Communication Services Stock Outlook: As Meta and Alphabet Soar, Traditional Telecom Comes Under Renewed Pressure

While pessimism weighs on telecom valuations, wireless carriers poised to reap benefits of recent price increases.

This article is part of Morningstar’s Q2 market review and outlook.

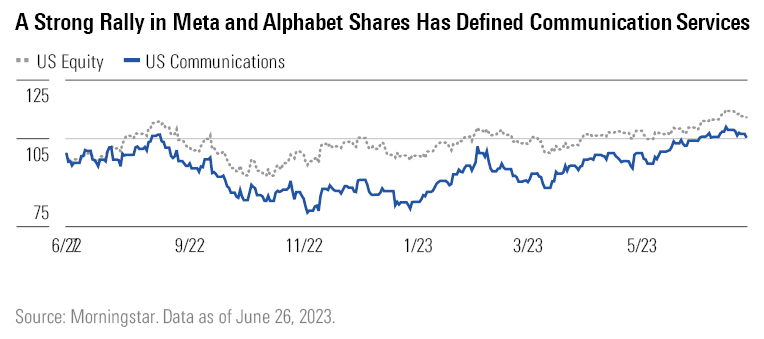

The sharp improvement in sentiment around Meta Platforms META, and to a lesser extent Alphabet GOOGL, has been the story of 2023 thus far in the communication services sector, as signs of a rebound in online advertising demand emerged. Meta returned to revenue growth during the first quarter even as it continued to trim headcount. The excitement around artificial intelligence has almost certainly benefited Meta and Alphabet shares, given the heavy investments both firms have made in large language models and the potential for the technology to enhance and extend their product offerings. With Meta up more than 130% and Alphabet up 40% this year, neither stock looks particularly cheap to us.

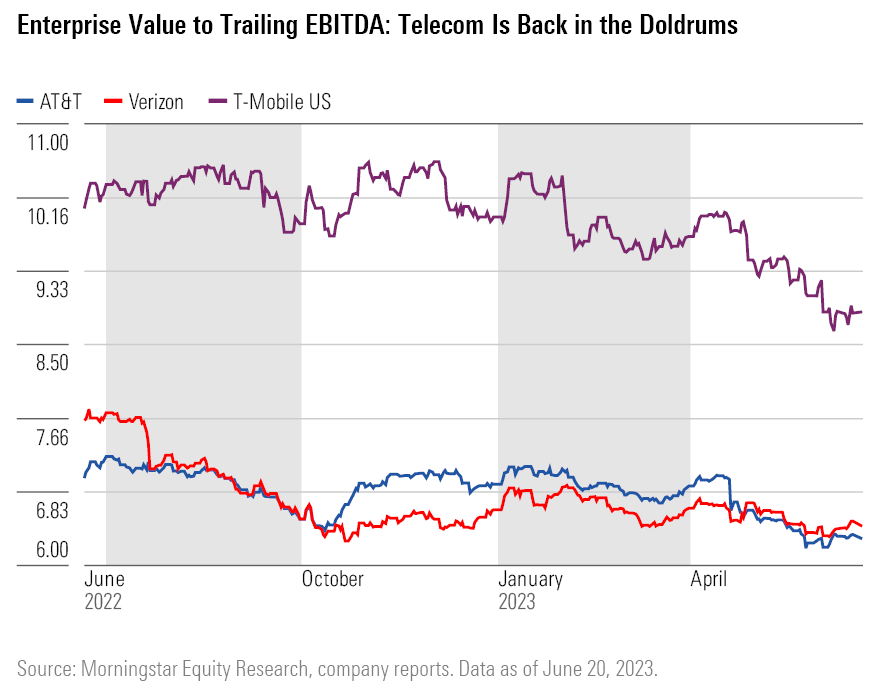

At the other extreme, sentiment around wireless carriers seems to know no bottom. Weak cash flow generation during the first quarter (especially at AT&T T) and a report that Amazon.com AMZN is interested in entering the wireless business contributed to a selloff among telecom stocks. Cash flow at each carrier should improve markedly over the remainder of the year as season pressure on working capital wanes and capital spending declines. As for Amazon, the firm would need an agreement with one of the Big Three carriers to offer full wireless coverage. We don’t see why any carrier would offer Amazon a sweetheart deal and risk disputing its core retail business. Also, Amazon Prime already enjoys high penetration in the United States, leaving little to gain from a money-losing wireless offering.

Dish Network DISH shares rallied on the Amazon news. Dish could strike a deal with Amazon out of desperation, looking for capital and a strong partner to help it truly challenge the Big Three. However, we expect chairman Charlie Ergen to remain focused on maximizing the long-term value of Dish’s spectrum hoard, which requires a healthy wireless industry overall.

