U.S. Sustainable Fund Flows Contract Again in 2023’s First Quarter

IShares fund accounts for nearly all withdrawals. New GMO fund gains inflows.

Investors pulled money from U.S. sustainable funds during the first quarter of 2023, although the pace of withdrawals moderated from the fourth quarter of 2022. One change in a model portfolio series is the most likely cause.

Sustainable Funds Fare Worse Than Conventional Peers … Again

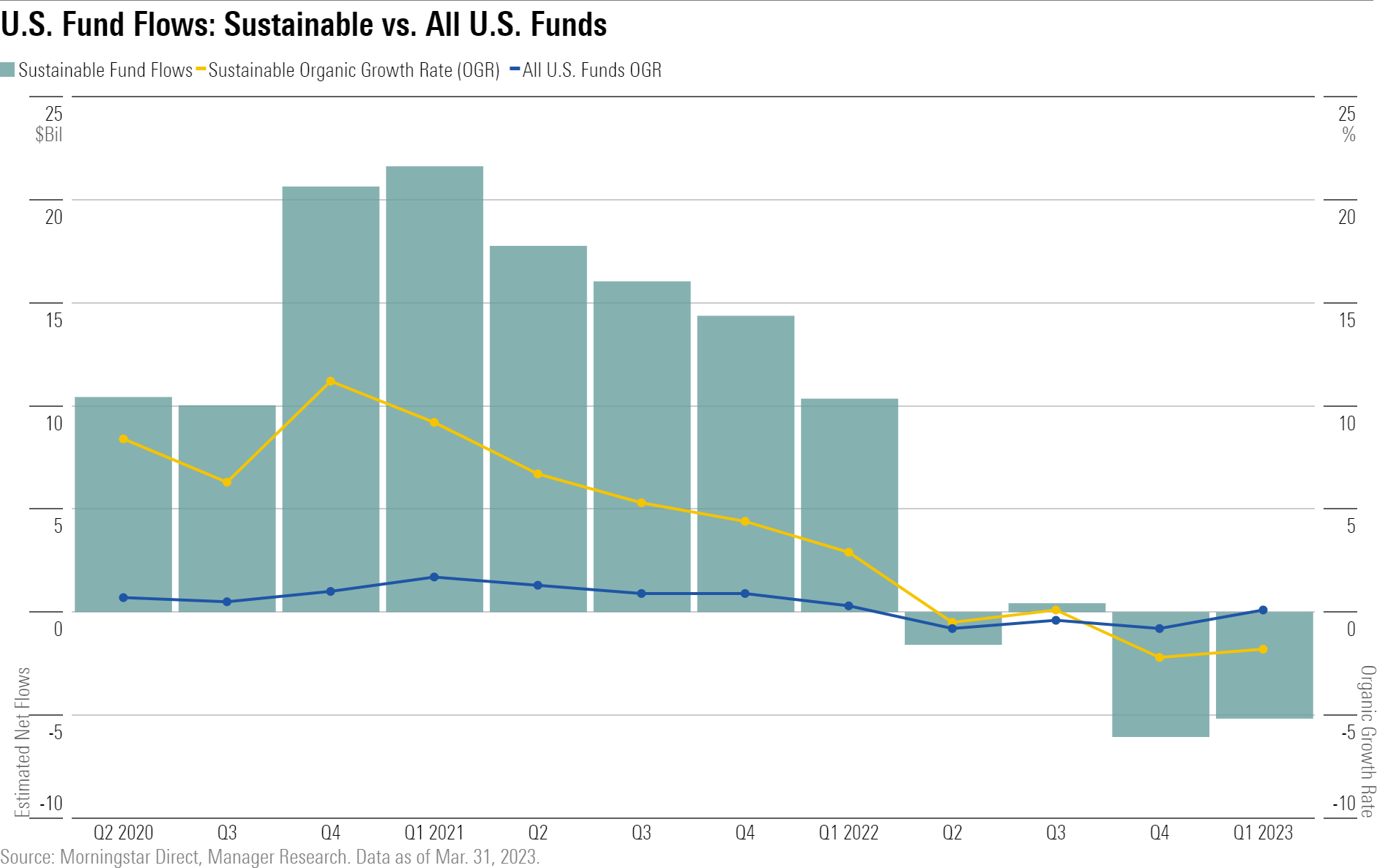

Investors pulled $5.2 billion from sustainable funds in the first quarter, for a total of nearly $12.4 billion from these funds over the past year. The outflow was a decline from the record $6.0 billion net outflow in 2022′s final quarter but marked the third quarter of outflows in a year. Global macroeconomic pressures, including an ongoing energy crisis and rising fears of recession, drove this retreat.

By contrast, the total universe of U.S. open-end and exchange-traded funds saw $17 billion in net inflows during the 2023′s first three months—down from their typical $100 billion-plus quarterly haul, but positive nonetheless.

Consequently, for the second quarter in more than five years, the U.S. sustainable funds segment saw a lower organic growth rate than the total U.S. fund universe. Calculated as net flows as a percentage of total assets at the start of a period, the organic growth rate puts the magnitude of fund flows into perspective. During the first quarter, sustainable funds contracted by 1.80% compared with a tiny 0.08% growth in the overall U.S. landscape.

