningstar, 684, or 80%, were up, and 166, or 20%, were down.

What Stocks Are Up?

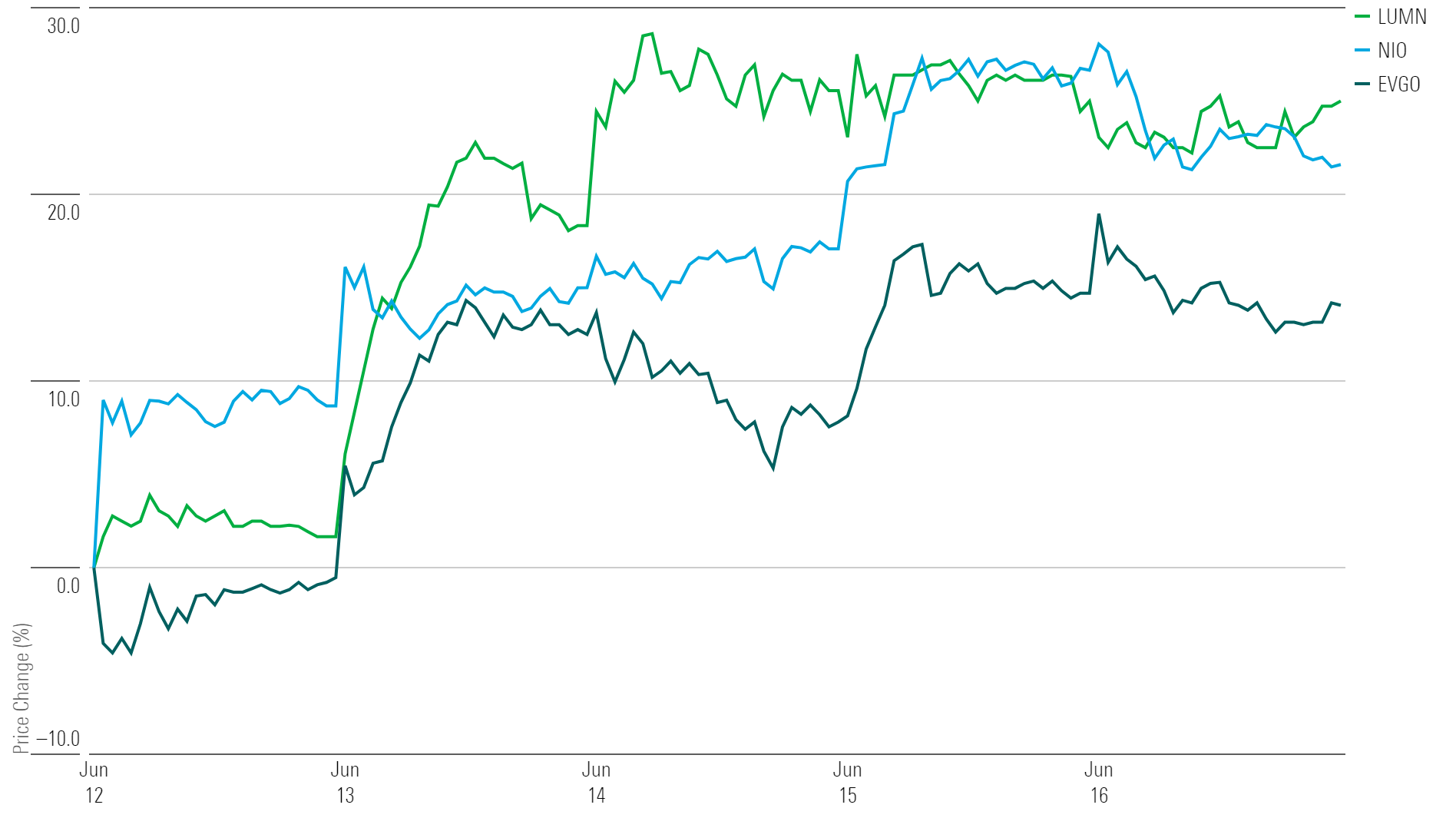

The Mediterranean fast-casual restaurant chain Cava Group CAVA began trading Thursday morning, with its shares priced at $42, up almost double from its initial public offering price of $22. It saw its stock rally by 99% during its debut on June 15 and finished the week down about 13%.

