Industrials Stock Outlook: Fewer Stocks Are Undervalued, but Investment Opportunities Still Exist

Easing supply chains and a more constructive outlook on the global economy have benefited the industrial distribution and industrial products businesses.

This article is part of Morningstar’s Q2 market review and outlook.

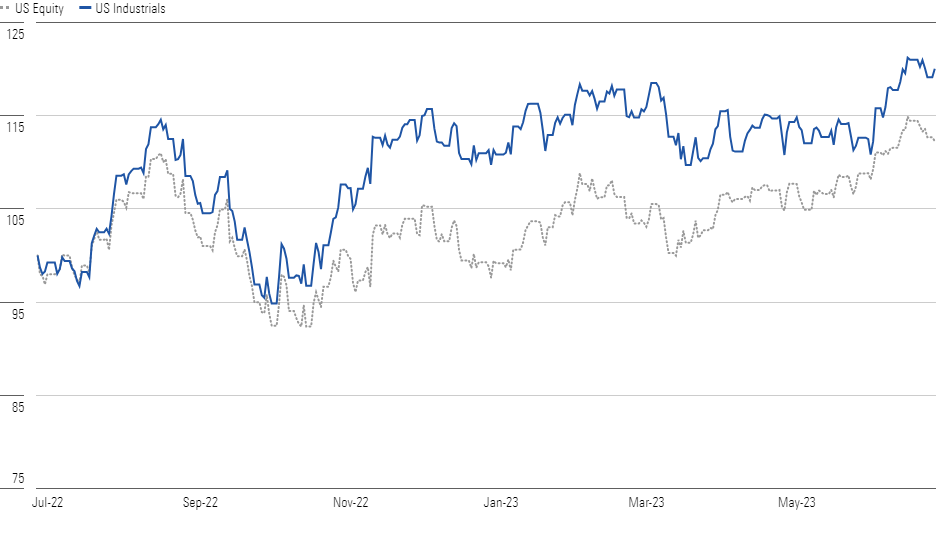

The Morningstar US Industrials Index underperformed the overall market during the second quarter of 2023, yet on a trailing 12-month basis it outperformed by 770 basis points. During the year to date, the industrial distribution, industrial products, and transportation and logistics industries have led the sector. Conversely, farm and heavy construction machinery, waste management, and aerospace and defense lagged.

Industrials Slightly Underperformed Market Index During Q2

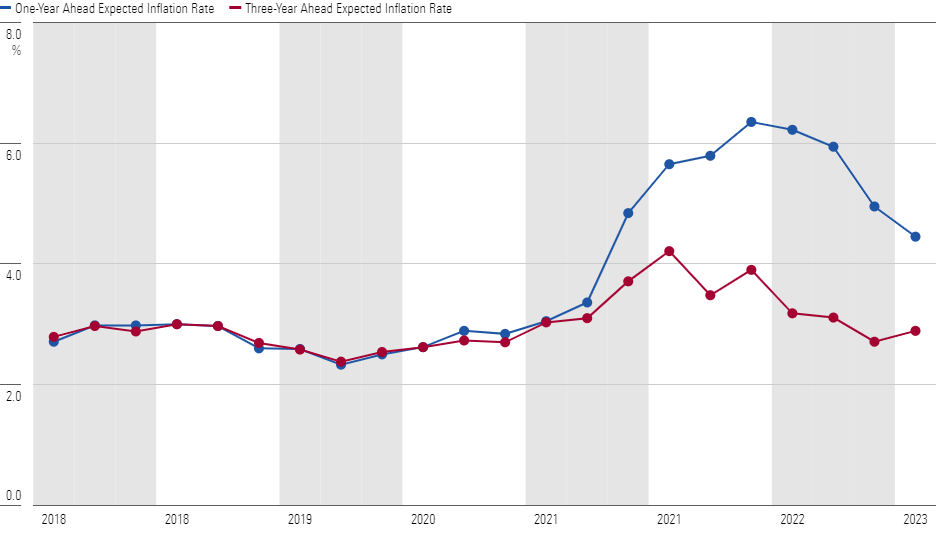

Easing supply chains and a more constructive outlook on the global economy have benefited names within industrial distribution and industrial products. As we enter the third quarter, inflation expectations have moderated significantly. The median one-year-ahead expectation for U.S. inflation is currently 4.4%, down from a peak of 6.8% in June 2022. Meanwhile, unemployment remains below 4%. This indicates the economy may be more resilient than initially anticipated, which would be a tailwind for these stocks.