Active Sustainable Funds See Inflows for the First Time Since Spring 2022

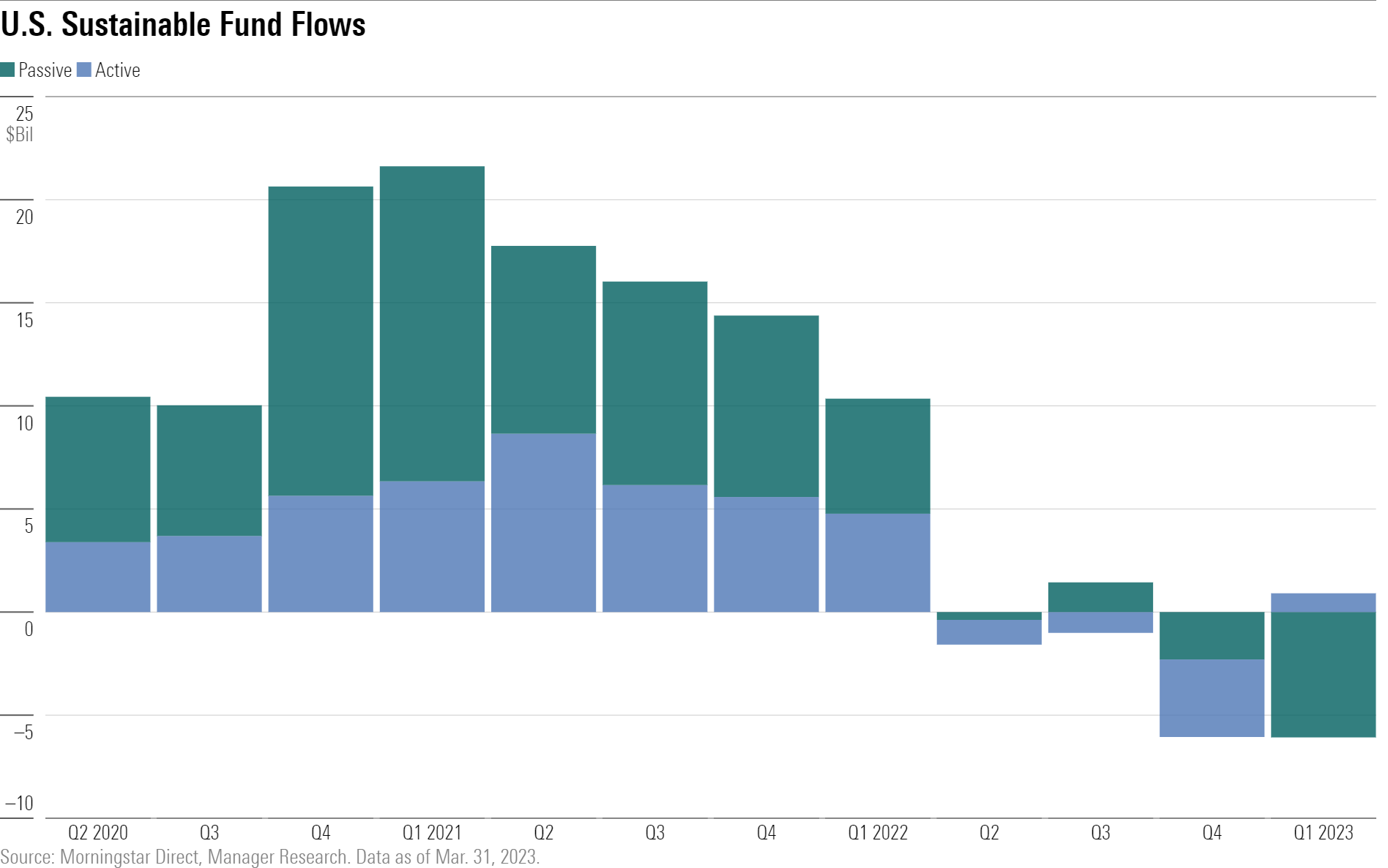

Actively managed sustainable funds broke a three-quarter outflows streak and bounced back into positive territory, netting a modest $91 million during the period.

Meanwhile, passive funds shed nearly $6.1 billion in the first quarter of 2023, bucking a multiperiod trend of holding down the fort for U.S. sustainable funds. If not for one fund—iShares ESG Aware MSCI USA ETF ESGU—passive funds would have ended the quarter in the black.

