7 Undervalued Substitutes to Overvalued Stocks

Loaded up on Apple, Tesla, and other market darlings? Pruning may be prudent in a fairly valued market.

You’ve done your homework and picked a winning stock. Congratulations! But now the price has hit—or maybe even surpassed—your initial expectations. Is it time to sell?

This is an age-old question in investing. After all, you know so much about this company, and you may have fallen in love with its story. Instead of selling, maybe you make a couple of tweaks to your projections, and ta-da! Now the stock doesn’t look so overvalued anymore, and it doesn’t seem like such a sure thing that it’s the right time to sell.

But if you find yourself making aggressive adjustments to expectations to justify hanging on to a stock, beware.

Shares can become overvalued for a number of reasons: short-term market exuberance, macroeconomic factors, or even just old-fashioned speculation. But in the end, the reason it’s overvalued doesn’t really matter. If it is, it might be time to say goodbye to your long-held winner rather than overstep to justify continued ownership.

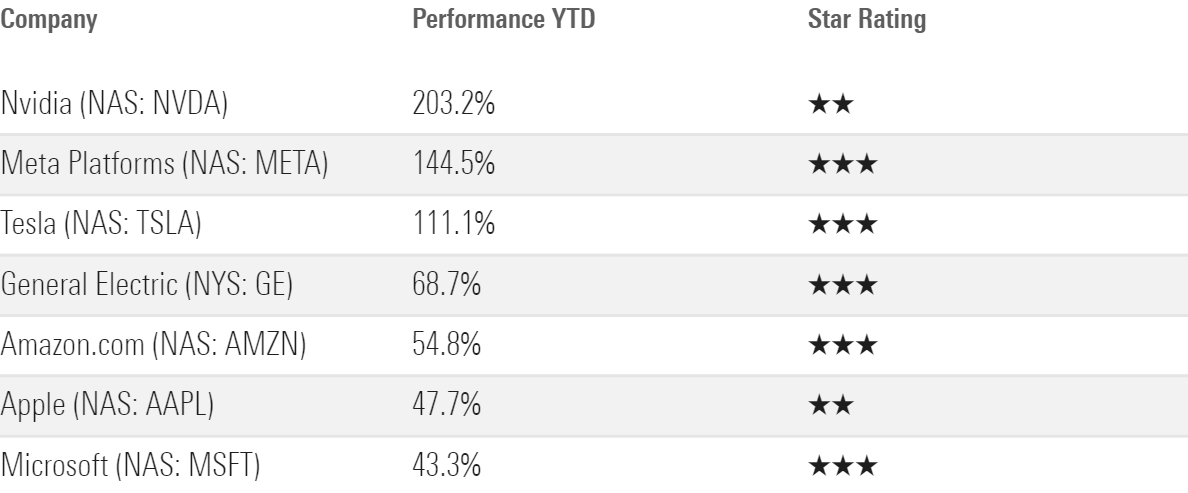

With the U.S. market now close to fairly valued—just 5% undervalued at the end of June, after rallying from a 23% discount in October 2022—there are bound to be a few overvalued stocks sitting in your portfolio. After all, strongly performing large-cap names like Apple AAPL, Tesla TSLA, and Nvidia NVDA are now rated 1 or 2 stars. Is it time to sell? Here are a few things to consider.

Several Large-Cap Names Have Performed Strongly in 2023 But Are No Longer Cheap

Some Considerations Before Selling Stocks

Before you rush to your broker’s website to sell a stock, it’s important to consider other factors, such as your own financial situation and risk tolerance.

Sometimes owning a stock with a lower expected rate of return, but also less uncertainty, may be palatable for investors with a more conservative risk tolerance.

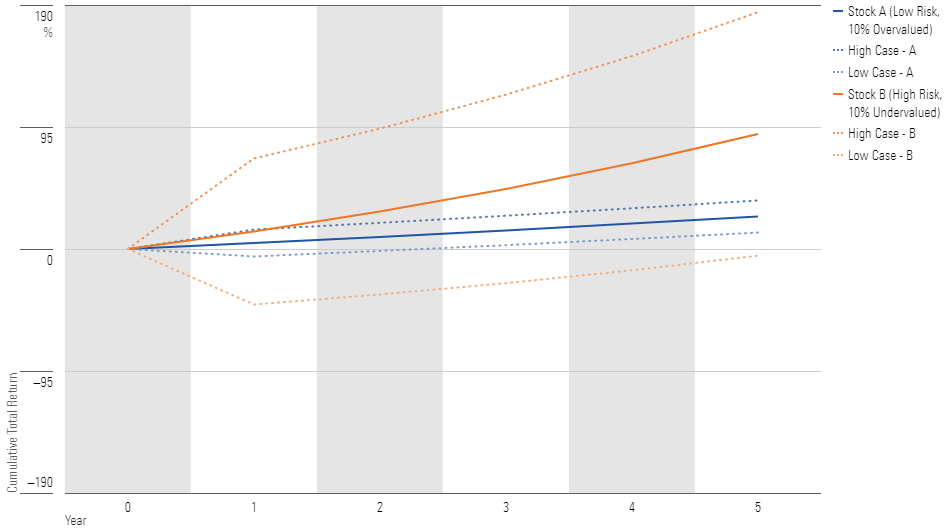

To illustrate with a hypothetical example:

- Stock A is a relatively low-risk company, with limited historical price volatility and fairly predictable future cash flows, but it looks about 10% overvalued.

