Q3 Stock Market Outlook: Time to Batten Down the Hatches or Raise the Sail?

Investors should take profits on overextended stocks and reinvest in undervalued names left behind by the rally.

Key Takeaways From Our Third-Quarter Stock Market Outlook

- U.S. stock market is trading at a 5% discount to composite of our fair value estimates.

- It’s time to move to underweight in the growth-stock category, especially the technology sector.

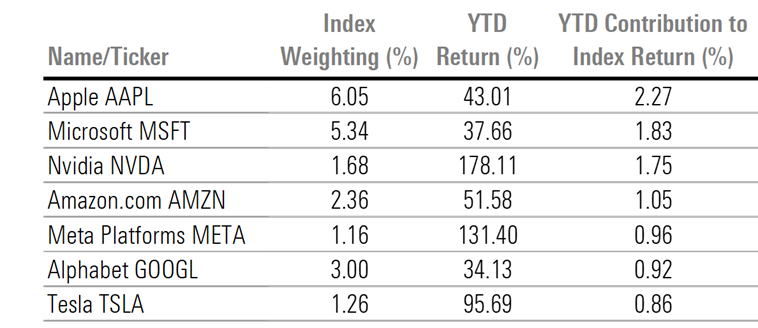

- The stock market rally is unusually concentrated: Only seven stocks account for approximately three-quarters of this year’s gains.

- Federal Reserve rate increases are coming to an end, but rate cuts won’t start until next year.

From its October lows, the U.S. stock market has risen 22% through June 26, breaching the technical indicator of a bull market.

Many market commentators are saying this rally marks the start of a new bull market and investors should jump into equities to ride this wave. But others argue it’s a bull trap in an ongoing bear market and investors should get out of stocks while the getting is good.

As detailed in our third-quarter Stock Market Outlook, the question for investors isn’t whether to raise the sails and ride the tailwind of a new bull market, or to batten down the hatches in preparation for a near-term squall, but rather how to best position their portfolios based on today’s valuations.

In the wake of the first half’s rally, we are seeing several opportunities for investors to reallocate their portfolios to take profits where the market has overextended itself and reinvest those gains in undervalued areas that have been left behind.

Third Quarter 2023 U.S. Stock Market Outlook

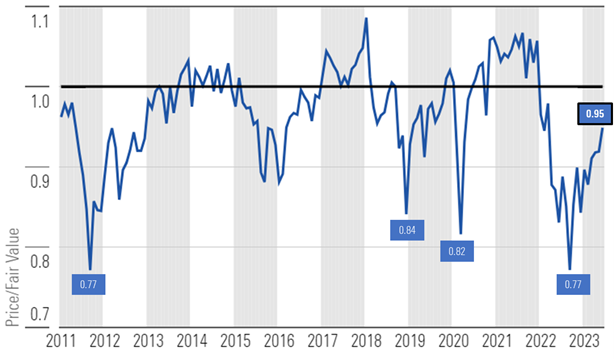

In October 2022, the market was trading at a 23% discount to a composite of our intrinsic stock valuations. Since 2010, such a discount has only occurred one other time, in 2011.

According to a composite of the more than 700 stocks we cover that trade on U.S. exchanges, as of June 26, 2023, the U.S. equity market was trading at a price/fair value ratio of 0.95, representing a 5% discount to our fair value estimates.

Growth stocks as measured by the Morningstar US Growth Index have risen 23.4% this year through June 26, outperforming the 13.2% increase in the Morningstar US Market Index. As such, the growth category is now trading near fair value, whereas it was the most undervalued category at the beginning of the year. At this point, on a relative value basis, investors would be best positioned by overweighting value stocks and underweighting core and growth stocks, both of which are trading near fair value.

Large-cap stocks have also outperformed this year, with the Morningstar Large Cap Index rising 16.0%, and are now trading slightly closer to fair value than the broader market. Mid-cap and small-cap stocks both remain at much greater discounts to fair value.