Once-Popular iShares ESG Fund Loses $5 Billion-Plus

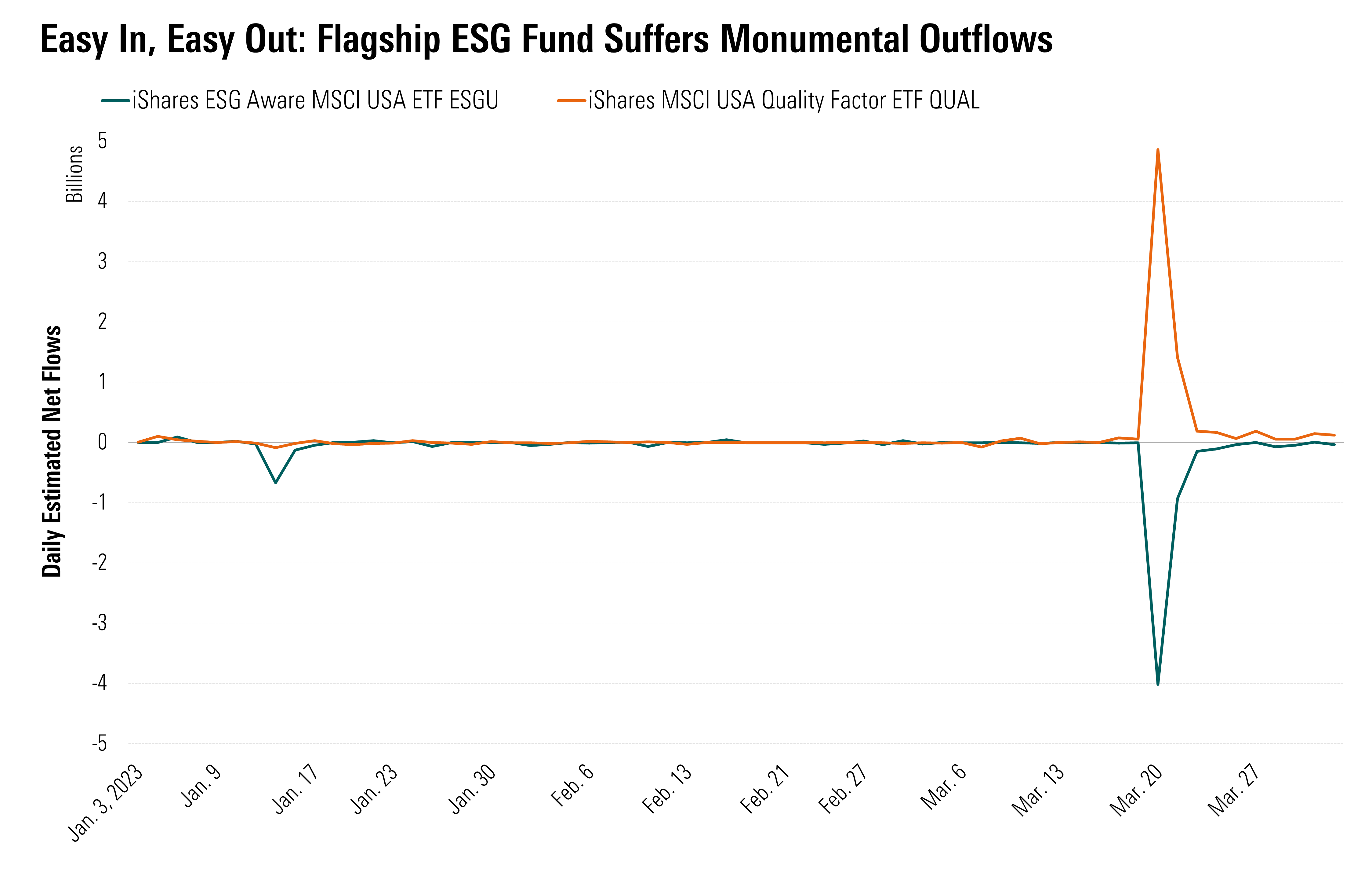

During the week of March 20, 2023, iShares ESG Aware MSCI USA ETF shed more $5 billion. This fund was the top flow-getter among U.S. sustainable funds in 2020 and 2021, and it held the crown as the largest U.S. sustainable fund at the end of 2022 despite outflows during the year. What took place in March set it back to third place.

On March 17, the fund had nearly $19 billion in assets. It lost more than one fifth of that base on the manic Monday that followed. This timing matched a change to BlackRock’s flagship target allocation ETF model portfolios, which had nearly $40 billion in assets as of December 2022. In March, BlackRock’s model portfolio management team pared back the allocation to iShares ESG Aware MSCI USA ETF from its portfolios and largely replaced it with iShares MSCI USA Quality Factor ETF QUAL. As model portfolios are not directly investable, it is impossible to perfectly track the impact of management recommendations. But by looking at these two funds’ daily net flows, we can approximate the effect the models had.

Ongoing economic uncertainty was the principal driver behind this trade. The ESG and quality funds have some similarities, but stocks in the latter tend to have wider moats than the former, meaning they tend to have more stable earnings and are better positioned to ride out a recession.

