Markets Brief: Is the Stock Rally Broadening?

The “Magnificent Seven” rally gives way to wider gains.

Check out our weekly markets recap at the bottom of this article, with a look at the stocks that made some of the past week’s biggest moves, including XPeng and Tilray Brands.

As stocks extend their rally in 2023, a wider swath of the market is taking part in the gains, lessening one of the main concerns about the durability of the move higher.

Through the first five months of the year, the overall stock market posted solid gains. However, those gains were almost entirely the result of the biggest names, which some observers dubbed the “Magnificent Seven.”

For most investors, especially those owning index funds that track the wider stock market, their portfolio returns would largely look the same whether a rally was concentrated or broad. But returns were so highly concentrated that observers worried the rally was vulnerable to disappointment among those major stocks. So while some were calling the situation a nascent bull market, there was the risk that the gains could quickly evaporate.

Why Broader Participation Matters

But now more stocks have been participating in the rally, leading market strategists to say the push higher is on more solid ground, even if uncertainties remain.

“I’ve been very concerned that the rally was way too narrow,” says Interactive Brokers chief strategist Steve Sosnick. “One of the more encouraging things now is that it is broadening out.” He explains: “Broader participation implies less risk.”

Stocks are now up nearly 20% from the start of the year, as measured by the Morningstar U.S. Market Index, and 27.8% from their bear market low—well into what many observers would call a bull market.

The rally has been fueled by growing optimism that the U.S. economy can avoid a recession despite the most aggressive series of interest-rate increases from the Federal Reserve in history. And with more evidence pointing toward inflation pressures softening, it’s possible the Fed’s July rate hike could be the last for this cycle.

