16 Water Stocks and Funds to Consider

Not all water funds are in the same boat. A quick guide to investing in water solutions.

As access to clean water becomes ever more scarce, a thematic investment opportunity arises. Water contributes significantly to industries such as agriculture, food production, and even semiconductor manufacturing. It is a scant resource without many alternatives. Given the central role it plays in many industries, the case for investing in water is strengthened by its increasing demand and unstable supply. In acknowledgment of World Water Day on March 22, we take stock of water investment solutions available to US investors.

There are just 11 water-focused funds domiciled in the United States, with a combined $6.3 billion in assets under management. Even though it is a small landscape, these funds come in all shapes and sizes.

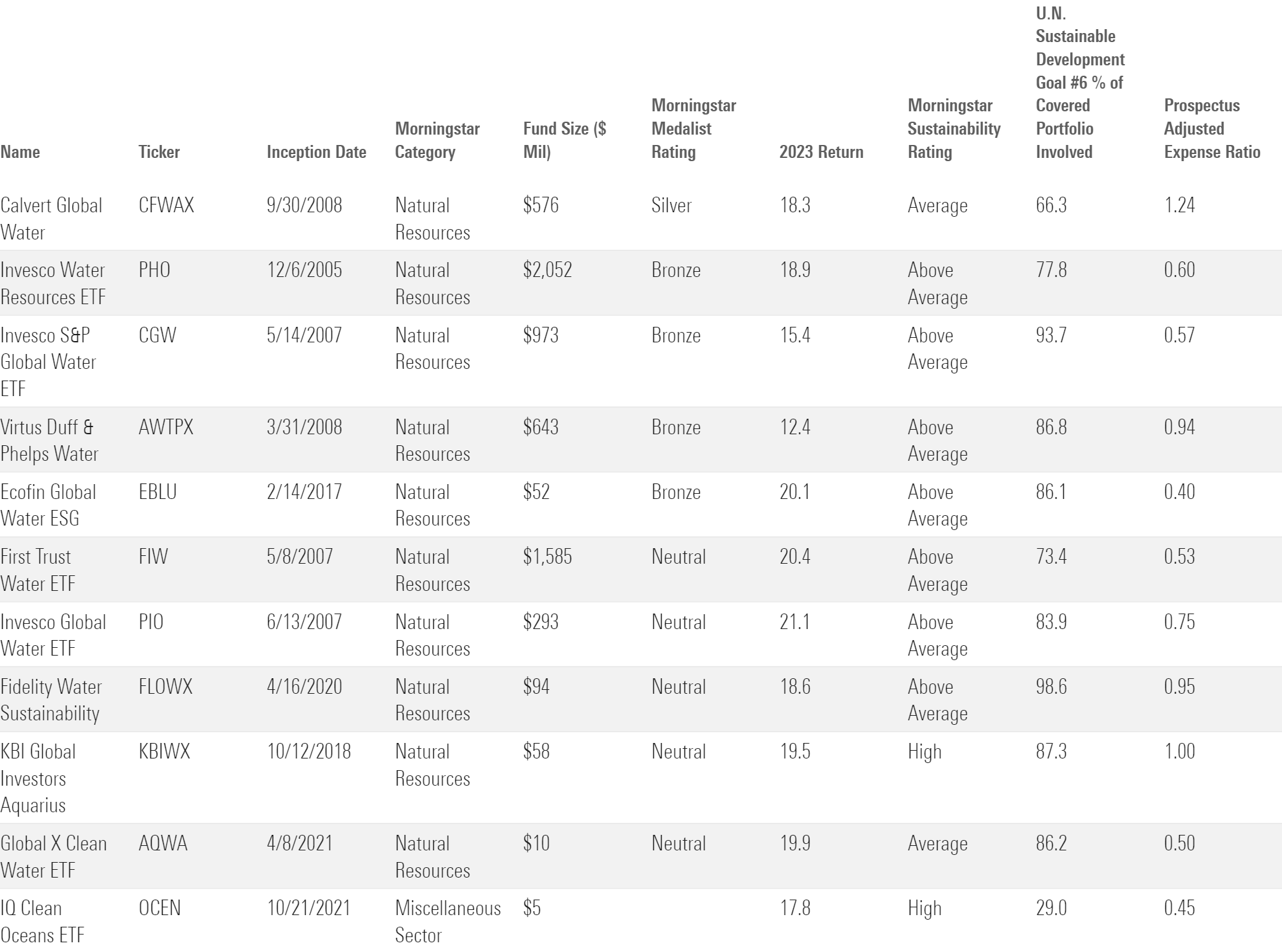

Below are the top 11 US water funds.

