Is Alphabet Stock a Buy, a Sell, or Fairly Valued Ahead of Earnings?

Watching for AI’s impact on Google’s results and any signs of a second-half turnaround for advertising.

Alphabet GOOGL is scheduled to release its second-quarter earnings report on July 24, 2023. Here’s Morningstar’s take on what to watch for in Alphabet’s earnings and stock.

Alphabet Stock at a Glance

- Fair Value Estimate: $154

- Morningstar Rating: 4 stars

- Morningstar Economic Moat Rating: Wide

- Morningstar Uncertainty Rating: High

What to Watch For in Alphabet’s Q2 Earnings

Advertising revenue growth in search and YouTube

For search, we’d like to see whether the continuing macroeconomic uncertainty is impacting advertisers. We have assumed there will be a turnaround in the second half of 2023. These results could show whether the release of ChatGPT late last year and Microsoft’s chat on Bing (using the ChatGPT technology) earlier this year has had and/or will have an effect on that business in the future.

For YouTube, while we expect revenue growth to be driven mainly by direct response ads, we will look for more color on contributions from broad-based campaigns, which could be an indicator of advertiser sentiment about the economy for the rest of the year.

Monetization plans for generative artificial intelligence

We would like the firm to provide more color regarding Bard, its generative AI-powered search/chatbot, and the monetization plans for the tool. We would also like to hear whether the search business is feeling any pressure from Microsoft’s Bing or other AI-powered search offerings.

We’ll be looking for more clarity about Alphabet’s strategy regarding another AI-powered search platform search-generative experience, or SGE, which is currently being tested in Search Labs. Will it replace regular search? Will it be combined with Bard? How will it be monetized? SGE’s interface is very similar to Google’s regular search.

The cloud segment

We will be focusing on the profitability of Alphabet’s cloud segment, and whether it has continued from the first quarter, which was the segment’s first-ever profitable quarter.

We’ll also look for more info on demand for cloud—specifically, whether it is now driven mainly by firms that want to include some generative AI features and functionalities. If AI demand grows within cloud, will Alphabet have to increase its capital expenditure much to accommodate the additional training and inference required by the technology?

Overall bottom line

We’d like to have a better sense of the firm’s traffic acquisition costs, and whether they will be increasing significantly as the firm is likely renegotiating with Apple.

In addition, there have been reports that after 12 years, Samsung is considering changing the default search engine on its devices from Google to Bing. If true, Alphabet may be forced to pay more than the roughly $3 billion it has been paying Samsung at least since 2017. Updates on Bard and SGE could give us a better idea about whether Apple and Samsung will pressure Google too much.

