The Stock Market Is Now Fairly Valued. Here’s What to Do Next.

After a fast and furious rally, we still see pockets of undervalued opportunities.

August Stock Market Outlook Key Takeaways:

- Following rally, U.S. stock market is now fairly valued.

- Pockets of opportunity remain as rally broadens out into value category and down into mid- and small-cap stocks.

- Good time to lock in profits on overvalued and overextended stocks.

What a year it’s been.

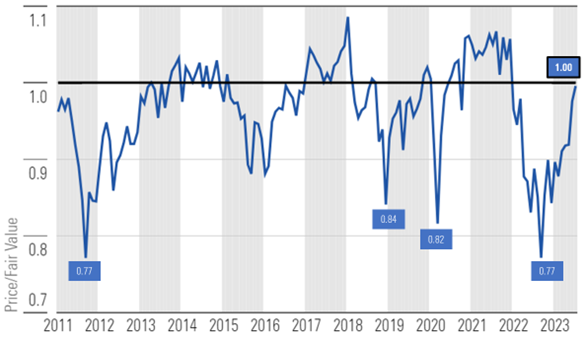

In our 2023 Market Outlook, we noted that the stock market was trading at a 16% discount to a composite of our fair valuations, and that was even after rebounding well off the October 2022 market lows.

Thus far this year, through July 31, the Morningstar US Market Index has risen a total of 20.59%. Following this rally, the U.S. equity market has now risen all the way back up to our fair value. According to a composite of the more than 700 stocks we cover that trade on U.S. exchanges, as of July 31, 2023, the U.S. equity market was trading at a price/fair value ratio of 1.00.

Historical Morningstar U.S. Equity Research Coverage Price/Fair Value Estimate at Month's End

What to Do Now

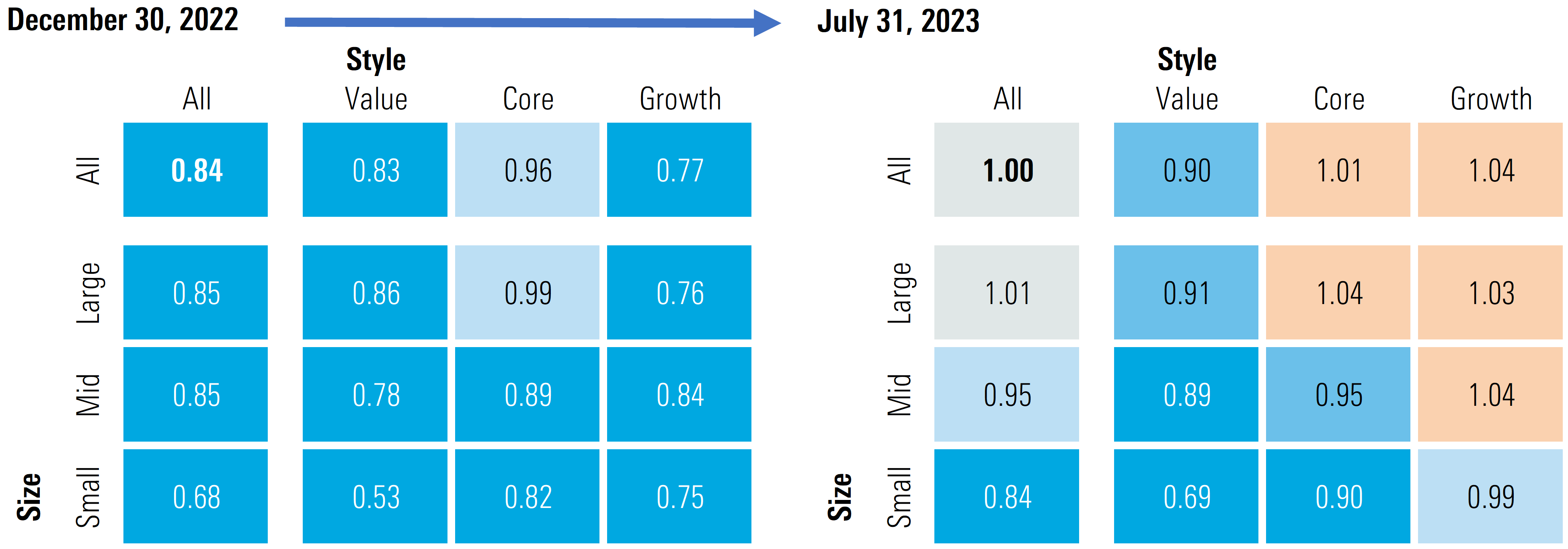

In the wake of this rally, we see several opportunities for investors to adjust their portfolios by taking profits where the market has overextended itself and reinvesting those gains in undervalued areas that have been left behind. For example, while the broad market is fairly valued, we continue to see undervaluation in the value category as well as in mid-cap and small-cap stocks.