Water Funds in the US

How Do Water Funds Stack Up?

Out of the 11 funds that make up the US water fund landscape, five earn our higher ratings under the Morningstar Medalist Rating system, meaning Morningstar believes they will outperform their respective Morningstar Category Indexes. In terms of sustainability, most of the funds earn High or Above Average Morningstar Sustainability Ratings (4 or 5 globes), a sign that their portfolios are exposed to lower ESG risks than their peers. Using Sustainalytics’ Impact Metrics, specifically the alignment to U.N. Sustainable Development Goal number six, we can see that all but one of these funds invest more than two thirds of their portfolios in companies that generate revenue from water management and sanitation activities. For example, Ecofin Global Water ESG EBLU consists of companies that derive at least half of their revenue from water. The fund itself has 86% of its portfolio tied to water.

Barely Staying Afloat

US sustainable funds suffered their first calendar year of outflows last year, making 2023 their worst year in more than a decade. Mostly identified as sustainable funds, water funds also experienced net redemptions in 2023. The end of the year, especially, accounted for a substantial portion of 2023’s outflows. Investors pulled more than $150 million from these funds in the last quarter of 2023. Invesco bore the brunt of the outflows, with both Invesco Water Resources ETF PHO and Invesco S&P Global Water ETF CGW ranking among the worst for fourth-quarter withdrawals.

Despite net outflows, assets in these 11 water funds rose to $6.3 billion at the end of 2023. This represents a nearly 7% decline from the record at the end of 2021, but a 21% increase from the recent low in 2022’s third quarter. By comparison, assets in the sustainable funds landscape also peaked at the end of 2021 and slid by 12% through the end of 2023.

Launches of new water funds slowed down in recent years, with no new offerings in 2023. Investors gained just one new water fund option in 2022—Ecofin Sustainable Water—but it liquidated after only a year on the market because it was unable to attract assets.

What’s Beneath the Surface?

Investors looking to invest in water funds should remember that these portfolios can be fairly concentrated and should beused wisely as part of a diversified portfolio. Funds like Invesco Water Resources ETF and Global X Clean Water ETF AQWA count just 41 holdings apiece and allocate roughly two thirds of their portfolios to the top 10 companies.

Calvert Global Water CFWAX, on the other hand, consists of 126 holdings and invests only 16% of its assets in the top 10 names. The firm is well-known for its sustainability credentials, and its water-based offering stands out as the lone recipient of a Silver Morningstar Medalist Rating within our list of water funds. The fund seeks to track an index composed of companies that manage water use in a sustainable way or that are actively engaged in expanding access to water, improving water quality, promoting efficient use of water, or providing solutions that address other global water challenges. One of the fund’s top holdings, Xylem XYL, is a leading water technology company that derives nearly three fourths of its revenue from water technologies, water utilities, and watershed adaptation. It receives an ESG Risk Rating of Low, a sign that it carries relatively low levels of risk compared with peers.

To be sure, Calvert Global Water also owns names like Procter & Gamble PG and L’Oreal LRLCY. These are not known as water companies and do not derive any revenue from water-related activities or products according to Morningstar Sustainalytics data. However, these names qualify for the index because of their efficient use of water. This is where it gets tricky.

Let’s Dive In

Because it is difficult to invest directly in water rights or have direct exposure to the price of water, water funds primarily invest in water utilities companies, water transportation companies, companies that produce equipment to treat and/or purify water, and companies that may be considered leaders in water efficiency. Below are the most common holdings in 11 US-domiciled water funds.

