After Earnings, Is The RealReal Stock a Buy, a Sell, or Fairly Valued?

With a debt overhang and a big jump in its stock price, here’s what we think of The RealReal.

The RealReal REAL released its fourth-quarter earnings report on Feb. 29. Here’s Morningstar’s take on The RealReal’s earnings and stock.

Key Morningstar Metrics for The RealReal

- Fair Value Estimate: $2.08

- Morningstar Rating: 1 star

- Morningstar Economic Moat Rating: None

- Morningstar Uncertainty Rating: Very High

What We Thought of The RealReal’s Q4 Earnings

- We believe The RealReal is in poor financial health. While we don’t think bankruptcy is an immediate concern ($176 million in cash and equivalents at the end of 2023 seems sufficient to fund near-term investments), the firm carries negative equity and needs access to capital markets to remain solvent, at least until it pays back its 2028 and 2029 notes.

- While we’re encouraged by the firm’s ability to restructure $146 million of its looming 2025 convertible notes (roughly 86% of the par value of that series), the rates the renegotiated debt carries are punitive at 13% (split between 8.25% cash interest and 4.25% in kind). The fourth quarter of 2023 couldn’t have come at a better time as the firm’s first-ever quarter of positive free cash flow, but we expect The RealReal will need access to capital markets to service its 2028 and 2029 debt, even with its material improvement.

- While the firm has made important strides toward getting its financial health in order, we believe The RealReal faces an uphill climb in the medium term, with few hard assets and negative shareholders’ equity.

The RealReal Stock Price

Fair Value Estimate for The RealReal

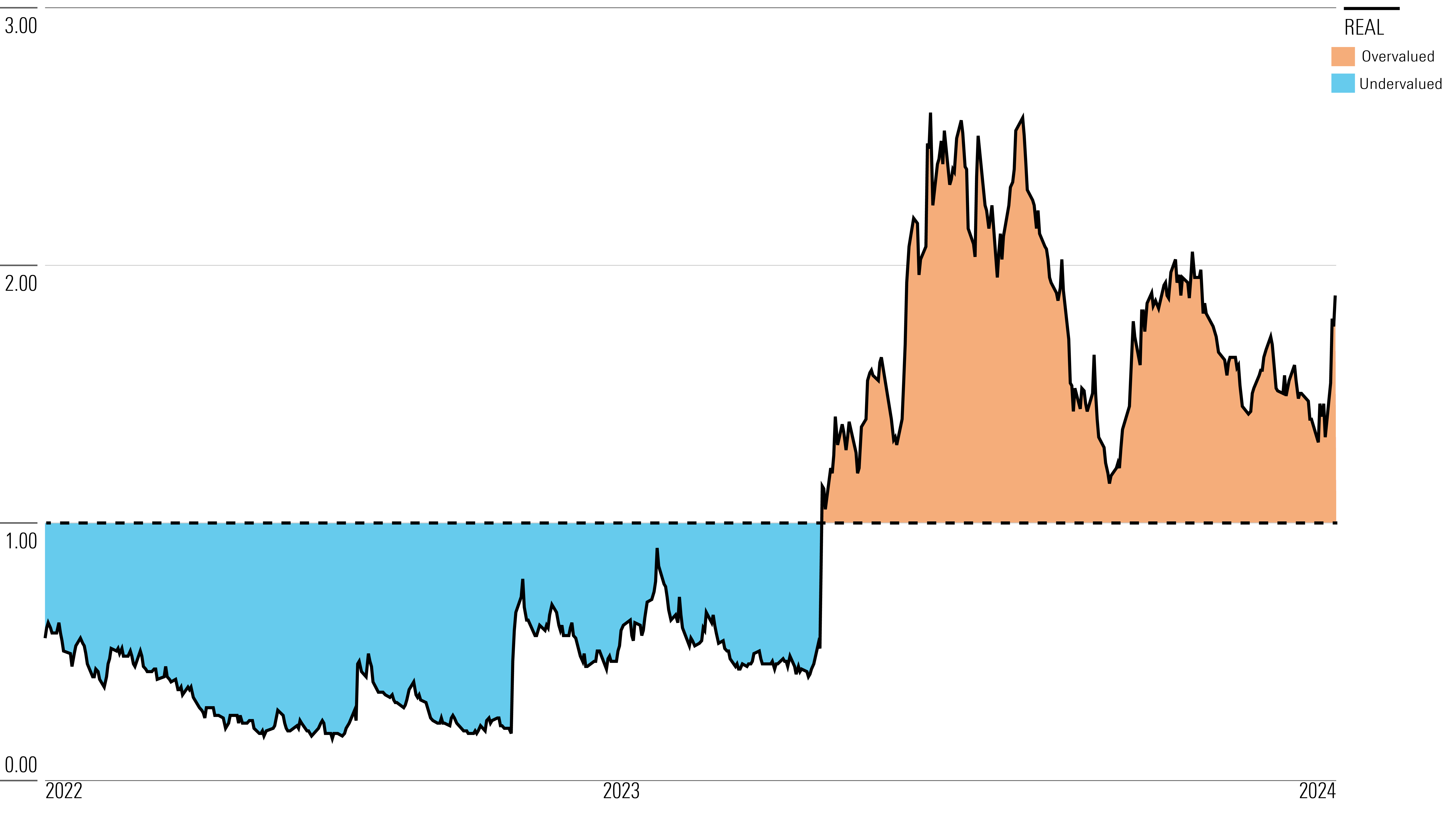

With its 1-star rating, we believe The Real Real’s stock is significantly overvalued compared with our long-term fair value estimate.

