5 Things for All Investors to Watch in Q1 Bank Earnings

Deposits, dividends, and credit quality will be in the spotlight.

As banks kick off first-quarter earnings season, there’s good reason for all investors to pay closer attention than usual to the results.

In the wake of the regional bank crisis that broke out in early March 2023, the focus will be on more than just earnings. Instead, the spotlight will be on what’s happening under the hood: deposit levels and funding costs that determine the financial strength and future profitability of banks.

These details will be central to whether individual banks will be able to maintain their dividend payouts.

“The biggest areas of focus will all be related to the funding side of the balance sheet,” says Morningstar strategist Eric Compton. “Earnings will not look that bad for the first quarter because the turmoil started so late in the quarter. It will be about what happened after March 10 and the outlook.”

The large commercial banks kick off earnings season on Friday, April 14, with JPMorgan Chase JPM, Citigroup C, and Wells Fargo WFC set to report first-quarter results. Bank of America BAC is scheduled to report April 18. Smaller regional banks, including Citizens Financial Group CFG and U.S. Bancorp USB, are due to begin reporting next week. Troubled First Republic Bank FRC reports April 24.

What to Watch in Q1 Bank Stock Earnings

- Deposit levels and rates

- Dividend outlook

- Net interest margins

- Credit loss trends

- Bank-loan growth

These trends matter far beyond the outlook for any one bank stock.

