The Top Female Fund Managers of 2024

Celebrating 30 women who are breaking through barriers.

Female fund managers continue to make their mark on the asset-management industry despite being a notable minority.

Though room for improvement in representation remains, some women have been able to break through obstacles and distinguish themselves in a highly competitive industry.

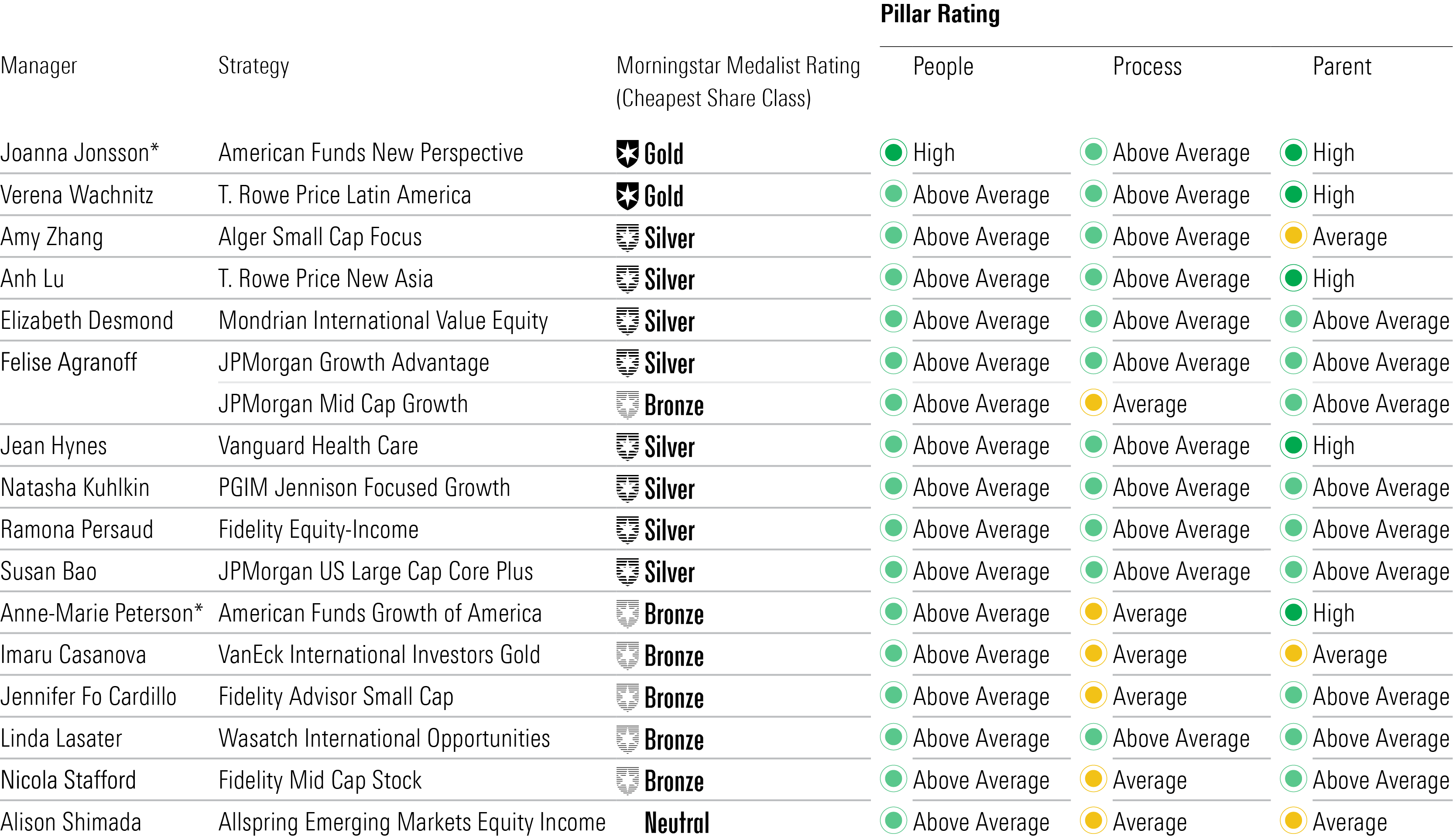

Even as the industry moves away from star managers, Morningstar analysts have identified a number of lead female portfolio managers or all-female teams that are more skilled than their average Morningstar Category peer.

In honor of International Women’s Day, we highlight the 30 female lead portfolio managers and teams of female managers that earn High or Above Average People Pillar ratings from Morningstar analysts in the United States. (Last year, we spotlighted 31 female managers who earned those grades.)

