What’s Inside Anti-ESG Funds?

These funds deliver on some expectations, surprise on others.

Editor’s Note: This article was updated on June 9, 2023, to include Strive Emerging Markets Ex-China ETF. The number of funds was revised to 27, and a note was added to the first two charts.

Over the past few years, the incorporation of environmental, social, and governance factors in investment decisions has become mainstream. As its popularity has risen, however, anti-ESG sentiment has also gathered steam. In a recent study, we took a closer look at some of these funds and what they stand for. One thing is clear: Anti-ESG investing is not a monolith.

To help investors navigate what can be a confusing landscape, we subdivided our list of 27 anti-ESG funds into five mutually exclusive categories: Anti-ESG, Political, Renouncers, Vice, and Voters.

The oldest funds in this group invest in companies (known as “sin stocks”) that were traditionally excluded by socially responsible funds. Some invest in companies aligned with politically conservative values. Others are traditional passive funds with anti-ESG proxy voting policies. Only one fund in our sample—Constrained Capital ESG Orphans ETF ORFN—neatly fits into the anti-ESG box by investing in businesses management believes are “‘orphaned,’ discarded or excluded by ESG-centric mutual funds.” That said, it filed with the SEC to liquidate in June 2023.

Anti-ESG funds employ diverse approaches to portfolio construction, but on average they tend to deliver greater exposure to ESG risk compared with peers (based on the Morningstar Sustainability Rating). Nearly half of the funds in our sample have High or Above Average levels of exposure to ESG risk, corresponding to 1 or 2 globes, respectively. For perspective, roughly 30% of the overall fund universe receives these ratings, so anti-ESG funds are disproportionately represented at the higher end of ESG risk exposure.