Looking ahead, we forecast that the rate of economic growth will slow sequentially in the third and fourth quarters, then bottom out in the first quarter of 2024. While we continue to view the broad market as undervalued, between slowing economic growth, tight monetary policy, and reduced credit availability, we suspect the rate of market gains will be limited over the next few quarters.

Morningstar Equity Research Price to Fair Value by Style Box

Stocks Remain Undervalued but With Less Margin of Safety

The U.S. stock market continued its march higher in the second quarter, as stronger-than-expected economic growth and excitement regarding the long-term potential for artificial intelligence to spur earnings growth lifted market sentiment. This year’s market rally has been unusually concentrated, as an attribution analysis reveals that the returns on only seven companies are responsible for approximately three-quarters of the overall gains.

For the rally to continue in the second half of this year, it will need to spread out into the value category as well as mid-cap and small-cap stocks. The U.S. stock market continues to trade at a discount to our fair valuations, but now at a much smaller margin of safety.

Historical Morningstar US Equity Research Coverage Price to Fair Value

Magnificent Seven Responsible for Almost Three-Quarters of Market Gains

According to an attribution analysis of the Morningstar US Market Index, the returns from only seven stocks account for almost three-quarters of the total market return thus far this year.

The excitement surrounding artificial intelligence—specifically natural language processing tools such as ChatGPT—drove the stocks of any companies that may stand to benefit from the future implementation of this technology significantly higher.