Star portfolio managers like Jean Hynes, Janet Rilling, and Hilda Applbaum are just a few of the women who have spearheaded their respective funds to success. Below we showcase these three high-achieving women.

Jean Hynes, Wellington

Jean Hynes is not only a portfolio manager, she is also the first female CEO of Wellington Management Company.

She began her remarkable career at Wellington as a pharmaceuticals and biotech analyst. She later rose through the ranks to become a portfolio manager, managing partner, and then CEO. Her ability to take on the challenges of running a firm while continuing to lead a $46 billion fund demonstrates how integral she is to her firm and investors.

Hynes’ extensive experience has helped her build an impressive record on Vanguard Health Care VGHAX, a Wellington-subadvised fund that earns a Morningstar Medalist Rating of Silver. She consistently utilizes a patient approach grounded in long-term thinking. In search of innovative healthcare companies, she isn’t limited by US borders and further distinguishes the fund from health-focused peers by expanding its portfolio’s reach globally.

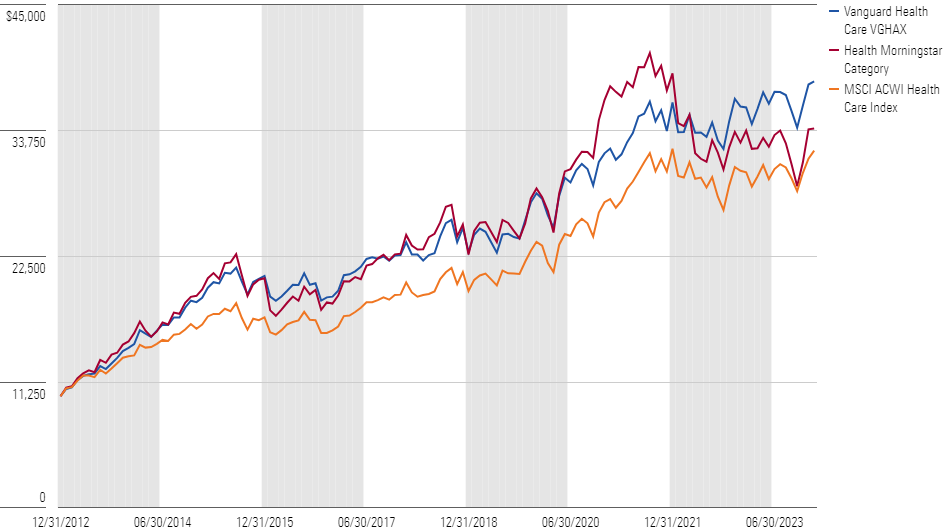

Since Hynes took the lead in 2013, the 12.8% annualized gain of the fund’s cheapest share class topped its primary prospectus benchmark MSCI ACWI Health Care Index’s 11.1% return and bested 61% of competitors in the health Morningstar Category.

Vanguard Health Care’s Growth of $10,000 Over Jean Hynes’ Tenure

Janet Rilling, Allspring

Janet Rilling has built an impressive career at Allspring and its predecessor firm Wells Fargo Asset Management. She has 28 years of investment experience and capably serves as Allspring’s head of the plus fixed-income team. The team’s culture under her leadership fosters collaboration and highlights individuals’ areas of expertise.

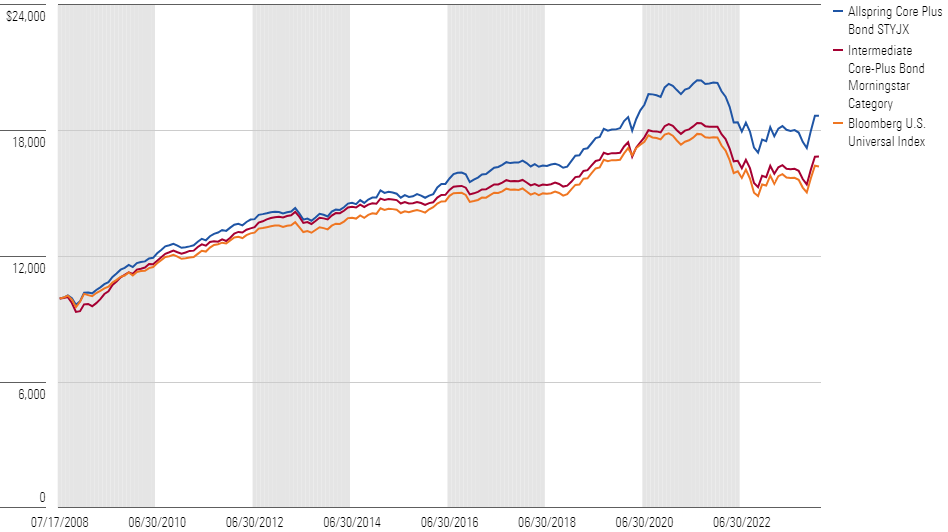

In July 2008, Rilling was named a portfolio manager of Allspring Core Plus Bond STYJX, which earns a Silver rating on its cheapest share class. She implements a thoughtful approach that balances quantitative rigor with qualitative judgment.