A New Face Joins the Top 10 Flow Recipients

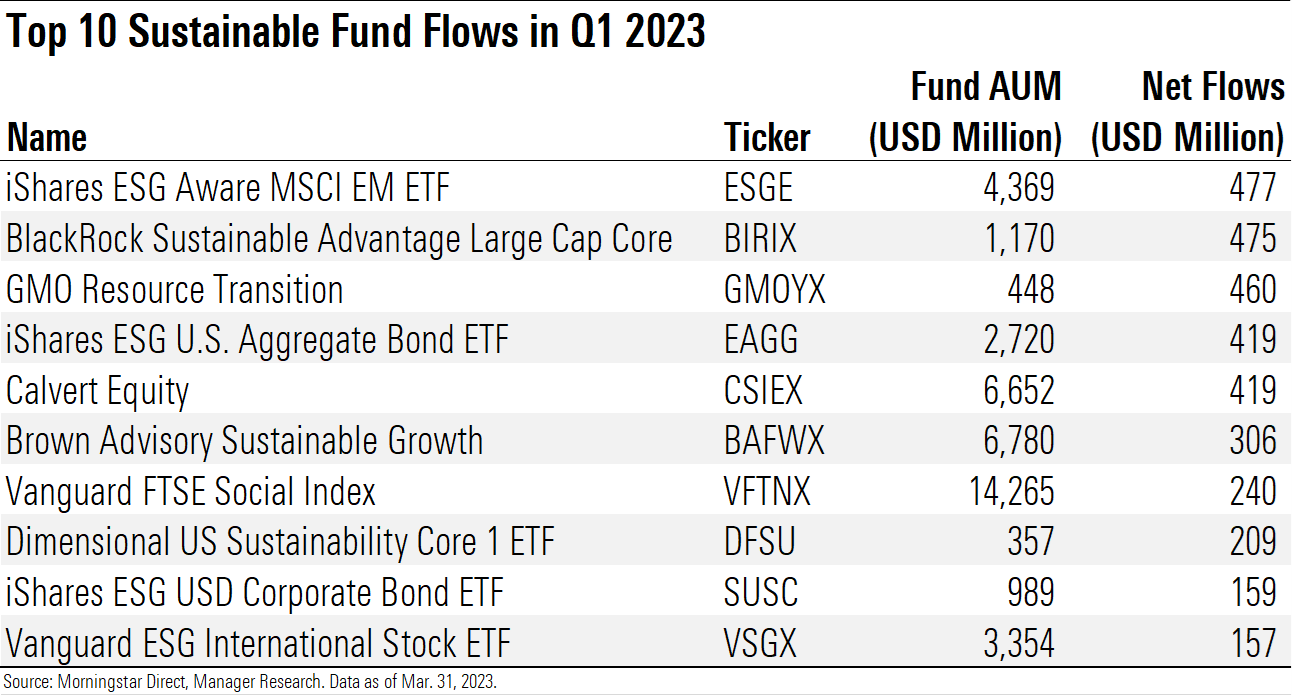

GMO launched GMO Resource Transition GMOYX on Feb. 15, and it quickly catapulted to third place in terms of first-quarter flows. The fund invests in natural-resources companies that it believes will benefit from the clean energy transition. This includes companies involved in mining, precious metals, forestry, and building materials, but it generally excludes traditional oil and gas companies.

Aside from GMO’s new entrant, BlackRock and Vanguard dominated the top flows table, as they usually do, with four and two funds making it into the top 10, respectively. One of these funds—iShares ESG U.S. Aggregate Bond ETF EAGG—has landed among the top 10 for each of the past three quarters.