As we digest fourth-quarter results, we’ve increased our fair value estimate to $2.08 from $1.21, almost exclusively because of our expectation that the firm should be able to avoid a very costly and dilutive equity raise, which was previously part of our base case. The company was able to restructure $146 million of its 2025 convertible notes until 2029, staving off immediate bankruptcy concerns and giving it time to push toward GAAP profitability and presumably better access to capital markets. The 13% interest rate those notes carry attests to the company’s continued perceived risk.

Consistent with other e-commerce operators in our coverage, we believe gross merchandise value, return rates, take rate, orders per buyer, and growth in active buyers are the key valuation drivers for The RealReal. Somewhat unique in the operator’s model is a relatively muted effect from average order value, with big-ticket items like handbags and watches generally carrying lower take rates, resulting in a muted net effect (higher sales dollars, similar margin dollars). We expect roughly 8% operating margins in 2033, with slower near-term growth limiting leverage over an estimated $250 million-$300 million fixed cost base.

Looking forward, The RealReal’s ability to diversify and expand supply-side sourcing remains integral to our forecasts, with a supply-constrained marketplace suggesting that investments in inventory sourcing initiatives like its recent drop shipping program are cogent. We believe the firm’s decision to move away from direct sales inventory and close four of its brick-and-mortar stores weakens its competitive position against exclusively online competitors like Poshmark and eBay EBAY. While the decisions are perhaps necessary cuts against a very challenging macroeconomic backdrop, we expect them to have meaningful implications for the firm’s ability to diversify its sourcing on the supply side and achieve market-level GMV growth.

Read more about The RealReal’s fair value estimate.

The RealReal Historical Price/Fair Value Ratio

Economic Moat Rating

The clothing resale space is dynamic, quickly growing, and suddenly very crowded, with operators competing for exclusive rights to one of a panoply of micro-niches. The $21 billion online domestic market is sliced up by inventory assortment, service level, geography, and fulfillment channel, with frequent overlap across platforms significantly muddying who emerges with a viable business model and (potentially) excess returns.

We view The RealReal’s take rate and attractive acquisition costs as potentially consistent with an economic moat, contingent on quantitative returns catching up over time, but we remain skeptical because of the firm’s challenged recent performance and our expectation of declining market share. As we see it, the route to durable profitability remains unproven, and we continue to fear that The RealReal’s model isn’t tremendously scalable. Its greatest differentiator (high-touch, curated services) ensures a hefty degree of variable costs—authentication, curation, sourcing—within a nascent market of an ill-defined size.

Read more about The Real Real’s moat rating.

Risk and Uncertainty

We believe The RealReal merits a Very High Uncertainty Rating. While more affluent luxury clientele are generally resilient amid economic turmoil, it looks increasingly likely that The RealReal performs more like a resale company than a luxury fashion house during a downturn. The firm addressed substantial near-term uncertainty by restructuring its 2025 convertible note repayment, but it still has more than $400 million in outstanding debt due in 2028 and 2029, with our projections calling for it to generate less cash flow than that in the interim.

Exacerbating this uncertainty is intense competition in the resale market, with robust growth rates attracting interest from peer-to-peer platforms, rental service providers, consignment outfits like the Vestiaire Collective, and e-tail marketplaces. Consolidation looks inevitable, and operators with extensive inventory, customer, or geographic overlap may see a race to the bottom on take rates and margin. While we believe The RealReal’s model is relatively insulated (with consignment preventing multihoming), blurring lines between self-service and white-glove consignment could pinch its addressable market and GMV growth over time.

Read more about The Real Real’s risk and uncertainty.

REAL Bulls Say

- Partnerships with Stella McCartney, Burberry, and Gucci should bolster trust in The RealReal’s authentication services, addressing a key pain point in luxury e-commerce.

- Ballooning acceptance of used apparel purchases and an emphasis on the circular economy provide meaningful secular tailwinds.

- The RealReal should continue to capture its fair share of growth, as an antiquated offline boutique and pawn shop market is ill-positioned to mimic the online reseller’s platform, authentication, and sourcing investments.

REAL Bears Say

- Growth in mobile commerce and younger luxury consumers may favor cheaper self-service marketplaces like eBay, Poshmark, or Mercari.

- As the first pure-play omnichannel luxury reseller, The RealReal is forced to path-find in its efforts to achieve enduring profitability, the success of which is not guaranteed.

- Pressure at other luxury marketplaces like Farfetch and YNAP suggests the category may not prove as amenable to online penetration as initially expected.

This article was compiled by Freeman Brou.

The author or authors own shares in one or more securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/52d86652-ba2b-43fe-a8fc-523af1fa6e47.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/347BSP2KJNBCLKVD7DGXSFLDLU.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TP6GAISC4JE65KVOI3YEE34HGU.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-29-2024/t_d0e8253d77de4af9ae68caf7e502e1bf_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/52d86652-ba2b-43fe-a8fc-523af1fa6e47.jpg)