A New Era for Retirement Savings

BlackRock tries to reach a new market by offering a target-date ETF series.

Saving for retirement became more accessible on Oct. 17, 2023, with the launch of the iShares LifePath Target Date ETF series, a target-date strategy offered as an exchange-traded fund. It is the only target-date ETF available on the U.S. market. According to BlackRock, the series is intended to serve the 57 million Americans who do not have access to a workplace retirement plan or for individuals who might want to supplement the plan they have. The BlackRock team behind its launch has lofty goals for its success, and in theory, there is a market for the series, but questions around its adoption loom.

If at First You Don’t Succeed, Try Again

This isn’t the first time BlackRock attempted to make target-date ETFs a thing. In 2008, it launched the iShares Target Date series, which closed in October 2014. The series failed to garner enough assets to make it a viable option. The firm learned a thing or two from its first attempt, leading to distinct differences between the new series and the previous one. The biggest difference is that the new iShares LifePath Target Date series takes advantage of BlackRock’s retirement research and is actively managed. This allows management to implement the timely research it utilizes in other target-date strategies, such as BlackRock LifePath Index, which has a Morningstar Medalist Rating of Gold. BlackRock’s previous target-date ETF tracked an index. This limited its opportunity set and cemented its changes to when the index changed, regardless if those changes aligned with the firm’s best thinking. This damped the appeal and likely influenced the downfall of the series.

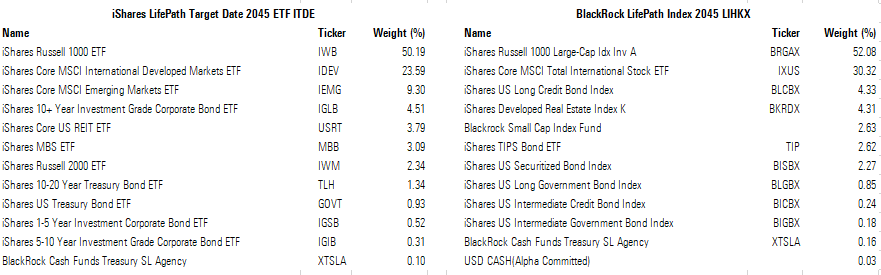

The new series is intended to be similar to the BlackRock LifePath Index mutual fund series, though, there are discernible differences. They share the same lead portfolio manager, Chris Chung, who conducts market-leading research for the firm’s target-date strategies. His leadership is a plus here, particularly for investors who would like access to the same research agenda. At launch, the ETF series has more granularity in its equity portfolio than the mutual fund version. For example, the international-equity exposure includes iShares Core MSCI International Developed Markets ETF IDEV and iShares Core MSCI Emerging Markets ETF IEMG, whereas the mutual fund version holds iShares Core MSCI Total International Stock ETF IXUS. The breakout in the ETF version allows the managers to implement their granular views and allows for more control over the split between international developed and emerging markets. Other differences across the holdings are prevalent; some are driven by the fact that the ETF version is limited to ETFs on the iShares platform. Despite their differences, the performance of the two series should be mostly in line with each other. Exhibit 1 illustrates the lineups of each series’ 2045 vintage; the data for the mutual fund version is as of Sept. 30, whereas the ETF is as of Oct. 23 because of reporting differences.

Underlying Holdings Comparison

The Evolving Investment Market

Changes in the investment market may lend itself to the potential success of this series. In 2014, the ETF market was just shy of $2 trillion; current assets sit at about $7.16 trillion (according to Morningstar Direct). That’s a substantial difference as investors have embraced the investment vehicle. It may lend itself to this series as more first-time investors are familiar and comfortable with investing in ETFs.

In contrast to target-date mutual funds, these target-date ETFs will likely mostly be used by those investing in taxable accounts rather than tax-advantaged workplace retirement plans. The ETF wrapper makes sense for these taxable accounts given the tax benefits that ETFs hold over mutual funds. From a tax efficiency standpoint, ETFs offer a compelling advantage in their treatment of capital gains. ETFs can create or redeem shares without realizing capital gains. A recent misstep by Vanguard illustrates one of the structural disadvantages of the mutual fund vehicle here: At the end of 2021, the Vanguard Target Retirement mutual funds made a costly error for investors. While its intention was good in trying to move investors to lower-cost funds, its action caused investors to sell out of more costly funds and buy cheaper ones. This created a large capital gains distribution, which ranged from 3% to 15% depending on the vintage year of the fund and resulted in hefty tax bills for investors holding the strategy in a taxable account. This affected about 1% of Vanguard’s Target Retirement investors. The ETF structure generally allows investors to better avoid realizing capital gains.

The team further modified this ETF series compared with the mutual fund series via the rebalancing schedule. Rather than following a monthly rebalancing schedule (like the mutual fund series), the ETF series will rebalance quarterly to improve tax efficiency.

In addition to tax advantages inherent to the ETF structure, this series is offered at a competitive cost that can benefit all investors, whether they invest in this series via taxable accounts or not. It charges 8 to 11 basis points, depending on the vintage year. That’s comparable to the cheapest share classes of other target-date index-based mutual fund series. Importantly, most investors would not have access to those share classes on their own owing to minimum investment levels. Individual investors would likely need to invest in more expensive shares, such as the A share class.

CITs and ETFs vs. Mutual Funds

As target-date assets have increasingly moved to collective investment trusts from mutual funds, it’s also worth noting where target-date ETFs may fit within this trend. As of the end of 2022, CITs made up 47% of target-date assets, up from 18% in 2014. ETFs won’t likely slow the success of target-date CITs, as ETFs are generally not supported on recordkeeping platforms. However, individual investors do not have access to CITs outside of their 401(k) plans, so target-date ETFs compete more directly with mutual funds for IRA, brokerage, and other individual account assets. Whether those markets have sufficient appetites for target-date ETF strategies remains questionable. If adopted, target-date ETFs will likely join CITs in eating away at target-date mutual funds’ market share.

Target-Date ETFs’ Success Is Not a Given

Despite having an available market outside of workplace plans, whether investors have an appetite for this option remains to be seen. The resounding success of target-date strategies—from asset growth and adoption perspectives—has primarily been driven by various factors, such as U.S. Labor Department regulations, the auto-enrollment of investors, and the hands-off aspect of the strategies. In contrast, target-date ETF investors have to first decide to invest and then actively select a target-date fund. So, while the ETF structure offers some compelling advantages, it’s far from assured that BlackRock’s latest attempt at target-date ETFs will be a success this time around.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/532c09c7-c679-4cfa-bfb6-578ca1149ef7.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/FGC25JIKZ5EATCXF265D56SZTE.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/532c09c7-c679-4cfa-bfb6-578ca1149ef7.jpg)