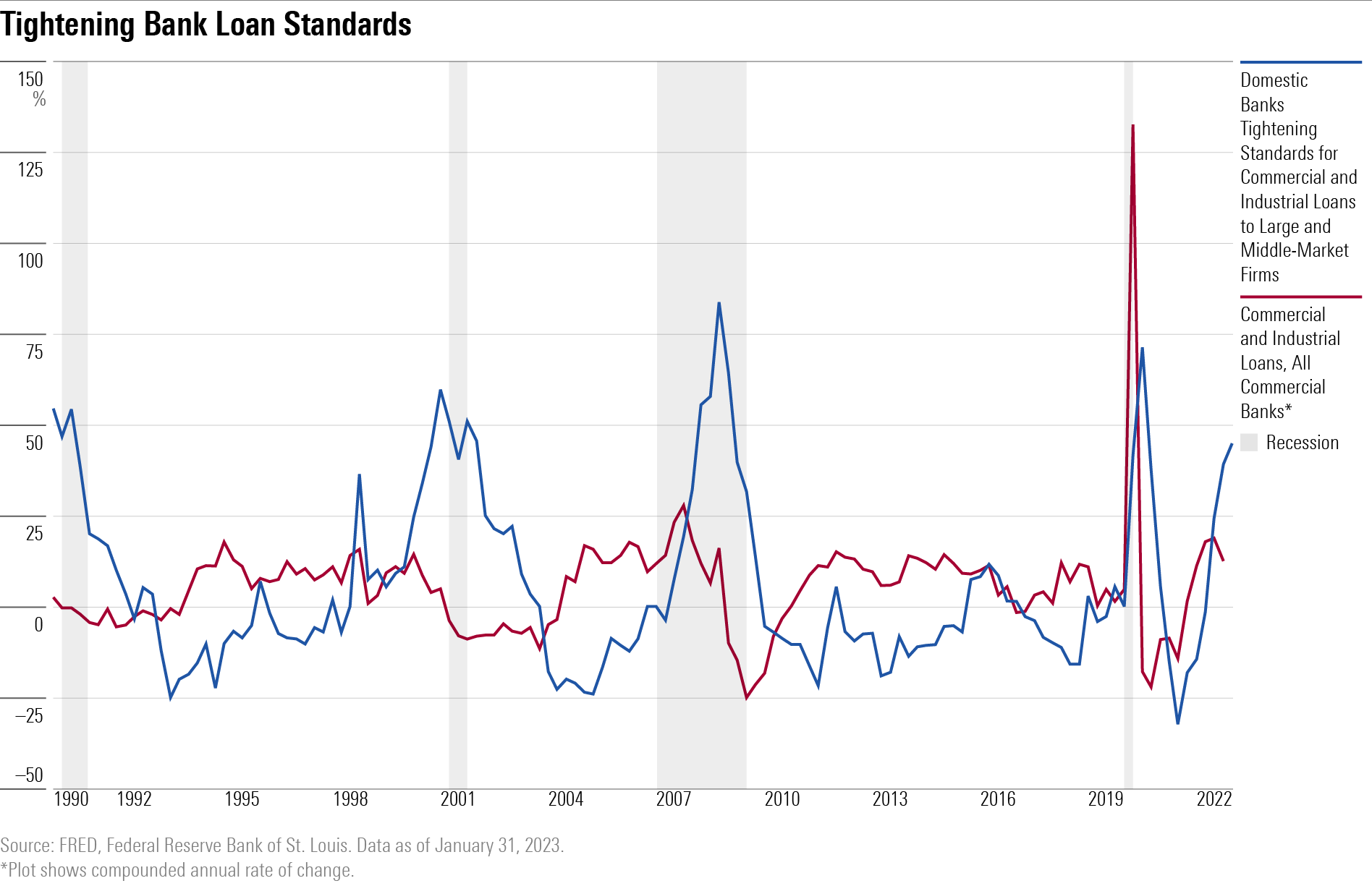

Bank lending standards have been tightening for much of the past year and are expected to get even stricter in the aftermath of the crisis as banks sacrifice growth for stability and survival. That could lead to slower economic growth, which would have implications across investors’ portfolios.

“If banks are being conservative with their reserves, and raising them at a faster pace, it will be a sign that they will likely be conservative in their lending,” says Andy Kapyrin, co-chief investment officer at CI RegentAtlantic, a wealth-management company based in Morristown, New Jersey. “Increases in credit loss reserves will be a sign of a slowdown for the broader economy.”

Banks, particularly midsize and regional banks, remain under intense pressure amid concerns about unrealized losses on bond investments, exposure to commercial real estate, and uneasiness about deposit flight. So far, most of the problems have emerged at midsize regional banks, which account for nearly half of all commercial and industrial loans, 70% of real estate loans, and nearly 40% of residential mortgages, according to Morgan Stanley.