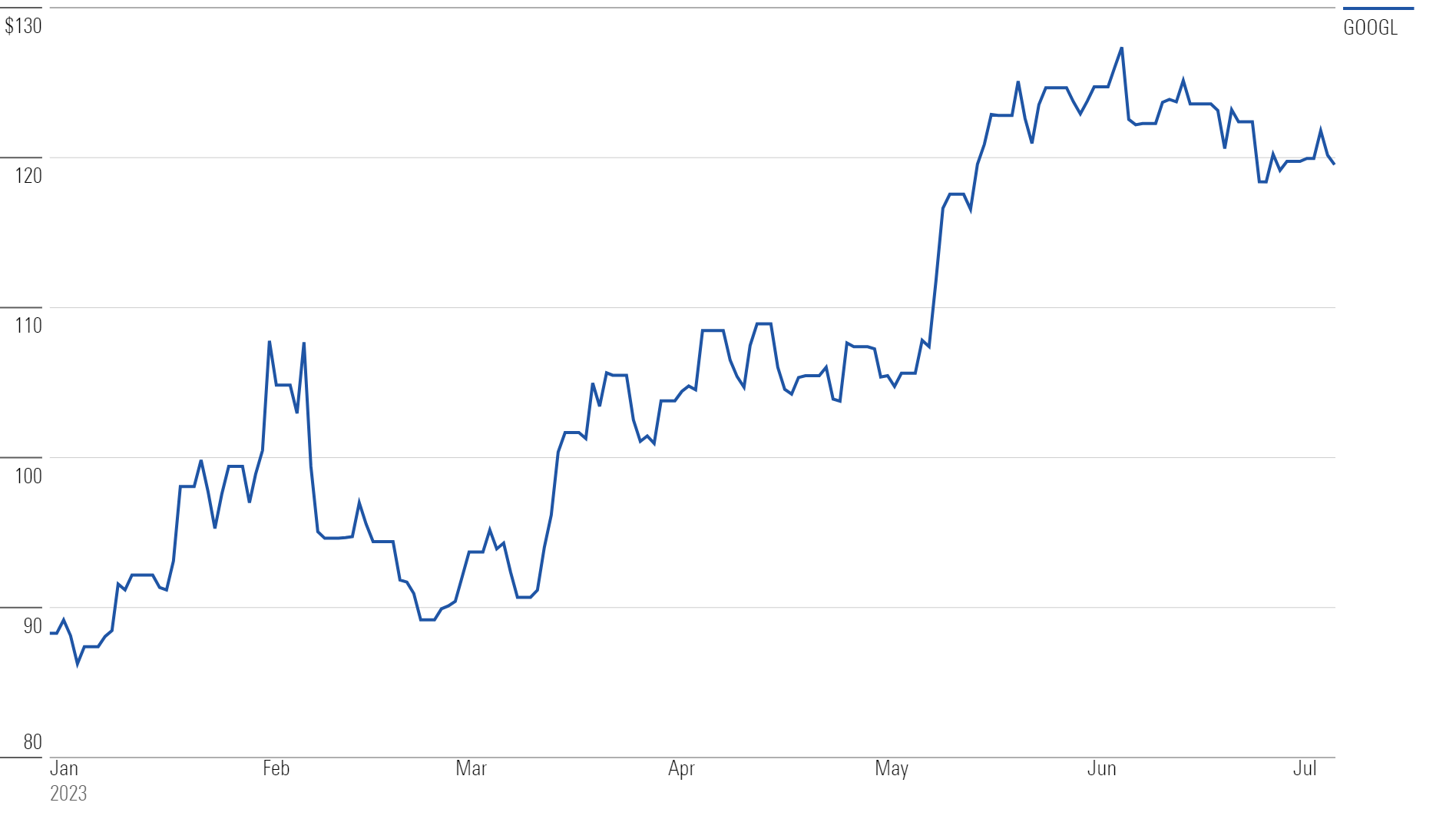

Alphabet Stock Price

Fair Value Estimate for Alphabet

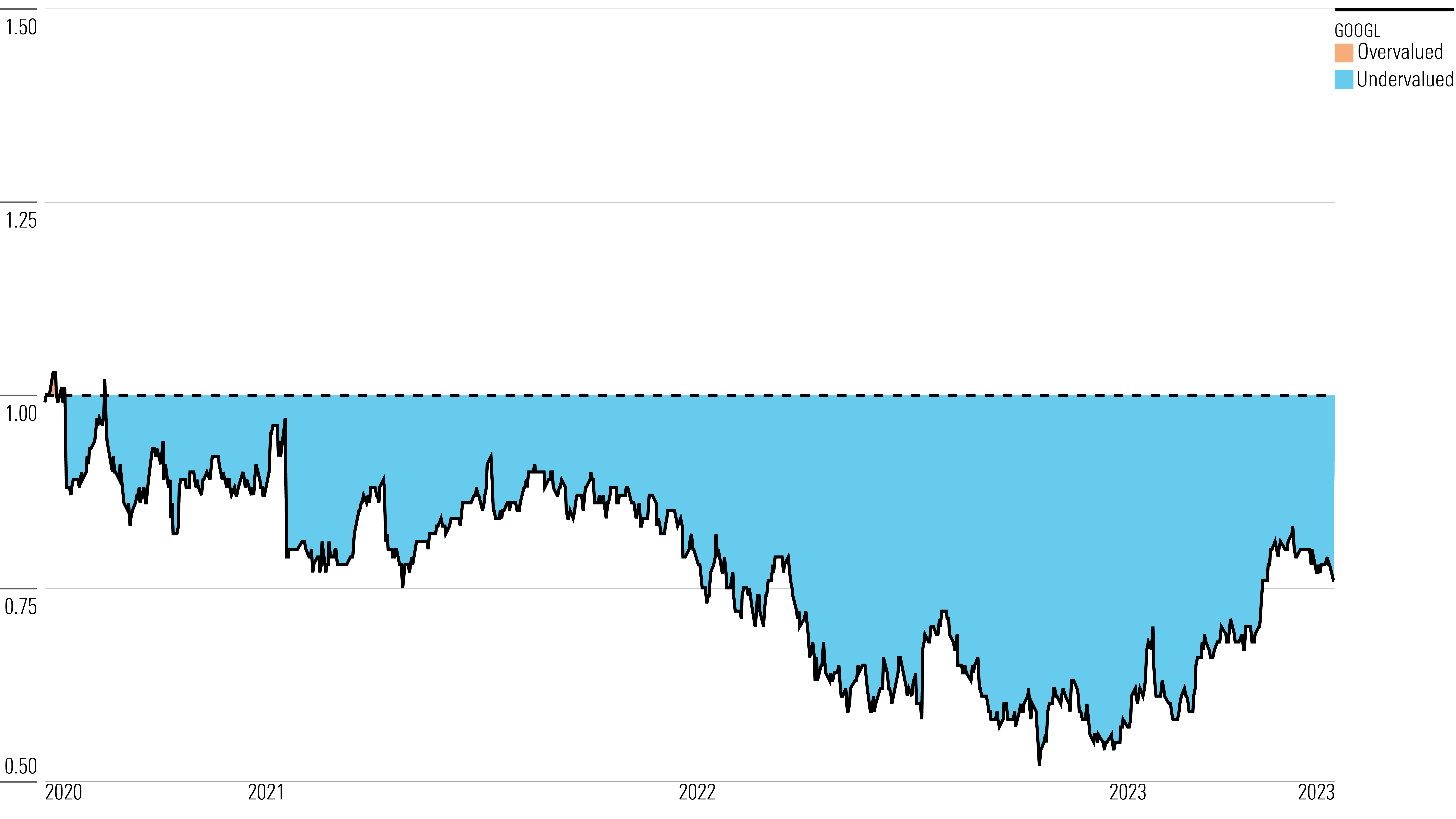

With its 4-star rating, we believe Alphabet stock is undervalued compared with our long-term fair value estimate.

Our fair value estimate is $154 per share, equivalent to a 2023 enterprise value/EBITDA ratio of 17. We expect margin pressure in 2023, given the firm’s aggressive hiring in 2022 and continued investments in growth initiatives. We look for margin improvement in 2024-27. Our model assumes a five-year compound annual growth rate of 11% for total revenue and a five-year average operating margin of 24%.

In the longer term, we believe Alphabet will continue to gain traction in the cloud market (20% annual revenue growth through 2027). We see the company’s other revenue (non-ad YouTube revenue, Google Play Store, and sales of hardware products), up 13% in 2023 (due to strong growth in YouTube Premium, Music, and TV subscriptions) and up 20% in 2024.

Read more about Alphabet’s fair value estimate.

Alphabet Historical Price/Fair Values Ratios

Economic Moat Rating

We assign Alphabet a wide moat rating, thanks to durable competitive advantages derived from the company’s intangible assets, as well as its network effect.

We believe Alphabet holds significant intangible assets related to overall technological expertise in search algorithms and machine learning, as well as access to and accumulation of data that is deemed valuable to advertisers. We also believe the Google brand is a significant asset; “Google it” has become synonymous with searching, and regardless of actual technological competency, the firm’s search engine is perceived as being the most advanced in the industry.

In our opinion, Alphabet’s network effects are derived mainly from its Google products such as Search, Android, Maps, Gmail, YouTube, and more. Ultimately, we view Google’s network as heterogeneous. All the aforementioned products have provided Google with a massive consumer base that allows the company to collect data. On the other side, via its rich collection of data and large user base, Google can offer the best return on investment for advertisers and build a growing network of advertising customers. The addition of each new ad and advertiser improves the efficiency of Google’s programmatic advertising offerings, allowing the firm to better monetize the network.

Read more about Alphabet’s economic moat rating.