- Stock B looks cheaper, 10% undervalued, but it has a bumpier track record and future cash flows that are tougher to predict.

In this case, assuming both converge upon their fair value estimates in five years, Stock B has a higher expected return than Stock A but greater potential volatility. This means that daily prices may swing around more than Stock A, and there’s some chance the stock will underperform entirely.

In a Hypothetical Example, an Undervalued but High-Risk Stock Could Prove Too Volatile for Some Investors

Key assumptions: Risk-free rate = 3.78% (10-year U.S. Treasury as of July 18, 2023). Stock A = 10% overvalued, with 10% standard deviation, beta of 0.63, and cost of equity of 6.6%. Stock B = 10% undervalued, with 50% standard deviation, beta of 1.67, and cost of equity of 11.3%.

Some investors won’t mind the wild ride of Stock B, or the potential for lower returns. For others, owning Stock B may be a sure path to heart palpitations. If you fall in the latter category, it might be a better call to stick with Stock A even though it’s currently overvalued.

Finding Substitutes for Overvalued Names

Once personal finance and risk considerations are satisfied, perhaps the most overlooked aspect of selling shares is the need to find alternatives.

Famed Fidelity Low-Priced Stock FLPSX manager Joel Tillinghast offered this insight on the Long View podcast: “The best investors that I’ve seen, by whatever criteria a stock is superb, they sell excellent stocks to make room for superb.”

For Morningstar equity analysts, superb stocks are those trading at substantial discounts to their fair value estimate, and they often have a narrow or wide Morningstar Economic Moat Rating. However, finding an alternative equity to buy also often involves considering a portfolio’s overall diversification, including trying to find (as closely as possible) new names that are in the same industry, geography, or market size as the stock being sold.

With that in mind, there are several potential alternatives to some of 2023′s top performers.

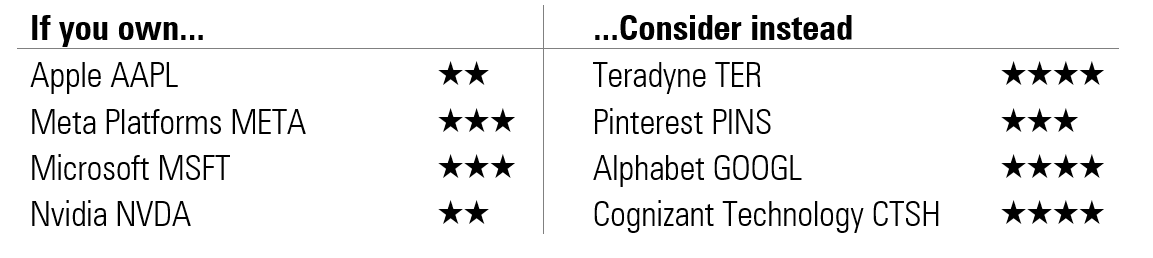

Potential Large-Cap Tech Substitute Stocks

Technology has proved to be a big winner so far in 2023, but several of the top performers are now overvalued, including Nvidia, Apple, and Meta Platforms META. While these remain high-quality businesses—each is assigned a wide moat rating—our analysts would point to several other undervalued opportunities in similar industries.

For more information, check out our latest articles and research on these names:

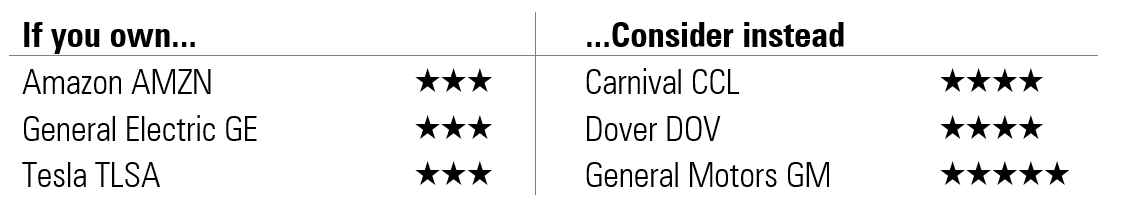

Other Large-Cap Stock Alternatives

Outside of large tech names, there are three other highfliers that have risen to fairly or overvalued levels: Amazon.com AMZN, General Electric GE, and Tesla. Here again, there are a handful of names in similar industries that could be worthy substitutes. In the consumer space, this includes looking to travel names—like Carnival CCL—given our view that humans’ ingrained desire to travel will continue to support strong demand rebound.

Again, these articles and research may be good starting points to learn more about these potential substitutes:

Nothing Is Without Risk, but Regular Portfolio Review Is Healthy

No one’s crystal ball is perfectly clear, and no set of fair value estimates will be 100% accurate. But it can be sensible to monitor your portfolio for overvalued stocks—particularly during major market rallies. While there are important considerations to take into account when selling a stock, it may make sense to spend some time finding deeply discounted alternatives for your former winners. Just be sure to take a little time to celebrate your gains, too.

The author or authors own shares in one or more securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/35091ad9-8fe9-4231-9701-578ec44b5def.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6A6R4SGLDNGMXHAH3K2CIQTF3Q.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PVJSLSCNFRF7DGSEJSCWXZHDFQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/F5UMFVVKMVFRPGGUY4LONIK6OY.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/35091ad9-8fe9-4231-9701-578ec44b5def.jpg)