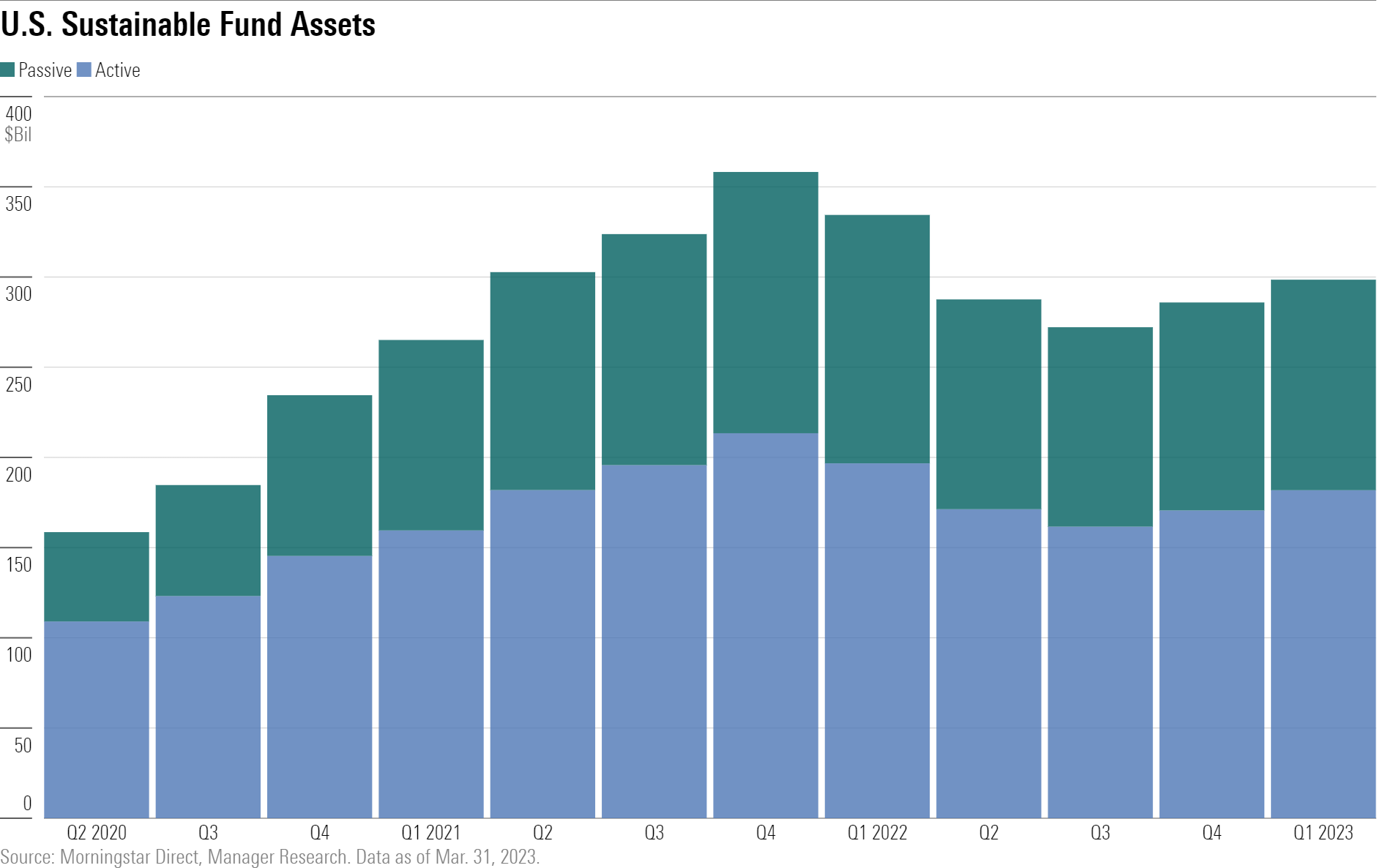

Assets in U.S. Sustainable Funds Rise on the Back of Market Appreciation

Despite outflows from sustainable funds, rising equity and bond valuations drove assets in these funds to nearly $296 billion, their highest point since the first quarter of 2022. This represents a 17% decline from the record of $358 billion at the end of 2021.