Risk and Uncertainty

Our Morningstar Uncertainty Rating for Alphabet is High, primarily due to its dependency on continuing online advertising growth.

While we remain confident that Google will maintain its dominant position in the search market, a long-lasting downturn in online ad spending could have a negative impact on Alphabet’s revenue and cash flow, resulting in a lower fair value estimate. On the other hand, positive returns on the firm’s investments in cloud and moonshots could increase our fair value estimate considerably.

Although its intangible assets and network effect will help Alphabet retain its competitive advantages, the minimal switching cost to utilize a rival search engine remains a risk for the company. This risk is discounted, as Microsoft’s Bing—the nearest competitor to Google’s search engine—currently does not have a significant presence in the mobile market, which is one of the main growth drivers of the search ad market.

Read more about Alphabet’s risk and uncertainty.

GOOGL Bulls Say

- As the number of online users and usage increase, so will digital ad spending, of which Google will remain one of the main beneficiaries.

- Android’s dominant global market share of smartphones leaves Google well positioned to continue generating top-line growth as search traffic shifts from desktop to mobile.

- The significant cash generated by the Google search business allows Alphabet to remain focused on innovation and the long-term growth opportunities new areas present.

GOOGL Bears Say

- There is little revenue diversification within Alphabet, as it remains heavily dependent on Google and the search ad space.

- Alphabet is allocating too much capital toward high-risk bets, which face a very low probability of generating returns.

- Google’s dominant position in online search is not maintainable, as more companies and regulatory agencies are contesting the methods through which the company has been extending its leadership.

This article was compiled by Monit Khandwala.

Get access to full Morningstar stock analyst reports, along with data and tools to manage your portfolio through Morningstar Investor. Learn more and start a seven-day free trial today.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/4JOND5R2SBFPZE63XWPYQDG56A.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/K36BSDXY2RAXNMH6G5XT7YIXMU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/BG4IFJHA25B6RKD3XNUYKROBBM.jpg)