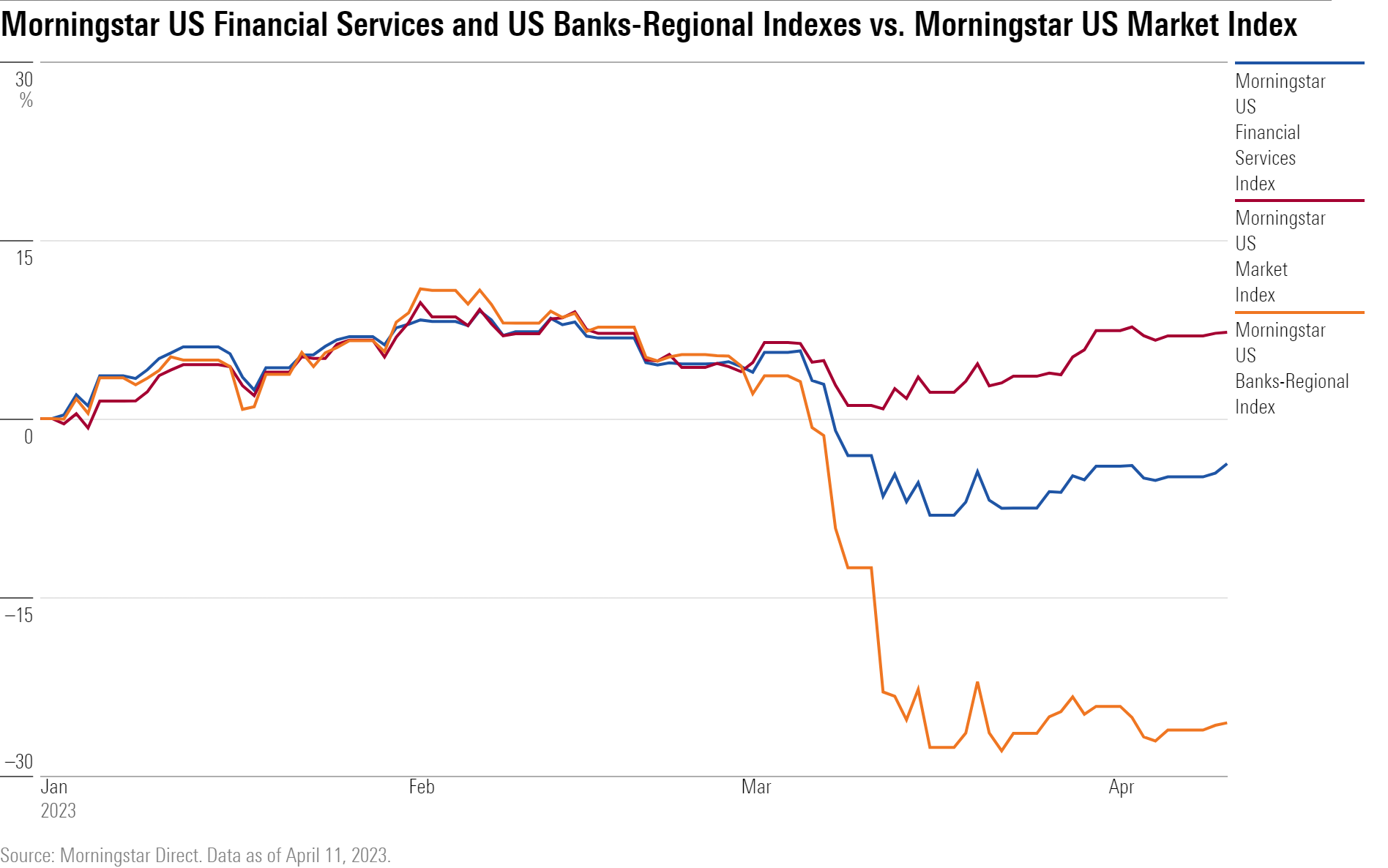

That’s translated into losses across the spectrum for banks and financial companies. The Morningstar US Financial Services Index is down 4.57% for the year to date, compared with a gain of 8.62% in the Morningstar US Market Index.

But regional bank stocks have been hit the hardest, and they are the focus of the biggest concerns. The Morningstar US Banks-Regional Index has fallen 25.07% so far this year.

A split between the fortunes of the big banks and regionals is expected to play out in the overall tenor of earnings results.

“You could see two different stories,” Kapyrin says. “Don’t interpret the strength of the large banks as a good sign of what’s happening at the midsize banks.”

Are Banks Losing Deposits?

First and foremost, investors will be looking for signs that deposit outflows have stabilized in the wake of the March 10 failure of SVB Financial’s Silicon Valley Bank following a run on its mostly uninsured deposit base—the biggest banking crisis since 2008.

Signature Bank collapsed soon after, and First Republic Bank required a lifeline from a consortium of major banks. First Republic has since suspended dividends on its common and preferred shares. At the same time, long-troubled multinational Credit Suisse was forced to sell itself to UBS as the pace of its deposit outflows mounted as customer confidence in its safety and soundness eroded.

In the wake of the SVB debacle, bank customers are newly focused on maintaining accounts at levels that don’t exceed the insured-deposit threshold of $250,000 and have been moving money to ensure their funds are protected. Customers have also been transferring their funds to higher-yielding alternatives, such as money market funds, in the past year, fed up with the measly rates offered on bank deposits despite the runup in rates in the past year. The pace of defections picked up following SVB’s demise.