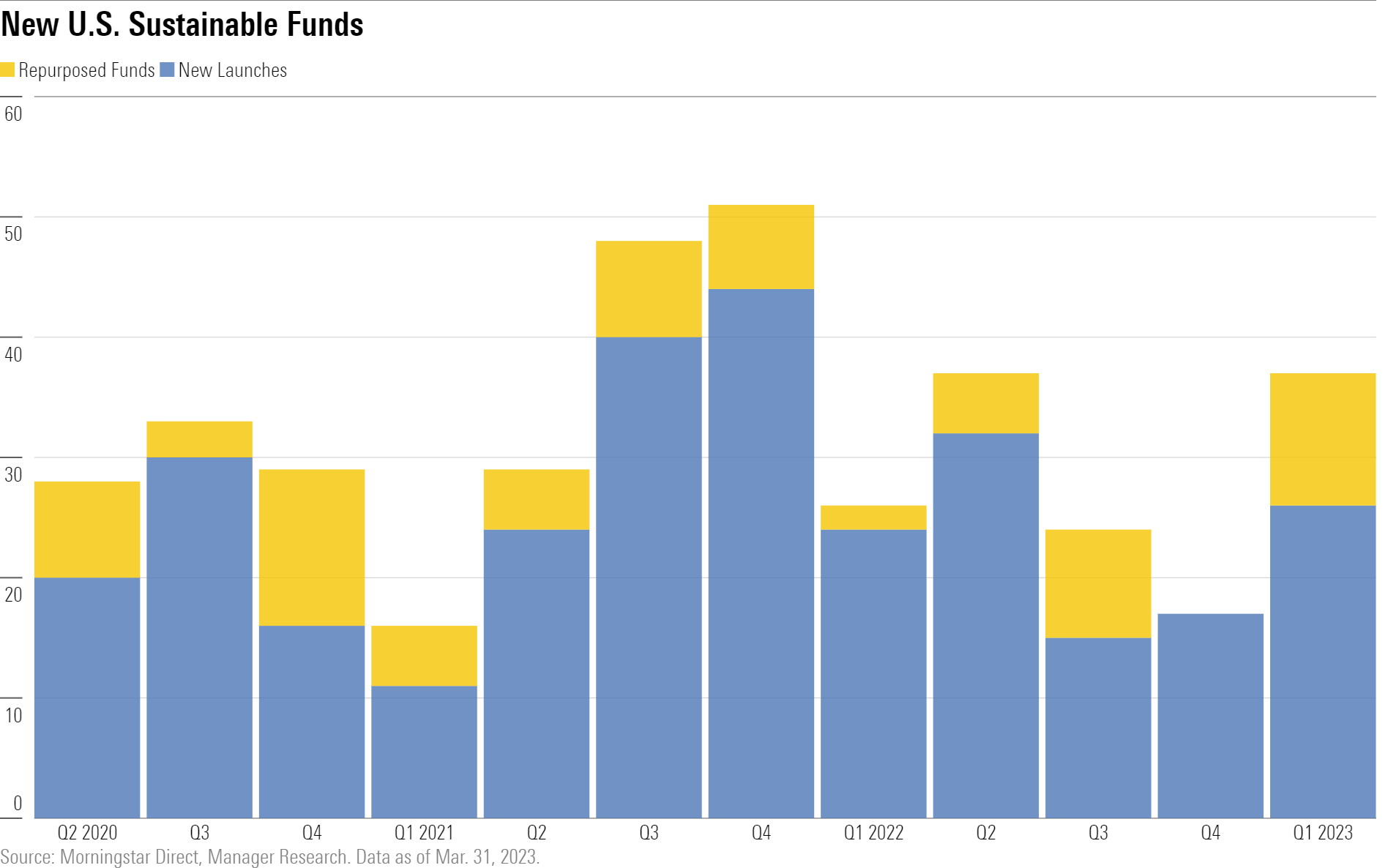

Despite Turbulent Demand, Product Development Picks Back Up

Some asset managers continue to see prospects for growth. During the first quarter, 26 new sustainable funds came to market, down from the record 44 in 2021′s fourth quarter but up from the latter half of 2022. Calvert, long seen as a sustainable-investing pioneer in the United States, launched six new exchange-traded funds during the period, most of which replicate preexisting U.S. mutual funds from the firm. One exception is Calvert US Large-Cap Diversity, Equity and Inclusion Index ETF CDEI, which has been available in Europe since early 2022 but just debuted to U.S. investors.

In the first quarter of 2023, Putnam launched a handful of new ETFs that are destined to be building blocks for its new Sustainable Retirement target-date strategy. The new offerings and repurposed funds brought the total number of sustainable open-end and exchange-traded funds in the U.S. to 638 at the end of the quarter.

Jason Kephart, CFA, contributed to this story.

This article is adapted from Morningstar’s U.S. Sustainable Fund Flows Commentary for the first quarter of 2023. Download the full report here.

Data reflects the list of sustainable funds compiled on April 5, 2023, and flows data extracted on April 14.

The author or authors own shares in one or more securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/987376c2-20a0-406b-b3ec-df530324b39c.jpg)

/s3.amazonaws.com/arc-authors/morningstar/532c09c7-c679-4cfa-bfb6-578ca1149ef7.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RFJBWBYYTARXBNOTU6VL4VSE4Q.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WYB37DY4NVDTVNZTSBDENH3GMI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/JPJHXR5CGSNR4LKQF5ZKLCCVYQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/987376c2-20a0-406b-b3ec-df530324b39c.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/532c09c7-c679-4cfa-bfb6-578ca1149ef7.jpg)