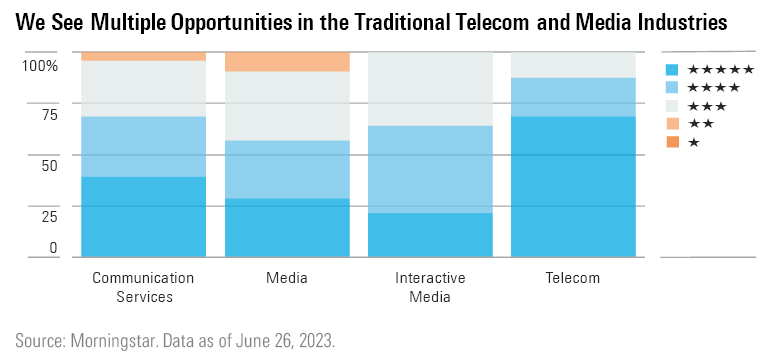

While Pessimism Surrounds Telecom Valuations, Recent Price Increases Bode Well for the Wireless Carriers

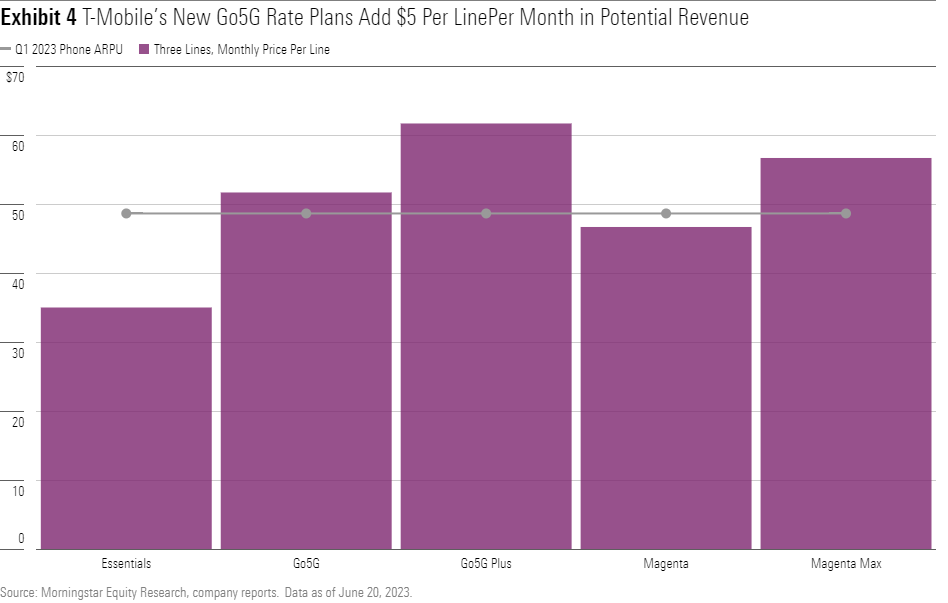

T-Mobile US TMUS and Verizon Communications VZ aren’t overly worried about competition. Both revamped their core postpaid wireless rate plans, adding potential revenue per customer. T-Mobile’s Go5G plans add perks versus its Magenta offerings, but at $5 more per line per month. As T-Mobile has done before, it’s currently offering a third line for free on its three flagship plans. Verizon’s simplified plan unbundles perks and allows customers to restore them for a fee. Replicating Verizon’s prior top plan will now cost more. Both Verizon’s Unlimited Welcome and T-Mobile’s Essentials provide access to limited phone promotions, a key benefit in purchasing higher-end plans. Similarly, T-Mobile’s Go5G plans offer more generous trade-ins than Essentials.

We suspect the differences in phone discounts between the cheaper and more expensive rate plans leave the carriers roughly indifferent as to what customers choose.

Top Communication Services Sector Picks

Disney DIS

- Fair Value Estimate: $145.00

- Star Rating: 4 Stars

- Uncertainty Rating: High

- Economic Moat Rating: Wide

We believe Disney remains the best-situated traditional media firm to navigate the transition to streaming. The firm’s deep content library, with major franchises and its strong studios, provides both family-friendly and adult-oriented content. We project that fans will continue to flock to its parks and resorts. The cable networks, like ESPN, will likely continue to lose subscribers, but will generate cash flow needed to fund the streaming ambitions that will gradually replace traditional cable revenues. The emphasis on revenue growth and cost controls should continue over the next year, but the flagship streaming service Disney+ should continue to build momentum with audiences around the world while moving toward profitability.

Verizon Communications

- Fair Value Estimate: $57.00

- Star Rating: 5 Stars

- Uncertainty Rating: Low

- Economic Moat Rating: Narrow

Verizon remains the cheapest of the three major U.S. wireless carriers, though the recent selloff in AT&T shares has narrowed the gap. Investors have soured on Verizon and its peers as cable wins market share and as competition among the carriers stiffens. Verizon specifically has struggled to grow wireless customers this past year and will likely continue to lose wireless market share. Pricing gains, plus a modest contribution from new services like edge computing and Fios expansion, should enable Verizon to slowly increase revenue. Continued cost-reduction efforts should allow margins to hold roughly steady over time, while a rational competitive environment keeps a lid on needed capital spending.

Pinterest PINS

- Fair Value Estimate: $36.00

- Star Rating: 4 Stars

- Uncertainty Rating: Very High

- Economic Moat Rating: Narrow

With continuing user growth, we believe Pinterest is well-positioned to benefit from a rebound in digital advertising. Pinterest’s first quarter results demonstrated a return of demand for broad-based advertising. Further improvements to the firm’s ad platform for direct response campaigns, the Amazon partnership, and fewer economic uncertainties should improve user monetization throughout the second half of 2023 while also strengthening Pinterest’s network effect.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/12c6871b-2322-44d8-bd98-0437fa1a0a07.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZEMES5XIZBD2LHOJ4CE4VEBM6I.png)

/d10o6nnig0wrdw.cloudfront.net/05-13-2024/t_3bda971142bb429e90b0e551f31b1fbb_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/B26QQUGWL5BVLMVULGYK3QQASI.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/12c6871b-2322-44d8-bd98-0437fa1a0a07.jpg)