The Best Target-Date Funds for 2024

Six picks that earn a Morningstar Medalist Rating of Gold.

Investors’ favorite hands-off retirement savings tools, target-date strategies, reached a record high of $3.5 trillion in assets under management at the end of 2023.

Investors poured $156 billion of net inflows into target-date strategies, of which $104.5 billion—or 67%—went into collective investment trusts. The continued popularity of CITs drove up their market share as they now hold 49% of target-date assets, up from 47% at the end of 2022. They are poised to become the most popular target-date vehicle by the end of 2024, stealing the crown from their mutual fund counterparts.

Lower-cost options continue to win over plan sponsors, exhibited by both inflows to lower-cost mutual fund series and the growing popularity of CITs. Target-date strategies with underlying passive funds tend to come at a lower cost and are experiencing an influx in net flows. The industry’s assets primarily sit with the largest target-date managers. The top five managers—Vanguard, Fidelity, T. Rowe Price, BlackRock, and American Funds—control about 80% of the market share, and the top 10 claim roughly 94%.

Morningstar’s recently published 2024 Target-Date Strategy Landscape breaks down the industry’s assets, the continued growth of CITs, flows in 2023, as well as other performance patterns exhibited by these all-in-one, set-it-and-forget-it retirement savings vehicles.

To help investors navigate the target-dates available, we publish Morningstar Medalist Ratings for target-date mutual funds and CITs, identifying the strengths and weaknesses of the various options.

Ratings Roundup: The Best Target-Date Funds

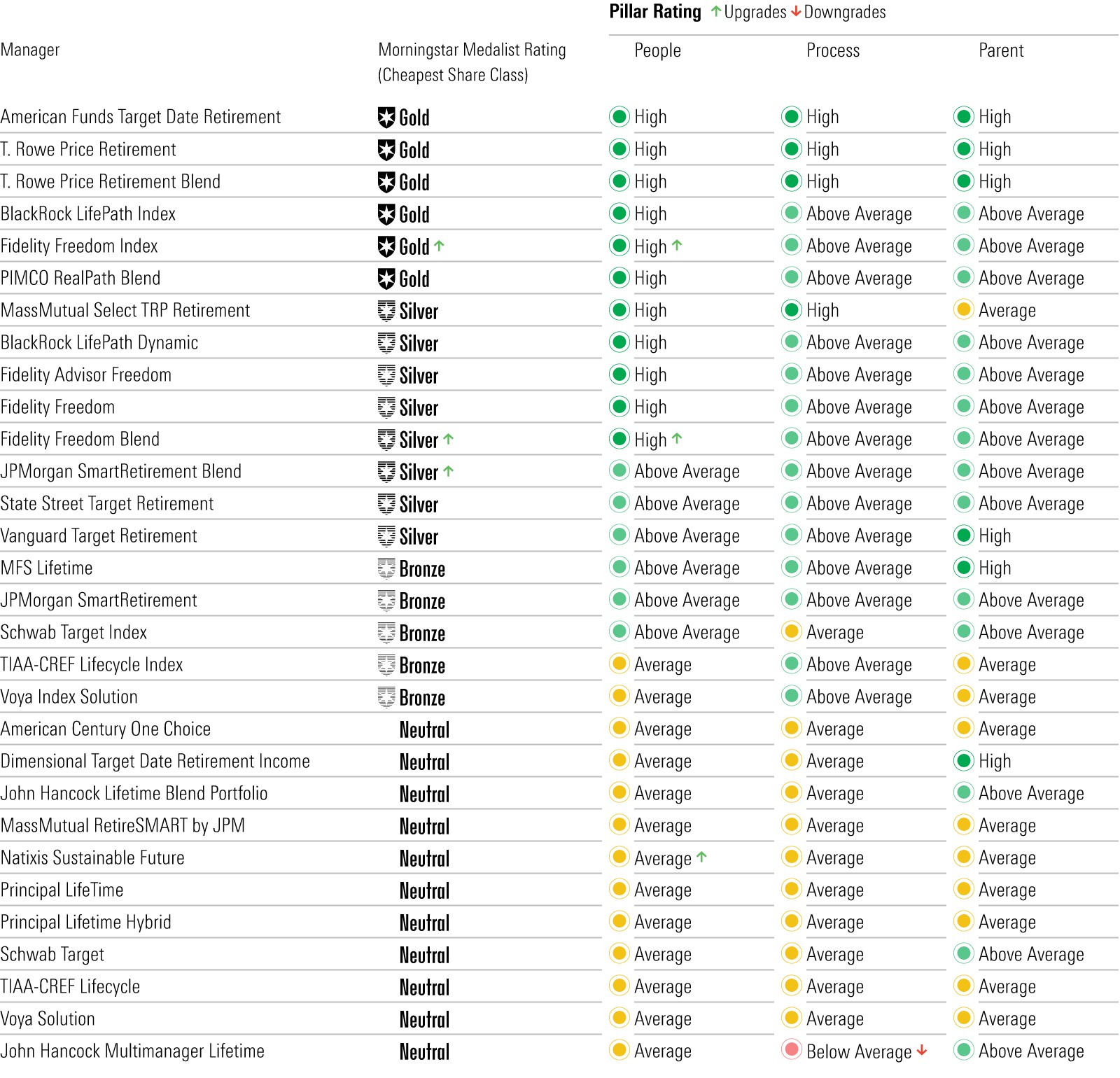

The table below highlights ratings assigned to the cheapest share class of the target-date fund series that are 100% covered by Morningstar analysts, as of March 2024. It also highlights how the Medalist Rating, People Pillar, Process Pillar, and Parent Pillar changed between March 2023 and March 2024. Morningstar analysts currently cover 27 CIT target-date series, which are mostly clones of their mutual fund counterparts.