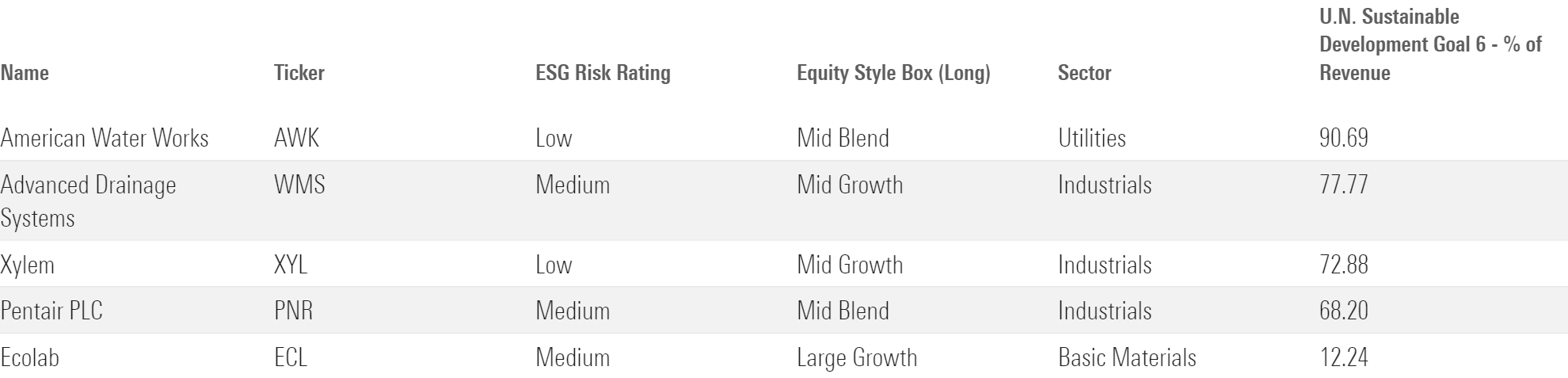

Top 5 Common Holdings in US Water Funds

To analyze these companies’ association to water-related themes, we looked at the sum of revenues associated with the sixth United Nations’ Sustainable Development Goal—Clean Water and Sanitation.

A majority of the funds invest in American Water Works AWK, Advanced Drainage Systems WMS, Ecolab ECL, Pentair PNR, and Xylem. Excluding Ecolab, the other four companies are pure plays that derive virtually all of their revenue from water-related products and activities. American Water Works is a regulated water utilities company, Advanced Drainage Systems is associated with water infrastructure, Pentair is a water treatment provider, and Xylem uses smart technology for water and wastewater application. Ecolab, on the other hand, produces and markets cleaning and sanitation products for the hospitality, healthcare, and industrial markets. According to Morningstar Sustainalytics, only an estimated 13% of its revenue comes from manufacturing water treatment and purification technologies.

Similar to Ecolab, there are some other names that have more of an indirect connection to water. Danaher DHR represents a whopping 8% of Invesco Water Resources ETF’s assets. According to Morningstar Sustainalytics data, the company derives minimal revenue from water-related sustainability themes. Only about 7% of the revenue comes from the water quality subsegment, which comprises multiple analytical instruments, chemical treatment solutions, and disinfectant systems. Other funds like First Trust Water ETF FIW and Virtus Duff & Phelps Water AWTPX also devote sizable positions to the life-sciences conglomerate.

Few options exist that can be categorized as pure-play water companies. However, most water-focused funds invest huge portions of their portfolios in companies that work to ensure the availability and sustainable management of water. On this World Water Day, investors looking for exposure to the reliable supply of safe freshwater should carefully consider these investments as part of a well-diversified portfolio.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/4295f84a-d866-4f43-8205-3fb777ae9f55.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RFJBWBYYTARXBNOTU6VL4VSE4Q.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WYB37DY4NVDTVNZTSBDENH3GMI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/JPJHXR5CGSNR4LKQF5ZKLCCVYQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/4295f84a-d866-4f43-8205-3fb777ae9f55.jpg)