The portfolio’s results speak for themselves: Over her tenure through January 2024, the fund’s cheapest share class outpaced 90% of peers on a total-return basis. Impressively, it also delivered strong risk-adjusted returns (as measured by the Sharpe ratio), placing it in the top decile of its peer group.

Allspring Core Plus Bond’s Growth of $10,000 Over Janet Rilling’s Tenure

Hilda Applbaum, Capital Group

Hilda Applbaum has served as the principal investment officer on American Funds Income Fund of America RIDGX since 2005, and her distinguished career at American Funds stretches over 29 years. Applbaum’s purview crosses borders as she not only oversees two funds in the US but also is a named manager on funds in Canada and Luxembourg.

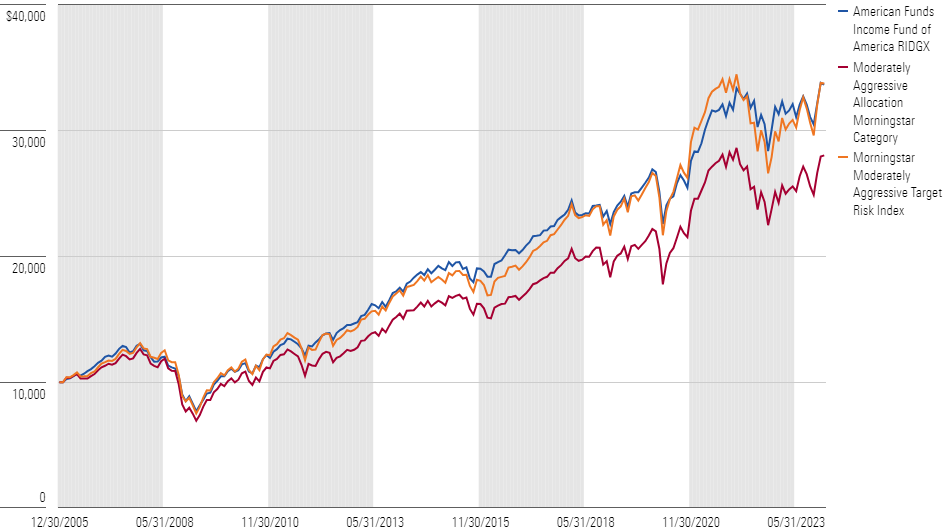

Applbaum’s leadership on the Silver-rated Income Fund of America has translated to investor success. As she strives to strike a balance between income and capital appreciation, she has built a portfolio of dividend-paying stocks and bonds. Though the equity portfolio tends to have a value tilt, which has been largely out of favor since the global financial crisis, it has kept up with the category index and outpaced 69% of peers on Applbaum’s watch through the end of January 2024.

American Funds Income Fund of America’s Growth of $10,000 Over Hilda Applbaum’s Tenure

2024′s Top Female Portfolio Managers for Investors’ Watchlists

These are just a few of the excellent female portfolio managers under our coverage.

Below we list all the US funds run by either a sole female manager or an all-female team that earn Above Average or High People Pillar ratings from Morningstar analysts.

Each woman named here earns Morningstar’s top marks and continues to stay a step ahead. Investors should keep each of them on their watchlists.