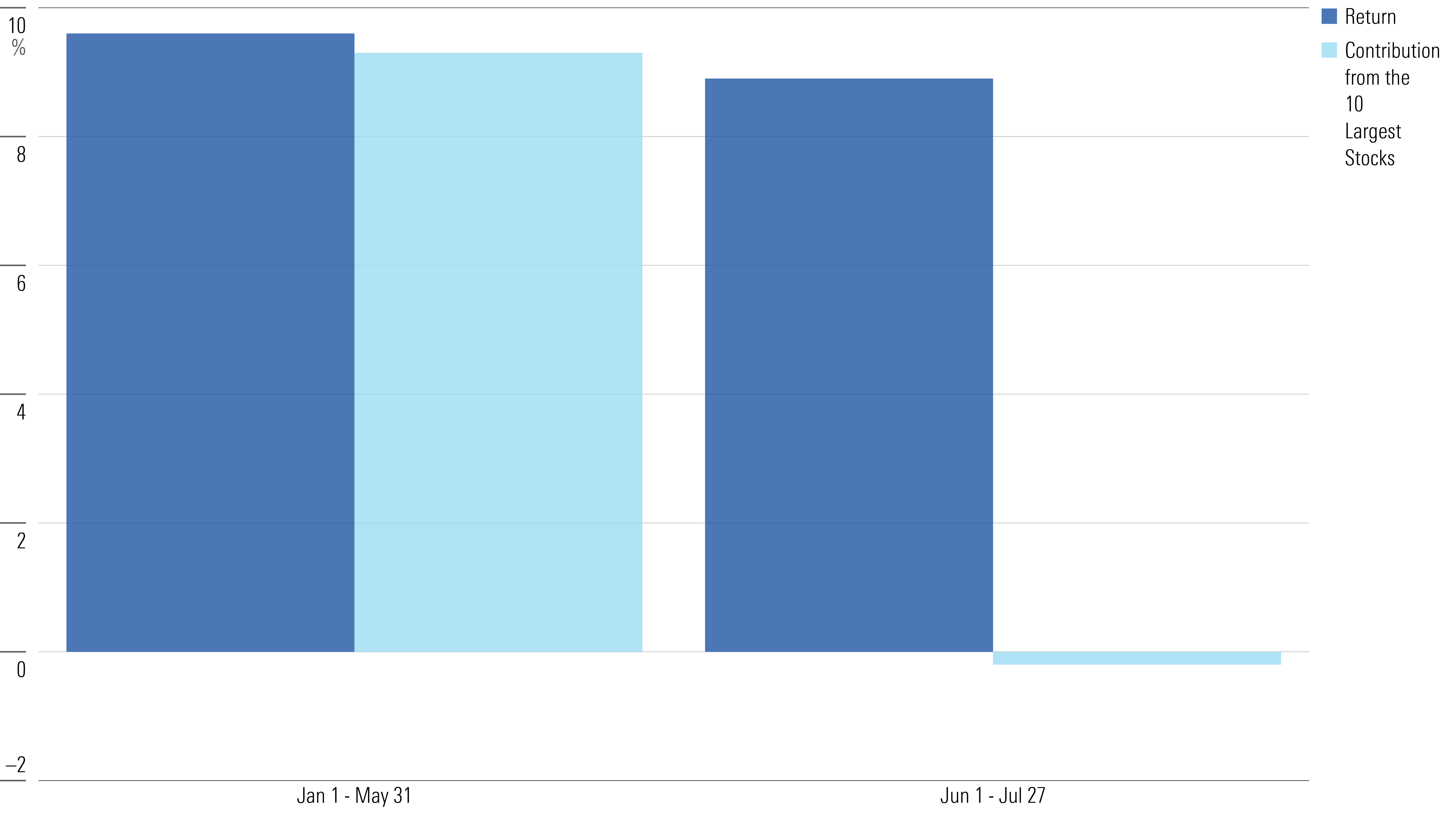

Against this backdrop, the dynamics of the market’s gains have changed. At the end of May, the Morningstar US Large-Mid Index—a collection of the largest U.S. stocks, one that performs closely in line with the S&P 500—gained 9.6%. However, 9.5% of that gain (or 99% of the total gain) came from the 10 largest stocks. Without their outsized returns, the overall market would have been flat.

In fact, the five largest stocks—Apple AAPL, Microsoft MSFT, Alphabet GOOGL, Amazon.com AMZN, and Nvidia NVDA—were responsible for 78% of the total return. The other two big winners rounding out the Magnificent Seven were Tesla TSLA and Meta Platforms META.

Since the end of May, it’s been a vastly different story. The largest stocks slightly detracted from the performance of the Large-Mid Index during this time, when it returned 8.9%