Morningstar Medalist Ratings for Target-Date Mutual Funds, Analyst-Covered

The Gold Standard of Target-Date Strategies

As of March 2024, Morningstar names six picks that earn a Morningstar Medalist Rating of Gold. Five have maintained their rating, and an upgrade for Fidelity Freedom Index elevated it to the top distinction.

The best target-date strategies are:

- American Funds Target Date Retirement

- BlackRock LifePath Index

- Fidelity Freedom Index

- Pimco RealPath Blend

- T. Rowe Price Retirement

- T. Rowe Price Retirement Blend

American Funds Target Date Retirement continues to stand out for its impressive asset-allocation team and the inclusion of the firm’s renowned bottom-up security selection through its underlying funds. Rather than muting their topnotch equity and fixed-income teams’ views, they allow them to control the sub-asset-class positioning, particularly the balance between US and international equities. Its long-term results speak for themselves and demonstrate their ability to build an attractive investment option for those saving for retirement.

An innovative group manages the BlackRock LifePath Index target-date series with a research-driven approach. Their best-in class retirement team continues to trailblaze in the target-date industry. For example, this series sets the standard as the first mover to increase the equity exposure at the onset of the glide path to 99%, and competitors have made similar changes in the ensuing years. And in 2022, they removed a fund tracking the Bloomberg US Aggregate Bond Index and replaced it with five fixed-income funds with more-targeted exposures to the index’s key underlying components, allowing the team to pinpoint the optimal duration and credit risks across the glide path.

Fidelity’s simple, low-cost target-date option, Fidelity Freedom Index, benefits from experienced managers and Fidelity’s retirement research engine, driving an upgrade to the People Pillar to High from Above Average, which boosted the Medalist Rating to Gold from Silver. A sharp trio of managers produces robust research that shapes a thoughtfully crafted glide path underpinned with index funds. Its cheapest share class charges 6 basis points, making it the lowest-cost target-date mutual fund.

Strong macroeconomic expertise paired with high-quality building blocks populating a sensible glide path add to the appeal of Pimco RealPath Blend. An experienced portfolio manager steers this series’ exposures. The team allocates the equity portion of the glide path to low-cost, broad market Vanguard equity index funds in conjunction with its strong in-house actively managed bond funds. The fixed-income portfolio courts more credit risk than peers that own broad bond market index funds as their core fixed-income holdings. Yet, the underlying active managers’ ability to constructively pair big-picture research and bottom-up analysis gives us confidence in the approach.

T. Rowe Price Retirement’s skilled team implements a collaborative, thoughtful approach that continues to instill confidence over the long run. The management trio continually conducts research and makes timely refinements to the series. In 2023, the managers added two funds to the lineup in an attempt to damp volatility near and in retirement, an important consideration particularly for this series, which has an above-average equity allocation and allocates to riskier bond funds.

T. Rowe Price Retirement Blend benefits from the same talented managers, robust resources, and forward-thinking process as T. Rowe Price Retirement. Its distinguished glide path is rooted in research, and the underlying holdings demonstrate that active and passive underlying funds aren’t an “either/or question” but can be a balancing act. This series takes advantage of the firm’s topnotch active funds in careful proportion to core passive funds, keeping costs low.

Ratings Shakeups

Fidelity Freedom Blend series also earned a People Pillar upgrade to High from Above Average, boosting its Medalist Rating to Silver from Bronze. Higher conviction in the robust asset-allocation team and strong resources drove the upgrade.

Natixis Sustainable Future secured an upgrade to the People Pillar to Average from Below Average. Despite having a smaller team than more-established target-date peers, it’s sufficiently resourced to guide the series.

John Hancock Lifetime Multimanager Lifetime received a Process Pillar rating downgrade to Below Average from Average because of its overly complex portfolio construction; the Medalist Rating remained Neutral.

JPMorgan SmartRetirement Blend (mutual fund) moved to Silver from Bronze, though none of the underlying pillars changed. Shifts in the peer group resulted in the series looking more attractive relative to the competition.

The author or authors own shares in one or more securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/532c09c7-c679-4cfa-bfb6-578ca1149ef7.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

/d10o6nnig0wrdw.cloudfront.net/07-25-2024/t_56eea4e8bb7d4b4fab9986001d5da1b6_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/BU6RVFENPMQF4EOJ6ONIPW5W5Q.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/532c09c7-c679-4cfa-bfb6-578ca1149ef7.jpg)