4 Growth Stocks Trading at Reasonable Prices

Paying up for growth may be the best option in fully valued sectors, but moats still matter.

We usually preach finding undervalued companies, often with wide Morningstar Economic Moat Ratings, as the primary strategy for maximizing long-term investment returns when investing in individual equities. But in a relatively fairly valued market, it might be worth thinking outside this box.

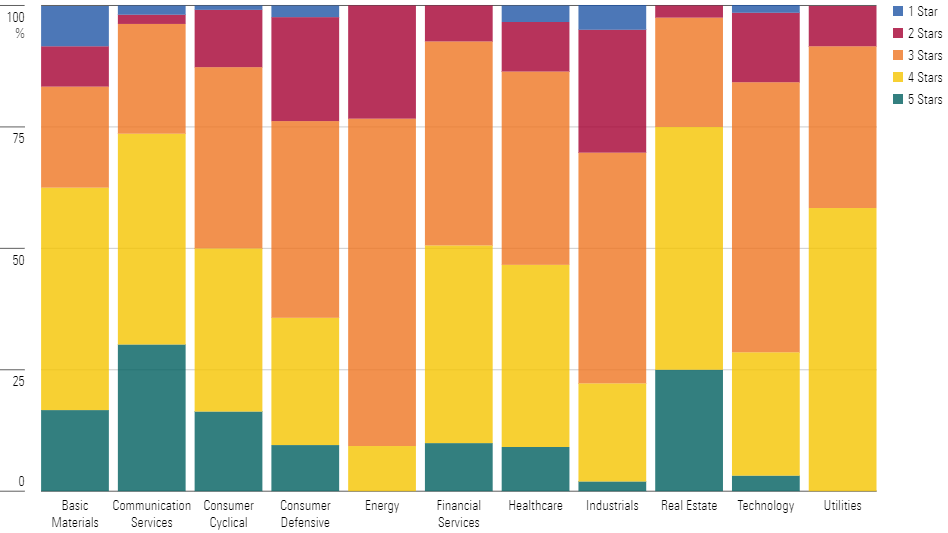

In particular, investors seeking broad sector diversification have little to consider in several sectors. This is most acute in the energy space, where our equity analysts see zero names with 5-star Morningstar Ratings and only four 4-star stocks in the United States. It’s a similar story in the consumer defensive, industrials, and technology sectors; while 72 stocks are rated either 4 or 5 stars, just 21 of these are assigned a wide moat rating. And even then, many of these names look undervalued because of recent financial underperformance or operational challenges.

Undervalued Opportunities Are Slim in the U.S. Consumer Defensive, Energy, Industrials, and Technology Sectors

Given limited choice in this handful of sectors, one alternative investing discipline we can look to is growth at a reasonable price, or GARP. Admittedly, this term borders on being self-evident; I don’t know of many successful investors who look to buy stocks at unreasonable prices.

But GARP investing is more than just holding your nose and paying full price for stocks. This discipline involves looking for high-quality businesses that are expected to increase their earnings faster than the overall market and have valuations that are palatable, if not screamingly cheap. It recognizes that high-growth names are often accompanied by high prices, but the goal remains to invest in companies that can compound value over the long term. For this reason, finding stocks with moats is still important.

With that in mind, we can look to Morningstar equity analysts’ coverage of nearly 750 stocks in the U.S. to determine which may be good GARP candidates in the consumer defensive, energy, industrials, and technology sectors.

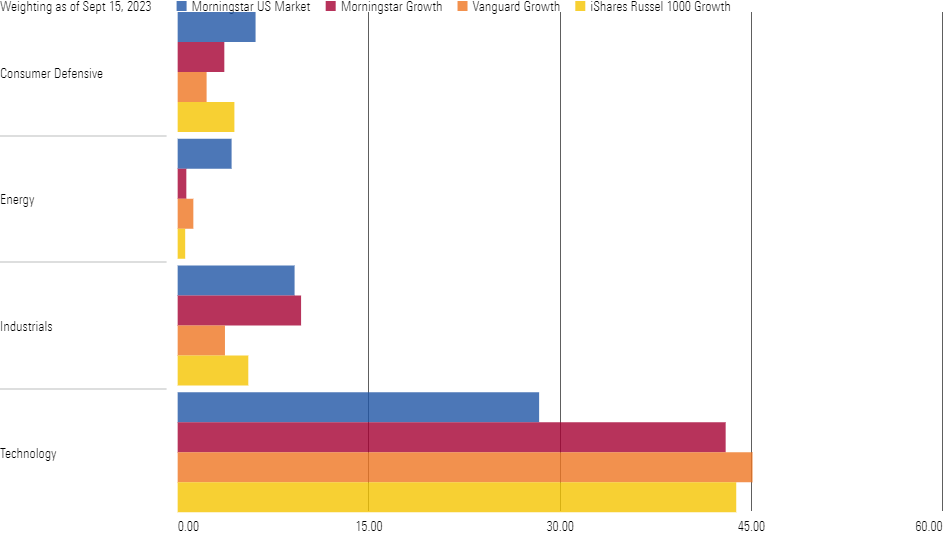

Identifying Growth

There are scores of exchange-traded funds, mutual funds, and indexes aimed at offering investors exposure to growth, including Vanguard Growth ETF VUG, iShares Russel 1000 Growth ETF IWF, and the Morningstar US Growth Index. But finding prospects among individual stocks is often more than just looking at the holdings in an index. As shown below, the consideration of historical growth measures alongside future projections leads to certain sectors becoming underweight the broader market. While there are plenty of tech names to choose from, investors looking for high-growth consumer defensive, energy, or industrials ideas are once again faced with slim pickings.