The Largest Stocks and Market Performance

It’s Not Just Mega-Cap Stocks

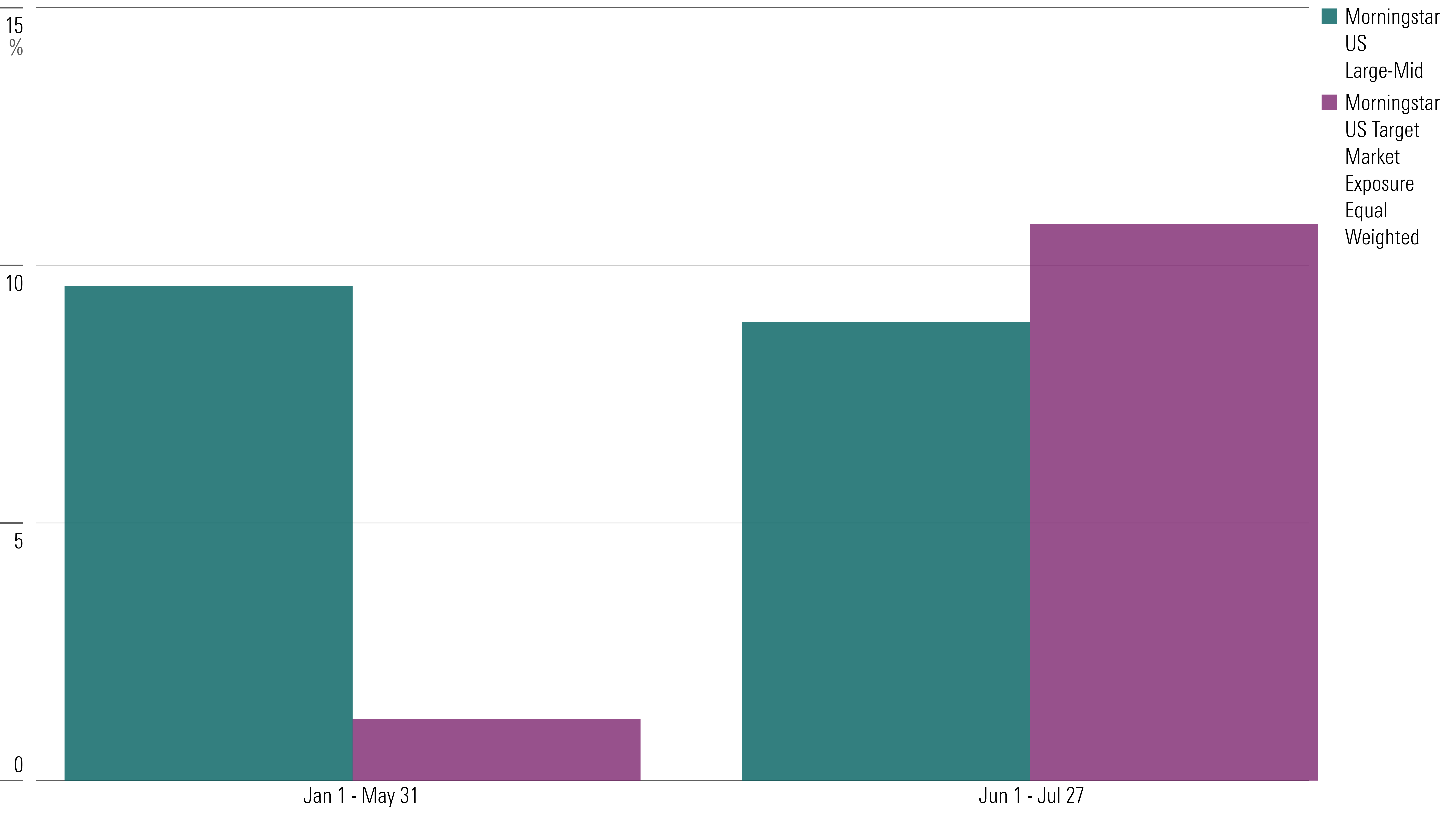

At Fidelity Investments, Jurrien Timmer, director of global macro, had also been watching the breadth of the rally as an indicator of the market’s durability. In particular, he was focused on the difference in performance between the most widely watched indexes—where stocks are weighted by market size—and equal-weighted indexes.

The equal-weighted S&P 500 index “appears to be breaking out of a year-long base, and as of yesterday 87% of the index is above their 50-day moving average,” Timmer says. “While the mega caps are still leading, the rest of the market is now following, which is not something we could have said a month ago.”

Using the Morningstar US Target Market Exposure Equal Weighted Index—a collection of the 590 largest U.S. stocks, all of which are weighted equally—this benchmark was up 1.2% through the end of May, compared with the 9.6% gain on the Large-Mid Index. However, since then, the equal-weighted index is up 10.8%, outstripping the 8.9% return on the Large-Mid Index.

Equal-Weighted Stock Index Performance vs. Market Cap Weighted

Another sign is at the sector level. During the first five months of 2023, the sectors contributing the most to the Large-Mid Index’s performance were technology (7.8 percentage points), communication services, which is home to Meta and Alphabet (2.1 percentage points), and consumer cyclical stocks, driven by Tesla (1.7 percentage points).

Since the end of May, tech stocks are still the top contributor to the market’s gains. In second place are financials, which had subtracted from investor returns during the start of the year but contributed 1.5 percentage points to the index’s gain during the more recent time frame. Since the end of May, JPMorgan Chase JPM stock has led the sector with a 15.6% return. Industrial stocks have also joined the rally, contributing 1.2 percentage points. “We have seen other sectors take the lead, and that’s always very important,” says Sosnick.

Sosnick believes the broadening has helped the overall market performance weather investor disappointment over second-quarter results from Tesla and Netflix NFLX. Despite the good news from the market dynamics, he is concerned about potential headwinds for stocks on the macroeconomic side. In particular, he’s watching for any impact from the resumption of student loan payments, as well as ripples from the widespread heat waves this summer, which could jack up utility bills and divert spending from other areas of the economy, such as back-to-school sales.