Nio NIO stocks rallied after the Chinese automobile manufacturer posted its first-quarter results. Although the company accrued losses due to weakened vehicle margins and increased operating expense ratios, Nio’s outlook reassures investors with the launch of new car models.

“We believe Nio’s premium branding through exemplary customer service and innovative charging technologies will differentiate itself from the competition and benefit from vehicle upgrade demand,” writes Morningstar equity analyst Vincent Sun.

EVgo EVGO stocks rose after it announced it will accelerate the output of its connectors for electric vehicles following news of Tesla’s TSLA collaboration with Ford Motor F and General Motors GM. The infrastructure company, which specializes in building and operating charging networks for EVs, stands to benefit from the increasing adoption of such vehicles and the announcement of similar partnerships.

Lumen Technologies LUMN stock gained after it unveiled plans to launch a new network interconnection ecosystem with Alphabet GOOGL and Microsoft MSFT. Already implemented in three large U.S. areas, the platform would improve traffic between networks for users. The rally reversed declines posted the previous week.

Highlighted Advancers

What Stocks Are Down?

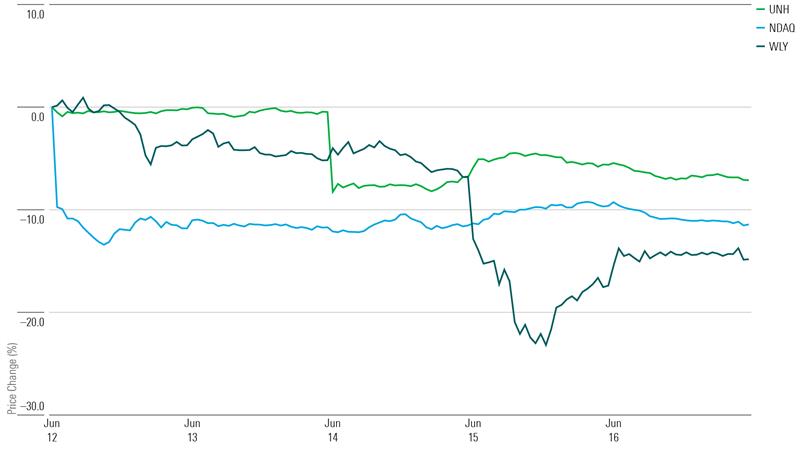

John Wiley & Sons WLY stock fell following the release of its fourth-quarter results. The publishing company announced it will divest from three of its noncore subsidiaries, which together accounted for close to 20% of its sales for the fiscal year.

Erin Lash, director of consumer sector equity research at Morningstar, says the firm’s core business had a lackluster year due to constraints from transitory issues. Additionally, its 2024 outlook includes a low-single-digit sales decline and a 30%-40% softening of its adjusted earnings per share. She expects that “it will take time to turn the business around.”

Nasdaq NDAQ stock declined after it announced its intent for a $10.5 billion acquisition of Adenza, a software company that specializes in risk management and post-trade reporting. The holding company will pay the deal with $4.75 billion in cash and the issuance of over 85 million in shares.

Although the acquisition may help Nasdaq drive its revenue to double-digit growth, Morningstar equity analyst Michael Miller says the holding company would be paying almost 18 times forward revenue for the firm, and that “it will take considerable time or an acceleration in revenue growth for Nasdaq to justify its investment.” Nasdaq expects its move to become earnings accretive within two years, but Miller notes that this does not account for $5.9 billion in new debt that would be issued upon the acquisition’s approval.

UnitedHealth Group UNH stock fell after the firm made comments about surging demand for healthcare services. This trend could hurt margins in its medical insurance business. However, the firm is not changing its guidance for the rest of the year. Morningstar senior equity analyst Julie Utterback says subsidiary Optum Health could benefit from the increasing demand for medical services, conditionally signaling an upswing for companies that provide such services and related suppliers.

“Investors should realize that UnitedHealth and the other managed care providers may limp through the rest of 2023 into a tough 2024 as Medicaid redeterminations continue, regulatory scrutiny on pharmacy benefit managers increases, and Medicare Advantage growth looks set to decelerate,” Utterback says.

Highlighted Decliners

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/N7VBPGEKIZDBPEAHLKIWYNRLBE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/MQJKJ522P5CVPNC75GULVF7UCE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZYJVMA34ANHZZDT5KOPPUVFLPE.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)