Anti-ESG Funds Invest in Fossil Fuels

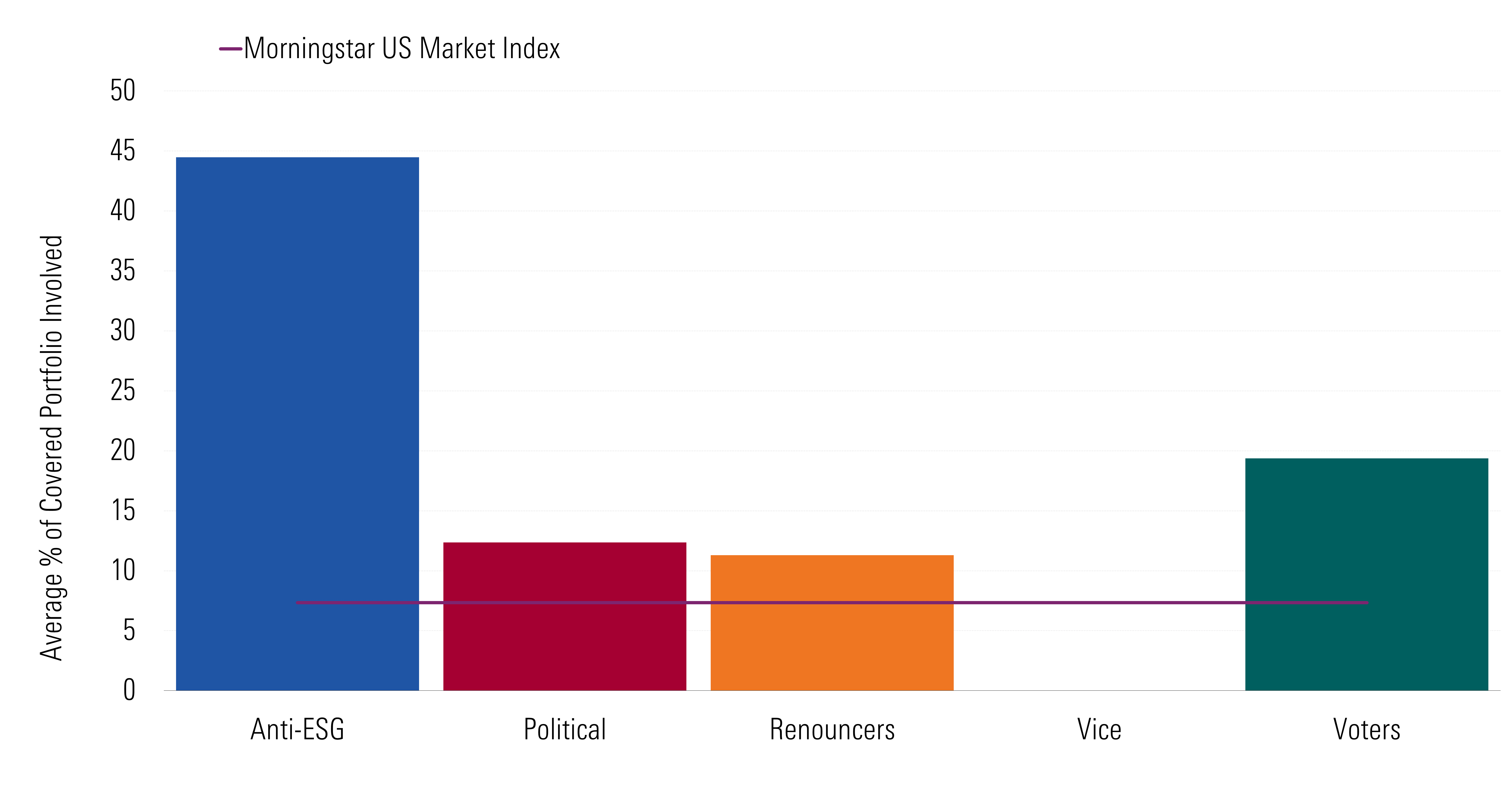

Among other things, high levels of ESG risk in a portfolio commonly match significant involvement in the fossil fuel industry. Morningstar Portfolio Fossil Fuel Involvement measures a portfolio’s exposure to thermal coal, oil and gas, oil sands, shale energy, deep-water production, and Arctic offshore exploration.

Except for Vice funds, each anti-ESG fund category carries higher exposure to fossil fuels than the Morningstar US Market Index. Constrained Capital ESG Orphans ETF exhibits the most staggering overweight, but it comes as no surprise that Voter fund Strive U.S. Energy ETF DRLL has the highest exposure to the fossil fuel industry. Approximately 97% of the companies in the portfolio earn revenue from fossil fuels.

Fossil Fuel Exposure: Anti-ESG Funds vs. the Morningstar US Market Index

For example, Exxon Mobil XOM accounts for nearly one fourth of Strive U.S. Energy ETF’s portfolio. It is also a top 10 holding in Political fund Unusual Whales Subversive Republican Trading ETF KRUZ and in ORFN. Oil and gas giant Exxon Mobil earns a Severe ESG Risk Rating from Morningstar Sustainalytics owing to the likelihood of oil spills across its broad network of pipelines and refineries, as well as its exposure to significant legal and financial liabilities as one of the world’s largest manufacturers of petrochemicals.

Surprisingly, Anti-ESG Funds Deliver Exposure to Environmental and Social Impact for Investors