Female Equity Managers

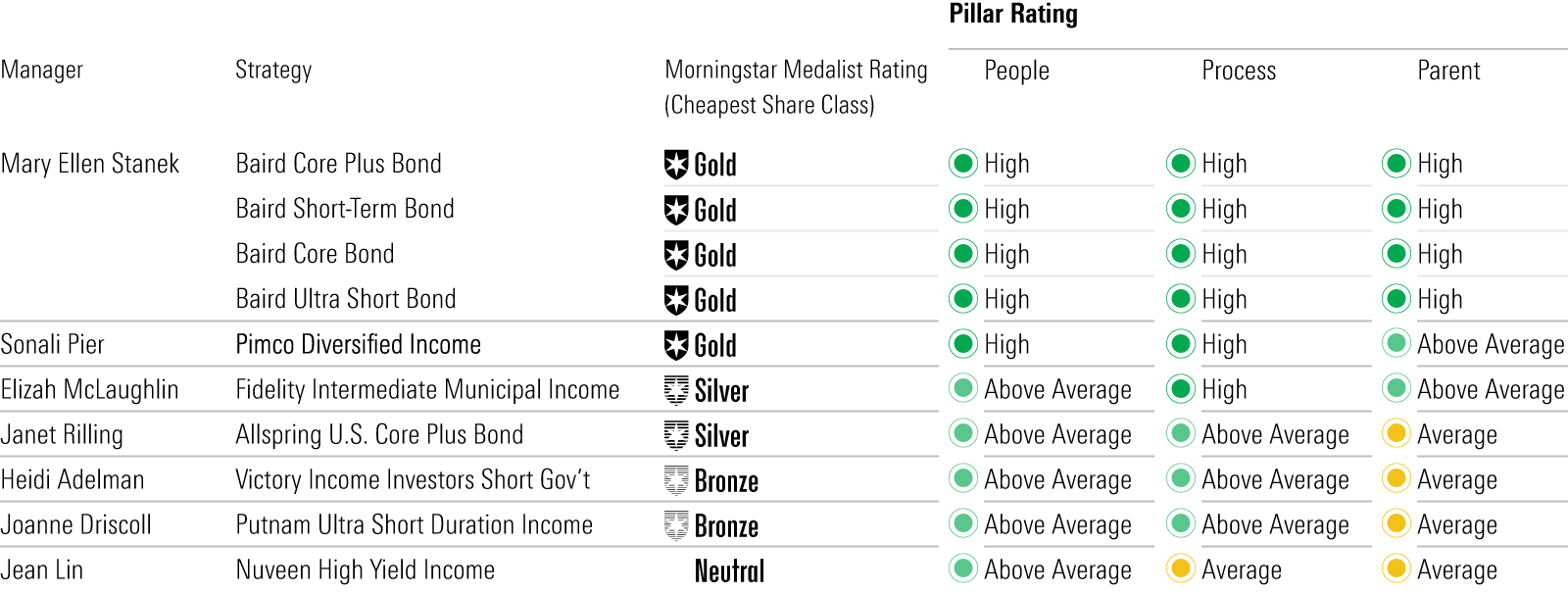

Female Fixed-Income Managers

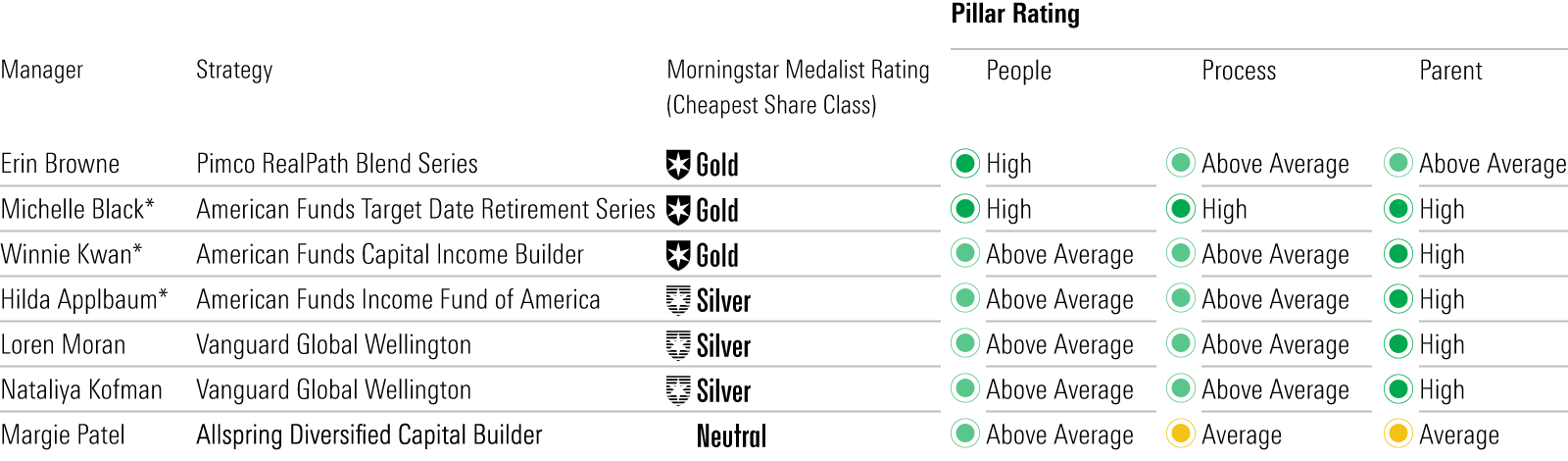

Female Allocation Managers

Morningstar quantitative analyst Amrutha Alladi contributed to this report.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/532c09c7-c679-4cfa-bfb6-578ca1149ef7.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/FGC25JIKZ5EATCXF265D56SZTE.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/532c09c7-c679-4cfa-bfb6-578ca1149ef7.jpg)