David Sekera, senior U.S. market strategist at Morningstar, says that as the market’s rally expands, there remain opportunities for investors.

As of July 21, value stocks were trading at an 11% discount to the fair value estimates assigned by Morningstar analysts, he says, while growth stocks were trading at a 3% premium to fair value and core stocks at a 2% premium. Large-cap stocks are trading at a 1% premium, mid-cap stocks are trading at a 5% discount, and small stocks are at an 18% discount.

“While we have seen the rally broaden since the end of May into value stocks as well as mid-cap and small stocks, based on our valuations, there is still room for that trend to continue,” Sekera says.

For the Trading Week Ended July 28

- The Morningstar US Market Index rose 0.97%.

- The best-performing sectors were communication services, up 5.2%, and energy, up 2%.

- The worst-performing sectors were utilities, down 2.1%, and real estate, down 1.8%.

- Yields on 10-year U.S. Treasuries increased to 3.97% from 3.85%.

- West Texas Intermediate crude prices rose 4.55% to $80.58 per barrel.

- Of the 847 U.S.-listed companies covered by Morningstar, 462, or 55%, were up, and 385, or 45%, were down.

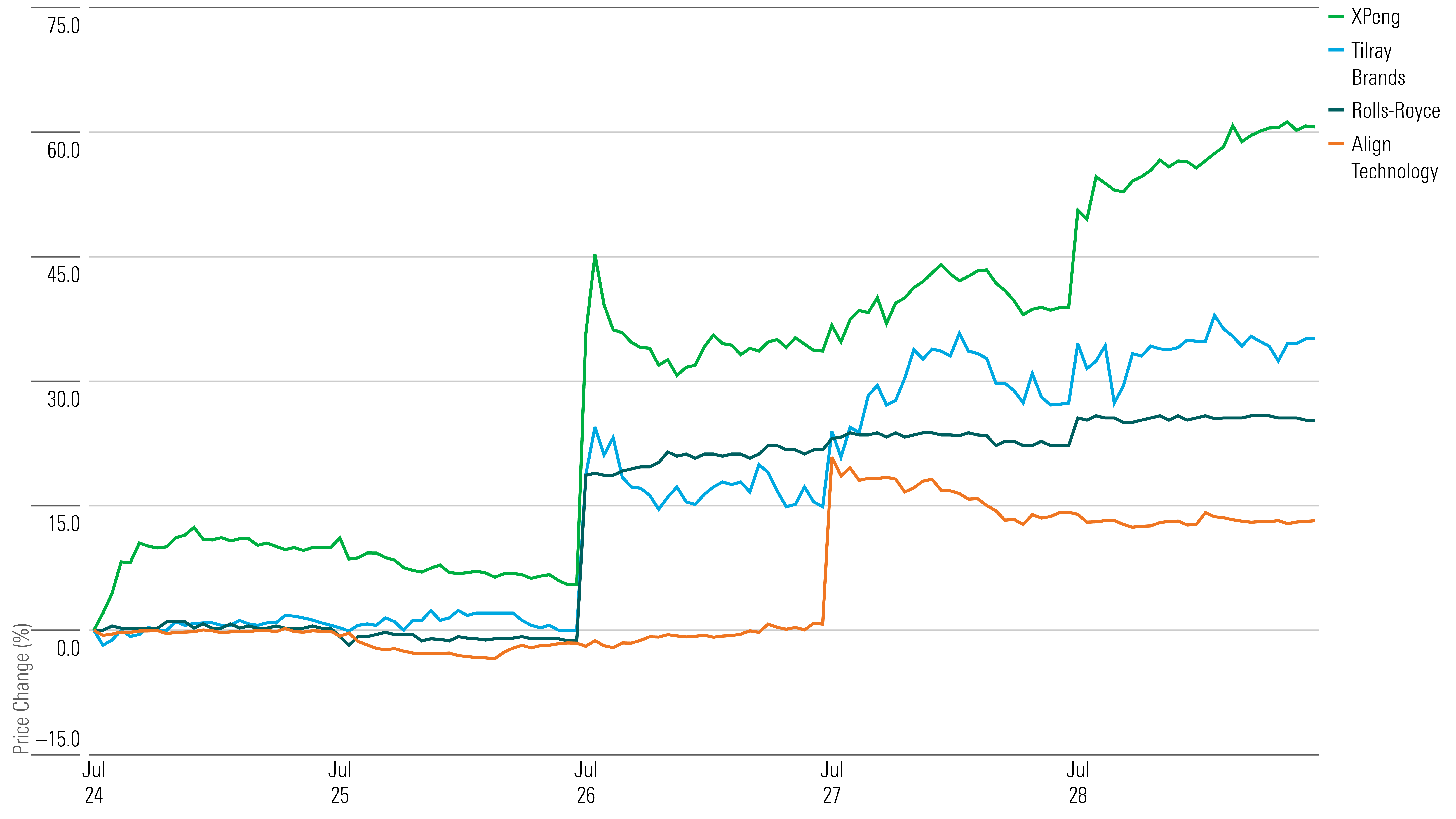

What Stocks Are Up?

XPeng XPEV and Volkswagen VWAPY announced a long-term strategic partnership, helping the Chinese electric vehicle company’s stock to rally more than 60% by the week’s end. Volkswagen will acquire 4.99% of XPeng’s Class A ordinary shares for a total consideration of $700 million. Under the Volkswagen brand, the two companies will also develop two B-class battery electric vehicles for the Chinese market.

Tilray Brands TLRY stock surged after the results of its latest fiscal quarter showed it’s returning to profit growth. The drug manufacturer generated $184 million in revenue, exceeding Morningstar equity strategist Kristoffer Inton’s $156 million forecast. However, he also cautioned investors about the company’s “slightly weaker guidance” and “expected dilution from refinancing pending maturities of convertible debt.”

Rolls-Royce Holdings RYCEY stock rose after the firm updated its full-year guidance. Posting a strong profit for the first half of the year, the British luxury car company raised guidance to a range of GBP 1.2 billion and GBP 1.4 billion from the previous range of GDP 800 million to GBP 1 billion. The firm cites the increased investments and optimizations of its civil aerospace, defense, and power systems divisions as the main drivers of its performance so far this year.

Align Technology ALGN stock also rose after the firm posted better-than-expected earnings for the second quarter. The orthodontics company’s “total sales were up 3.2% year over year, driven by strong clear aligner pricing and volume as well as improved utilization rates among dental professionals,” according to Morningstar equity analyst Keonhee Kim. Align also raised its full-year guidance for its top-line margin and operating margin.