U.S. Inflation Expectations Are Easing

Airlines and less-than-truckload carriers have been top performers in transportation and logistics. Airlines have benefited from robust post-pandemic-peak demand amid constrained capacity, which has resulted in expanding profit margins. However, we see airlines as a no-moat industry with little prospect for sustainable long-term economic profits. LTL trucking contract prices have held up better than full truckload rates given more balanced capacity, and we suspect investors are optimistic about these carriers’ longer-term prospects for margin expansion. However, valuations for LTL truckers have grown lofty, in our view.

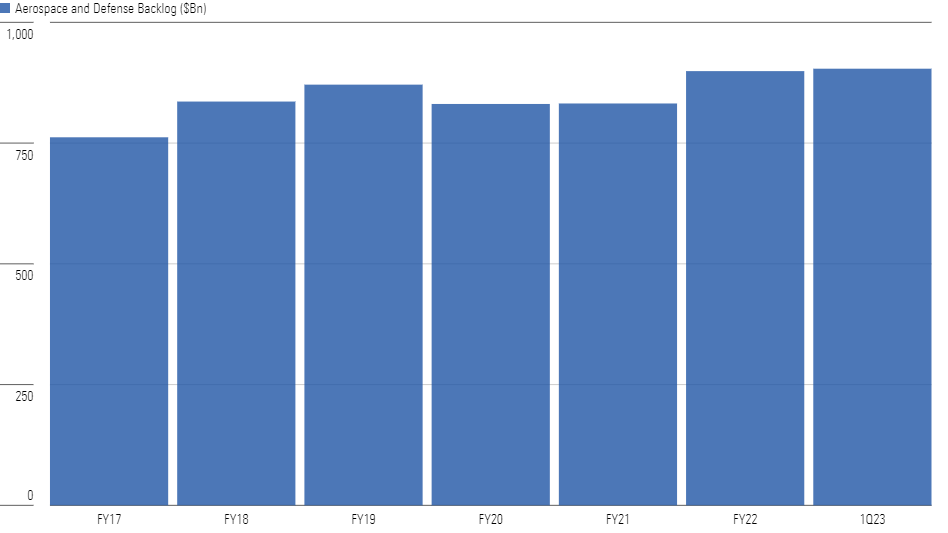

We believe aerospace and defense underperformance is largely due to the industry’s outperformance last fiscal year, when it was the best-performing industry in the sector. We continue to remain constructive on the industry as consolidated backlog continues to increase. We expect this trend to continue, as bookings should benefit from geopolitical uncertainty and continued government support of defense spending. We estimate the portion of U.S. defense spending available to defense contractors will grow at a low-to-mid-single-digit percentage in the medium term, and will be augmented by defense systems sales to allied foreign governments.

Aerospace and Defense Bookings Remain Strong

Top Sector Picks

Jacobs Solutions J

- Fair Value Estimate: $155.00

- Star Rating: 4 stars

- Uncertainty Rating: Medium

- Economic Moat Rating: None

Jacobs Solutions is a global provider of engineering, design, procurement, construction, and maintenance services, as well as cyber engineering and security solutions. The firm services industrial, commercial, and government clients in a wide variety of sectors, including water, transportation, healthcare, technology, and chemicals. We believe the company’s critical mission solutions segment is poised to benefit from increased opportunities in space exploration, robotics, and the continued 5G rollout, allowing the company to generate excess returns on invested capital.

Dover DOV

- Fair Value Estimate: $174.00

- Star Rating: 4 stars

- Uncertainty Rating: Medium

- Economic Moat Rating: Narrow

Dover is a diversified industrial manufacturing company with products and services that include digital printing for fast-moving consumer goods, marking and coding for the food and beverage industry, loaders for the waste collection industry, pumps for the transport of fluids (including petroleum and natural gas), and commercial refrigerators used in groceries and convenience stores. The company is well-positioned to capitalize on multiple secular trends, including mRNA and single-use technology in biopharma, as well as C02 refrigeration and heat pump systems.

Stericycle SRCL

- Fair Value Estimate: $59.00

- Star Rating: 4 stars

- Uncertainty Rating: Medium

- Economic Moat Rating: Narrow

Stericycle is the largest provider of medical waste disposal and data destruction (primarily paper shredding) services in the United States. An aggressive acquisition strategy under the previous management regime caused the company to stray from its core competencies, but the current management team has started to right the ship by divesting noncore businesses and implementing much-needed oversight and standardization. Stericycle’s self-help measures and significant exposure to the growing U.S. medical waste market should result in solid top-line growth and margin expansion over the next five years.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZEMES5XIZBD2LHOJ4CE4VEBM6I.png)

/d10o6nnig0wrdw.cloudfront.net/05-13-2024/t_3bda971142bb429e90b0e551f31b1fbb_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/B26QQUGWL5BVLMVULGYK3QQASI.jpg)