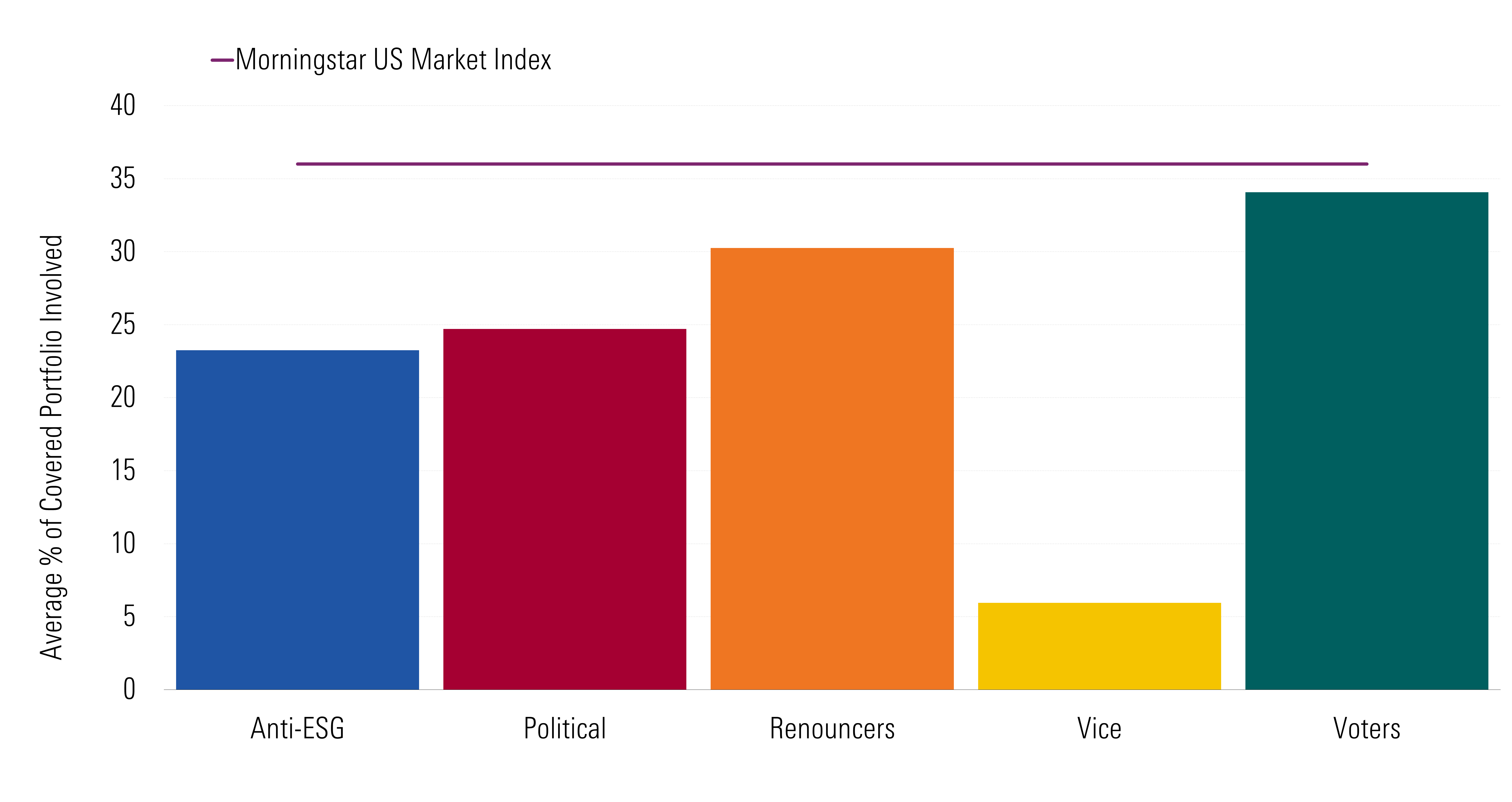

While metrics like fossil fuel involvement may help an investor assess risks in their portfolio, Morningstar’s Portfolio Impact Metrics help them understand the portfolio’s exposure to revenue associated with positive environmental or social impact.

One of the five key themes, Climate Action, is concerned with the global effort to curb the Earth’s temperature rise and cope with the unavoidable consequences of climate change. It includes measures to promote clean energy and limit greenhouse gas emissions, among others.

Climate Action Impact Exposure: Anti-ESG Funds vs. the Morningstar US Market Index

On average, each of the categories in our sample has lower exposure to climate action compared with the Morningstar US Market Index.

However, shockingly, many portfolios in our list have high levels of alignment to climate action impact. For instance, 84% of Strive U.S. Semiconductor ETF’s SHOC portfolio is involved in climate action impact, a whopping 48-percentage-point overweight relative to the benchmark, followed by Strive 1000 Growth ETF STXG and Strive 500 ETF STRV at 43% and 36%, respectively. Each of the three funds has a major position in Nvidia NVDA, a multinational technology company that contributes heavily to the climate action theme. For example, Nvidia recently launched its Earth-2 initiative to build the world’s most powerful artificial intelligence supercomputer dedicated to predicting climate change. In 2021, the company also disclosed manufacturing energy-efficient GPUs for gaming and professional visualization.