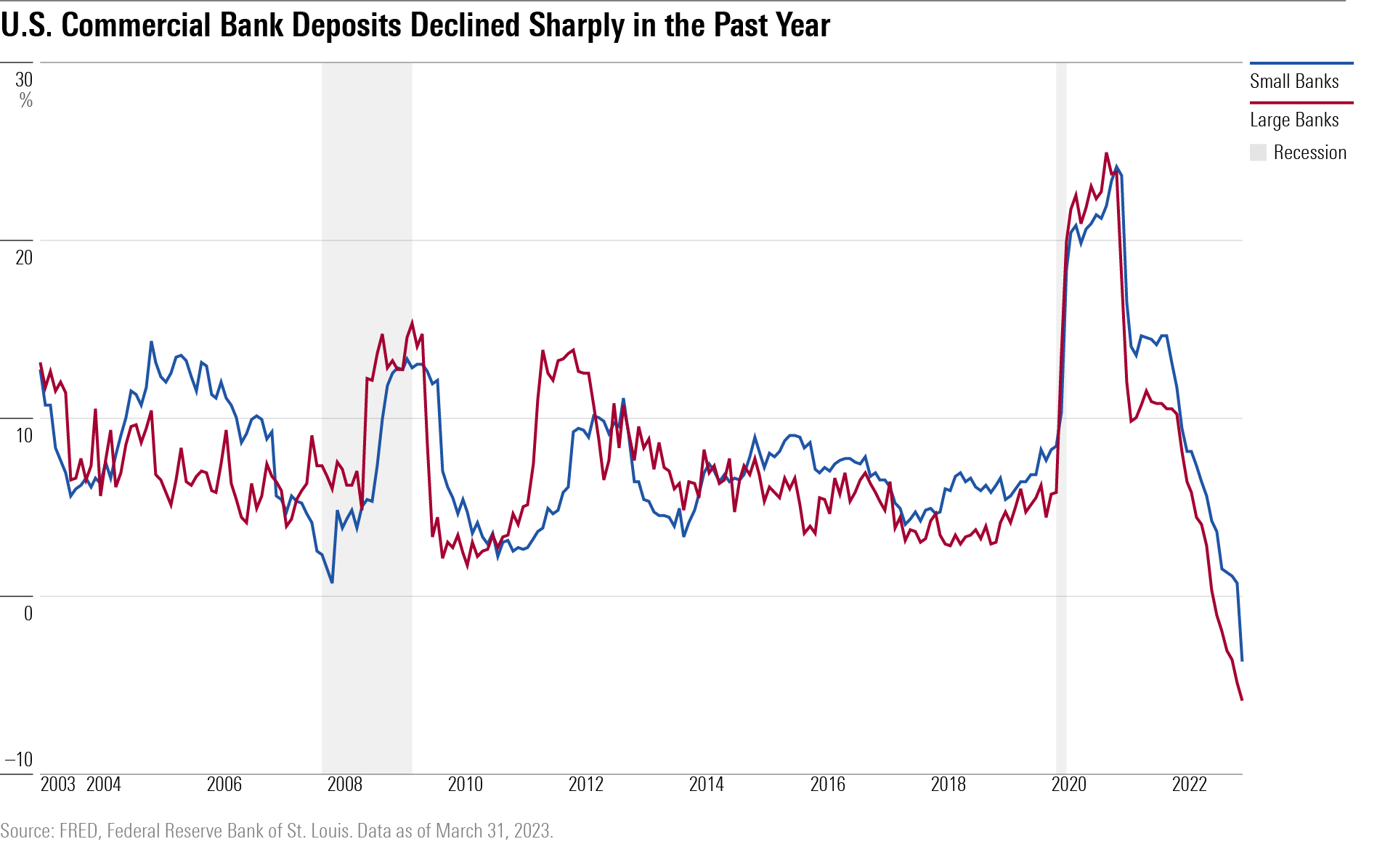

Deposits at large U.S. commercial banks declined by $519.8 billion year over year through March 29, while deposits at small U.S. commercial banks fell by $375.5 billion, according to Federal Reserve Board data. Since March 8, deposits at large U.S. commercial banks fell by $83.1 billion, while those at small U.S. banks declined by $157.2 billion. Assets in money market funds reached a record $5.2 trillion as of April 5.