Magnificent Seven Responsible for Almost Three-Quarters of Market Gains

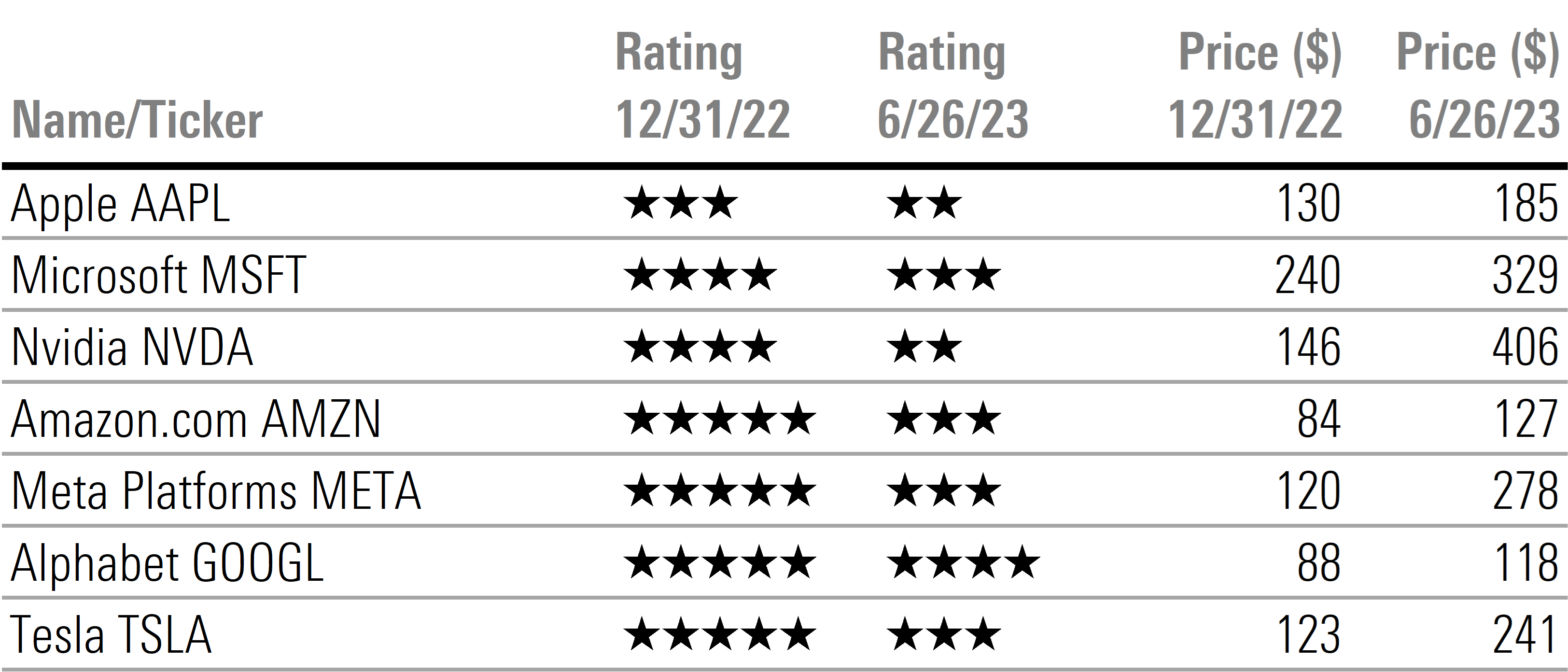

From a valuation standpoint, it appears the main driver of the 2023 rally has run out of steam. While six of these seven stocks were rated either 4 or 5 stars at the beginning of the year, only one remains at 4 stars, while four are now rated 3 stars and two are rated 2 stars.