At the beginning of the year, we recommended a barbell-shaped portfolio by overweighting growth and value and underweighting core. We then revised our growth recommendation to market weight in our May Market Outlook as growth neared fair value. In our Third-Quarter 2023 Market Outlook we again revised our growth recommendation to underweight as value stocks were much more attractive on a relative-value basis.

Based on our valuations, we continue to advocate for an overweight position in value, and to underweight both growth and core categories. We also continue to recommend overweighting mid- and small-cap stocks. For a detailed presentation on our outlook for the market and the economy, you can view our full webinar: 2023 Midyear Markets Outlook.

Progression of the Morningstar Price to Fair Value Metric

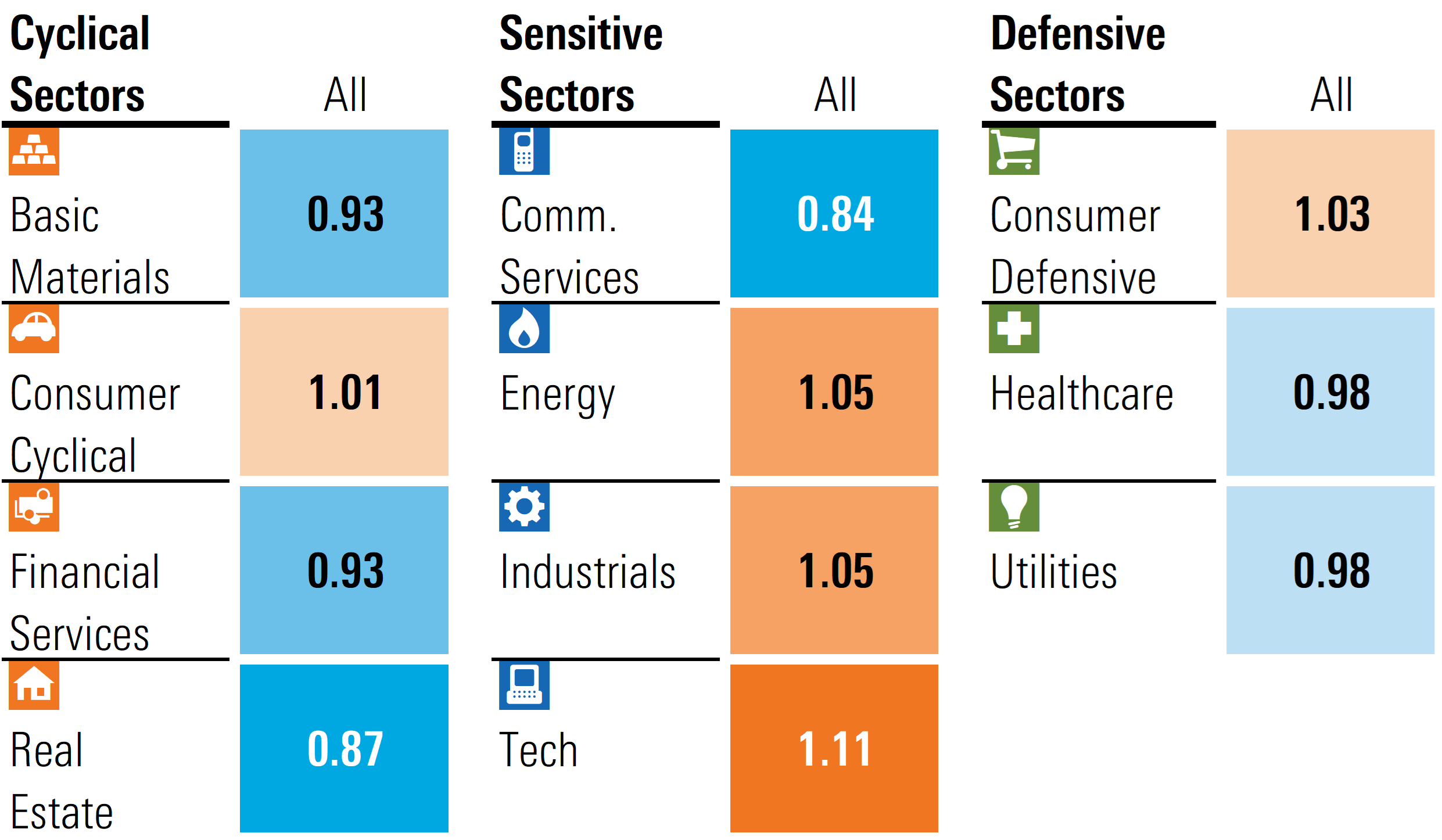

Sector Valuations

Communications remains the most undervalued sector, albeit much less undervalued as the sector has skyrocketed 44% thus far this year. Within communications, Alphabet GOOGL has risen 50% this year but remains a 4-star-rated stock as it trades at an 18% discount to our intrinsic valuation. Meta Platforms META has risen 198% this year and has now moved into 3-star range after having started the year with a 5-star rating. We see a significant amount of value among the traditional communications names such as AT&T T and Verizon VZ, which trade at 37% discounts to fair value and pay over 7% dividend yield.

Real estate is the second most undervalued sector. Commercial real estate, especially office space, has been under intense investor scrutiny. Valuations for office space have been declining as employees show a continued preference to work from home. According to the Kastle Workplace Occupancy Barometer, average urban office occupancy levels have stabilized at only 50%. While office valuations may remain under pressure, we see value for investors in other real estate assets where foot traffic continues to rebound, such as retail malls.

Financial services, particularly regional banks, appear to have bottomed out following the failure of Silicon Valley Bank earlier this year. In our view, the sector is under pressure, but the business model is not broken. Although we expect earnings to decrease sequentially through the rest of this year, we see many undervalued opportunities for investors willing to ride out the volatility.

Although technology was the third most undervalued coming into the year, following its meteoric 48% return, it is now the most overvalued sector. Technology is the most overvalued, trading at an 11% premium to our fair values. Considering how much many of these stocks have risen and how overvalued they have become, we think now is a good time to lock in profit in many of these stocks such as Nvidia NVDA, Oracle ORCL, and Palantir PLTR.

After starting to dip into undervalued territory last month, energy rose 8% in July taking its valuation back up above fair value and both industrials and consumer defensive remain fully valued.

