The Worst-Performing Stocks of Q1

Stocks for Sabre, SunPower, and Arcadium were among the quarter’s biggest losers.

The stock market went up by 10% in the first quarter. However, many stocks were unable to ride the wave.

Overall, it was a good quarter for the US stock market. The Morningstar US Market Index rose 10.2%, extending last year’s rally. But of the 698 US-listed stocks under Morningstar’s coverage as of March 31, 206 were in negative territory. Of that group, 81 lost more than 10%, and 30 saw their stock price fall by more than 20%.

In the first quarter, the worst-performing US-listed stock covered by Morningstar analysts was Sabre SABR, which fell 45%. According to Dan Wasiolek, senior equity analyst for Morningstar, there were two main reasons for this: worries about the growth in business travel transactions on Sabre’s platform, and concerns about the firm’s leveraged balance sheet, which poses a potential issue if the recovery of business travel is less robust than expected. “Sabre has done a good job to refinance much of its near-term debt maturation, but sentiment remains poor for companies with high debt levels,” he says.

The worst performers in the first quarter also included Arcadium Lithium ALTM and Compass Minerals International CMP. Arcadium’s stock price fell 42.33%, while Compass lost 37.24%. Arcadium was hurt by anxieties about falling lithium prices and its ability to grow the volume of production, according to Morningstar equity strategist Seth Goldstein. Meanwhile, he says that Compass saw the cancellation of its lithium project, the loss of an important contract with the US Forest Service, and expectations that a mild winter will lead to lower salt revenue and profits.

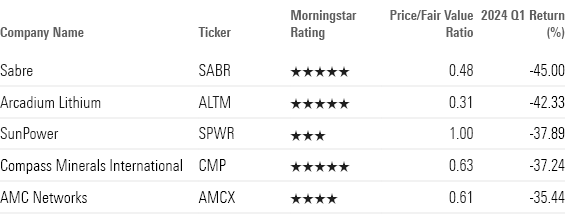

These were the quarter’s worst-performing stocks under Morningstar’s US coverage:

Q1 Worst-Performing Stocks

2024 Q1 Worst-Performing Stocks

Here’s a closer look at Q1′s worst-performing stocks, along with their key Morningstar metrics and selected commentary from our analysts. All data is as of April 1, 2024.

Q1 Worst-Performing Stocks

Sabre SABR

- Fair Value Estimate: $5.00

- Morningstar Rating: 5 stars

- Morningstar Economic Moat Rating: Narrow

“Despite near-term economic and credit market and long-term corporate travel demand uncertainty, we expect Sabre to maintain its position in global distribution systems over the next 10 years, driven by a leading network of airline content and travel agency customers as well as its solid position in technology solutions for these carriers and agents. Sabre’s 30%-plus GDS air transaction share is the second largest of the three companies (behind narrow-moat Amadeus AMADY and ahead of privately held Travelport) that together control about 100% of market volume. Sabre is also a leader in providing technology solutions to travel suppliers.”

Arcadium Lithium ALTM

- Fair Value Estimate: $14.00

- Morningstar Rating: 5 stars

- Morningstar Economic Moat Rating: Narrow

“We view current lithium prices as being at cyclically low levels. Prices are below the marginal cost of production. In response, higher-cost existing production has shut down, while new projects have been delayed by all major producers. This includes Arcadium, which announced reduced capital expenditures, citing the desire not to fund higher-cost brownfield capacity expansions or new greenfield projects with debt in a low-price environment. We think this is the correct move, as it should ensure Livent management, which was largely retained as the management of Arcadium, does not become overleveraged, as happened in 2020 during the prior cyclical low.”

SunPower SPWR

- Fair Value Estimate: $3.00

- Morningstar Rating: 3 stars

- Morningstar Economic Moat Rating: None

“The focus of SunPower’s fourth-quarter results was more on solving its ongoing liquidity challenge and less on reported results. Regarding liquidity, the company secured up to $200 million in new capital commitments, mainly via a second-lien term loan from its two majority shareholders, TotalEnergies and Global Infrastructure Partners. The liquidity comes at a steep cost, however. The term loan carries a 13% cash interest rate and the company granted warrants for nearly 42 million shares (potentially increasing to 75 million if all liquidity is utilized) to the financing parties. The warrants represent meaningful dilution based on total shares outstanding of approximately 176 million as of year-end 2023.”

Compass Minerals International CMP

- Fair Value Estimate: $25.00

- Morningstar Rating: 5 stars

- Morningstar Economic Moat Rating: Wide

“Compass Minerals announced the company did not secure a wildfire retardant contract from the United States Forest Service in 2024. The USFS cited corrosion issues in the air tankers that had used Compass’ magnesium-chloride-based product during the 2023 wildfire season. As a result, Compass management said the wildfire retardants will not be used for the foreseeable future. We updated our model to assume no wildfire retardant revenue or profits going forward. Separately, we slightly reduced our salt outlook to assume Compass’ salt business generates volumes, revenue, and profits in line with management’s mild winter scenario, as we assume the 2023-24 winter will continue to see below-average snowfall throughout Compass’ largely US Midwest footprint.”

AMC Networks AMCX

- Fair Value Estimate: $20.00

- Morningstar Rating: 4 stars

- Morningstar Economic Moat Rating: Narrow

“AMC Networks has transformed its flagship AMC channel from a minor cable channel showing classic movies into a premier prestige platform for original scripted content. The transformation provides AMC with growth potential, but this growth remains contingent on AMC’s ability to source and cultivate strong original content as well as monetize programs internationally and on streaming platforms.”

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/347BSP2KJNBCLKVD7DGXSFLDLU.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TP6GAISC4JE65KVOI3YEE34HGU.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-29-2024/t_d0e8253d77de4af9ae68caf7e502e1bf_name_file_960x540_1600_v4_.jpg)