Highlighted Advancers

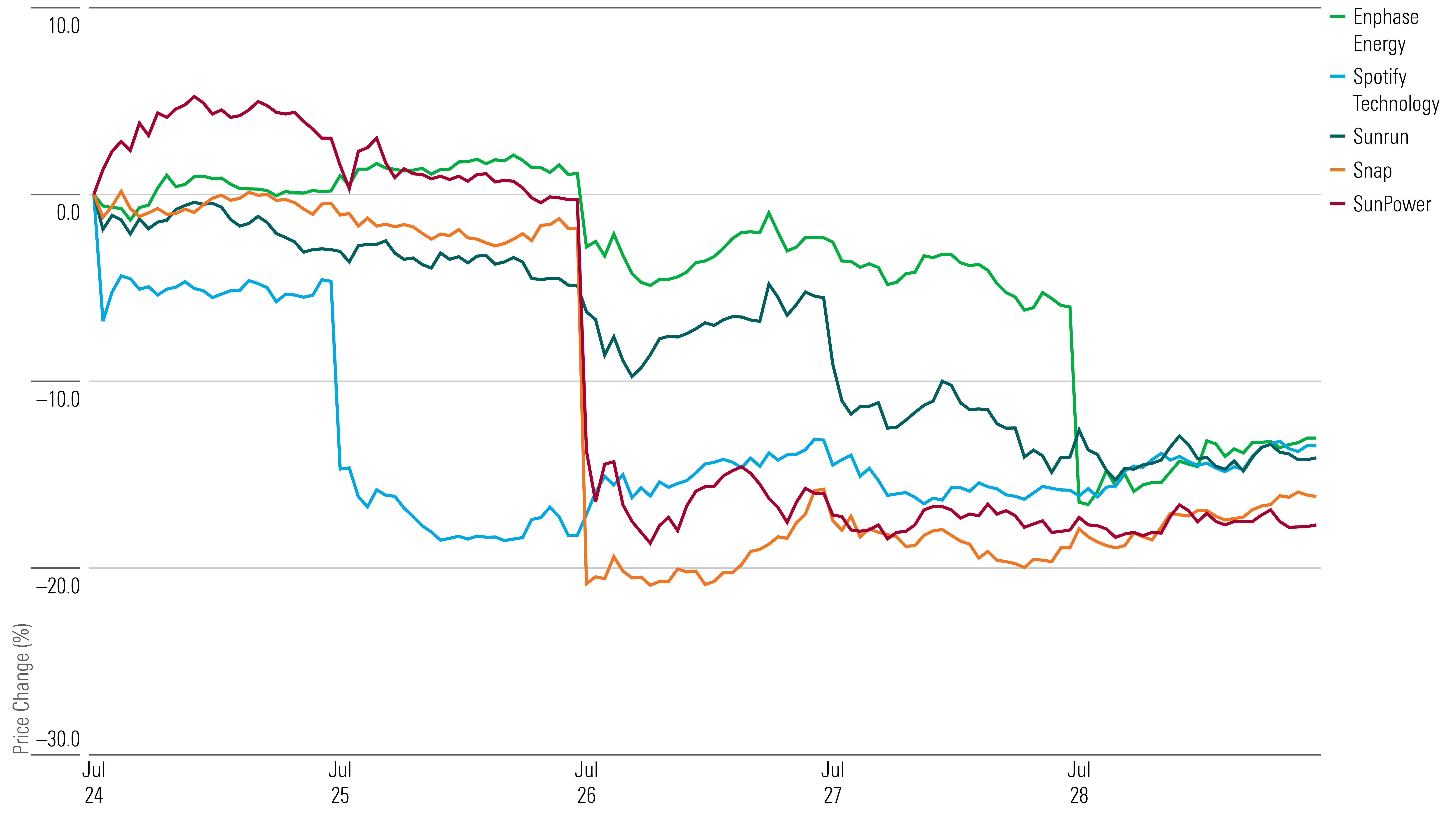

What Stocks Are Down?

Shares for solar energy providers such as SunPower SPWR and Sunrun RUN fell after preliminary second-quarter results showed a weakened demand for the renewable energy source in the United States. SunPower reduced expectations for customer additions by 20%.

While its second-quarter results were close to expectations, Enphase Energy’s ENPH third-quarter guidance spooked investors, sending its stock down. The firm expects to generate $575 million in revenue by the middle of the third quarter, which is down 20% sequentially and 23% below PitchBook consensus. Morningstar senior equity analyst Brett Castelli says he expects “continued volatility in residential solar companies in the near term, given slowing demand in the United States, the result of unfavorable California regulatory changes and higher interest rates.” He adds that this volatility may present opportunities for traders, “notably in solar inverter names like SolarEdge SEDG and Enphase, but valuations are not currently overly attractive.”

Snap SNAP stock sank after the firm struggled to generate revenue through advertisers and user monetization in the second quarter. While the social media company increased its daily average users up 14% year over year, its “efforts to make its platform easier for advertisers to use its first-party data more effectively and to monetize Spotlight have not yet generated any return for the firm and its shareholders,” Morningstar senior equity analyst Ali Mogharabi says.

Despite user growth in its second-quarter earnings, revenue for Spotify Technology SPOT also fell due to lags in monetization, leading its stock to fall after posting results. Mogharabi expects “monetization to improve in the second half of this year and through 2024 due to the firm’s price increases and less hesitancy by advertisers.”

Highlighted Decliners

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ed529c14-e87a-417f-a91c-4cee045d88b4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LDGHWJAL2NFZJBVDHSFFNEULHE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/MCOHMFJ2MVEVPAJNB73ASRA4EA.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ed529c14-e87a-417f-a91c-4cee045d88b4.jpg)