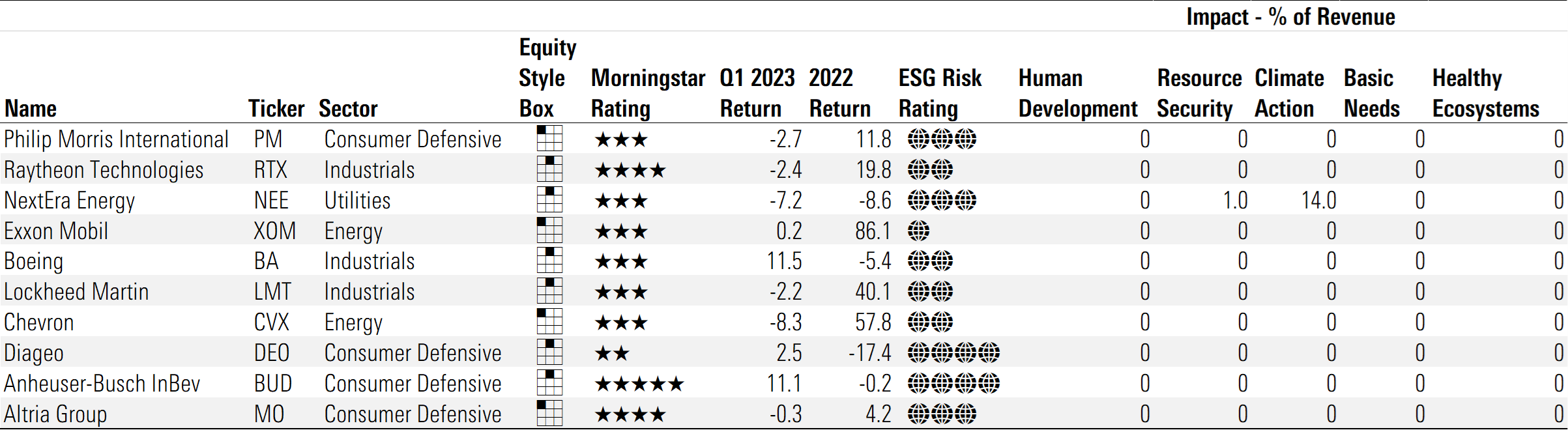

A Closer Look at the Anti-ESG Fund Before It is Liquidated

Top Ten Holdings in Capital Constrained ESG Orphans ETF

Although Nvidia was a common holding for many anti-ESG funds, the only fund in our sample that neatly fits into the anti-ESG box does not count it among its top 10 holdings. The exhibit above shows ORFN’s top 10 holdings as of March 31, 2023.

Top holdings include Exxon Mobil, tobacco firm Philip Morris PM, and defense contractor Raytheon Technologies RTX. In 2021, Exxon Mobil and Chevron CVX posted gains of 86% and 58%, respectively, due to the fossil fuel price surge that followed Russia’s invasion of Ukraine. Six stocks in this group carry Severe to High levels of ESG Risk, with Exxon Mobil getting the riskiest rating. As expected, the higher levels of risk in these names can be traced to each company’s high carbon emissions and/or the greenhouse gas emissions of their products and services while in use by consumers.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/4295f84a-d866-4f43-8205-3fb777ae9f55.jpg)

/s3.amazonaws.com/arc-authors/morningstar/987376c2-20a0-406b-b3ec-df530324b39c.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/CFV2L6HSW5DHTFGCNEH2GCH42U.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/7JIRPH5AMVETLBZDLUSERZ2FRA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/YWKBIVULT5DGJEIGAJGBA6H5ZA.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/4295f84a-d866-4f43-8205-3fb777ae9f55.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/987376c2-20a0-406b-b3ec-df530324b39c.jpg)