These Growth Vehicles Are Overweight Tech but Underweight Other Sectors

To instead build our own bottom-up GARP picks, the first step is to find stocks with growth expectations over the next few years that are expected to outpace the overall market. Per PitchBook consensus estimates, weighted operating income growth (or, for financial-services companies, net income) for the Morningstar US Market Index is expected to fall nearly 2% in 2023. But analysts are forecasting a rebound in 2024 and 2025 to double-digit growth each year. The compound annual growth rate over the three years is about 8%, a bit below the 10% annual growth rate of S&P 500 operating earnings per share since 2018 but ahead of the 7% annual 10-year history.

Within Morningstar equity analysts’ U.S. coverage, about 320 companies are forecast to grow their operating earnings more than 8% annually over the next three years, according to PitchBook consensus. About half of these sit within our four target sectors.

Layering on Moats and Valuation

Beyond finding companies with solid earnings growth prospects over the next three years, narrow or wide economic moats can also protect firms from competitive forces for a decade or more. After all, while growth will likely naturally slow as the law of large numbers takes hold, companies with moats are those that have Morningstar analysts’ greatest conviction for continued high returns on invested capital and the ability to compound value over time.

Valuation is another important consideration. While a search for GARP names isn’t focused on finding stocks trading at the largest margin of safety, we still want to avoid investing in businesses without solid cash flow prospects or that look particularly expensive.

Within the cohort of 320 U.S. stocks with above-average growth, 41 in the consumer defensive, energy, industrial, and technology sectors fit the bill of also having a narrow or wide economic moat, a 3-star rating, and a price/fair value estimate ratio below 1.0.

Below are four names that are among the top expected growth stocks from this group, offering potential ideas outside the 5-star names we typically highlight.

These 4 Stocks Offer Solid GARP Prospects

Consumer Defensive: Brown-Forman BF.B

Admittedly, finding a high-growth prospect in the consumer defensive sector can be challenging; by their nature, these companies tend to be steadier but lower-growing than many of their publicly traded peers. But our equity analysts expect the wide-moat producer of Jack Daniels and other premium spirits to enjoy strong growth as its high-end positioning in the structurally attractive whiskey category aligns well with consumers’ increasing willingness to pay up for quality spirits.

Beyond this, Morningstar analysts surmise the firm is poised for volume expansion, thanks to a strong innovation pipeline of promising new releases not only in whiskeys and tequilas but also in the attractive fast-growing ready-to-drink category like premixed Jack and Coke. Margin recovery following three years of pandemic-driven supply chain disruptions and tariffs further supports the company’s bottom-line growth outlook.

Energy: Core Laboratories CLB

Core Labs is the premier provider of reservoir characterization services for oil and gas exploration and production, or E&P, firms. The firm has spent the better part of the past century aggregating and analyzing its vast reservoir database, the foundation of the firm’s network effect that supports its wide-moat rating.

Public E&P companies were already facing heavy investor scrutiny before the pandemic, and they drastically slashed their budgets to preserve capital in 2020 and 2021. The industry has steadily recovered since then, and global activity will likely remain elevated moving forward, especially in non-U.S. markets, where 70% of Core’s business resides. Our equity analysts expect capital spending will remain tempered compared with prepandemic levels as E&Ps balance high global oil and gas demand with value generation for shareholders, but they nonetheless forecast the expansion of industry spending moving forward.

Industrials: Xylem XYL

Xylem is one of the leading water technology companies in the world. The company enjoys a narrow moat, which is primarily due to customer switching costs. Xylem’s large installed base of equipment generates recurring revenue driven by aftermarket service and replacement parts in the water infrastructure segment, replacement parts in the applied water segment, and long-term contracts (up to 15-20 years) in the measurement and control solutions segment.

Our equity analysts think the company is poised to benefit from long-term trends, including global population growth, water scarcity in developing countries, and the need to replace aging water infrastructure in developed countries. While cost inflation could be a headwind in the short run, the firm has room for further margin expansion. Morningstar equity analysts project a roughly 200-basis-point operating margin expansion relative to prepandemic levels, from 13.9% in 2019 to around 16.0% by 2027.

Technology: Palo Alto Networks PANW

Palo Alto Networks is a leader in multiple cybersecurity subsegments, including network security, cloud security, and security operations. The firm’s sticky platforms, combined with a broad range of cybersecurity applications, have helped Palo Alto build a wide economic moat around its business.

Morningstar equity analysts believe the firm’s value proposition, as a platform vendor that can help customers save money by consolidating their security spend, continues to draw customer attention despite macro-related headwinds. Palo Alto stands to materially benefit from secular tailwinds as cloud migrations shift to zero-trust security, and increased automation in cybersecurity increases the company’s value proposition to its clients.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/35091ad9-8fe9-4231-9701-578ec44b5def.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZPLVG6CJDRCOTOCETIKVMINBWU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZZSPP5AYAJB2RIRVFE2XR23GUQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NYUEHSFI4BDCJPQZJ76HH4PKSM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/35091ad9-8fe9-4231-9701-578ec44b5def.jpg)