Star Rating and Price Changes for Magnificent Seven Through June 26

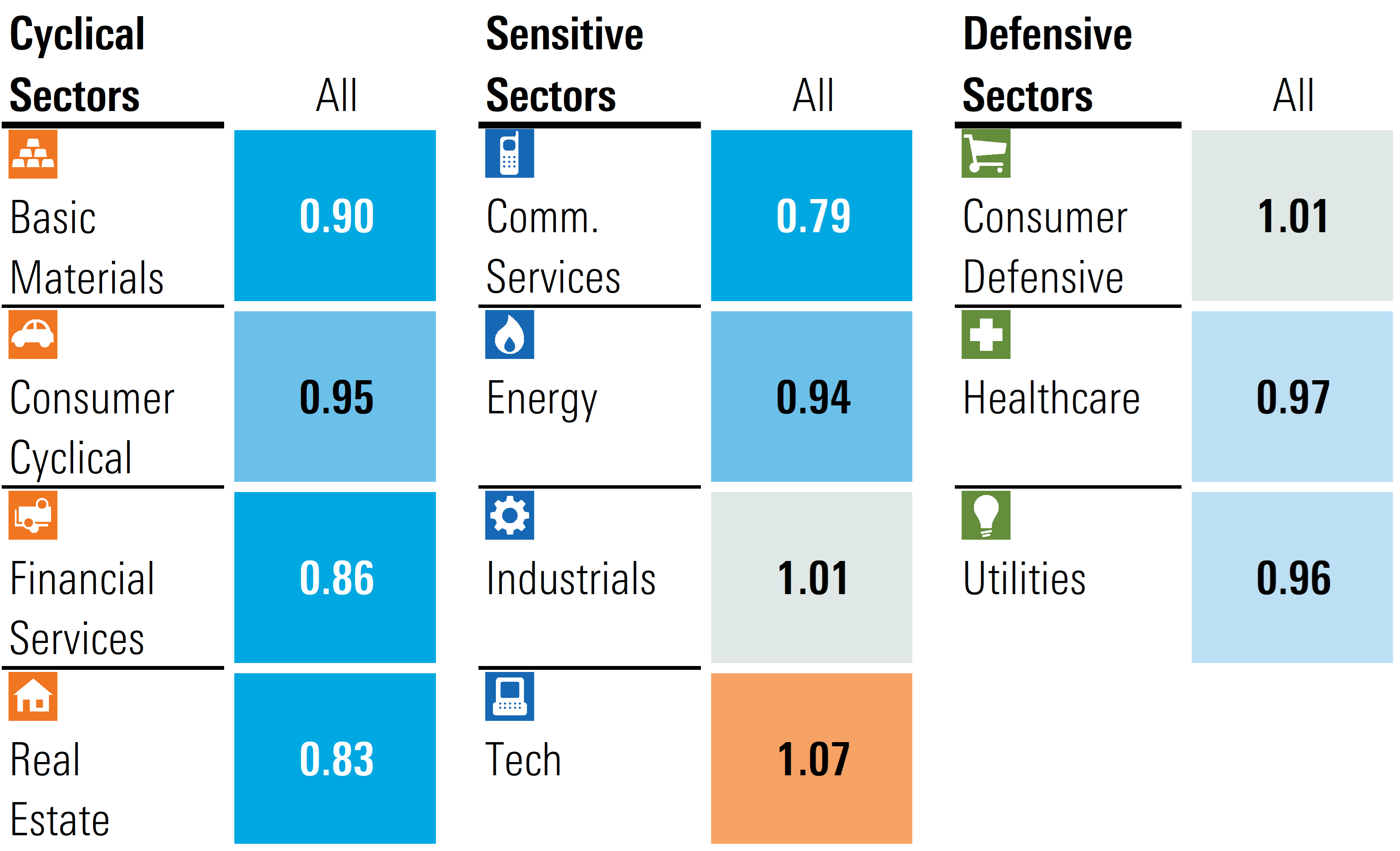

Sector Valuations: Technology Stocks Looking Expensive

Following its 12% increase in the second quarter through June 26 and its 37% surge during the year to date, the technology sector has risen into overvalued territory. This is the first time since the beginning of 2022 that the sector has traded above its fair value. According to our valuations, it appears this may be a good time to underweight this sector to add to overweight positions in communications and cyclical sectors.

Communications rose 10% in the second quarter through June 26 and a total of 32% thus far this year, but it remains the most undervalued sector. However, within this sector, Alphabet GOOGL is now trading at much less of a discount to fair value, and following the surge in Meta Platforms’ META stock, it’s now rated 3 stars. Within communications, we see the best value in the more traditional telecom and media stocks.

Real estate is the second-most undervalued sector. Commercial real estate, especially office space, has been under intense investor scrutiny. Valuations for office space have been declining as employees show a continued preference to work from home. According to the Kastle Workplace Occupancy Barometer, average urban office occupancy levels have stabilized at only 50%. While office valuations may remain under pressure, we see value for investors in other real estate assets where foot traffic continues to rebound, such as retail malls.

Financial services, particularly regional banks, appear to have bottomed out following the failure of Silicon Valley Bank earlier this year. In our view, the sector is under pressure, but the business model is not broken. Although we expect earnings to decrease sequentially through the rest of this year, we see a plethora of undervalued opportunities for investors willing to ride out the volatility.