Morningstar Price to Fair Value Metric by Sector

For Rally to Continue It Needs to Broaden

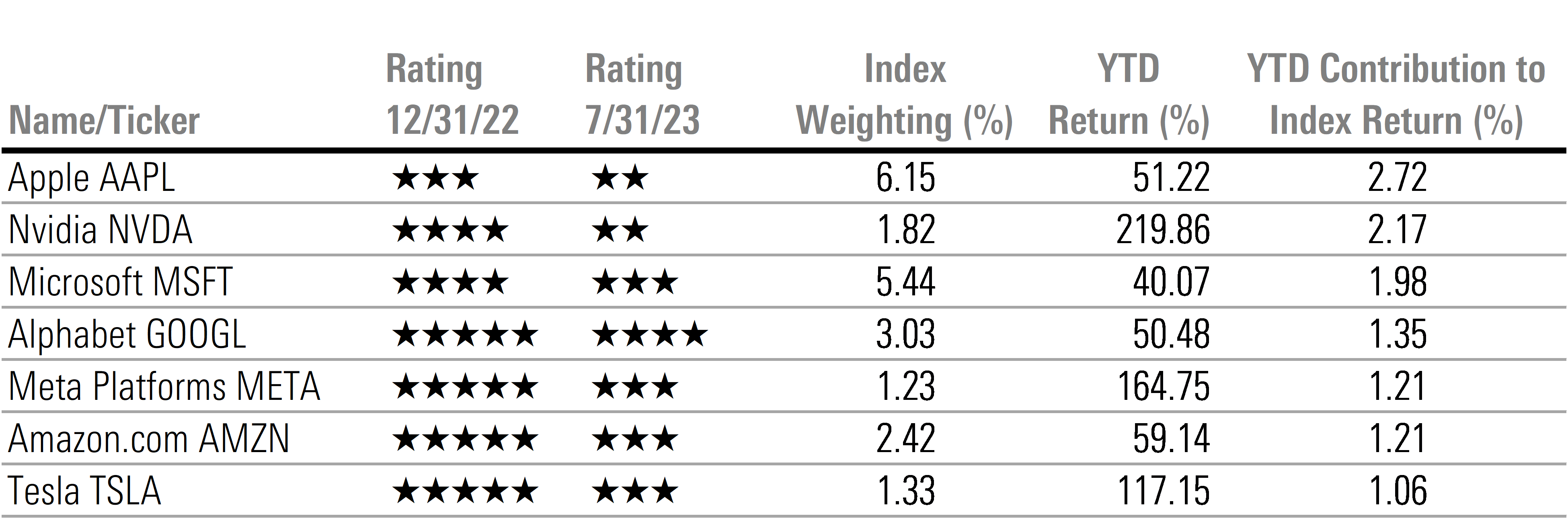

In our June 2023 Market Outlook, we noted that only a handful of stocks were responsible for the preponderance of the entire market gains. Of the aptly named “Magnificent 7″ at the beginning of the year, six were significantly undervalued and rated 4 or 5 stars. However following extremely strong gains, at this point only Alphabet remains undervalued, four are now fairly valued, and two are overvalued.

Based on our valuations, we think the tailwind that these stocks provided driving the market higher is behind us. As we noted over the past few months, in order for the rally to continue, it will need to broaden out, in our view into value stocks and down in capitalization into mid- and small-cap stocks.

Morningstar US Market Index: Return Attribution Analysis

Looking Forward

With the market now trading at fair value, we expect that the excess gains derived from broad market exposure over the first seven months of this year are behind us. Looking forward, we caution investors to moderate their expectations as returns will likely drop toward more normalized levels consistent with long-term historical averages.

Over the next three quarters, we forecast that the combination of tight monetary policy and declining credit availability will take its toll on the economy. While we do not project a recession, we forecast that the rate of economic growth will slow over the next three quarters. The slowing economy in turn will pressure earnings growth, which in turn will test the markets. In our view, investors should look past this potential short-term volatility and, where their risk tolerance allows, use pullbacks to move from market weight back into overweight positions.

We think this is an opportune time for investors to take gains where stocks have become overvalued and overextended and reinvest those proceeds in those areas that remain undervalued and unloved.

Weekly Livestream to Provide You With What You Will Need to Know for the Week Ahead

Interested in staying up to date with our research and learning about new investment ideas? Join Susan Dziubinski and me on Monday Morning Markets With Morningstar at 8 a.m. CT/9 a.m. ET via our livestream as we discuss:

- what investors should be watching the week ahead,

- new financial research from Morningstar you shouldn’t miss, and

- weekly stock picks and pans.

Over the past two weeks, Susan and I have been keeping investors up to date with earnings and highlighting those stocks that we think are undervalued and worth your attention. Our most recent livestreams include:

5 Wide Moat Stocks to Buy After Earnings where we discussed our expectations and what investors should watch for in Apple AAPL and AMZN earnings, as well as reviewing GOOGL, Taiwan Semiconductor Manufacturing TSM, RTX RTX, GSK GSK, and Biogen BIIB.

5 Financial Stocks to Buy After Earnings where we discussed our outlook for the Magnificent 7 Stocks and why we think this market tailwind has died down. We also walked through several undervalued regional bank stocks, including US Bancorp USB, PNC Financial Services Group PNC, KeyCorp KEY, and Zions Bancorp ZION; and explained why we think Goldman Sachs GS is undervalued.

4 Stocks to Avoid in 3Q 2023 where we discussed why we thought earnings season was set up to surprise to the upside. We also reviewed our valuations on NVDA, ORCL, AAPL, and Hess HES, and discussed why we think investors should look for better opportunities elsewhere.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/54f9f69f-0232-435e-9557-5edc4b17c660.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LDGHWJAL2NFZJBVDHSFFNEULHE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/MCOHMFJ2MVEVPAJNB73ASRA4EA.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/54f9f69f-0232-435e-9557-5edc4b17c660.jpg)