Are Bank Dividends at Risk?

Compton notes that investors will be zeroing in on whether banks gained or lost deposits after the SVB failure, whether they had to borrow from the Federal Home Loan Bank to replace deposits, and whether they are paying more for those deposits and seeing their cost of funds rise. Higher funding costs will squeeze their net interest margins and cut into profitability.

Deposit trends and a rise in funding costs could have implications for the dividends that banks pay.

Lower earnings could result in banks forgoing increasing dividends, reducing payouts, or worse, omitting them. Stock buyback programs could also be halted.

“Some banks will have to cut the dividend as a defensive move to conserve capital,” Kapyrin says.

Indeed, last week beleaguered First Republic Bank said it was suspending dividends on its preferred stock after suspending the dividend on its common stock in mid-March.

“Investors in financial stocks have to be more thoughtful and cautious relative to a year ago,” Kapyrin adds. “Don’t gravitate to stocks with the highest dividend yields or that have fallen the most because that just reflects their risk.”

Potential Profit Squeeze

Kapyrin notes that banks have been benefiting for much of the past year as they paid virtually nothing on their customers’ deposits and charged higher rates on the loans that those deposits fund, resulting in wider net interest margins. To maintain a stable deposit base, banks likely will have to pay more competitive rates on savings accounts, and that could result in a “meaningful loss of profits,” Kapyrin says.

The combination of higher costs and lower profits could prove to be an “existential threat” to some banks, especially those that are facing unrealized losses on their investment portfolios, says Ed Yardeni, president of Yardeni Research, a provider of global investment research and strategic analysis.

“We expect that the rising costs of deposits and shrinking profits will force banks to cut costs, prompting lots of M&A [merger and acquisition] activity among them,” he notes.

Yardeni adds that increased regulation and heightened supervision of smaller banks will also lead to rising expenses and result in more mergers as banks seek to lower costs.

Bank Credit Trends

Credit-quality trends at banks will also be scrutinized, not only as a measure of bank health but to get a read on the outlook for the economy.

Bloomberg reported Tuesday that some of the major U.S. banks that threw a lifeline to First Republic Bank to help shore up its deposit base are planning to bolster their credit-loss reserves by as much as $100 million each in the quarter to cover potential losses from the move.

“We believe larger impacts from recent stress in the banking sector will materialize later this year as tighter lending standards and wider credit spreads reduce the availability and raise the cost of credit, ultimately weighing on GDP growth,” says Jeff Schulze, an investment strategist at ClearBridge. “This headwind is likely to come at a time when the economy is slowing into a recession.”

The latest data available from the Federal Reserve Board has shown that small and large commercial banks have been tightening their lending standards. But that data was collected before the banking crisis, and current conditions “are likely to be even worse,” Schulze says.

Smaller banks, he says, were responsible for 57% of total loan growth last year and are expected to pull back on credit more than their larger peers. This could spill over to their small-business customers, who are already facing multiple headwinds to profitability. This will curb their ability to grow and weigh on job creation as small businesses account for nearly 90% of the excess job openings since the onset of the pandemic. And, Schulze notes, that will weigh on broader economic expansion.

Investors also expect bank managements to address in their first-quarter commentary other potential threats that could be looming, such as problems in their commercial real estate loan portfolios.

“They need to address concerns head-on, that will be important,” says Kapyrin of CI RegentAtlantic. “In the current environment that means commercial real estate, in particular. What type and where is it?”

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ed88495a-f0ba-4a6a-9a05-52796711ffb1.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5MECJUE65CADONYJ7GARN2A3E.jpeg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/d10o6nnig0wrdw.cloudfront.net/04-22-2024/t_ffc6e675543a4913a5312be02f5c571a_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ed88495a-f0ba-4a6a-9a05-52796711ffb1.jpg)