Morningstar Equity Research Price to Fair Value by Sector

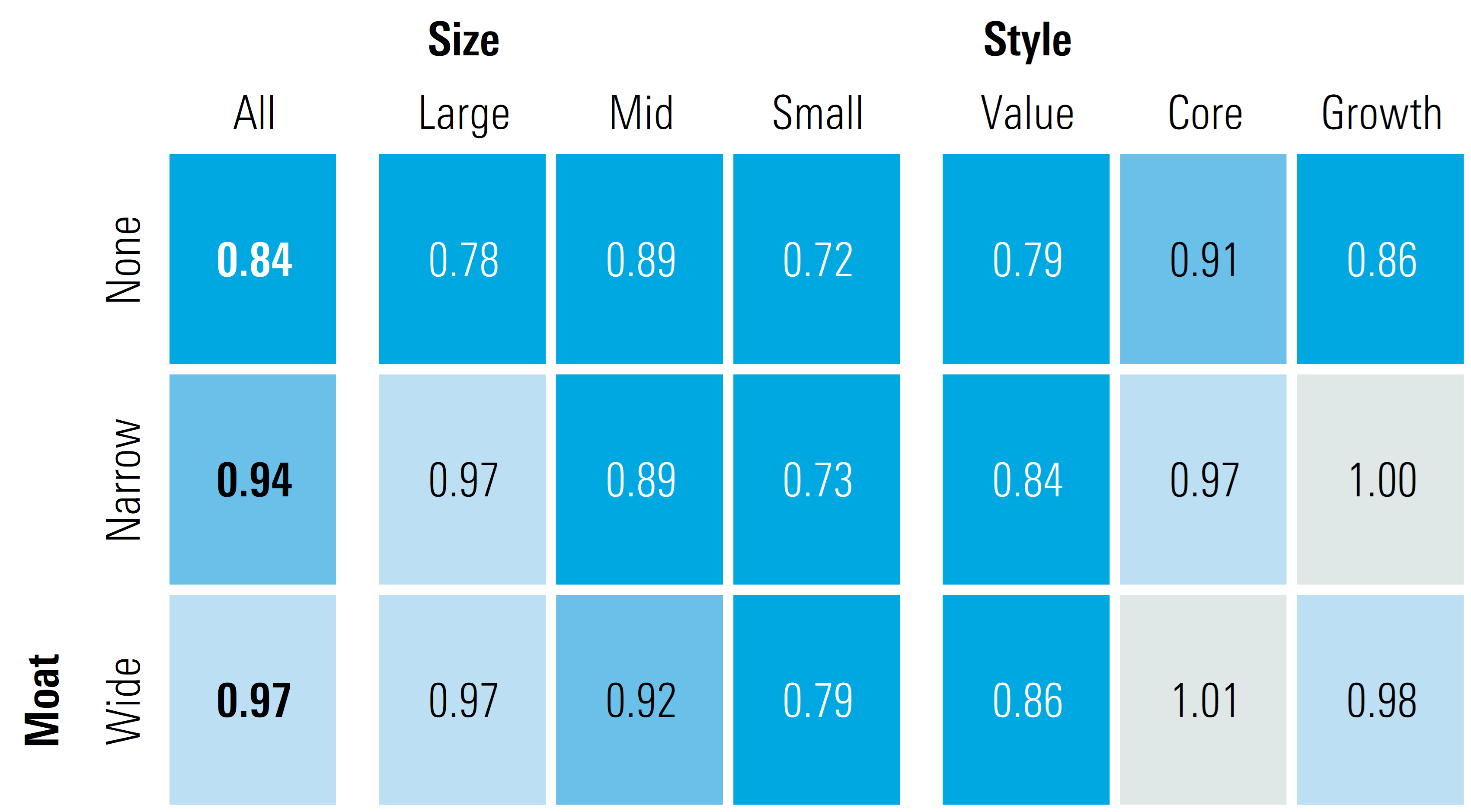

Valuations by Economic Moat

Stocks with wide economic moats have well outpaced the broad market rally this year. As such, stocks with wide moats are now trading at less of a discount to fair value than the broad market. Through June 26, the Morningstar Wide Moat Composite Index has risen 19.15%, and the Morningstar Wide Moat Focus Index has increased even more, rising 20.07%.

There’s a handful of high-quality companies whose stocks remain undervalued, but these opportunities are becoming increasingly hard to find. We recently highlighted four wide-moat stocks on sale, as well as four undervalued wide-moat stocks with defensive characteristics.

Stocks for those companies that don’t have long-term durable competitive advantages have lagged and are trading at a significant discount to fair value. While the margin of safety here provides a cushion against downsides, we caution investors to choose carefully among no-moat stocks.

Morningstar Equity Research Price to Fair Value by Economic Moat

Investment Outlook

The stock market is off to a strong start this year, coming off what we noted were initially very undervalued levels in our piece on the outlook for 2023. While we continue to view the broad market as undervalued, between slowing economic growth, tight monetary policy, and reduced credit availability, we suspect the rate of market gains will be limited over the next few quarters.

As the market nears our view of fair value and there is a smaller margin of safety from intrinsic value, risk-off sentiment could lead to brief selloffs. However, we suspect any pullbacks would be relatively shallow and not anywhere near the magnitude of the selloff in 2022. In such a scenario, investors may be interested in 5 Undervalued Stocks for a Sideways Market.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/54f9f69f-0232-435e-9557-5edc4b17c660.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/MQJKJ522P5CVPNC75GULVF7UCE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZYJVMA34ANHZZDT5KOPPUVFLPE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/S7NJ3ZTJORFVLCRFS2S4LRN3QE.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/54f9f69f-0232-435e-9557-5edc4b17c660.jpg)