The Morningstar Rating for stocks is an analyst-driven measure of a stock’s current price relative to a Morningstar equity analyst’s estimate of what the shares are worth.

Morningstar Rating for Stocks

What is the Morningstar Rating for stocks?

Stock star ratings indicate whether a stock is cheap, expensive, or fairly priced compared with the analyst’s assessment of its intrinsic value, or the fair value estimate.

Stocks trading at large discounts to their fair values receive the highest ratings (4 or 5 stars), while stocks trading at large premiums to their fair values receive lower ratings (1 or 2 stars). A 3-star rating means the current stock price is close to the analyst’s fair value estimate. The ratio of a stock’s price/fair value estimate that corresponds with each star rating is determined by its Uncertainty Rating.

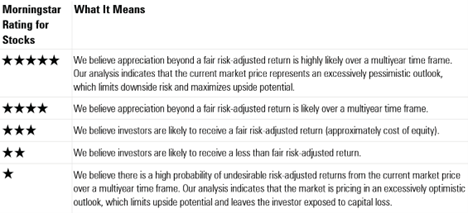

The Morningstar Ratings for stocks are defined below: